Tuesday, February 28, 2017

Eastern Panhandle Independent Community (EPIC) Radio:Rockpile and Best of the Left on EPIC -- Tuesdays

Blog: Eastern Panhandle Independent Community (EPIC) Radio

Post: Rockpile and Best of the Left on EPIC -- Tuesdays

Link: http://www.enlightenradio.org/2017/02/rockpile-and-best-of-left-on-epic.html

--

Powered by Blogger

https://www.blogger.com/

Monday, February 27, 2017

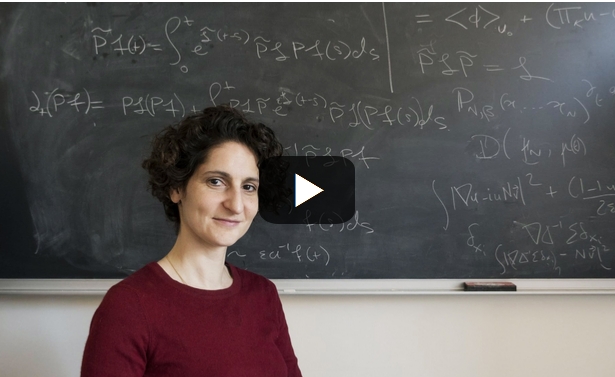

Fwd: In Mathematics, ‘You Cannot Be Lied To’

| | ||||||||||||||||||

|

| |||||||||||||||||

--

Harpers Ferry, WV

Fwd: Till We Watch History Turn

Sent from my iPhone

Begin forwarded message:

From: Stewart Acuff <acuff.stewart@gmail.com>

Date: February 27, 2017 at 8:36:05 AM EST

To: Stewart <acuff.stewart@gmail.com>

Subject: Till We Watch History Turn

Born of the strain of struggle

Conceived in genocide and slavery

America has never been as good as her words

But our people fought through it all

In never ending effort to make her words real

Now we face the threat once thought unimaginable

The assault on all we believed we were

Shredding our freedoms

Bullying the weak

Destroying the strong

It is now our turn and our time

To meet the struggle with strength

Standing in solidarity

Don't give in, don't give out, don't give up

Refuse his authority

Resist his power

Resist , defy, defend

As Americans always have

Till we watch history turn

Sent from my iPhone

Sunday, February 26, 2017

EPIC Radio Podcasts:Podcast of Paul Tillich's classic theological address to the Harvard Divinity School, 1960

Blog: EPIC Radio Podcasts

Post: Podcast of Paul Tillich's classic theological address to the Harvard Divinity School, 1960

Link: http://podcasts.enlightenradio.org/2017/02/podcast-of-paul-tillichs-classic.html

--

Powered by Blogger

https://www.blogger.com/

Eastern Panhandle Independent Community (EPIC) Radio:Fwd: Monday's poet is Afaa Michael Weaver

Blog: Eastern Panhandle Independent Community (EPIC) Radio

Post: Fwd: Monday's poet is Afaa Michael Weaver

Link: http://www.enlightenradio.org/2017/02/fwd-mondays-poet-is-afaa-michael-weaver.html

--

Powered by Blogger

https://www.blogger.com/

Eastern Panhandle Independent Community (EPIC) Radio:Monday on EPIC Radio

Blog: Eastern Panhandle Independent Community (EPIC) Radio

Post: Monday on EPIC Radio

Link: http://www.enlightenradio.org/2017/02/monday-on-epic-radio.html

--

Powered by Blogger

https://www.blogger.com/

Fwd:

Sent from my iPhone

Begin forwarded message:

From: Stewart Acuff <acuff.stewart@gmail.com>

Date: February 26, 2017 at 8:56:49 AM EST

To: Stewart <acuff.stewart@gmail.com>

The fire of rebellion has been lit

In town after town, state upon state

We have decided we will not quit

It is we, us who will stoke that fire no matter how late

That fire must burn

Till we destroy the fascism that will not be our fate

We will burn til all learn

That we will not bow to the gods of money and power.

Sent from my iPhone

Saturday, February 25, 2017

EPIC Radio Podcasts:Apologies for Down Time -- Get Ready for Little FEAT tonite, and Philo-Religion tomorrow

Blog: EPIC Radio Podcasts

Post: Apologies for Down Time -- Get Ready for Little FEAT tonite, and Philo-Religion tomorrow

Link: http://podcasts.enlightenradio.org/2017/02/apologies-for-down-time-get-ready-for.html

--

Powered by Blogger

https://www.blogger.com/

Friday, February 24, 2017

Robots, or automation, are not the problem: Too little worker power is [feedly]

http://www.epi.org/publication/robots-or-automation-are-not-the-problem-too-little-worker-power-is/

The fear of job-stealing robots has been recently stoked in the media and pundits frequently refer to automation as a key driver of long-term middle-class wage stagnation. But are robots actually transforming the labor market at an unprecedented pace? Nope—in fact, the opposite is true. First, it's important to note that technology and automation have consistently transformed the way work gets done. So, technology itself is not a problem. Robots and automation allow us to increase efficiency by making more things for less money. When goods and services are cheaper, consumers can afford to buy more robot-made stuff, or have money left over to spend on other things. When consumers spend their leftover cash on additional goods and services, it creates jobs. These new jobs help compensate for the jobs lost to automation.

But are robots now eroding jobs and replacing human labor at a faster pace that the economy can't absorb? Again, no. Perhaps surprisingly to some, the data on investments and productivity do not reveal worrisome footprints of accelerated robot activity: in fact, in recent years the growth of labor productivity, capital investment and, particularly, investment in information equipment and software has strongly decelerated in the 2000s. There is no basis for believing that robots or automation are having an unusual transformative effect on the labor market.

The first chart below shows that productivity and capital investment did indeed accelerate during the late 1990s tech boom. But productivity and capital investments were much slower in the recovery from 2002–2007, and decelerated further in the period since the Great Recession.

