Historic Climate Legislation Passed

by Perry Bryant

The US Senate has historically been the place where climate legislation has died: cap and trade legislation in 2009, the Kigali Agreement phasing out hydrofluorocarbons, etc. Not this time. The Senate passed and President Biden has signed into law the Inflation Reduction Act (IRA), providing almost $370 billion in funding over the next ten years to significantly reduce America’s greenhouse gas emissions.

Princeton University’s Zero Lab projects that the IRA will cut the United States’ emissions by 40% by 2030. Without the IRA, our emissions would only have been reduced by 27% by 2030. The 40% cut in emissions puts the US close to meeting our Paris climate goals of a 50 to 52% reduction in emissions by 2030.

As important as these reductions in US emissions are -- and they are vitally important -- the IRA also reasserts American world leadership on climate issues increasing the chances (although there’s certainly no guarantee) that China, India and other countries will up their commitment to fighting the climate crisis during the upcoming November UN Conference of Parties in Egypt.

There’s a lot to the IRA. This article will summarize the major energy and environmental provisions and then provide some details on the tax credits that are available to individuals for purchasing an electric vehicle (EV) and the rebates available for retrofitting homes for energy efficiency.

Energy Production

For homeowners who install a solar array or a wind turbine, there is a 30% tax credit for the cost of installing these system, and that tax credit is available for the next ten years (until 2032). Battery storage, which currently does not qualify for investment tax credits, becomes available for the 30% tax credit in January and is also available over the next ten years.

Utility-grade solar, wind, geothermal, and batteries will also qualify for the 30% investment tax credit if the developer pays prevailing wages and has an apprenticeship program. These solar and wind projects can qualify for additional tax credits if they are located in “energy communities” that include brownfield sites, communities with high unemployment, and census tracts were a coal mine closed after 1999 or a coal-fired power plant retired after 2009. Altogether it appears that a facility could qualify for a 40% tax credit if it met all these add-ons including using domestically produced material in construction of the facility.

By 2030, the amount of solar energy produced in the US is expected to increase fourfold; wind energy threefold; and battery storage fourteen-fold. The IRA could well make the 2020s the decade of renewables. That is not too soon for addressing the climate crisis.

Electric Vehicles (EVs)

Transportation is the largest source of greenhouse gas emissions in the country. Moving to electric vehicles (EVs) is an essential step towards reducing these emissions. During the negotiations on the IRA, Senator Manchin expressed concerns about providing incentives that would encourage EV purchases with batteries made in China and reliance on critical minerals mined in countries outside North America. The final version has significant restrictions on the EV tax credits that reflect his concerns about importing batteries and minerals from China and other countries.

If you are considering buying an EV, or want to understand the restrictions on EV tax credits, the details of these tax credits are outlined at the end of this article. Both the tax credits and the restrictions on the EV tax credits are significant and may well impact how successful the EV tax credits will be in promoting the sale of electric vehicles.

Energy Efficiency

The IRA revives a tax credit program for homeowners installing energy efficiency measures and establishes two new rebates to help pay homeowners to retrofit their homes to make them more energy efficient. The tax credit program, now called the Energy Efficiency Home Improvement Credit had lapse. The benefits are now made retroactive to 2022 although it will only pay 10% of the improvements. Beginning in 2023, the benefits increase to 30% and annual and lifetime caps are improved.

The new rebate program promoting electrification (tax credits for electric heat pumps, e.g.) is income based. While one almost always wants higher income levels so more people qualify for these rebates, the income levels are not unreasonable, in my opinion.

The second program – Home Owners Managing Energy Savings (HOMES) – provides enhanced benefits to low-income households, but is available to all households regardless of income. This program provides larger rebates depending on how much energy is projected to be saved from the retrofit. The details on all three of these energy efficiency programs, including eligibility guidelines and what will pay for (they are extensive) are at the end of this article.

Both of these new rebate programs will be run by the state. The state will need to submit a draft program to the US Department of Energy for approval before benefits will be available. It is unclear how soon that will happen. By contrast the tax credit program, the Energy Efficiency Home Improvement Credit, is in effect now with enhanced benefits in 2023.

