Friday, March 31, 2017

Enlighten Radio:Podcast: Labor Beat -- Medical Cannabis--Phoenix from the WV Legislative Train Wreck

John Case has sent you a link to a blog:

Blog: Enlighten Radio

Post: Podcast: Labor Beat -- Medical Cannabis--Phoenix from the WV Legislative Train Wreck

Link: http://www.enlightenradio.org/2017/03/podcast-labor-beat-medical-cannabis.html

--

Powered by Blogger

https://www.blogger.com/

Blog: Enlighten Radio

Post: Podcast: Labor Beat -- Medical Cannabis--Phoenix from the WV Legislative Train Wreck

Link: http://www.enlightenradio.org/2017/03/podcast-labor-beat-medical-cannabis.html

--

Powered by Blogger

https://www.blogger.com/

Bernstein: Up for a little meta-discussion of tax policy? I thought so… [feedly]

Up for a little meta-discussion of tax policy? I thought so…

http://jaredbernsteinblog.com/up-for-a-little-meta-discussion-of-tax-policy-i-thought-so/

-- via my feedly newsfeed

So, with those ground rules in place, and with the recognition that "we" is a tricky word in today's polity, let's think about what we want our tax system to accomplish.

• It must raise ample revenue for the public sector to meet the challenges that the private sector won't address. Markets fail, and markets are incomplete. No private business will provide optimal levels of public goods and services such as education, transportation, health care and retirement security, global protection (both defense and climate), the justice system, labor and financial market oversight, and anti-poverty and countercyclical policies (not a complete list, I'm sure, but you get the idea). What that revenue level should be is of course the hard part, but let me resort to averages, which if not a systematic, bottom-up calculus, at least reveals how we've answered this question historically.

Since 1970, the federal revenue share of the gross domestic product has averaged 17.4 percent, ranging from around 15 to 20 percent. It's just under 18 percent today. Congressional Budget Office analysis reveals that meeting the promises of Social Security and Medicare would require about 2.5 percentage points more than that by 2027. That takes us slightly past the upper bound of the historical record, but the extent of our aging demographics is historically unique.

In other words, revenue neutrality is an insufficient goal. Tax reform — meaning changes in revenue dictated by needs and obligations — should be revenue positive.

• We can argue whether a tax system should reduce market inequalities — based on non-merit-based inequalities embedded in the market economy, I think it should — but I know no cogent argument for why tax changes should be dis-equalizing. Yes, you still hear about "trickle-down": give the rich a tax break and they'll create opportunity for everyone else. But as noted, this is nothing but a fact-free rationale for regressive tax cuts. I'm probably being too optimistic, but I sense that people increasingly know this, and that the politicians who sell this snake oil are starting to sense that maybe the people are on to them.

• We want a tax code that does not distort people's behaviors too much, although it's easy to overdo these concerns. There are many different types of tax systems around the globe, and at the end of the day they don't have nearly the impact on people's willingness to work, invest, move, trade, and so on that the noise from this part of the debate would lead you to believe.

So we want a tax system that will raise ample revenue without worsening pretax inequality, in which "ample" means enough to meet the functions in the list above.

I'm sure there are readers who think that by dint of arguing for more revenue, I've punted on objectivity and tilted in support of more government. I disagree. Unless what you're saying is, "No, we don't need or want as much Social Security, Medicare, schools, roads, police, armies and so on as we already have," you either have to agree with me or explain to me where we get the money. If your answer is cut waste, fraud, abuse and foreign aid, you're not being serious.

If your answer is, "We can't afford all the above and must cut them," I disagree, but at least you're consistent. You are, however, out of step with most Americans who want what's on that list, and it's very important to recognize that they're not being unreasonable: These are things provided by governments in every advanced economy — again, for good reason. They are public goods.

I urge you to keep all this in mind during the forthcoming tax debate, although I warn you that to do so is to reveal the complete nonreality of that debate. I hope you're not allergic to cognitive dissonance.

Jared Bernstein

http://jaredbernsteinblog.com/up-for-a-little-meta-discussion-of-tax-policy-i-thought-so/

-- via my feedly newsfeed

Last week in Washington, we were all abuzz about health-care reform. Now we're all abuzz about tax reform. Our problem — one of our problems — is that all the buzzing crowds out rational thought. An objective look at the reality of today's economy, our demographics and our income distribution suggests that the current tax debate is terribly misguided.

I suspect I'm shouting into a void here, but that's never stopped me: The nation does not need and most of us don't want a big, regressive tax cut. Yet despite claims to the contrary, that's what we're likely to see at the end of this benighted process.

An objective look at the questions posed by tax reform requires both sides to banish some shibboleths. For Republicans, this means dropping the assumption that tax cuts are always and everywhere desirable, as they generate more economic activity and shrink government. Neither of those claims are anywhere close to true, as there's no empirical correlation between tax cuts on the wealthy or businesses and favorable, lasting economic outcomes. Neither do tax cuts shrink government, as tax-cutting policymakers are happy to use deficit spending to replace revenue losses.

Also, the increasing tendency of Republicans to engage in reverse Robin Hoodism — paying for huge breaks for the wealthy by raising taxes or cutting spending on the poor — in an economy that generates too much inequality before taxes kick in is unjust and terrible policy.For Democrats, it means abandoning the notion that we can have everything we want and send the bill to the top 1 percent, and accepting that the corporate tax system is a hot mess that needs repair.

Yes, the rich disproportionately benefit from pretax growth and, in a progressive system, should not be shielded from paying more taxes. Ideas such as getting rid of the estate tax are preposterous saps to the superwealthy for no other reason than to do their bidding. But "get it from the rich" can't be the extent of every Democratic tax plan.

The statutory corporate tax rate — at 35 percent — is among the highest among advanced economies, but because of all the loopholes the effective rate is at least 10 points lower. This creates a strong incentive for special treatment, and these carve-outs are a function not of thoughtful policy but of the skills and connections of your lobbying team. There is some bipartisan consensus to lower the rate while maintaining at least revenue neutrality by closing the loopholes, but the problem is always that the lobbyists are very good at protecting their turf

I suspect I'm shouting into a void here, but that's never stopped me: The nation does not need and most of us don't want a big, regressive tax cut. Yet despite claims to the contrary, that's what we're likely to see at the end of this benighted process.

An objective look at the questions posed by tax reform requires both sides to banish some shibboleths. For Republicans, this means dropping the assumption that tax cuts are always and everywhere desirable, as they generate more economic activity and shrink government. Neither of those claims are anywhere close to true, as there's no empirical correlation between tax cuts on the wealthy or businesses and favorable, lasting economic outcomes. Neither do tax cuts shrink government, as tax-cutting policymakers are happy to use deficit spending to replace revenue losses.

Also, the increasing tendency of Republicans to engage in reverse Robin Hoodism — paying for huge breaks for the wealthy by raising taxes or cutting spending on the poor — in an economy that generates too much inequality before taxes kick in is unjust and terrible policy.For Democrats, it means abandoning the notion that we can have everything we want and send the bill to the top 1 percent, and accepting that the corporate tax system is a hot mess that needs repair.

Yes, the rich disproportionately benefit from pretax growth and, in a progressive system, should not be shielded from paying more taxes. Ideas such as getting rid of the estate tax are preposterous saps to the superwealthy for no other reason than to do their bidding. But "get it from the rich" can't be the extent of every Democratic tax plan.

The statutory corporate tax rate — at 35 percent — is among the highest among advanced economies, but because of all the loopholes the effective rate is at least 10 points lower. This creates a strong incentive for special treatment, and these carve-outs are a function not of thoughtful policy but of the skills and connections of your lobbying team. There is some bipartisan consensus to lower the rate while maintaining at least revenue neutrality by closing the loopholes, but the problem is always that the lobbyists are very good at protecting their turf

So, with those ground rules in place, and with the recognition that "we" is a tricky word in today's polity, let's think about what we want our tax system to accomplish.