The second chart looks more closely at two components of capital investment, information processing equipment investment (mainly computers and communications equipment), and software investment. Information processing equipment investment grew at a 8.0 percent annual rate over the 2002–2007 period, roughly half the 15.6 percent rate of the 1995–2002 period, and grew even more slowly (4.8 percent annually) after 2007. If technology were rapidly transforming our workplaces, we would expect to see exactly the opposite—a surge in the use of information equipment and software in the production of goods and services. That is what occurred in the late 1990s, but it is not happening now.

We need to give the robot scare a rest. Robots are not leading to mass joblessness and are not the cause of wage stagnation or growing wage inequality. Recently, the New York Times referred to the robot scare as a "distraction from real problems and real solutions." Instead, we should focus on policy choices that lead to things that truly threaten workers and their families like eroding labor standards, declining unionization, elevated unemployment, unbalanced globalization, and declining top tax rates.

-- via my feedly newsfeed

Charles Blow: The death of compassion, and commentary

Harpers Ferry, WV

NYtines: What Americans Do for Work

Harpers Ferry, WV

Dan Little: DIVIDED

Divided ...

Why is part of the American electoral system so susceptible to right-wing populist appeals, often highlighting themes of racism and intergroup hostility? Doug McAdam and Karina Kloos address the causes of the radical swing to the right of the Republican Party in Deeply Divided: Racial Politics and Social Movements in Postwar America. Here is the key issue the book attempts to resolve:

If the general public does not share the extreme partisan views of the political elites and party activists and, more to the point, is increasingly dismayed and disgusted by the resulting polarization and institutional paralysis that have followed from those views, how has the GOP managed to move so far to the right without being punished by the voters? Our answer — already telegraphed above — is that over the past half century social movements have increasingly challenged, and occasionally supplanted, parties as the dominant mobilizing logic and organizing vehicle of American politics. (Kindle location 303-307).

McAdam and Kloos argue that the social movements associated with the 1960s Civil Rights movement and its opposite, the white segregationist movement, put in motion a political dynamic that pushed each party off of its "median voter" platform, with the Republican Party moving increasingly in the direction of white supremacy and preservation of white privilege.

More accurately, it is the story of not one, but two parallel movements, the revitalized civil rights movement of the early 1960s and the powerful segregationist countermovement, that quickly developed in response to the black freedom struggle. (lc 1220)The dynamics of grassroots social movements are thought to explain how positions that are unpalatable to the broad electorate nonetheless become committed platforms within the parties. (This also seems to explain the GOP preoccupation with "voter fraud" and their efforts at restricting voting rights for people of color.) The primary processes adopted by the parties after the 1968 Democratic convention gave a powerful advantage to highly committed social activists, even if they do not represent the majority of a party's members.

This historical analysis gives an indication of an even more basic political factor in American politics: the polarizing issues that surround race and the struggle for racial equality. The Civil Rights movement of the 1950s and 1960s was a widespread mobilization of large numbers of ordinary citizens in support of equal rights for African Americans in terms of voting, residence, occupation, and education. Leaders like Ralph Abernathy or Julian Bond (or of course, Martin Luther King, Jr.) and organizations like the NAACP and SNCC were effective in their call to action for ordinary people to take visible actions to support greater equality through legal means. This movement had some success in pushing the Democratic Party towards greater advocacy of reforms promoting racial justice. And the political backlash against the Democratic Party following the enactment of civil rights legislation spawned its own grassroots mobilizations of people and associations who objected to these forms of racial progress. And lest we imagine that progressive steps in the struggle for racial justice largely derived from the Democratic Party, the authors remind us that a great deal of the support that civil rights legislation came from liberal Republicans:

The textbook account also errs in typically depicting the Democrats as the movement's staunch ally. What is missed in this account is the lengths to which all Democratic presidents—at least from Roosevelt to Kennedy—went to placate the white South and accommodate the party's Dixiecrat wing. (kl 411)

The important point is that as long as the progressive racial views of northern liberal Democrats were held in check and tacit support for Jim Crow remained the guiding—if unofficial—policy of the party, the South remained solidly and reliably in the Democratic column. (lc 1301)So M&K are right -- issues and interests provide a basis for mobilization within social movements, and social movements in turn influence the evolution of party politics.

But their account suggests a more complicated causal story of the evolution of American electoral politics as well. M&K make the point convincingly that the dynamics of party competition by themselves do not suffice to explain the evolution of US politics to the right, towards a more and more polarized relationship between a divided electorate. They succeed in showing that social movements of varying stripes played a key causal role in shaping party politics themselves. So explaining American electoral politics requires analysis of both parties and movements. But they also inadvertently make another point as well: that there are underlying structural features of American political psychology that explain much of the dynamics of both movements and parties, and these are the facts of racial division and the increasingly steep inequalities of income and wealth that divide Americans. So structural facts about race and class in American society play the most fundamental role in explaining the movements and alliances that have led us to our current situation. Social movements are an important intervening variable, but pervasive features of inequality in American society are even more fundamental.

Or to put the point more simply: we are divided politically because we are divided structurally by inequalities of access, property, opportunity, and outcome; and the mechanisms of electoral politics are mobilized to challenge and defend the systems that maintain these inequalities.

Harpers Ferry, WV

Eastern Panhandle Independent Community (EPIC) Radio:The Friday Lineup on EPIC Radio -- Paris on the Potomac, Labor Beat, old time radio, jazz

Blog: Eastern Panhandle Independent Community (EPIC) Radio

Post: The Friday Lineup on EPIC Radio -- Paris on the Potomac, Labor Beat, old time radio, jazz

Link: http://www.enlightenradio.org/2017/02/the-friday-lineup-on-epic-radio-paris.html

--

Powered by Blogger

https://www.blogger.com/

Fascism, Dissent and the Outlawing of Protest

Authorities are destroying the camps at Standing Rock that were used as staging areas for the Anerican Native opposition to the North Dakota pipeline.