Just Transition

As the country transitions away from coal and towards renewables for electric generation, there undoubtedly will be additional loss of coal mining jobs. One the best alternatives to mining jobs is to provide a true or just transition by creating good-paying manufacturing jobs. The IRA provides $10 billion in tax credits for manufacturing clean energy components such as solar panels, wind turbines, parts for EVs, etc. This funding through section 48C of the IRS tax code provides a 30% tax credit for manufacturing clean energy components, and $4 billion has to be spent in “coal communities.” This includes communities where a coal mine has closed since 1999 or a coal-fired power plant retired after 2009. Funding for a specific 48C project isn’t assured; funding is awarded on a competitive basis. This is a golden opportunity to diversify the state’s economy, particularly in southern West Virginia. One can only hope that state government and manufacturers take advantage of this once-in-a-lifetime opportunity.

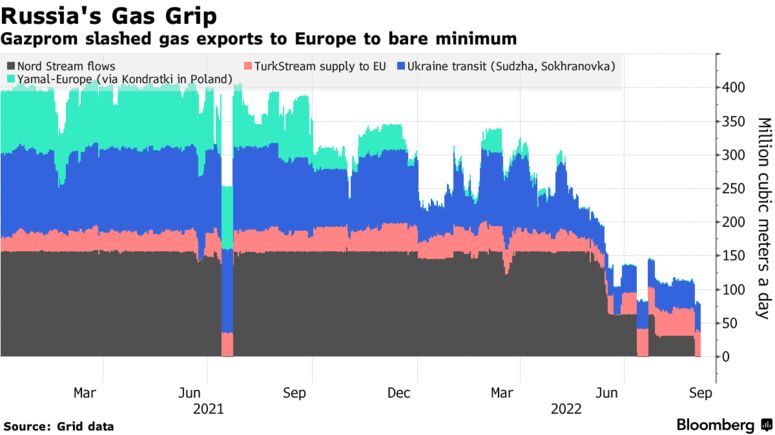

Methane Fee

Methane is a very powerful greenhouse gas. Over a 100-year period, methane is 25 times more potent at trapping heat in the atmosphere than carbon dioxide (CO2). However, unlike CO2 which impacts the atmosphere for hundreds of years, methane dissipates in 10 to 12 years. So, reducing methane emissions can have some of the most immediate (in climate time) impact on global warming.

The oil and natural gas industry is a top source of U.S. emissions of methane. They emit methane at every step in the production of oil and natural gas: drilling, processing, and distribution.

The IRA imposes a fee on methane emissions of $900 per metric ton beginning in 2024. The fee increases to $1,500 per ton by 2026. The fee only applies to large methane emitters, exempting small operators who emit as much as 60% of all methane emissions according to the Congressional Research Service. The IRA provides the oil and natural gas companies with $1.5 billion in grants and other incentives to help them reduce their methane emissions. And if companies can comply with an anticipated EPA regulation on methane emissions, they will be exempt from the methane fee.

Environmental Justice

The IRA contains numerous provisions supporting low-income communities and communities of color. Listed below are just two examples of the environmental justice provisions in the IRA. The Greenhouse Gas Reduction Fund sometimes referred to as the “Green Bank,” provides $27 billion in funding to EPA. These funds are intended to leverage private funding to develop low- and zero-emission projects. $20 billion will be available to nonprofit financing institutions, and 40% of these funds ($8 billion) must be invested in low-income and disadvantaged communities.

The Environmental and Climate Justice Block Grants provide EPA with $3 billion for environmental justice projects for disadvantaged communities. Eligible activities include pollution monitoring, transportation emissions reduction, and pollution prevention.

Black Lung

The tax on the mining of coal that historically funded the black lung program expired last year. The IRA permanently restores the tax on coal mining to fund the black lung program.

Fossil Fuels

The IRA reflects Senator Manchin’s “all of the above” strategy for energy development. For example, the bill prohibits the Interior Department from approving renewable energy development on federal property over a ten-year period unless it also opens lands to oil and gas development.

