The impact of the US-China trade war on East Asia

Massimiliano Calì 15 October 2018

The recent decision of the Trump administration to impose a new round of tariff increases on imports from China has taken the US-China trade dispute to a new level. The new list is subject to a 10 percentage point increase in import tariffs, which would be eventually raised to 25 percentage points at the end of the year. It represents a large expansion in the range of Chinese products included in the first two tranches of US import tariff hikes implemented on 6 July and 23 August. The policy has triggered retaliation. China raised tariffs by 25 percentage points on similar amounts of imports from the US on the same dates that the US tariffs came into force.1

This protectionist tit-for-tat can have dramatic consequences for the economies of the warring parties, as the experience of the Great Depression illustrates (McDonald et al. 1997, Eichergreen and Irwin 2010). At the same time it can also affect third countries, especially those more economically linked to the US and China. In this column, I provide novel partial equilibrium estimates of the potential trade and investment impacts of the US-China trade dispute, focusing on East Asia.2 Countries in this region are the most exposed to the dispute given their integration with Chinese-led supply chains and the similarity of their export baskets with China. I focus on the impact on these countries of US tariff hikes on Chinese goods.

Direct trade and investment impacts

I first estimate the expected import response to the tariff increase. To do so I combine HS-8 digit US import data for 2017 from the US Census Bureau of Statistics, HS-6 digit product-level price elasticity of US imports (estimated by Kee et al. 2008) and the published lists of Chinese products subject to the three tranches of US tariffs.3 I assume the price of import to increase proportionately with the tariff, which is then multiplied by the relevant elasticity and the import value to obtain the expected reduction in US import from China.

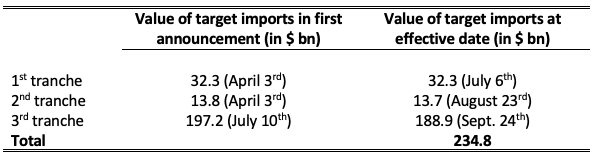

My calculations suggest that the total US imports from China in the affected products amounted to $234.8 billion in 2017, of which $188.9 billion have been targeted in the last tranche of tariffs (Table 1).4 Based on the data we use, the tariffs would reduce US imports from China by $68.6 billion, equivalent to 13.6% of total US imports from China and 3% of global Chinese merchandise exports. This expected drop in Chinese exports would translate into a reduction in domestic value added by $41.4 billion, a relatively modest 0.3% of Chinese GDP.5 This is an upper bound of the direct impact on Chinese exports, as it does not consider the possible re-direction of these exports towards third markets.

Table 1 Value of US imports from China targeted by the tariff measures

Source: Authors' estimation based on various USTR published documents (see footnote 3 for details) and US import data from US Census Bureau.

The bulk of the affected imports is concentrated in electronic equipment and machinery and their components (Figure 1). Electronic and optical equipment (including TV and sound recording devices) and their components, as well as machinery, boilers and mechanical appliances account for almost half of the expected drop in US imports from China. A significant amount of the import drop is also expected in consumer products, such as furniture, vehicles, leather articles and fish and crustaceans, which may have some direct impact on parts of the US household consumption basket.

Figure 1 Expected drop in US imports from China due to US tariffs hike, by HS-2 digit sector ($ million)

Source: Authors' estimates based on USTR, US Census and Kee et al. (2008)

The upside of the reduction in Chinese exports to the US is the potential diversion of US imports towards non-Chinese suppliers, particularly in East Asia, where export structures present some similarities with China. To get a sense of these potential export opportunities, I identify the Chinese products (at the HS-8 digit level) that are subject to higher tariffs in the US market and which happen to be also exported to the US by other East Asian countries for a value of at least $10 million in 2017. The intuition is that a country which is already exporting a non-negligible amount of the same product to the same market would be more likely to replace an existing exporter in that product-market pair.6