Trump continues his war against Muslims and immigrants.

The founders honored dissent. They were all guilty of dissent.

America was born of dissent.

Slavery in America was only abolished after a century of dissent by African-Americans, Quakers, Congregationalists and other people of faith.

Some of us have expected that Trump and his followers would bring down the Iron Heel on dissent. Now his followers in Arizona have.

Do you still doubt that we are in a dire struggle against fascism?

The ongoing assault against Muslims and immigrants is torn from the Nazi play book. Pick a minority (Jews in Germany) to blame for the woes of the majority.

We've experienced 40 years of stagnant wages and declining benefits and living standards because of unfettered and unrestrained predatory capitalism-- not because of immigrants.

One reason the predators have been able to hold us down is the dangerous weakening of the American labor movement.

I was greatly saddened to hear yesterday that the afl-cio is laying off staff in the wake of membership losses and the 2016 election debacle.

And the labor federation appears to have no strategy for growth.

Growth is possible, but it requires a strategy , resources and re-thinking.

We grew the American labor movement significantly in. 2007 and 2008 when I was the organizing director because we focused on growth.

We cannot grow without focus and without seriously engaging workers who want a better life.

Unfortunately for all of us, a vibrant democracy requires a vibrant workers movement. If the leaders of the afl- cio aren't prepared to step up to the Struggle before us, they should step aside.

Sent from my iPhone

Thursday, February 23, 2017

More Republican Handouts to the Rich [feedly]

http://cepr.net/publications/op-eds-columns/more-republican-handouts-to-the-rich

Unfortunately, this is not a joke. One of the major problems facing workers today is the inability to save for retirement. Traditional defined benefit pensions are rapidly disappearing. Roughly half the workforce now has access to a 401(k) defined contribution plan at their workplace, but we know that these generally are not providing much support in retirement.

Most workers manage to accumulate little money in these accounts over the span of their working career. Part of this is due to the fact that they often change jobs. They may go several years without being able to contribute to a 401(k) plan at their workplace. And they often cash out the money that they saved in a plan when they leave a job.

In addition, many of these plans charge high fees. This is often overlooked by workers since the financial companies operating the plans usually don't like to advertise their fees. The average fee is close to 1.0 percent of the money saved, with many charging fees of 1.5 percent of higher.

If this sounds like a small matter, imagine that you were able to save $100,000 in a 401(k). That would put you way ahead of most workers, since the median accumulation among the 60 percent of the workforce who have 401(k)s was just $26,000 in 2015, but $100,000 is certainly a plausible amount for a worker earning $60,000 a year.

A fee of 1 percent means that this worker is giving $1,000 a year to the financial industry. If they are paying 1.5 percent, then they are giving the financial industry $1,500 a year. But this is not a single year story. Suppose you average $100,000 in your account over a 20-year period. You might have handed over $30,000 to a bank, brokerage house or insurance company for basically nothing. Feel good now?

Several states, most notably Illinois and California, are in the process of opening up their public retirement plans to workers in the private sector to allow people to save without giving so much money to the financial industry. Under this plan, workers in private firms would have the option to contribute to a state managed system.

This would have the advantage of keeping the same plan even as someone changed jobs and the fees would be far lower. Instead of fees of 1 to 1.5 percent, workers would likely be seeing fees in the range of 0.2 to 0.3 percent. Did I mention this was voluntary?

Okay, so we're talking about giving workers the option to save for their own retirement in individual accounts. If the Republican Party stood for anything other than giving money to rich people, this would be it.

But the Republicans are up in arms against making it easier for workers to save. Paul Ryan and his gang are planning to deny states the right to offer such plans. The trick they are using is in a ruling by the Labor Department which gives the individual employers exemptions from the Employee Retirement Income Security Act (ERISA) requirements when their workers contribute to the state sponsored plan. The ERISA requirements are designed to ensure that an employer operating a pension plan for their workers is doing proper bookkeeping and is handling the money appropriately.

In this case, it doesn't make sense for the ERISA rules to apply to individual employers since all they are doing is sending a check for their workers' contributions to the state-operated system. The individual employer plays zero role in what happens to the money.

This is the reason the Labor Department ruled last year that ERISA did not apply to individual employers who had workers taking part in the state-sponsored system. It is this ruling that Paul Ryan's gang wants to reverse. They argue, incredibly, that workers need safeguards with their savings and that the government must have oversight over employers sending checks to the state system.

This one is too ridiculous even for Washington politics. Everyone knows that there is nothing the Republicans in Congress hate more than government regulations that protect workers. This is why they were so anxious to repeal the fiduciary rule requiring financial advisers to act in the interest of their clients. This is why they want to gut the Consumer Financial Protection Bureau.

The story here is about as simple as it gets. Republicans' buddies in the financial industry will lose a lot of money if workers can put their money in these state-sponsored retirement systems instead of having to rely on their rip-off outfits. The Republicans are rigging the system to transfer tens of billions of dollars a year from ordinary workers to their rich friends. The only principle here is giving more money to the rich.

-- via my feedly newsfeed

Governor Justice’s Tax Plan: Who Pays? [feedly]

http://www.wvpolicy.org/governor-justices-tax-plan-who-pays/

Governor Jim Justice has not introduced any tax measures yet, but in his State of the State Address and his executive budget there are plans to enact several tax increases to close the Fiscal Year 2018 budget gap of $500 million and address the state's declining road fund that pays for highway construction, maintenance, and road repairs. This includes an estimated $450.2 million in the proposed general revenue fund revenue enhancements and $177 million in new revenue for the state road fund. While Governor Justice should be commended for putting forth much-needed revenue to address the state's growing budget crisis, the combined impact of his tax increases will fall harder on low-income West Virginians. Instead of just relying on regressive tax measures, Governor Justice should include revenue enhancements that ask a little more from the folks that have received most of the income gains in the state over the last several decades.