• It must raise ample revenue for the public sector to meet the challenges that the private sector won't address. Markets fail, and markets are incomplete. No private business will provide optimal levels of public goods and services such as education, transportation, health care and retirement security, global protection (both defense and climate), the justice system, labor and financial market oversight, and anti-poverty and countercyclical policies (not a complete list, I'm sure, but you get the idea). What that revenue level should be is of course the hard part, but let me resort to averages, which if not a systematic, bottom-up calculus, at least reveals how we've answered this question historically.

Since 1970, the federal revenue share of the gross domestic product has averaged 17.4 percent, ranging from around 15 to 20 percent. It's just under 18 percent today. Congressional Budget Office analysis reveals that meeting the promises of Social Security and Medicare would require about 2.5 percentage points more than that by 2027. That takes us slightly past the upper bound of the historical record, but the extent of our aging demographics is historically unique.

In other words, revenue neutrality is an insufficient goal. Tax reform — meaning changes in revenue dictated by needs and obligations — should be revenue positive.

• We can argue whether a tax system should reduce market inequalities — based on non-merit-based inequalities embedded in the market economy, I think it should — but I know no cogent argument for why tax changes should be dis-equalizing. Yes, you still hear about "trickle-down": give the rich a tax break and they'll create opportunity for everyone else. But as noted, this is nothing but a fact-free rationale for regressive tax cuts. I'm probably being too optimistic, but I sense that people increasingly know this, and that the politicians who sell this snake oil are starting to sense that maybe the people are on to them.

• We want a tax code that does not distort people's behaviors too much, although it's easy to overdo these concerns. There are many different types of tax systems around the globe, and at the end of the day they don't have nearly the impact on people's willingness to work, invest, move, trade, and so on that the noise from this part of the debate would lead you to believe.

So we want a tax system that will raise ample revenue without worsening pretax inequality, in which "ample" means enough to meet the functions in the list above.

I'm sure there are readers who think that by dint of arguing for more revenue, I've punted on objectivity and tilted in support of more government. I disagree. Unless what you're saying is, "No, we don't need or want as much Social Security, Medicare, schools, roads, police, armies and so on as we already have," you either have to agree with me or explain to me where we get the money. If your answer is cut waste, fraud, abuse and foreign aid, you're not being serious.

If your answer is, "We can't afford all the above and must cut them," I disagree, but at least you're consistent. You are, however, out of step with most Americans who want what's on that list, and it's very important to recognize that they're not being unreasonable: These are things provided by governments in every advanced economy — again, for good reason. They are public goods.

I urge you to keep all this in mind during the forthcoming tax debate, although I warn you that to do so is to reveal the complete nonreality of that debate. I hope you're not allergic to cognitive dissonance.

Alex Tuckett: Does productivity drive wages? Evidence from sectoral data

This is an bit wonky of an article, but, there is no unsolved question in Economics that is bearing down harder on effective economic policy-making and planning than the slowdown in US productivity. Expectations ran high from the miracles of the high tech revolution, automation, health science and space travel that a boom in creativity and value-creating labor comparable to the deployment of steam technology in the era of industrialization was imminent. Not so, or, nowhere near expectations anyway.

This article explores several aspects of the question.

1. In the LONG RUN there is a strong correlation between wages and productivity. "LONG RUN" -- think decades and scores of years. Also, remember "productivity" is a rate of increase in production per unit of labor (usually calculated in hours). Productivity is obviously closely related to overall economic growth. Produce more with less cost, especially time cost. Population is usually growing, so a rate of economic growth greater than that generated by population growth alone is necessary to increase overall wealth, per capita The data series analyzed by Alelx Tucket sustain a definite correlation, but a multi-dimensional one.

2. The article points out a very important aspect of the relationship between increased productivity and increased wages. The relationship is two-way. In other words, in labor movement vocabulary, the rise in technology demands increased demand for new skills in the labor market, which puts pressure on the labor market -- assuming there is not mass unemployment at the time! But the social struggle of workers for higher wages and benefits was itself a driver of investment by business in labor saving technologies.

The article does not address the large debate about how to measure productivity. However, when you consider valuing commodities like software and other intangible products or services, an unknown, but probably large, missing component in reported data is the cost of theft arising from the relative ease at which products of immense "value" -- say the source code for Microsoft Windows Operating System for example -- can be copied, carried out the door on a thumb drive, in some cases. Thus millions of copies were freely copied in China. That degrades the products economic value, and thus the measured productivity of its creators.

The article skips the rather large social and political narratives that are inseparable companions of any structural -- and many incremental -- economic changes required to either deploy technologies throughout an economy, or to establish institutions of social security, justice, labor rights and protections, or to educate and reeducate new workforces for new occupations and new divisions of the work of society.

Does productivity drive wages? Evidence from sectoral data

Alex Tuckett

Since 2008, aggregate productivity performance in the UK has been substantially worse than in the preceding eight years. Over the same period, aggregate real wage growth has also been significantly lower – it has averaged -0.4% per annum from 2009-16, compared with 2.3% per annum from 2000-08. The MPC, and others, have drawn a link between these two phenomena, arguing that low productivity growth has been a major cause – if not the major cause – of weak wage growth. The logic is simple – if workers produce less output for firms, then in a competitive market firms will only be willing to employ them at a lower wage.

However, wages undershot forecasts before the crisis (Saunders, 2017), and alternative reasons have been advanced for slow wage growth: developments in labour supply, which may have lowered the natural rate of unemployment, or low headline inflation. A careful analysis of the sectoral data suggests that the relationship between productivity and wages is not simple, and that causality may run in both directions.

The slowdown in productivity performance has been uneven across sectors (a recent BU post offers readers an interactive tool that can be used to explore sectoral productivity trends). A number of sectors, such as agriculture and construction, have actually seen productivity growth accelerate. Can the dispersion of productivity performance across industries tell us anything about the link between productivity and wages?

Economic theory argues that the marginal product of labour is the most important determinant, in the long-run, of wages. Average output per worker is only an imperfect guide to marginal product, but over the very long term, aggregate productivity and wages have indeed moved closely together (Haldane, 2015). However, perhaps surprisingly, economic theory does not necessarily predict a strong link between productivity in any particular industry and wages in that industry. If labour can move freely between sectors, then productivity growth in one particular industry will result in slightly higher wages for the workforce in general, not just workers in that industry. What matters for wages is the outside option for workers – which in turn is determined by productivity in the economy as a whole.

In reality, moving between sectors can involve time, money and taking a risk. Furthermore, the picture is complicated because productivity changes can be 'passed forward' into prices as well as 'passed backwards' into wages.

To investigate the link between wages and productivity empirically, ONS data on sectoral output can be combined with data on sectoral wages and employment from the Average Weekly Earnings (AWE) survey. Together, these data give a picture of the joint behaviour of productivity and wages across 24 industries in the economy.

This level of disaggregation is more detailed than the 16 industry split published in the Quarterly National Accounts (QNA); manufacturing is split into 6 industries, whilst on the service side, wholesale and retail are separated, as is transport from communications. Data quality at lower levels of aggregation is likely to be slightly worse; however the results are similar using the smaller set of industries defined in the QNA.

The AWE employment data do not include self-employment, which will bias the calculations of productivity slightly for some industries in which self-employment is important. This is likely to be more of an issue for the level of productivity than the growth rate.