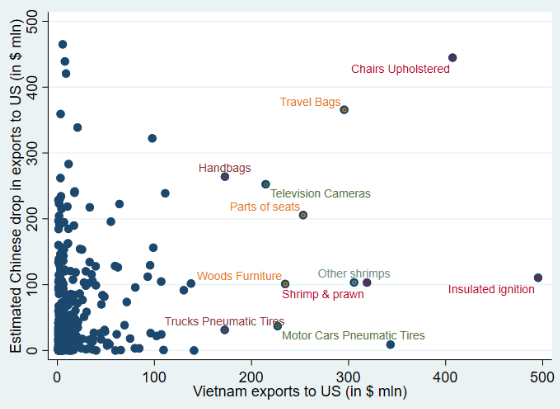

According to this metric, the replacement potential of Chinese exports in the US by East Asian countries – especially emerging economies – is quite significant. Vietnam, the Philippines, and Cambodia are the East Asian countries with the largest replacement potential relative to the size of their economy (Figure 2). The estimated drop in Chinese exports to the US in products which Vietnam already supplies to the US for at least $10 million is worth 10.9% of Vietnam's GDP, or 4.4% of GDP when considering the associated domestic value added of these exports.7 The largest opportunities lie in those products where both the expected Chinese export drop and the existing Vietnamese exports to the US are large, such as chairs, insulated ignition, shrimp and prawns, travel bags, parts of seats, television cameras, wooden furniture and handbags (Figure 3). A much smaller set of products fulfils these characteristics for Cambodia, including plywood sheets, handbags, travel and sports bags, lighting sets for Christmas trees, dog or cat food, parts of seats and bicycles, reflecting the high concentration of its export basket. Taiwan, Singapore, Malaysia, and Thailand also have non-negligible exports replacement potential. The potential replacement is more limited for Indonesia. The drop of Chinese gross exports in products also exported by Indonesia to the US is worth 1.3% of GDP, with an associated domestic value added of 1.0% of GDP.8

Figure 2 Potential replacement of Chinese exports to the US, by countries (% of GDP)

Source: Authors' estimates based on data from USTR, US Census Bureau, OECD TiVA and Kee et al. (2008)

Figure 3 Main potential products where Vietnam could replace Chinese exports in the US

Source: Authors' estimates based on USTR, US census bureau and Kee et al. (2008)

By raising the cost of serving the US market from China, the trade war could also lead to diversion of investments towards third countries. This diversion would likely concern mainly Chinese investments seeking to by-pass US import tariff hikes. The extent to which investments may relocate towards other countries to serve the US market would partly depend on each country's ability of producing the same set of affected products for the relevant market and perceptions about the duration of the trade war. I measure this ability through the correlation index between the expected drop in US imports from China and US imports from each East Asian country in the HS 8-digit products subject to the tariffs.9 The value of the index is highest for Taiwan, followed by Thailand, Malaysia, Vietnam, and the Philippines (Figure 4). Indonesia and Myanmar have the lowest value of the index. While this ranking tries to capture only one of the several criteria used for investments choices, it is suggestive of the variation in the relative attractiveness across potential destinations for investments based on existing similar export basket as China.

Figure 4 Degree of similarities of export baskets to the US with China for affected products

(index of correlation at HS-8 digit)

Source: Authors' estimates on the basis of US Bureau Census of Statistics

Indirect trade impact

While China has progressively absorbed large chunks of the value chain in various sectors (Kee and Tang 2016), it still relies on imports of foreign intermediates and final inputs for some of its production. East Asian countries are key suppliers of such intermediates and inputs to China. Hence, the expected drop in Chinese exports to the US may have knock-on effects on these countries via backward linkages. The extent of this impact would depend on what parts of the value chain each country contributes to. This in turn determines what intermediates and raw materials countries provide to China in the production of the products affected by the tariff hike.

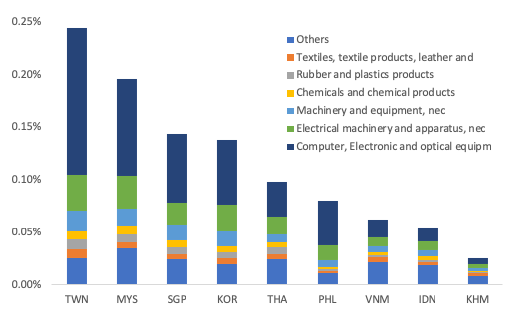

In order to gauge the importance of this channel, I match our estimated drop in Chinese exports at the HS-8 digit level with the country-specific shares of domestic value added in Chinese gross exports to the US in those products (available from OECD TiVA data).10 Taiwan and Malaysia are the East Asian countries that appear most vulnerable to the drop in Chinese exports via the supply chain with an estimated GDP loss of 0.24% and 0.20% respectively (Figure 5). That is mainly due to the countries' provision of inputs for Chinese exports to the US in electronic and optical equipment as well as electrical machinery, which account for two third of this loss. Singapore and South Korea, and Thailand are all expected to lose more than 0.1% of their GDP via this channel, while the effect for Cambodia, Indonesia and Vietnam are relatively muted given the low participation in Chinese-led global value chains.