Governor Justice's proposed revenue enhancements for FY 2018 include:

General Revenue Fund Revenue Enhancements

- Increasing the Sales & Use Tax from 6 percent to 6.5 percent ($92.7 million).

- Broadening the Sales Tax base to include some professional services ($82 million) and advertising services ($5.6 million).

- Enacting a new Commercial Activity Tax (gross receipts tax) on businesses of 0.2 percent ($214 million).

- Raising Beer Barrel Tax from $5.50 to $8.00 ($2.8 million) and Wholesale Liquor from 28 percent to 32% ($2.8 million).

- Repealing Film Tax Credit ($2.5 million in FY19), modifying Excess Acreage Tax to 5 cents per acre (unknown), and a new tiered Severance Tax rate (unknown).

- Ending a general revenue fund transfer to Division of Highways ($11.7 million) and re-directing Workers' Compensation Debt Fund revenue (onetime money) to general revenue fund in FY 2017 ($25.5 million) and FY2018 ($38.25).

State Road Fund Enhancements

- Raising the excise motor fuel tax from 20.5 cents per gallon to 30.5 cents per gallon ($144 million)

- Raise Division of Motor Vehicle registration fees from $30 to $50 ($33 million)

- Implementing a $1 toll increase on the West Virginia Turnpike ($500 million) to fund a Turnpike Bond, a voter approved general obligation bond ($400 million), and legislative approval for increasing GARVEE capacity (bond) ($500 million).

The specifics of the revenue enhancements listed above are unknown, but it is clear that the brunt of the changes will fall harder on low-income West Virginians compared to those with higher incomes. The chart below illustrates this point by looking at the tax impact of the proposed sales tax changes, enactment of a new commercial activities tax, and the 10 cent gas tax increase. For West Virginians that only make $11,000 annually (lowest 20 percent), they will pay on average 1.3 percent more of their income in additional taxes or $133 dollars. For West Virginians in the top one percent who make on average $778,000, they will pay an additional 0.2 percent of their income in taxes under Justice's revenue plan. While the amount of taxes paid by income group increases with income, the tax change as a share of income decreases – meaning that it takes a larger bit out of low and middle income taxpayers than higher income West Virginians.

Until Governor Justice's revenue plan is introduced, it will be difficult to measure exactly how it will impact working families in the state. That said, it is clear that it would fall hardest on low-income people in the state. There are number of options that exist to make his plan more balanced. This could include reinstating the business franchise tax and raising the corporate net income tax to their 2006 levels, increasing the severance tax on natural gas from 5 percent to 6.5 percent, enacting a three percent income tax surcharge on incomes above $200,000, and creating a refundable state Earned Income Tax Credit that is available in 26 other states. Lawmakers could also include expanding the sales tax base to include digital downloads and other personal services.

Though Justice's tax plan is not perfect, it offers a real opportunity for lawmakers to include more progressive revenue enhancements that will ensure that state addresses its huge budget crisis while ensuring that it takes a balanced approach to tax increases that is more closely aligned with the ability to pay.

-- via my feedly newsfeed

Jared Bernstein: If only we could apply dynamic scoring to the rest of life [feedly]

http://jaredbernsteinblog.com/if-only-we-could-apply-dynamic-scoring-to-the-rest-of-life/

"Dynamic scoring" is one of those phrases that sounds way more innocent than it is. It's the process of guesstimating what impact your budget proposals will have on economic growth, and in turn, revenues flowing into the Treasury.

For example, if your budget includes big tax cuts, as Trump's will, that's obvious a revenue loser, which is exactly what the "static" scores show. But with dynamic scoring, you can claim to make back some share of that loss due to the growth effects spun off by your awesome, pro-growth tax-cut plan.

You see the problem. Economic models are dumb, or at least compliant, beasts who will give you whatever answer you want. Put such models in the hands of the purveyors of alternative facts, and the outcome is predictable, as the WSJ reported on Friday and budget nerd extraordinaire Stan Collender takes apart here. Depending on your willingness to torture the model, that "some share of the loss" you can allegedly get back approaches 100%.

This is a serious problem, and I'm not sure what the rest of us can do about it. In normal times, the scoring of the Trump budget by the nonpartisan Congressional Budget Office, which would surely show it to cause deep pools of red ink, would pose at least somewhat of a constraint. But expect team Trump to be closer to the heavenly figure below (h/t: R Kogan, who has this cartoon on his office wall).

Source: New Yorker

In the meanwhile, consider how great it would be if we could use dynamic scoring in the rest of our lives:

Diets: This salted caramel milkshake with extra whip cream has a static calorie score of 800. But when I factor in the efforts expended in 1) taking the paper off the straw 2) drawing the thick shake through the straw (which really is exhausting) and 3) stirring in the extra whip cream, the net caloric intake is -60.

Dating apps: "Statically scored, I probably don't seem that appealing. But once you dynamically account for certain attributes, you'll want to swipe right. I mean, who else up here is going to regale you with in-the-weeds facts on budget processes? If you're looking for a pro-growth guy, that's me!"

Sports outcomes: The static box score had us losing the basketball game 100-40, but once you dynamically model the counterfactual that their 7-foot center played for our team instead of theirs, that score flips and we win.

Elections: Yes, Trump won the electoral college, but he lost the popular vote, and if we dynamically score the possible damage to our fiscal accounts by putting him in charge, especially given the extent to which he will abuse dynamic scoring, he loses. Yes, that logic uses dynamic scoring against dynamic scoring, but what are you gonna do about it?!