These data can be used to answer a number of questions:

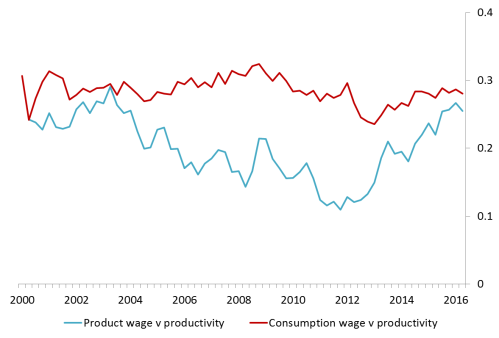

Do industries with high productivity also have high wages?

Yes. Figure 1 shows the correlation across industries between log real output per worker and log average real wages. The red line shows the correlation between real productivity and real consumption wages (RCW). Real consumption wages are nominal wages from AWE deflated by the aggregate CPI; they try to measure what a wage is worth in terms of the goods and services it can purchase. The blue line shows the correlation of productivity with real product wages (RPW). RPW are nominal wages deflated by the price deflator for that industry, and try to measure the cost of labour to the firm in terms of the goods or services the firm produces. The correlation between productivity and wages has been positive at all times for both measures.

Figure 1: Correlation across industries between the level of productivity and average pay

Source: ONS, author's calculations. Excludes manufacture of textiles, leather and clothing; for this industry, the deflator increases very sharply (by around 40%) over 2012 and 2013, abruptly increasing the RPW-productivity correlation. Given the problems with the measurement of clothing and footwear prices this is likely to be at least partly spurious.

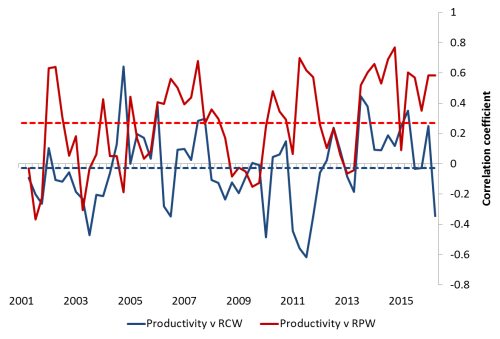

Do industries with higher productivity growth have higher wage growth?

Productivity growth can vary considerably across industries. Even excluding mining and extraction (the industry with the most volatile productivity by far), the cross-sectional standard deviation of annual growth averages around 6 percentage points although it has been trending downwards. At any one time, productivity can be growing fast in one industry whilst stagnating (or contracting) in another.

Do these industry-specific variations in productivity growth feed through into real wage growth? That depends on the measure. As the blue line in Figure 2 shows, there is little or no reliable correlation between growth in productivity and RCW (the chart shows the correlation for annual growth rates, but the results are similar using higher or lower frequency measures).

There is a much better industry-level correlation between growth in productivity and RPW (the red line in Figure 2). Although not stable, the correlation is positive in most periods and averages 0.25. The beta in a cross-sectional regression of productivity on RPW has averaged about 0.33; that is, a 1% increase in productivity growth is associated with an increase in RPW of around 0.3%. The value of this coefficient has been trending up over time.

Figure 2: Correlation between annual growth (quarter on quarter of previous year) in productivity and real wages

Source: ONS, author's calculations. Excludes manufacture of textiles, leather and clothing.

RPW growth is also better correlated with productivity growth at an aggregate level. That suggests that RCW growth is moved around by factors other than productivity – for instance, movements in the exchange rate that affect retail prices – and so points to a limited role for 'real wage resistance' (the idea that increases in living costs from higher import prices will lead workers to bid up nominal wages to support the real value of their earnings). The cross-sectional evidence supports the idea that it is output prices, not retail prices, which matter for wages.

These correlations may also tell us something about how an increase in productivity in a particular industry feeds through into real wages. Rather than bidding up relative nominal wages (and therefore, the relative RCW in that industry), an increase in productivity leads to lower relative prices for the output of that industry, increasing RPW for given nominal wage. This boosts the real consumption wages of workers in all industries. The benefits of productivity gains are diffuse; the costs, of course, may not be, if productivity gains lead to lost employment in that industry.

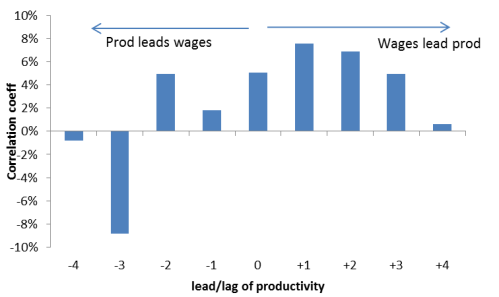

Does productivity growth help predict wage growth at an industry level?

Not really, no. The distribution of productivity growth across industries is positively correlated with subsequent wage growth – industries with higher productivity growth now will tend to have higher wage growth in subsequent quarters. However, productivity growth has little additional value in predicting wage growth over and above univariate models. Figure 3 shows the results from correlating industry level productivity shocks with wage 'shocks' (defined as the residuals from a univariate regression, with lag-structure chosen to optimise information criteria). The link between where an industry is in the current distribution of productivity growth and where it will be in the future distribution of wage growth is not very reliable. If anything, it is relative wage growth that tends to lead relative productivity growth.

Figure 3: Cross-industry correlation between shocks to productivity and lags, leads of wages

Average correlation from 2000Q1-16Q3 for each lead/lag combination, between shocks to productivity and to wages. Shocks are estimated as the residuals from a univariate regression, with lags chosen to optimise information criteria.

Looking at each industry in turn, Granger causality tests do not find a clear role for productivity growth in predicting wage growth. As shown in Figure 4, productivity growth Granger causes wage growth for only a minority of industries. Wages Granger-cause productivity for a larger group of industries, although still fewer than half.

Figure 4: Two–way Granger causality tests between real productivity and RPW at industry level

P-values: averages across industries for the test of whether lags of productivity (wages) have a joint coefficient of zero when added to a regression of wages (productivity) with lags of dependent variable. Proportions show share of industries with p-values below 10% (5%); e.g. using 6 lags, we can reject the null hypothesis that wages do not Granger cause productivity for 29% of industries.

Together, both cross-sectional and within industry time-series evidence are consistent with a two-way relationship between wages and productivity. There may be shocks from labour supply – or developments in other industries – which first affect wages, leading industries to adapt (for instance, change capital intensity) in a way that changes productivity. Alternatively, shocks to the demand for an industry's output could initially move wages, followed by a productivity response.

Conclusions

Rather than a simple and clean link from productivity to wages, the industry level data point to a richer and more multi-directional relationship between productivity and wages. Productivity growth is linked to wages, but the relationship may go both ways, and the link between productivity and real wages may operate through prices as much as nominal wages.

Alex Tuckett works the Banks external MPC unit.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied.

Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

John Case

Harpers Ferry, WV

Harpers Ferry, WV

The Winners and Losers Radio Show

7-9 AM Weekdays, The EPIC Radio Player Stream,

Sign UP HERE to get the Weekly Program Notes.

