https://www.bloomberg.com/news/articles/2020-03-22/top-economists-see-some-echoes-of-depression-in-u-s-sudden-stop

- Key is length of contagion and the economic policy response

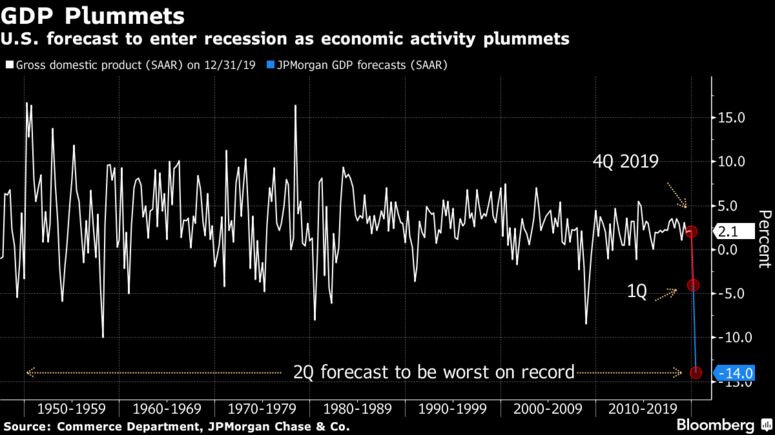

- Economy seen headed for worst quarter in records back to 1947

We're tracking the latest on the coronavirus outbreak and the global response. Sign up here for our daily newsletter on what you need to know.

The U.S. is entering a recession. The ultimate fear is that could turn into a protracted malaise that has some flavor of a depression.

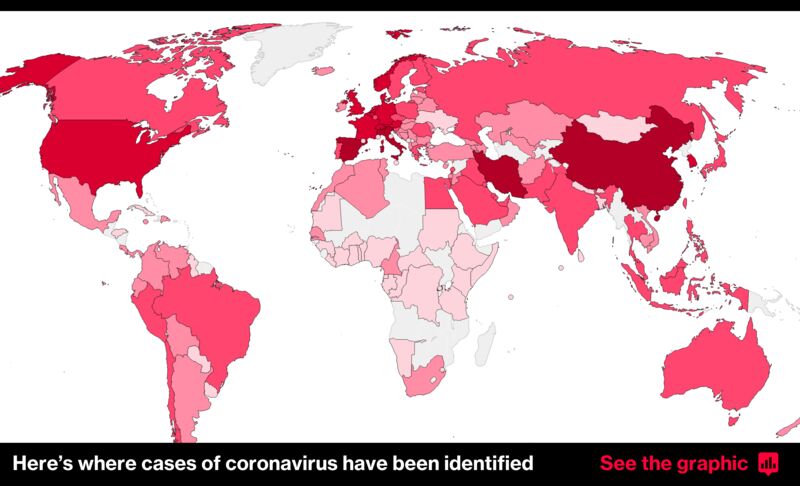

That's far from the base case, with many analysts and investors taking heart from signs of revival in the original epicenter of the coronavirus -- China -- and predicting a second-half upturn in the U.S. after the contagion hopefully subsides.

But as business activity halts and layoffs surge, some prominent economy watchers -- including former White House chief economists Glenn Hubbard and Kevin Hassett and former Federal Reserve Vice Chairman Alan Blinder -- have drawn comparisons to the Great Depression, though they've stopped well short of forecasting another one.

Former International Monetary Fund chief economist Maury Obstfeld said the world hasn't seen a synchronized interruption in economic output in decades. The best example the University of California, Berkeley, professor can think of: "Well, maybe the Great Depression."

The U.S. undoubtedly will suffer a huge economic contraction as businesses close and Americans stay home. By some estimates, the economy is headed toward its worst quarter in records since 1947. JPMorgan Chase & Co. expects gross domestic product to shrink at an annualized rate of 14% in the April-June period while Bank of America Corp. and Oxford Economics both see a 12% drop. Goldman Sachs Group Inc. sees a 24% plunge.

Read More: Bloomberg Economics on U.S. GDP Facing 9% Contraction

While that's an enormous wallop, it's only one quarter. In the Great Depression of 1929-33, the entire economy shriveled by roughly a quarter as unemployment neared 25%.

Recessions, which refer to periods of significant, broad-based declines in economic activity, vary in length. Depressions, of which there is only one since 1900, require the downturn to last for a long time, perhaps years.