-- via my feedly newsfeed

A Thumbnail Moon Rose Over the Ridge

It's light too dim to shine away the shadows

But enough to be a beacon

For the early traveler

In his dark morning run

Sometimes the light too dim

To see the path

As night prepares for day

And the traveler makes a way

Sometimes the light stands alone

A sign in the sky

The light stays with the traveler

Tho the path is still a dark challenge to try.

Sent from my iPhone

Eastern Panhandle Independent Community (EPIC) Radio:Wonk City -- ALL Day on EPIC RAdio

Blog: Eastern Panhandle Independent Community (EPIC) Radio

Post: Wonk City -- ALL Day on EPIC RAdio

Link: http://www.enlightenradio.org/2017/02/wonk-city-all-day-on-epic-radio.html

--

Powered by Blogger

https://www.blogger.com/

Tuesday, February 21, 2017

Paul Krugman: On Economic Arrogance [feedly]

http://economistsview.typepad.com/economistsview/2017/02/paul-krugman-on-economic-arrogance.html

Why do Republicans insist, contrary to the evidence, that tax cuts and deregulation will spur economic growth:

On Economic Arrogance, by Paul Krugman, NY Times: According to press reports, the Trump administration is basing its budget projections on the assumption that the U.S. economy will grow very rapidly over the next decade — in fact, almost twice as fast as independent institutions like the Congressional Budget Office and the Federal Reserve expect. There is, as far as we can tell, no serious analysis behind this optimism; instead, the number was plugged in to make the fiscal outlook appear better.

I guess this was only to be expected from a man who keeps insisting that crime, which is actually near record lows, is at a record high, that millions of illegal ballots were responsible for his popular vote loss, and so on: In Trumpworld, numbers are what you want them to be, and anything else is fake news. ...

The only way we could have a growth miracle now would be a huge takeoff in productivity... This could, of course, happen: maybe driverless flying cars will arrive en masse. But it's hardly something one should assume for a baseline projection.

And it's certainly not something one should count on as a result of conservative economic policies. ...

The ... belief that tax cuts and deregulation will reliably produce awesome growth isn't unique to the Trump-Putin administration. We heard the same thing from Jeb Bush (who?); we hear it from congressional Republicans like Paul Ryan. The question is why. After all, there is nothing — nothing at all — in the historical record to justify this arrogance. ...

The evidence ... is totally at odds with claims that tax-cutting and deregulation are economic wonder drugs. So why does a whole political party continue to insist that they are the answer to all problems?

It would be nice to pretend that we're still having a serious, honest discussion here, but we aren't. At this point we have to get real and talk about whose interests are being served.

Never mind whether slashing taxes on billionaires while giving scammers and polluters the freedom to scam and pollute is good for the economy as a whole; it's clearly good for billionaires, scammers, and polluters. Campaign finance being what it is, this creates a clear incentive for politicians to keep espousing a failed doctrine, for think tanks to keep inventing new excuses for that doctrine, and more.

And on such matters Donald Trump is really no worse than the rest of his party. Unfortunately, he's also no better.

-- via my feedly newsfeed

Stiglitz How to survive Trump

How to Survive the Trump Era

Any view regarding the way forward is necessarily provisional, as Trump has not yet proposed detailed legislation, and Congress and the courts have not fully responded to his barrage of executive orders. But recognition of uncertainty is not a justification for denial.

On the contrary, it is now clear that what Trump says and tweets must be taken seriously. Following the election in November, there was near-universal hope that he would abandon the extremism that defined his campaign. Surely, it was thought, this master of unreality would adopt a different persona as he assumed the awesome responsibility of what is often called the most powerful position in the world.

Something similar happens with every new US president: regardless of whether we voted for the new incumbent, we project onto him our image of what we want him to be. But, while most elected officials welcome being all things to all people, Trump has left no room for doubt that he intends to do what he said: a ban on Muslim immigration, a wall on the border with Mexico, renegotiation of the North American Free Trade Agreement, repeal of the 2010 Dodd-Frank financial reforms, and much else that even his supporters dismissed.

I have, at times, criticized particular aspects and policies of the economic and security order created in the aftermath of World War II, based on the United Nations, NATO, the European Union, and a web of other institutions and relationships. But there is a big difference between attempts to reform these institutions and relationships to enable them to serve the world better, and an agenda that seeks to destroy them outright.

Trump sees the world in terms of a zero-sum game. In reality, globalization, if well managed, is a positive-sum force: America gains if its friends and allies – whether Australia, the EU, or Mexico – are stronger. But Trump's approach threatens to turn it into a negative-sum game: America will lose, too.

That approach was clear from his inaugural address, in which his repeated invocation of "America first," with its historical fascist overtones, affirmed his commitment to his ugliest schemes. Previous administrations have always taken seriously their responsibility to advance US interests. But the policies they pursued usually were framed in terms of an enlightened understanding of national interest. Americans, they believed, benefit from a more prosperous global economy and a web of alliances among countries committed to democracy, human rights, and the rule of law.

If there is a silver lining in the Trump cloud, it is a new sense of solidarity over core values such as tolerance and equality, sustained by awareness of the bigotry and misogyny, whether hidden or open, that Trump and his team embody. And this solidarity has gone global, with Trump and his allies facing rejection and protests throughout the democratic world.

In the US, the American Civil Liberties Union, having anticipated that Trump would quickly trample on individual rights, has shown that it is as prepared as ever to defend key constitutional principles such as due process, equal protection, and official neutrality with respect to religion. And, in the past month, Americans have supported the ACLU with millions of dollars in donations.

Similarly, across the country, companies' employees and customers have expressed their concern over CEOs and board members who support Trump. Indeed, as a group, US corporate leaders and investors have become Trump's enablers. At this year's World Economic Forum Annual Meeting in Davos, many salivated over his promises of tax cuts and deregulation, while eagerly ignoring his bigotry – not mentioning it in a single meeting that I attended – and protectionism.