Check out Socialist Economics, the EPIC Radio website, and

Krugman: Coal Country Is a State of Mind [feedly]

jcase: Apologies for no text on this one -- NYT no longer permits copying text. But there should not be paywall on the article

I am beginning to think Krugman should give up on politics. One does not have to conjure up a mass "nostalgia" for a vanished past to explain coal/natural gas influence in the West Virginia. It turns out that it does not matter if only 4% of the workforce is related to mining when 15-20% of the state revenue is from a coal and gas severance tax on extracted resources. The tax buys the continued dominion of natural resource industries over state government, which is highly centralized in West Virginia from a 100 year legacy of subordination to coal interests.

https://www.nytimes.com/2017/03/31/opinion/coal-country-is-a-state-of-mind.html

-- via my feedly newsfeed

Enlighten Radio:Treeman and Ms Sustainable Shepherdstown Return to Paris, WV Rs shoot Pot

John Case has sent you a link to a blog:

Blog: Enlighten Radio

Post: Treeman and Ms Sustainable Shepherdstown Return to Paris, WV Rs shoot Pot

Link: http://www.enlightenradio.org/2017/03/treeman-and-ms-sustainable.html

--

Powered by Blogger

https://www.blogger.com/

Blog: Enlighten Radio

Post: Treeman and Ms Sustainable Shepherdstown Return to Paris, WV Rs shoot Pot

Link: http://www.enlightenradio.org/2017/03/treeman-and-ms-sustainable.html

--

Powered by Blogger

https://www.blogger.com/

Thursday, March 30, 2017

Enlighten Radio:Revolution Radio Begins at 9 AM this Morning

John Case has sent you a link to a blog:

Blog: Enlighten Radio

Post: Revolution Radio Begins at 9 AM this Morning

Link: http://www.enlightenradio.org/2017/03/revolution-radio-begins-at-9-am-this.html

--

Powered by Blogger

https://www.blogger.com/

Blog: Enlighten Radio

Post: Revolution Radio Begins at 9 AM this Morning

Link: http://www.enlightenradio.org/2017/03/revolution-radio-begins-at-9-am-this.html

--

Powered by Blogger

https://www.blogger.com/

Wednesday, March 29, 2017

On Populism, Nationalism, Babies and Bathwater [feedly]

On Populism, Nationalism, Babies and Bathwater

http://www.globalpolicyjournal.com/blog/28/03/2017/populism-nationalism-babies-and-bathwater

-- via my feedly newsfeed

http://www.globalpolicyjournal.com/blog/28/03/2017/populism-nationalism-babies-and-bathwater

On Populism, Nationalism, Babies and Bathwater

Duncan Green - 28th March 2017Ducan Green shares some thoughts on recent discussions over how the aid sector should repond to the rising tide of nationalism, populism, and attacks on aid.

A couple of Oxfamers were over from the US recently so ODI kindly pulled together a seriously stimulating conversation about life, theuniverse and everything. More specifically, how should 'we' – the aid community broadly defined – respond to the rising tide of nationalism, populism, and attacks on aid. It was Chatham House rules, so I've already told you too much, but here are some of the highlights:

North v South: The traditional focus of international development NGOs has been the 'Global South' (although North-South distinctions have become increasingly dubious). Should that now change? Some people stressed that we need to focus more on politics in the North, both because the risks to progressive values that we used to consider the consensus are now very real. In the UK 'the winning side (on Brexit) is starting to change the minds of the losing side' – people who weren't bothered about immigration before now accept that it is 'an issue'. 'Ethics are like a muscle – they have to be exercised regularly or they will atrophy'.

There is also an instrumental argument: 'we need to invest in the North, or we'll lose the ability to have impact in the South.' Specifically 'we need to spend less time on policy and more on shaping public debate.'

In addition, maybe the current turmoil could provide the 'window of opportunity' to do more to refocus the long term agenda on promoting local control, stewardship, ownership etc, including giving higher priority to domestic taxation and the social contract between citizens and state.

Universalism v Nationalism: I was struck by how many people take the SDGs seriously as a symbol that we have moved beyond North-South to universalism, in which issues like rights, inequality and climate change are truly shared. But there was some fascinating scepticism in the room about how far 'we' can shift to a truly universalist approach. 'Aren't we part of the 1945-2015 consensus (on the division of the world into North and South)? Don't we just need to get out of the way and let a new generation of people and organizations move towards universalism?' That resonated with me, because I have seen just how hard it is for NGOs to move beyond a North-South frame in which the people we help are hungry, rural, oppressed and a long way away. Oxfam has been about to go urban since the late 1980s, according to successive strategic plans (thanks John Magrath for doing the digging on that!). It is very hard for development organizations to start working on shared agendas on tobacco, road traffic or obesity, however important they may be, simply because they fall so far outside our traditional narrative of what matters in developing countries.

Hug Populism, reject it or prepare for its collapse? 'We have fundamentally miscalculated our fellow citizens' in assuming a progressive consensus existed on at least some issues. What next? First, there is a risk of over-reacting – people have multiple identities bubbling away, and at different times, different ones come to the fore. We should still appeal to the better angels of people's natures because those angels are still there.

But is it better to respond to rising nationalism by engaging with it, trying to understand it better, building bridges with some elements within it etc, or is that a fool's errand in which we are forced to abandon principles and cross red lines with very little to show for it? Elements of the progressive agenda (inequality, industrial policy) feature in the populist rhetoric (if not their practice) so should we try and reclaim them for the progressive cause or pick other battles? In any case, what if the populist tide is peaking, shortly to come crashing down amid economic and political chaos? If so, wouldn't it be better to start preparing messages, alliances, ideas etc in advance so that we are as ready as possible for that historical critical juncture when it comes?

Aid: and then there's aid. We met the day after President Trump recommended a 28% cut in US aid, so

understandably we kept coming back to it. People contrasted 2015 and 2017. 2015 = an illusion of consensus, everyone debating the content of the SDGs; an 'end of history' moment when all that was required was better data. Fast forward two years and there is a 'relentless assault' on both sides of the Atlantic. When aid gets attacked, out of both self interest and commitment to the aid project, aid organizations spring to its defence. But isn't that one reason why they are the wrong ones to lead on universalism? And anyway 'whenever we try and move 'beyond aid', we do so by doing things through aid'. Ouch.

Overall, I was left confused and concerned (doubtless the mark of a good conversation). Concerned that the development community could jump into current northern battles on populism, Brexit etc not primarily because doing so is vital to helping the world end poverty in the long term, or because the issues that matter have suddenly become universal, but because the values of northern activists push them to get involved for personal reasons. If that happens, we risk forfeiting our legitimacy, which in the eyes of northern publics and policy makers is rooted in our links with and understanding of events in the South. And what do we gain if 'Going Northern' doesn't add much to the existing progressive forces in the North?

And although many issues like equal rights, inequality etc are universal, some things (like famine) are not. There are still huge differences between rich and poor people and countries, and that matters. Take fragile and conflict–affected states – you simply can't equate what goes on in rich countries and events in places such as Yemen or Somalia: perhaps unfortunately, they are the likely future of the aid industry, simply because more stable countries will graduate through a combination of growth, poverty reduction and rising taxation. Whatever we do in the North, we need to ask ourselves whether it is relevant and helpful to the communities in those places. If the answer is 'not really', we should worry about that.

I'm now stuck in a global confab of Oxfam big cheeses on similar subjects – will report back on anything new that emerges.

-- via my feedly newsfeed

Peter Dorman: The Intersectionality that Dare Not Speak Its Name [feedly]

The Intersectionality that Dare Not Speak Its Name

http://econospeak.blogspot.com/2017/03/the-intersectionality-that-dare-not.html

Peter Dorman

http://econospeak.blogspot.com/2017/03/the-intersectionality-that-dare-not.html

The New York Times ran a Nate Cohn piece today that epitomizes the way conventional liberals spin American politics. On the one hand we have the turnout and voting preferences of people of color—blacks, Hispanics, Asian-Americans. On the other we have whites and, in particular, the white working class. Not much happened in the 2016 presidential election on the POC side, says Cohn; nearly all the movement was among working class whites.

I suppose it's good that political discourse can now acknowledge the presence of a working class, at least where white people are concerned. Wouldn't it be nice if they allowed people of other hues to be workers too?

Seriously, what's the basis for dichotomizing the political terrain into race versus class? Why not examine not just white workers, but workers?