Figure 5 Estimated effects of US-China trade war on GDP via supply linkages

Source: Bank staff estimates based on data from USTR, US Census Bureau, OECD TiVA and Kee et al. (2008)

While these negative effects are smaller than the estimated (positive) export replacement potential, the two figures are not necessarily comparable. The latter are upper bound estimates of the potential for replacement. In fact, the true dimension of the replacement effect is likely to be considerably smaller than what is reported in Figure 2 for two reasons: first, each country would compete for the same potential market; second, any such replacement would hinge on the supply response in each country-product pairs, which could be relatively small (and even zero) in many cases. On the other hand, the effects via the supply chain are likely to provide a more precise order of magnitude of the actual losses.

This type of analysis could help policymakers in East Asia (and beyond) identify the potential winners and losers among domestic producers from the US-China trade war. Governments could help the former replace Chinese exports in the US markets through measures such as facilitating access to imported inputs, which are heavily used by East Asian exporters, and ensuring the availability of finance, including trade finance, required for the additional production and exports. At the same time ,assistance to potential losers to reallocate their production and/or their labour could help minimise the domestic costs of the trade war.

Author's note: This column does not necessarily reflect the views of the World Bank or of its member countries. The author is grateful to Ndiame Diop and Florian Moelders for useful comments and to Hazmi Ash Sidqi for excellent research assistance.

References

Cadot, O, M D Pierolaand F Rauch(2013), "Success and failure of African exporters", Journal of Development Economics 101: 284-296.

Eichergreen, B and D A Irwin (2010), "The Slide to Protectionism in the Great Depression: Who Succumbed and Why?", The Journal of Economic History 70(4): 871-897.

Kee, H L, A Nicita and M Olarreaga (2008), "Import demand elasticities and trade distortions", Review of Economics and Statistics 90(4): 666-682.

Kee, H L and H Tang (2016), "Domestic Value Added in Exports: Theory and Firm Evidence from China", American Economic Review 106(6): 1402–1436.

McDonald, J A, A P O'Brien and C M Callahan (1997), "Trade Wars: Canada's Reaction to the Smoot-Hawley Tariff", The Journal of Economic History 57(4): 802-826.

Endnotes

[1] Given the large Chinese bilateral trade surplus with the US, the last round of tariffs has been imposed by China on imports from the US worth less than half of the latest list of targeted Chinese exports to the US.

[2] The partial equilibrium analysis allows for highly sectoral disaggregated analysis and it relies on limited data requirement. On the other hand, it does not consider the general equilibrium and the feedback impacts, such as those emanating from the slower growth of China and the US as a result of the tariffs, from the change in international prices of the affected products or from the interactions (and substitutions) between markets.

[3] I estimate a 25 percentage point tariff increase also for the third tranche of US tariff increase.

[4] Note that this figure is slightly lower than the $200 billion reported by the US government administration in last week's press release.

[5] This figure is obtained by matching the expected export drop with the sector-specific domestic value added in Chinese gross exports to the US derived from the OECD Trade in Value Added database.

[6] Cadot et al. (2013) provide some evidence from African exporters in support of this intuition. The $10 million threshold in existing exports allows to exclude all those products where a country is a marginal supplier to the US, which may make it more challenging to replace Chinese exports in those products.

[7] To obtain this figure I use the sector-specific domestic value added in Vietnamese gross exports to the US, taken from OECD TiVA data.

[8] The large size of its economy along with the moderate penetration of its products in the US limit the potential replacement impact for Indonesia

[9] The intuition is that export similarity signals the existence in the country of established supply chains as well as the presence of adequate factors to produce the specific products.

[10] This OECD TiVA data is available for 2011 and relies on a much more aggregated level of sectoral breakdown (only 18 macro sectors) than the tariff data. I match the two sectoral classifications using the ISIC Rev. 4 classification as the bridge.

Harpers Ferry, WV

No comments:

Post a Comment