Specifically, in order for the Interior Department to issue rights-of-ways on federal property for solar and wind development, they are required to lease as much as 2 million acres onshore each year and at least 60 million acres offshore each year for oil and gas development. (Inside Climate News, July 28, 2022.) There is leasing reform along with this leasing. These reform measures include, “raising royalty rates and rental rates to hold a lease, eliminating non-competitive bidding, (and) raising bonding requirements.” (West Virginia Rivers Coalition, August 9, 2022.)

The IRA also provides enhanced benefits for carbon capture and storage (CCS). CCS is a technology that removes CO2 from emissions from the flue gases at coal- or gas-fired power plants or industrial facilities (e.g., cement or steel plants). CCS technology is not currently economically viable and demonstration projects have struggled or failed. The IRA increases the amount of tax credits that a company can claim from the current $50 per ton of CO2 to $85 per ton of CO2.

Senator Manchin secured agreement from legislative leaders to also pass permitting reforms as part of his support for passing the IRA. At least two proposals for permitting reform have been suggested. One would move judicial review of the Mountain View pipeline from the 4th Circuit Court of Appeals to the DC Court of Appeals. The other would limit agency reviews under the National Environmental Policy Act to two years, and restrict judicial review once an agency has made a NEPA decision.

Agriculture and Forestry

The IRA provides $20 billion to help farmers reduce and store greenhouse gases. There is an additional $14 billion to help rural electric co-ops to transition to renewable forms of energy production.

The US Forrest Service will receive $1.8 billion to reduce fuel in the wildland-urban interface, as well as $50 million to complete an inventory of old-growth forest and to protect old-growth forest.

Conclusion

Whew. There is a lot in the IRA, and this review only touches on some of the more important provisions. One weakness of the IRA is that it does not require action by individuals or most industries. There are plenty of carrots in the IRA but few sticks. Developing the sticks will fall on President Biden’s shoulders. One can only hope that the combination of the IRA carrots and President Biden’s regulatory action will be enough to make the monumental transition away from fossil fuels to renewables; a transition that the International Energy Agency, the world’s energy experts, has called the most difficult in human history.

In making this transition, the IRA is foundational. It is the most significant and comprehensive climate legislation ever passed by Congress. It creates the opportunity for the US to lead the world on climate reform and conceivably hold global warming to an increase of 1.5 degrees Celsius -- a very daunting challenge. But at least we have an opportunity to meet this challenge thanks to the IRA.

Details on the EV Tax Credits

Currently, the tax credit for EVs is limited to the first 200,000 customers for each car manufacturer. Tesla and General Motors have already reached that limit and Toyota will shortly. The IRA eliminates this cap, but requires all EVs be assembled in the North America in order to qualify for the tax credit. Any tax credit that is available can be applied at the point of the sale, rather than waiting to file a tax return the following April.

The EV tax credit in the IRA is up to $7,500 per vehicle, and is split equally into two buckets. The first bucket provides up to half of the tax credit ($3,750) and requires that batteries be manufactured or assembled in North America. In 2023, when the new EV tax credit becomes effective, 50% of the batteries have to be manufactured or assembled in North America. That increases over time until 2029 when 100% of the batteries must be manufactured or assembled in North America in order to qualify for the tax credit.

The second bucket of up to $3,750 is contingent on where minerals used in the batteries are mined or processed. Beginning in 2023, 40% of these minerals (e.g., lithium, cobalt, and nickel) must be mined, processed or recycled in North America. This increases each year until 2027 when 80% of the battery’s minerals must be mined, processed, or recycled in North America.

It is unclear how quickly EV manufacturers can develop supply chains to meet these requirements. The US is heavily dependent on China for lithium-ion battery cells (80%) as well as graphite used for battery electrodes. EV manufacturers that can break this reliance on China will have a competitive advantage over EV manufacturers that are unable to do so.

There are also limits on the cost of the EVs and income limits on taxpayers who can qualify for EV tax credits. EV cars cannot cost more than $55,000 and SUVs and light trucks cannot cost more than $80,000 and still qualify for the tax credit. Additionally, individuals earning more than $150,000 and couples earning more than $300,00 do not qualify for the EV tax credits.