The issue is not simply how many nonwhite workers switched their vote to Trump or waited out the election altogether. The starting point should be that Trump ran the most openly racist presidential campaign since George Wallace, and this should have cost him big time among all the groups he disparaged—but it didn't. So let's do a class breakdown for nonwhite voters the way it's now becoming fashionable to do for whites. How did Clinton do with working class black and Hispanic voters compared to more affluent POC? How does adding the nonwhite slices of the electorate change how we assess the role of the working class as a whole in electing Trump, if at all?

The working class is multiracial, and it is also a working class. There's nothing either/or about it.

-- via my feedly newsfeed

I suppose it's good that political discourse can now acknowledge the presence of a working class, at least where white people are concerned. Wouldn't it be nice if they allowed people of other hues to be workers too?

Seriously, what's the basis for dichotomizing the political terrain into race versus class? Why not examine not just white workers, but workers?

The issue is not simply how many nonwhite workers switched their vote to Trump or waited out the election altogether. The starting point should be that Trump ran the most openly racist presidential campaign since George Wallace, and this should have cost him big time among all the groups he disparaged—but it didn't. So let's do a class breakdown for nonwhite voters the way it's now becoming fashionable to do for whites. How did Clinton do with working class black and Hispanic voters compared to more affluent POC? How does adding the nonwhite slices of the electorate change how we assess the role of the working class as a whole in electing Trump, if at all?

The working class is multiracial, and it is also a working class. There's nothing either/or about it.

-- via my feedly newsfeed

EPI: What does good child care reform look like? [feedly]

What does good child care reform look like?

Elise Gould, Lea J.E. Austin, Marcy Whitebook

http://www.epi.org/publication/what-does-good-child-care-reform-look-like/

-- via my feedly newsfeed

http://www.epi.org/publication/what-does-good-child-care-reform-look-like/

-- via my feedly newsfeed

Child care reform occupies an increasingly prominent role in U.S. policy debates. There is widespread concern that the U.S. early care and education system, on which a majority of families with young children rely, is inadequate and falls far short of systems in our peer countries. Because children's experiences in the first five years of life establish the foundation for ongoing learning and progress, high-quality early care and education for all children is critical (IOM and NRC 2015). That is why many peer nations provide universal affordable child care through subsidies, extensive prekindergarten programs, and paid family leave. In contrast, the American system for the provision of early care and education is deeply fragmented and severely under-resourced, which results in vastly uneven quality of and access to services.

This report was produced in collaboration with University of California Berkeley's Center for the Study of Child Care Employment.

This fragmentation comes out of our century-long tradition of separating "care" from "education" as if they are distinct activities that do not occur simultaneously. And because public funding for early care and education is limited in the U.S., the cost burden of early care and education is borne primarily by parents and by the early childhood workforce in the form of their low wages.

The destructive rise in income inequality in recent decades has both compounded the problem of inadequate early care and made it more urgent to address. Rising inequality over the past four decades has meant sluggish wage growth for most American workers (Gould 2017). That means families have less to invest in high-quality child care and early education. And because lower income families have less access to paid family leave than higher income families, these families are less able to provide that high quality care and education themselves. This combination of economic inequality and disparate access to high-quality early care and education is at the root of achievement gaps between children from high- and low-income families. These gaps persist and perpetuate inequality.

Achieving high-quality early care and education for all children will require meaningful public policy interventions and investments. Multiple plans have been floated over the years and more are likely to emerge. By outlining the necessary components of a high-quality early care and education system for all children, this paper provides a framework with which to assess proposed policy solutions:

1. To be effective, child care reform must tackle the main problems with the current system:

- Lack of resources for parents to stay home with very young children

- Lack of access to affordable early care and education

- Low and uneven quality of early child care and education options

2. Child care policy proposals should be assessed against the following criteria:

- Does the policy allow all parents the option to stay home with their infants, newly adopted children, or new foster children?

- Does the policy relieve the cost burden of early child care and education for low- and middle-income families?

- Does the policy improve quality by investing in the early care and education workforce?

3. Solutions that do not sufficiently or effectively address each of the above questions should be disregarded.

Problems with the current system

The difficulties of achieving high-quality care for America's children are widespread and multifaceted, but can be boiled down to three major problems: lack of resources for parents to stay home with very young children, lack of access to affordable care and education, and low and uneven service quality of early child care and education options. In summary, parents too often lack viable options: both staying at home and going to work are unaffordable.

Lack of uniform paid family leave

Adequate leave that makes it feasible for parents to stay at home with their young children is an essential component of early care and education systems around the globe (OECD 2016). Yet in the United States, far too many parents lack the option to stay at home with their young children at their earliest stage of life because of insufficient or nonexistent paid family leave. While 87 percent of private-sector workers have unpaid family leave, primarily thanks to the Family and Medical Leave Act1 (the first law President Clinton signed in 1993), only 13 percent have any paid family leave (BLS 2016).2 Unpaid leave provides valuable job security, but it doesn't help parents pay bills or avoid the sharpest trade-off involved in deciding to stay home: loss of income versus paying the cost of outside care. Further, the distribution of workers with paid family leave is skewed toward higher-wage workers. As shown in Figure A, workers in the top 10 percent of the wage distribution are six times more likely to have paid leave to take care of their young children (newborns, newly adopted children, or new foster children) than workers in the bottom 10 percent. National paid family leave policy can level these disparities and give parents across the wage distribution the ability to stay home with their newborn, adopted, or foster children.

Figure A

Lack of access to affordable child care and education

Child care costs too much for many families

High-quality child care is out of reach for many American families—not just those with low incomes. Most families pay out-of-pocket for some portion of child care costs (including preschool or prekindergarten). The average fee for full-time child care ranges from $4,000 to $22,600 a year, depending on where the family lives and the age of the child (EPI 2016). According to the Economic Policy Institute's "Cost of Child Care" interactive fact sheets, child care costs are one of the most significant expenses in a family's budget (EPI 2016). Among families with two children (a 4-year-old and an 8-year-old), child care costs exceed rent in 500 out of 618 communities ("family budget areas," as designated by the Economic Policy Institute, which encompass the entire U.S.) (Gould and Cooke 2015).3 Child care consumes so much of a family's budget largely because child care and early education is a labor-intensive industry, requiring a low child-to-teacher ratio (Child Care Aware of America 2017a). The Department of Health and Human Services has historically considered child care affordable if it consumes 10 percent or less of a family's income (but has recently reduced this threshold to 7 percent) (U.S. HHS 2014; 2015).

Affording child care is particularly difficult for low-wage families. For a full-time, full-year minimum-wage worker, child care costs as a share of income far exceed even the less stringent 10 percent affordability standard. For example, the shares of annual minimum-wage earnings required to afford center-based infant care range from 31.8 percent in South Dakota to 103.6 percent in Washington, D.C. (Bivens et al. 2016). This expense becomes even further out of reach for families with more than one child requiring care.

However, the cost of child care is not just a problem for low-income families. By the 10 percent metric, infant care is "affordable" for the median family in only two states—South Dakota and Wyoming. In Massachusetts, which has one of the highest center-based infant care costs, child care costs exceed this affordability test for over 80 percent of families. This is illustrated in Figure B, which depicts the share of families able to afford infant care in each state. Similarly, Figure C displays the share of families in each state able to afford 4-year-old care.

Figures B & C

Subsidies and public programs reach only a small portion of low-income families that need them

Child care subsidies are the primary vehicle for making child care available to some low-income families. The Child Care Development Fund (CCDF), authorized under the Child Care and Development Block Grant Act (CCDBG), is the primary source of federal funding for child care subsidies for low-income working families. In 2016, total federal spending on CCDBG was $5.7 billion (Schmit and Walker 2016). Although CCDF is a single federal program targeting low-income families in each state, it functions as separate state programs in practice because states have considerable flexibility to set rules for how the CCDBG funds are distributed, including eligibility. For instance, many states set eligibility below the federal cap of 85 percent of the state median income (Walker and Schmit 2016).