Even more worrying was the lack of courage: it was clear that many of those who were concerned about Trump were afraid to raise their voices, lest they (and their companies' share price) be targeted by a tweet. Pervasive fear is a hallmark of authoritarian regimes, and we are now seeing it in the US for the first time in my adult life.

As a result, the importance of the rule of law, once an abstract concept to many Americans, has become concrete. Under the rule of law, if the government wants to prevent firms from outsourcing and offshoring, it enacts legislation and adopts regulations to create the appropriate incentives and discourage undesirable behavior. It does not bully or threaten particular firms or portray traumatized refugees as a security threat.

But when we are constantly barraged by events and decisions that are beyond the pale, it is easy to become numb and to begin looking past major abuses of power at the still-greater travesties to come. One of the main challenges in this new era will be to remain vigilant and, whenever and wherever necessary, to resist.VAmerica's leading media, like The New York Times and The Washington Post, have so far refused to normalize Trump's abnegation of American values. It is not normal for the US to have a president who rejects judicial independence; replaces the most senior military and intelligence officials at the core of national security policymaking with a far-right media zealot; and, in the face of North Korea's latest ballistic missile test, promotes his daughter's business ventures.

Harpers Ferry, West Virginia

EPIC Radio Podcasts:Fanny Crawford and Ellouise Schoettler share stories of women pioneers in the US military services

Blog: EPIC Radio Podcasts

Post: Fanny Crawford and Ellouise Schoettler share stories of women pioneers in the US military services

Link: http://podcasts.enlightenradio.org/2017/02/fanny-crawford-and-ellouise-schoettler.html

--

Powered by Blogger

https://www.blogger.com/

Resistance Radio, Wed Feb 22 at 10 am

Please join me and special guest Laura Markwardt for Resistance Radio tomorrow at 10 am est as we bring you up to date on Our Resistance and all the threats to our democracy including the fascistic assault on academic freedom. Please find our small but great, global radio station at www.enlightenradio.org.

Sent from my iPhone

Sunday, February 19, 2017

Eastern Panhandle Independent Community (EPIC) Radio:EPIC Radio Podcasts: the Are You Crazy? podcast: Dr Leslie-Beth Wish, D...

Blog: Eastern Panhandle Independent Community (EPIC) Radio

Post: EPIC Radio Podcasts: the Are You Crazy? podcast: Dr Leslie-Beth Wish, D...

Link: http://www.enlightenradio.org/2017/02/epic-radio-podcasts-are-you-crazy.html

--

Powered by Blogger

https://www.blogger.com/

Eastern Panhandle Independent Community (EPIC) Radio:Quaker Radio, the Partially Examined Life, and Richard Diamond, Private EYE -- Sunday on EPIC Radio

Blog: Eastern Panhandle Independent Community (EPIC) Radio

Post: Quaker Radio, the Partially Examined Life, and Richard Diamond, Private EYE -- Sunday on EPIC Radio

Link: http://www.enlightenradio.org/2017/02/quaker-radio-partially-examined-life.html

--

Powered by Blogger

https://www.blogger.com/

Saturday, February 18, 2017

EPIC Radio Podcasts:Paris on the Potomac Reviews the Gaslighting and Confusion downstream

Blog: EPIC Radio Podcasts

Post: Paris on the Potomac Reviews the Gaslighting and Confusion downstream

Link: http://podcasts.enlightenradio.org/2017/02/paris-on-potomac-reviews-gaslighting.html

--

Powered by Blogger

https://www.blogger.com/

Friday, February 17, 2017

Letter to the Subcommittee on Workforce Protections on federal wage and hour policies [feedly]

http://www.epi.org/publication/letter-to-the-subcommittee-on-workforce-protections-on-federal-wage-and-hour-policies/

EPI Senior Economist and Director of Policy Heidi Shierholz sent the following letter to the House Committee on Education and the Workforce, Subcommittee on Workforce Protections on February 16th, 2017.

Dear Representatives Foxx, Scott, Byrne, and Takano:

The Economic Policy Institute is pleased to submit this letter in regards to the February 16, 2017, Subcommittee on Workforce Protections hearing, "Federal Wage and Hour Policies in the Twenty-First Century Economy." The Economic Policy Institute, a nonprofit, nonpartisan organization, is this country's premier think tank that focuses on the economic condition of low- and middle-income workers and their families. We are deeply interested in any changes to wage and hour policies that protect workers. The components that must be a core part of any reform related to the minimum wage and to overtime protections are described below.

The Minimum Wage

The current federal minimum wage, $7.25, is roughly 25 percent below its historic value in real terms. A full-time worker with one child who earns the federal minimum wage is earning below the federal poverty line. There is an enormous amount of rigorous research on the economic impacts of minimum wage increases, and what the weight of that literature shows is that minimum wage increases have raised wages but have caused little to no negative effect on the employment of low-wage workers. The vast majority of those who would benefit from an increase in the minimum wage are adults in working families, they are disproportionately women, and their households depend on these earnings to make ends meet.

Any reform related to the minimum wage must do the following things:

- Establish a wage floor that ensures a decent standard of living for all workers. The Raise the Wage Act of 2015 provides a blueprint for what a decent wage floor could be, along with reasonable steps to get there.

- An increase of the minimum wage must be accompanied by gradual phasing out of a lower subminimum wage for tipped workers. Tipped workers experience dramatically higher poverty rates in states where they can be paid a separate, lower minimum wage, and this practice must end.

- To prevent future erosion of the minimum wage and to provide predictability for employers, the minimum wage should be indexed to growth in overall wages on an annual basis.