Used EVs sold by a car dealer also qualify for tax credits of up to $4,000 or 30% of the sales price, whichever is less. The sales price cannot exceed $25,000 and the EV must be at least two years old. Individuals who purchase a used EV cannot earn more than $75,000 (joint filers $150,00) a year. These tax credits take effect January 1, 2023.

Details on the Energy Efficiency Rebates

There is one revived tax credit program for energy efficiency and two new rebate energy efficiency programs in the IRA.

The tax credit program, now called the Energy Efficiency Home Improvement Credit, had lapsed. It has been revived and made retroactive to 2022, although with only limited benefits: 10% tax credit on qualified efficiency measures with a $500 lifetime cap. Beginning in 2023, the tax credit increases to 30% and the lifetime cap on benefits is replaced with a cap of $600 per measure, and a $1,200 annual cap. Exceptions to these caps are included in the chart below.

Eligible services and home improvements must be highly rated by Energy Star or other rating system, and include:

Heat pumps and heat pump water heaters ($2,000 credit)

Insulation and air sealing

Energy audits ($150 tax credit)

Energy-efficient HVAC systems (including furnaces, boilers, and central AC)

Electrical panel upgrades; must be at least 200 amps capacity

Energy-efficient windows and doors ($500 tax credit for doors)

The High-Efficiency Electric Home Rebate Program is one of the two new energy efficiency rebate programs. This one focuses on electrification. It provides rebates (not tax credits) to low-income homeowners for 100% of the amount listed below for installing electrical upgrades:

Heat pump water heater

$1,750

Heat pump for HVAC

$8,000

Electric stove or heat pump clothes dryer

$840

Electric service upgrade

$4,000

Insulation and air sealing

$1,600

Electrical wiring

$2,500

Low-income homeowners are defined as households that earn less than 80% of the area median income as determined by the US Department of Housing and Urban Development (HUD) (see the chart below). Multi-family properties qualify if 50% of the residents meet this income requirement.

Moderate-income households qualify for 50% of the maximum benefit listed above. For example, a moderate-income family could receive a rebate up to $4,000 for installing a heat pump. Moderate-income households are defined as earning between 80% and 150% of the area median income as defined by HUD (see the chart below). Households earning more than 150% of the median income do not qualify for rebates under this electrification program. Multi-family properties qualify if 50% of the residents meet these income requirements.

According to the HUD website,[1] estimates for what 80% and 150% of the median income for West Virginia in 2021 for various household sizes are shown below. Please note that these are 2021 figures and will change. And they represent the best data available and should be considered estimates.

Household Size

80% of the median income in West Virginia

150% of the median income in West Virginia

1

$33,750

$63,300

2

$38,600

$72,300

3

$43,400

$81,450

4

$48,250

$90,450

The second energy efficiency program in the IRA is the HOMES program, and is a more traditional energy efficiency program. It provides rebates for the cost of a project depending on how much energy is saved through the project.

For retrofits that are projected to save 35% or more of the household’s energy, the rebates are $4,000 or 50% of the project costs, whichever is less. The benefits increase to $8,000 or 80% of the cost of the project whichever is less for households earning less than 80% of the area median income.

For retrofits that are projected to save between 20% and 35% of the household’s energy, the rebates are $2,000 or 50% of the project costs, whichever is less. The benefits increase to $4,000 or 80% of the cost of the project whichever is less for households earning less than 80% of the area median income.

For retrofits that achieve energy savings of at least 15%, they will receive “a payment rate per kilowatt hour saved…equal to $2,000 for a 20% reduction of energy use for the average home in the state.”[2] Benefits increase for households earning less than 80% of the area median income.

Benefits from these two energy efficiency programs cannot be combined. Both programs will be run by the state. The state will need to submit a draft program to the US Department of Energy for approval before benefits will be available. It is unclear how soon that will happen.

________________

[1] See https://www.huduser.gov/portal/datasets/il/il2021/2021summary.odn?inputname=STTLT*5499999999%2BWest+Virginia&selection_type=county&stname=West+Virginia&statefp=54.0&year=2021

[2] I have no idea what this language means. But it is verbatim from the IRA statute.