Key barriers to access for families who are income-eligible for CCDF funds include the limited number of subsidies, inability to afford copayments even with the subsidies, and, in some states, ineligibility for subsidies while job-searching. Among those eligible, only 11 percent access CCDF subsidies (U.S. GAO 2016). In addition to this "oversubscription," copayments—the portion of the total cost of child care a family must pay out of pocket—have generally increased over time. Based on the 10 percent metric, required copayments are unaffordable for a family of three with an income at 150 percent of poverty in nine states (Schulman and Blank 2015).

In addition to the child care subsidy program, publicly funded programs that offer free or low-cost early learning experiences provide this to only a fraction of their target population. For example, Head Start offers free early care and education services for young children in poverty, but reaches less than half of eligible preschool-age children. Early Head Start reaches less than 5 percent of eligible infants and toddlers (NWLC 2015). Forty-two states and the District of Columbia funded prekindergarten programs in the 2014–2015 school year, but these programs reached only 29 percent of 4-year-olds and 5 percent of 3-year-olds (Barnett et al. 2016).

Low and uneven quality of early child care and education

Child care quality depends on a number of factors, including facility quality, health and safety standards, and child-adult ratios. Quality also hinges on increasing acceptance of the notion that care providers are early educators. All early childhood services need to provide early enrichment as well as keeping children safe while their parents are at work. Thus quality care rests upon the knowledge, skills, well-being, and stability of the educators responsible for delivering early care and education. Most people in the field recognize this and refer to child care providers as early educators. The Institute of Medicine and the National Research Council of the National Academies have underscored the central role that these early educators play in service quality (IOM and NRC 2015). The report also concludes that the failure to give care providers the support and education they need hurts society, stating that "adults who are underinformed, underprepared, or subject to chronic stress themselves may contribute to children's experiences of adversity and stress and undermine their development and learning." Accordingly, the Institute of Medicine recommends setting qualification levels for early care providers, under which entry-level workers need to possess foundational knowledge and lead teachers must have a bachelor's degree as well as specialized knowledge and competencies (IOM and NRC 2015). These recommendations are applied across all settings, including those serving infants and toddlers and those serving preschool age children. To date, no states have qualification systems in line with these recommendations. Across and within states, there are varying qualifications for regulated home-based programs, center-based child care, and public preschool teachers; fewer than a dozen states set consistent entry-level requirements across licensed settings (Whitebook, McLean, and Austin 2016a). Other qualifications set by the federal government for military child care, Early Head Start, and Head Start programs add further complexity to the array of requirements in a given community (Whitebook, McLean, and Austin 2016b). For example, in a given community, the required qualifications for a preschool teacher may range anywhere from no or minimal training or education to a college degree, depending on the funding source for the program in which he or she is employed, rather than the development needs of the children.

Most educators working with children from birth to age five are not expected to possess professional qualifications. These persistently low expectations perpetuate the false notion that teaching in early education is low-skilled work. This notion has in turn made early education a generally low-wage profession with little opportunity for additional training or advancement. But even when teachers have achieved higher levels of education, including college degrees, as they have in Head Start and many public and private preschool programs, wages remain low and are a fraction of what similarly educated teachers of older children and those working across occupations earn (Whitebook, McLean, and Austin 2016a, 15). In fact, those classified by the Bureau of Labor Statistics as child care workers, and those classified as preschool teachers, are among the country's lowest-paid workers, and they seldom receive job-based benefits such as health insurance. The median hourly wage for child care workers is $10.31, almost 40 percent below the $17.00 median hourly wage of workers in other occupations (Gould 2015). These low wages fuel economic insecurity among the early care and education workforce. Studies have demonstrated high levels of worry about paying for food and housing costs among early educators (Whitebook, Phillips, and Howes 2014; Whitebook, King, et al. 2016). Indeed, one in seven child care workers (14.7 percent) live in families with incomes below the official poverty line, compared with 6.7 percent of workers in other occupations (Gould 2015). And, close to one-half of child care worker families—a rate that is nearly double the national average for the U.S. workforce as a whole—accessed at least one federal income support (Whitebook, McLean, and Austin 2016a).

Employers of all types know that to attract and retain the best workers, they need to offer more competitive compensation. The child care and education profession is no exception. We need to create targets like those that exist for other high-skill professions, and not rely on substandard expectations of workers who may excel under difficult circumstances, but can't be expected to do the work simply as a mission.

Consequences of the current system for the achievement gap

Some of the consequences of the current early child care and education system have already been touched on: low- and middle-income families are so stretched by child care costs that many can't make ends meet, and child care workers struggle to get by as well because of low pay—with 15 percent living in poverty. Another consequence deserves special attention. Disparate access to high-quality early care and education contributes to striking achievement gaps between children from high- and low-income families. As shown in Figure D, these achievement gaps grow from birth to about age 5 and then remain relatively constant as children age. When they enter kindergarten, the most socioeconomically disadvantaged children lag substantially not only in reading and math skills but also in noncognitive skills such as persistence and self-control, which also affect achievement throughout a person's life (Garcia 2015). It is clear that efforts to close these gaps must include high-quality childhood educational practices that provide school-readiness well before K–12 education actually begins, whether by parental investments or through high-quality child care experiences.

Figure D

The consequences of inequitable access and uneven quality of early care are borne by the economy in terms of preparedness of the workforce, but also by children and their families. In today's system, the care and education a young child receives is dependent upon what his or her family can afford and has access to, and not upon his or her developmental and learning needs. The current system drives inequities from birth, and undermines the capacity of quality early care and education experiences to foster lifelong and healthy development.

Assessing proposed policy reforms

An effective, high-quality early care and education system would first of all give parents a feasible option for staying home with their children for initial bonding time through paid family leave. It would also ensure that all families can access high-quality child care provided by professional staff who are well-trained in early childhood education. While policy solutions may vary, any good child care reform policy must include three essential components, as reflected in the following three questions:

- Does the policy allow all parents the option to stay home with their infants, newly adopted children, or new foster children?

- Does the policy relieve the cost burden of early child care and education for low- and middle-income families?

- Does the policy improve quality by investing in the early care and education workforce?

If a policy fails to sufficiently address these questions, then it is unlikely to be very effective at solving the core problems with the early child care and education system today. Each of these three components are necessary to ensure that high-quality child care and education are accessible and affordable for families across the country, at all levels of income, across racial and ethnic groups, and in rural and urban areas alike. A public investment is required to tackle both affordability and quality.

The text that follows details how to use these questions to assess potential policies and assesses a few proposed and existing policies.

Does the policy allow all parents the option to stay home with their infants, newly adopted children, or new foster children?

Promising proposals provide family leave that is:

- Available to all persons with parental responsibilities, not just birthing mothers

- Of sufficient duration (no less than three months [Gault et al. 2014])

- Accompanied by adequate wage replacement (wage replacement should be progressive, approaching 100 percent for the lowest-wage workers)

Problematic proposals provide leave that meets the needs of just some types of families. Providing short-term disability insurance payments to mothers after the birth of a child is absolutely essential, but is not enough. Proposals to provide mothers who are giving birth a small portion of their full pay while they are on leave would not allow for recovery after birth and would do nothing for adoptive mothers and new fathers. While birthing mothers often need the leave to care for their own health, time for bonding and caretaking by all parents is also essential for the best childhood outcomes (Shonkoff and Phillips 2000).

Does the policy relieve the cost burden of early child care and education for low- and middle-income families?

