Comments on June Employment Report

http://feedproxy.google.com/~r/CalculatedRisk/~3/EP8Wzf307ys/comments-on-june-employment-report.html

http://feedproxy.google.com/~r/CalculatedRisk/~3/EP8Wzf307ys/comments-on-june-employment-report.html

The headline jobs number in the June employment report was above expectations, and employment for the previous two months was revised up. However, the participation rate was unchanged and the unemployment rate increased slightly to 5.9%.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in June to 81.7% from 81.3% in May, and the 25 to 54 employment population ratio increased to 77.2% from 77.1% in May.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 9.8% from 10.2% in May. This is down from the record high in April 22.9% for this measure since 1994 and close to pre-recession lows.

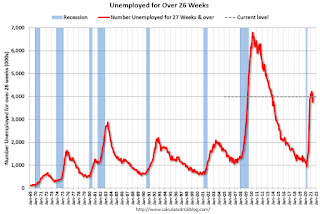

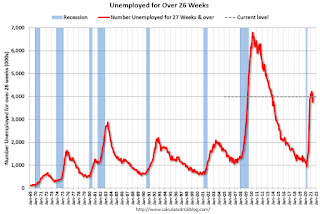

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, there are 3.985 million workers who have been unemployed for more than 26 weeks and still want a job, up from 3.752 million in May.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was above expectations, and the previous two months were revised up by 15,000 combined. However, the headline unemployment rate increased slightly to 5.9%.

-- via my feedly newsfeed

Leisure and hospitality gained 343 thousand jobs. In March and April of 2020, leisure and hospitality lost 8.2 million jobs, and are now down 2.2 million jobs since February 2020. So leisure and hospitality has now added back almost 73% of the jobs lost in March and April 2020.

Construction employment declined 7 thousand in June, and manufacturing added 15 thousand jobs.

NOTE: State and Local education added 230 thousand jobs, seasonally adjusted. But this is a seasonal quirk - there were actually 413 thousand education jobs lost in June NSA, but that was fewer than normal for June, so seasonally adjusted this showed a gain.

Earlier: June Employment Report: 850 Thousand Jobs, 5.9% Unemployment Rate

In June, the year-over-year employment change was 7.919 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

Earlier: June Employment Report: 850 Thousand Jobs, 5.9% Unemployment Rate

In June, the year-over-year employment change was 7.919 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

This data is only available back to 1994, so there is only data for three recessions.

In June, the number of permanent job losers decreased to 3.187 million from 3.234 million in May.

In June, the number of permanent job losers decreased to 3.187 million from 3.234 million in May.

These jobs will likely be the hardest to recover.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in June to 81.7% from 81.3% in May, and the 25 to 54 employment population ratio increased to 77.2% from 77.1% in May.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons decreased by 644,000 to 4.6 million in June. This decline reflected a drop in the number of persons whose hours were cut due to slack work or business conditions. The number of persons employed part time for economic reasons is up by 229,000 since February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in June to 4.627 million from 5.271 million in May.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 9.8% from 10.2% in May. This is down from the record high in April 22.9% for this measure since 1994 and close to pre-recession lows.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more.According to the BLS, there are 3.985 million workers who have been unemployed for more than 26 weeks and still want a job, up from 3.752 million in May.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was above expectations, and the previous two months were revised up by 15,000 combined. However, the headline unemployment rate increased slightly to 5.9%.

There was a sharp decline in part time workers (for economic reasons), but the number of permanent job losers - and the long term unemployed - remain high.

-- via my feedly newsfeed

No comments:

Post a Comment