Whether the coming contraction proves to be prolonged depends a lot on how long it takes to check the contagion.

"Unless this virus miraculously disappears from the population over the course of the next few months, it is a reasonable scenario that we might be in this lockdown setting for quite a while, measured in quarters," said Harvard University professor James Stock, who is a member of the National Bureau of Economic Research panel that dates the timings of recessions.

If everybody stays home for six months, "it is going to be like the Great Depression," Hassett, who's returning to the White House to advise on economic matters, told CNN on Thursday.

Read More: Bloomberg Economics on U.S. GDP Facing 9% Contraction

The downturn's depth and duration will depend on the economic policy response. It was policy mistakes -- particularly by the Fed -- that turned the contraction nearly a century ago into a depression.

"I am fearful of that if we don't do the right policy," said Hubbard, now at Columbia Business School.

A big concern: The sudden stop leads to widespread firings and bankruptcies that scar the economy for years, as in the Great Depression.

Goldman Sachs sees jobless claims surging to a record 2.25 million in the week ended March 21, while Bank of America projects 3 million and Citigroup 4 million. That compares with 281,000 in the prior week and would be more than triple the record 695,000 during one week in 1982.

Unprecedented Wave of Layoffs

Coronavirus effects expected to throw millions out of work

Source: Labor Department, Goldman Sachs

Greg Brown, finance professor at the University of North Carolina's Kenan-Flagler Business School, said unemployment will rise as high as 9% in two months, from February's 50-year low of 3.5%.

With such job loss, "spending is not going to be as easy to restart because you just can't see the same level of spending if you have people that have lost that income," said Andrew Hollenhorst, chief U.S. economist at Citigroup Inc.

In addition, if companies can't make planning and investment commitments now, "that can have impacts on spending today but also on potential innovation in the future," said Tara Sinclair, an economist at job website Indeed and professor at George Washington University.

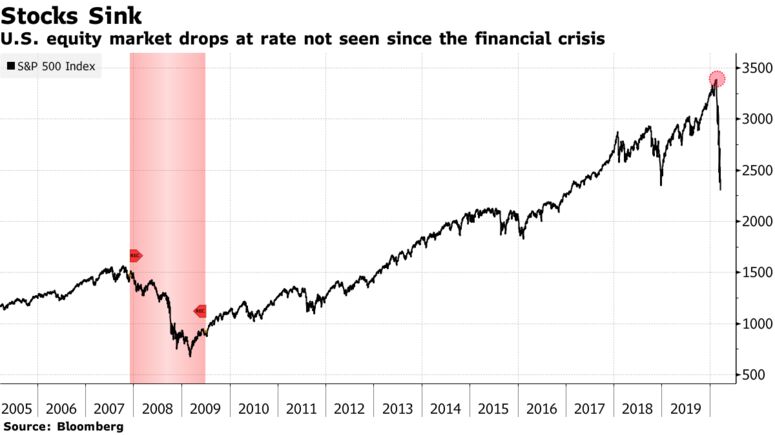

Unlike nearly a century ago, the Fed has acted fast, cutting interest rates effectively to zero, restarting quantitative easing and resurrecting emergency financing facilities it used during the financial crisis.

President Donald Trump, who has been criticized by some for a sluggish response, has also now recognized the enormity of the coming economic hit. He said Saturday that negotiators in Congress and his administration are "very close" to agreement on a plan that an adviser said will aim to boost the U.S. economy by about $2 trillion. Majority Leader Mitch McConnell was aiming for a final vote on the measure Monday.

"The economic hit could be sharp and deep," said Harvard University professor Jeffrey Frankel. But assuming that infections peak in 2020, "there is no reason why economic activity should stay depressed for a period of years, which I take to be the definition of a depression."

Some analysts trying to project the economy's path cite the 1918 influenza pandemic that claimed an estimated 50 million lives worldwide.

In a recent presentation to a virtual Brookings Institution conference, economist Robert Barro said that countries back then typically suffered a 6% reduction in GDP, about in line with that of the last recession but far smaller than in the Great Depression.

He described his findings as an upper-bound estimate of the economic impact from the coronavirus. Global health systems are better equipped to handle contagion now, but the world is more interconnected, Barro said.

"We think of a depression as a recession that is very, very deep and very, very long," said Blinder, now a Princeton University professor. "That's the kind of thing that could happen" should infections peak only temporarily then return in the fall.

No comments:

Post a Comment