Promising proposals:

- Cap child care expenses as a manageable share of family income

- Address affordability for low- and middle-income families, relieving the burden equitably across the board

Promising proposals are efficient and well-targeted and address the needs of families most in need. Problematic proposals disproportionately target benefits to the most well-off. The Child and Dependent Tax Credit (CDCTC) is an example of a policy that is problematic. It allows parents to report up to $3,000 per child in child care costs (up to $6,000 total) and receive a tax credit of 20 percent to 35 percent, or up to $2,100, based on their adjusted gross income. Despite its progressive structure, the federal CDCTC provides little benefit to low-income families because it is nonrefundable, meaning families with little or no tax liabilities are unable to receive it.4 This shortcoming of the credit means it cannot be used by well over a third of the lowest-income households. And tax credits are less practical for cash-strapped low-income families because the benefits are only available when or if a family files an income tax return, rather than at the time the expenses are incurred.

The employer-sponsored dependent care flexible spending account allows an employee to exclude from taxation up to $5,000 of his or her salary, regardless of the number of children receiving care. Since these are pretax dollars, higher-income families typically benefit more from the exclusion than from the tax credit because they save both on income and payroll taxes.5 Proposals that draw on the tax system in these ways exacerbate their regressivity.

Does the policy improve quality by investing in the early care and education workforce?

Promising proposals:

- Create improved standards for qualifications and compensation

- Provide sufficient funding to accomplish these goals

Problematic proposals do not provide adequate guidance or resources to invest in the workforce. The 2014 reauthorization of the Child Care Development Block Grant included provisions to ensure the health and safety of children in child care settings and improve the quality of care, with a small set-aside for training to improve the skills of providers. But increasing standards without making the necessary financial investments will not help much. The 2014 reauthorization did not include a significant increase in federal funding; states were therefore burdened with the challenge of having to make difficult tradeoffs in order to meet the new objectives (Matthews et al. 2015). And as has been the case for decades, the funding levels remain inadequate to improve early childhood educator qualifications and compensation. Unfunded mandates without adequate resources will be ineffective.

Reform proposals that increase qualification standards without corresponding investments for improving compensation, and without access to education and training to meet those higher qualification standards, fall short of any standard for high-quality child care reform.

Example: Assessing the Department of Defense's early education program

The early education and care program for the military, subsidized by the Department of Defense (DOD), is an example of a policy that includes many of the necessary components for success. It serves as a much better model for what we should pursue than do the insufficient policy proposals examined above. How does the DOD program stack up in answering our three essential questions?

1. Does the policy allow all parents the option to stay home with their infants, newly adopted children, or new foster children?

Somewhat. The military provides 12 weeks continuous paid maternity leave for all uniformed service members (Ryan 2016). Unfortunately, new fathers are only paid for 14 days of paternity leave. On the whole, this amount of parental leave is a move in the right direction, but it is still insufficient for parents (mainly fathers) who want to stay home with their young children for a more extended period.

2. Does the policy relieve the cost burden of early child care and education for low- and middle-income families?

To a great extent. Subsidies for child care are provided to families on a sliding scale (CCAA 2017b). In general, families' contributions cap out at around 12 percent of family income irrespective of the number of children in child care. In addition, the military provides for 12 hours of subsidized child care a day, in recognition of parents' often long working hours (Ryan 2016).

3. Does the policy improve quality by investing in the early care and education workforce?

Yes. The military sets early childhood teachers' salaries at a rate of pay equivalent to those of other Department of Defense employees with similar training, education, seniority, and experience. Further, the military child care program has a well-articulated career ladder and provides resources to ensure that education and training to meet higher qualifications are accessible and affordable. Over the first 25 years that this policy has been in place, the base pay of new hires among early childhood teaching staff in military child development centers has increased by 76 percent, and turnover has plummeted (Whitebook, Phillips, and Howes 2014).

Using the three questions outlined above, we can easily weed out proposals that fail to contain the essential components of a successful early child care and education reform program. Policy proposals that are insufficiently funded cannot, by definition, pass the test. Policies backed by unfunded mandates or that rely on the small amount of money that could be generated by eliminating what little waste, fraud, and abuse exists in the unemployment insurance system are simply insufficient to deal with the magnitude of the problems in the child care system today.

Effective policy solutions need to break the link between what people pay and what early child educators earn. If quality is based solely on what people can afford to pay, then early educators will continue to subsidize the services through their low pay—and the quality of service will suffer as a result. Therefore, solutions need to be sufficiently funded to attract and retain a skilled workforce, and the subsidy scheme needs to sufficiently relieve families' burdens.

The bottom line for an effective child care and education investment agenda

While there are some efforts aimed at providing more affordable and quality early care and education to a broader swath of American children, the system is currently insufficient to address the realities of 2017 family economics and to reflect what we know about the science of early learning and development. Quality child care access and affordability is a particular hardship for low- and moderate-income families, and policies should address both the size and the scope of this problem. The current child care and education system is too uneven in quality and access and requires further investments to live up to its potential. Increasingly researchers and policymakers are regarding these investments in the system as infrastructure investments, because an effective child and early education system supports not just families but the economy and society overall. For this reason, those concerned with making this "infrastructure investment" in American's children and families are looking to innovations that have become commonplace in our advanced industrial peer countries (provision of universal affordable child care through subsidies, extensive prekindergarten programs, and paid family leave, for example) but have not yet arrived in the United States (OECD 2016). Because we lack adequate policies to support parents' ability to remain in the labor force after having children, many parents—mostly mothers—drop out. This has important ramifications for their future work prospects, including their career path and earnings potential. Likewise mothers' career paths and earnings have implications for family income levels and well-being and the economy as a whole. Lastly, it should not be overlooked that nearly 2 million adults, mostly women, are currently paid to provide early care and education services to more than 12 million children across the country (U.S. Census Bureau 2013; NSECE 2013). If these jobs were properly rewarded, they could be a desirable form of employment in every community. All of this should be addressed with a major infrastructure investment in America's children and families. Anything less will continue to shortchange our future.

About the authors

Elise Gould, senior economist, joined EPI in 2003. Her research areas include wages, poverty, economic mobility, and health care. She is a co-author of The State of Working America, 12th Edition. In the past, she has authored a chapter on health in The State of Working America 2008/09; co-authored a book on health insurance coverage in retirement; published in venues such as The Chronicle of Higher Education, Challenge Magazine, and Tax Notes; and written for academic journals including Health Economics, Health Affairs, Journal of Aging and Social Policy, Risk Management & Insurance Review, Environmental Health Perspectives, and International Journal of Health Services. She holds a master's in public affairs from the University of Texas at Austin and a Ph.D. in economics from the University of Wisconsin at Madison.

Lea J.E. Austin joined the Center for the Study of Child Care Employment (CSCCE) at the Institute for Research on Labor and Employment, UC Berkeley, in 2010. She has extensive experience in the areas of workforce development, public policy and administration, and early childhood leadership competencies and curricula. In previous roles she developed leadership programs in higher education and community settings, and implemented a large-scale initiative focused on attainment of college education. She has led multiple research projects including the Early Childhood Higher Education Inventory studies, and is a co-author of the Early Childhood Workforce Index report and Leadership in Early Childhood: A Curriculum for Emerging and Established Agents of Change. She holds a master's degree in Public Administration from California State University, Hayward, and a master's degree and Ed.D. in Educational Leadership from Mills College.

Marcy Whitebook is the Founding Director of CSCCE at UC Berkeley, where her research focuses on the nexus of the relationship between good jobs for early educators and the quality of services available to children and families, and appropriate and accessible professional preparation for teachers. Prior to coming to UC Berkeley, she taught in early childhood programs for many years and was the founding Executive Director of the Washington-based Center for the Child Care Workforce (CCW), an organization she began in 1977 as the Child Care Employee Project. In addition to authoring numerous publications, Marcy has led several large-scale early childhood research projects, including the landmark National Child Care Staffing Study, which first brought public attention to the low wages and high turnover of child care teachers, and more recently Worthy Work, STILL Unlivable Wages, and the Early Childhood Workforce Index. She holds a master's degree in Early Childhood Education from UC Berkeley and a Ph.D. in Developmental Studies from the UCLA Graduate School of Education.