Overtime Protections

To help ensure the basic, family-friendly right to a limited workweek, the Fair Labor Standards Act (FLSA) requires that most workers—including both hourly and salaried workers—be paid at least 1.5 times their regular rate of pay when they work more than 40 hours a week. One narrow exception to this is for bona-fide executive, managerial, and professional workers. However, the way that exception is defined has become woefully out of date, and in May of 2016, the Department of Labor issued a rule to provide a much needed update. The rule is currently under a nationwide injunction, but that injunction will hopefully be short-lived, since the rule delivers better work-life balance and fairer pay to millions of workers.

The new rule updated the salary threshold below which most salaried workers are entitled to overtime pay if they work more than 40 hours a week. Before this rulemaking, the threshold had been updated only once since 1975, and had thus eroded dramatically—providing overtime protections to less than 10 percent of full-time salaried workers, compared with more than 60 percent in 1975. The current threshold of $455 per week ($23,660 annually for a full year) is well under the poverty threshold for a family of four.

The update includes two crucial components:

- It increases the salary threshold from $455 per week ($23,660 annually) to $913 per week ($47,476 annually). This updated threshold is well within historical norms; if the 1975 threshold had simply kept up with inflation, it would now be around $57,000 annually.

- It automatically updates the salary threshold every three years based on weekly wage growth of full-time salaried workers. Thus, as salaries rise over time, the threshold would rise with it, ensuring that the standard laid out in the new rule is preserved, instead of steadily weakening over time. This is good for workers and provides crucial predictability to employers.

These updates to the overtime rule mean that millions of workers, disproportionately women, would likely be asked to work fewer overtime hours, and would get the overtime pay they deserve when they do work more than 40 hours a week. This is good for families; close to 2.5 million children would see at least one parent gain overtime protections. And an increase in the threshold would be a job creator, with Goldman Sachs estimating that it would add around 100,000 jobs to the economy.

Since 1975, the top 5 percent of all households have seen their incomes grow by more than 90 percent, whereas the median (or "typical") household has seen its income grow by less than 20 percent. That means that the last quarter of the 20th century and the first 17 years of the 21st century have been marked by rising inequality. Reform for the 21st century should focus on reversing that rising inequality and building a fairer economy. Providing a strong minimum wage and overtime salary threshold, and then indexing them going forward so they don't erode over time as prices and wages rise, are common sense steps towards creating an economy that works for everyone and should be at the center of any effort to "update" wage and hour policy for the 21st century.

Sincerely,

Heidi Shierholz

Senior Economist and Director of Policy

The Economic Policy Institute

1225 Eye St. NW, Suite 600

Washington, DC 20005

-- via my feedly newsfeed

Trump Administration’s New Health Rule Would Reduce Tax Credits, Raise Costs, For Millions of Moderate-Income Families [feedly]

http://www.cbpp.org/research/health/trump-administrations-new-health-rule-would-reduce-tax-credits-raise-costs-for

The Trump Administration's new proposed rule on health care would raise premiums, out-of-pocket costs, or both for millions of moderate-income families. If finalized as proposed, the rule would reduce the amount of health care that marketplace plans have to cover. That would allow individual-market insurers to offer plans with higher deductibles and other out-of-pocket costs than they can now sell through the marketplaces.[1] It would also have the hidden impact of reducing the Affordable Care Act's (ACA) premium tax credits, which help moderate-income marketplace consumers afford health care. As a result, the rule would force millions of families to choose between higher premiums and worse coverage.

THIS MEANS THAT FOR PEOPLE WHO WANTED TO MAINTAIN THE SAME COVERAGE THEY HAVE TODAY, TAX CREDITS WOULD COVER LESS OF THE COST. As explained in more detail below, the proposed rule would result in reduced premium tax credit amounts because it would lower the standards for "silver" plan coverage. Under the ACA, the premium tax credits that consumers receive to help pay for marketplace plans are calculated based on the local cost of a silver plan. By allowing less generous silver plans, the rule would reduce the value of premium tax credits for many of the more than 9 million consumers who receive them — an effect the rule itself acknowledges.[2] This means that for people who wanted to maintain the same coverage they have today, tax credits would cover less of the cost.

The Administration argues that allowing less generous health plans, with higher deductibles and out-of-pocket costs but lower premiums, will give consumers more choices, draw more people into the marketplace, and, in this way, stabilize the market. But, in fact, this provision of the rule will do just the opposite. Due to the impact on premium tax credits, it will mainly serve to make marketplace coverage more expensive for marketplace consumers. Together with other provisions of the rule, that will almost certainly result in lower enrollment and a weaker risk pool which, in turn, will weaken market stability. Moreover, the rule does nothing to dispel the main source of uncertainty and instability currently affecting the marketplace: the looming threat that congressional Republicans will repeal the ACA, without enacting a comprehensive replacement.

What the Proposed Rule Would Do

The proposed rule allows individual-market insurers to offer plans with higher deductibles and out-of-pocket costs, but lower premiums, than they're now allowed to offer. That's because it allows plans with lower "actuarial value." Actuarial value is the share of a typical consumer's medical costs that the plan covers, as opposed to what the consumer pays directly through deductibles, copays, and coinsurance. For example, in a silver plan with an actuarial value of 70 percent, the plan picks up 70 percent of a typical consumer's costs for covered benefits, while the consumer would expect to pay 30 percent of costs out of pocket.

To help consumers understand and compare plans, marketplace health plans are tiered by actuarial value: 60 percent (bronze), 70 percent (silver), 80 percent (gold), and 90 percent (platinum).[3] Current rules allow insurers to still meet their actuarial value standards if they deviate by a "de minimis" 2 percentage points from these standard values.[4] The proposed rule would allow plans with actuarial values as much as 4 percentage points below the standard values. That would allow bronze plans with higher deductibles than any current marketplace plans.[5] It also would allow silver plans with actuarial values as low as 66 percent. By allowing for such silver plans, the rule would reduce the size of premium tax credits for millions of families, as explained in the next section.