Endnotes

1. The Family and Medical Leave Act (FMLA) allows eligible employees to take up to 12 weeks of unpaid, job-protected leave within a calendar year for a serious health condition, the birth of a child, or to care for a newly born, adopted, or foster child, or to care for an immediate family member with a serious health condition.

2. Most workers with paid family leave also have access to unpaid family leave under the FMLA.

3. Cost estimates are for center-based care in metropolitan areas and home-based care in rural areas.

4. There are many reasons families would have little or no tax liabilities: parents could be working and be very low income or could be in school or looking for a job.

5. While both low-wage and high-wage families pay payroll taxes, higher-income families generally pay higher marginal tax rates. So while middle-wage families also benefit, high-income families benefit the most from flexible spending accounts because those with the highest marginal tax rates benefit the most.

References

Barnett, W. Steven, Allison H. Friedman-Krauss, Rebecca E. Gomez, Michelle Horowitz, G.G. Weisenfeld, Kirsty Clarke Brown, and James H. Squires. 2016. The State of Preschool 2015: State Preschool Yearbook. National Institute for Early Education Research, Graduate School of Education at Rutgers.

Bivens, Josh, Emma Garcia, Elise Gould, Elaine Weiss, and Valerie Wilson. 2016. It's Time for an Ambitious National Investment in America's Children: Investments in Early Childhood Care and Education Would Have Enormous Benefits for Children, Families, Society, and the Economy. Economic Policy Institute.

Bureau of Labor Statistics (BLS) (U.S. Department of Labor). 2016. "Leave Benefits: Access" [Employee Benefits Survey data table]. March.

Center for the Study of Child Care Employment (CSCCE). 2016. The Early Childhood Workforce Index.

Child Care Aware of America (CCAA). 2014. Parents and the High Cost of Child Care: 2014 Report.

Child Care Aware of America (CCAA). 2017a. Parents and the High Cost of Child Care: 2016 Report.

Child Care Aware of America (CCAA). 2017b. 2017 Child Care Fee Assistance Total Family Income Categories, DoD Parent Fees, High Cost Installations, and Provider Caps.

Council of Economic Advisers. 2014. The Economics of Early Childhood Investments.

Economic Policy Institute. 2016. "Cost of Child Care" [interactive graphic]. Last updated April 2016.

Garcia, Emma. 2015. Inequalities at the Starting Gate: Cognitive and Noncognitive Skills Gaps between 2010–2011 Kindergarten Classmates. Economic Policy Institute.

Gault, Barbara, Heidi Hartmann, Ariane Hegewisch, Jessica Milli, and Lindsey Rechlin. 2014. Paid Parental Leave in the United States: What the Data Tell Us about Access, Usage, and Economic and Health Benefits. Institute for Women's Policy Research.

Gould, Elise. 2015. Child Care Workers Aren't Paid Enough to Make Ends Meet. Economic Policy Institute.

Gould, Elise. 2016. "DC Paid Leave Bill is a Step in the Right Direction" [press release]. Economic Policy Institute, December 20.

Gould, Elise. 2017. The State of American Wages 2016: Lower Unemployment Finally Helps Working People Make Up Some Lost Ground on Wages. Economic Policy Institute.

Gould, Elise, and Tanyell Cooke. 2015. High Quality Child Care Is out of Reach of Working Families. Economic Policy Institute.

Institute of Medicine and National Research Council (IOM and NRC). 2015. Transforming the Workforce for Children Birth through Age 8: A Unifying Foundation. Washington, D.C.: The National Academies Press.

Matthews, Hannah, Karen Schulman, Julie Vogtman, Christine Johnson-Staub, and Helen Blank. 2015. Implementing the Child Care and Development Block Grant Reauthorization: A Guide for States. National Women's Law Center.

National Association for the Education of Young Children (NAEYC). 2017. "Child Care and Development Block Grant." Accessed March 2017.

National Survey of Early Care and Education Project Team (NSECE). 2013. Number and Characteristics of Early Care and Education (ECE) Teachers and Caregivers: Initial Findings from the National Survey of Early Care and Education (NSECE). OPRE Report #2013-38, Washington D.C.: Office of Planning, Research and Evaluation, Administration for Children and Families, U.S. Department of Health and Human Services.

National Women's Law Center (NWLC). 2015. Gaps in Support for Early Care and Education.

Organization for Economic Co-operation and Development (OECD). 2016. OECD Family Database [database]. Directorate for Employment, Labour and Social Affairs.

Ryan, Missy. 2016. "Pentagon Extends Maternity and Paternity Leave for Military Families." The Washington Post, January 28.

Schmit, Stephanie, and Christina Walker. 2016. Disparate Access: Head Start and CCDBG data by Race and Ethnicity. The Center for Law and Social Policy.

Schulman, Karen, and Helen Blank. 2015. Building Blocks: State Child Care Assistance Policies 2015. National Women's Law Center.

Shonkoff, Jack P., and Deborah A. Phillips, eds. 2000. From Neurons to Neighborhoods: The Science of Early Childhood Development. Washington, D.C.: National Academies Press.

U.S. Census Bureau American Community Survey. Various years. "S1903: Median Income in the Past 12 Months (In 2014 Inflation-Adjusted Dollars)."

U.S. Census Bureau. 2013. How Do We Know? Child Care: an Important Part of American Life[infographic].

U.S. Department of Health and Human Services (U.S. HHS). 2014. "Fun"damentals of CCDF Administration.

U.S. Department of Health and Human Services (U.S. HHS). 2015. Child Care and Development Fund (CCDF) Program; Proposed Rule, vol. 80, no. 247.

U.S. Government Accountability Office (U.S. GAO). 2016. Child Care: Access to Subsidies and Strategies to Manage Demand Vary Across States.

Walker, Christina, and Stephanie Schmit. 2016. A Closer Look at Latino Access to Child Care Subsidies. The Center for Law and Social Policy.

Whitebook, Marcy, Elizabeth King, George Phillip, and Laura Sakai. 2016. Teachers' Voices: Work Environment Conditions That Impact Teacher Practice and Program Quality. Center for the Study of Child Care Employment, University of California, Berkeley.

Whitebook, Marcy, Caitlin McLean, and Lea J.E. Austin. 2016a. Early Childhood Workforce Index—2016. Center for the Study of Child Care Employment, University of California, Berkeley.

Whitebook, Marcy, Caitlin McLean, and Lea J.E. Austin. 2016b. Early Childhood Workforce Index—2016 [interactive map]. Center for the Study of Child Care Employment, University of California, Berkeley.

Whitebook, Marcy, Deborah Phillips, and Carollee Howes. 2014. Worthy work, STILL Unlivable Wages: The Early Childhood Workforce 25 Years after the National Child Care Staffing Study. Center for the Study of Child Care Employment, University of California, Berkeley.

Subscribe to:

Comments (Atom)

West Virginia GDP -- a Streamlit Version

A survey of West Virginia GDP by industrial sectors for 2022, with commentary This is content on the main page.

-

John Case has sent you a link to a blog: Blog: Eastern Panhandle Independent Community (EPIC) Radio Post: Are You Crazy? Reall...

-

---- Mylan's EpiPen profit was 60% higher than what the CEO told Congress // L.A. Times - Business Lawmakers were skeptical last...

-

via Bloomberg -- excerpted from "Balance of Power" email from David Westin. Welcome to Balance of Power, bringing you the late...