How the Proposed Rule Would Reduce Premium Tax Credits

Under the ACA, the premium tax credits that consumers receive to help pay for marketplace plans are calculated based on the local cost of a silver plan. By letting insurers offer less generous silver plans, the rule would reduce premium tax credits for many of the more than 9 million consumers who receive them — and that's true whether a consumer buys a silver plan or any other kind of plan.[6]

Specifically, premium tax credits adjust dollar-for-dollar based on the premium for the second-lowest-cost silver plan where a consumer lives, known as the "benchmark" plan. All else being equal, a plan with a lower actuarial value will have lower premiums than one with a higher value. In particular, a plan that covers 66 percent of a typical consumer's medical costs will have a lower premium than an otherwise identical plan that covers 68 percent of costs. Allowing plans with lower actuarial values to qualify as silver plans can thus result in lower benchmark plan premiums and, in turn, lower premium tax credits. While low-income families would be largely protected by other provisions of the ACA, moderate-income families would be left with the choice of paying higher premiums or opting for worse coverage. [7]

Consider an example: Under the ACA, a family of four with $65,000 of income is expected to contribute $5,664 per year to buy the benchmark plan. Suppose the current benchmark plan has an actuarial value of 68 percent and a premium of $13,080 per year — the national average benchmark premium for a family of four. The family's premium tax credit will equal the difference between the gross premium of $13,080 and the $5,664 that the family is expected to pay: or $7,416. If, however, the benchmark plan's actuarial value falls to 66 percent and its premium falls commensurately, the premium tax credit will fall by $327.[8]

At first blush, the family might be indifferent between these two outcomes because both its premium tax credit and its benchmark premium fell. But in fact, as illustrated by Table 1, the family would now face a worse set of choices.

- It could pay the same amount in premiums as before, but buy a plan with a lower actuarial value, meaning some combination of higher deductibles, higher copays, and higher coinsurance. In the illustrative example in the table, the deductible for a benchmark plan increases by $550 per person under the new rules.

- Or, the family could choose to buy a plan with the same cost sharing as it had before, but it now would have to pay more in premiums. The 68 percent actuarial value plan that previously cost the family $5,664 in premiums will now cost $5,991, a premium increase of $327 per year.

To be sure, the proposed rule does not require all silver plans to reduce their actuarial values to 66 percent. Just like today, insurers presumably would offer silver plans with a range of actuarial values within the allowed corridor. But because premium tax credits are based on the second-lowest-cost silver plan on offer, they will generally be based on silver plans that adopt the actuarial values at or near the bottom of the allowable range: 68 percent today, 66 percent under the rule. That's especially likely to be the case in more competitive markets.

As a result, while a stated goal of the rule is to expand consumer choice, it actually would leave many moderate-income consumers with worse choices and less affordable coverage.

| TABLE 1 | |||||

|---|---|---|---|---|---|

| How the Proposed Rule Could Affect Coverage Affordability Illustrative Example: Family of Four with Income of $65,000* | |||||

| Annual Gross Premium | Premium Tax Credit | Net Premium | Per-person Deductible | Change for Family | |

| Current Rules | |||||

| 68% actuarial value silver plan (benchmark) | $13,080 | $7,416 | $5,664 | $1,900 | N/A |

| Proposed Rule | |||||

| 66% actuarial value silver plan (new benchmark) | $12,753 | $7,089 | $5,664 | $2,450 | Deductible ↑$550/person |

| 68% actuarial value silver plan (old benchmark) | $13,080 | $7,089 | $5,991 | $1,900 | Premium ↑$327/year |

* The illustrative example assumes an initial premium equal to the national average benchmark premium for a family of four with one 40-year-old adult, one 38-year-old adult, and two children. It assumes that 85 percent of the plan's premium covers medical costs, while 15 percent covers administrative costs and profits. Deductible values are calculated using the Centers for Medicare and Medicaid Services 2017 actuarial value calculator assuming a plan with a deductible that applies to all services, a 30 percent coinsurance rate above the deductible, and a $7,200 out-of-pocket maximum.

End Notes

[1] The proposed rule would also allow lower-value plans in the Affordable Care Act-compliant, off-marketplace individual market.

[2] The rule notes that this provision "would likely reduce the benchmark premium for purposes of the premium tax credit, leading to a transfer from credit recipients to the government."

[3] These rules also apply in the ACA-compliant small group market and off-marketplace individual market.

[4] Starting in 2018, certain bronze plans may have actuarial values of up to 65 percent, but still not below 58 percent.

[5] Catastrophic plans with lower actuarial values can be sold through the marketplace, but are only available to a small subset of consumers and do not qualify for premium tax credits.

[6] Data on consumers currently receiving premium tax credits are as of early 2016: Centers for Medicare and Medicaid Services, "March 31, 2016 Effectuated Enrollment Snapshot," June 30, 2016, https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2016-Fact-sheets-items/2016-06-30.html.

[7] It appears that the proposed rule partially protects consumers who qualify for cost-sharing reductions — those with incomes below 250 percent of the federal poverty level — from increases in costs. When these families purchase silver plans, insurers are required to provide them with cost-sharing reduction "variant" coverage with higher actuarial values, for which the insurers are reimbursed by the federal government. The proposed rule does not appear to modify actuarial value requirements for these variant plans. However, the rule would still reduce premium tax credits for these families, increasing their net premiums if they choose to purchase plans in a metal tier other than silver (and in some cases if they choose to purchase a silver plan other than the local benchmark). Meanwhile, families with incomes above 250 percent of the federal poverty level qualify only for premium tax credits, not cost-sharing reductions.

[8] This calculation assumes that 85 percent of the plan's premium covers medical costs, while 15 percent covers administrative costs and profits. Thus, the reduction in actuarial value from 68 percent to 66 percent lowers the premium by $327. Here's the arithmetic: 85%×$13,080×(1-66/68).

-- via my feedly newsfeed