Monday, August 10, 2020

Enlighten Radio:Recovery Radio: The Families of convicted persons

Blog: Enlighten Radio

Post: Recovery Radio: The Families of convicted persons

Link: https://www.enlightenradio.org/2020/08/recovery-radio-families-of-convicted.html

--

Powered by Blogger

https://www.blogger.com/

Bloomberg: Trump Oversees All-Time Low in White Collar Crime Enforcement [feedly]

https://www.bloomberg.com/news/articles/2020-08-10/trump-oversees-all-time-low-in-white-collar-crime-enforcement

Donald Trump calls himself the "law and order" president, but when it comes to white collar crime, he has overseen a significant decline in enforcement.

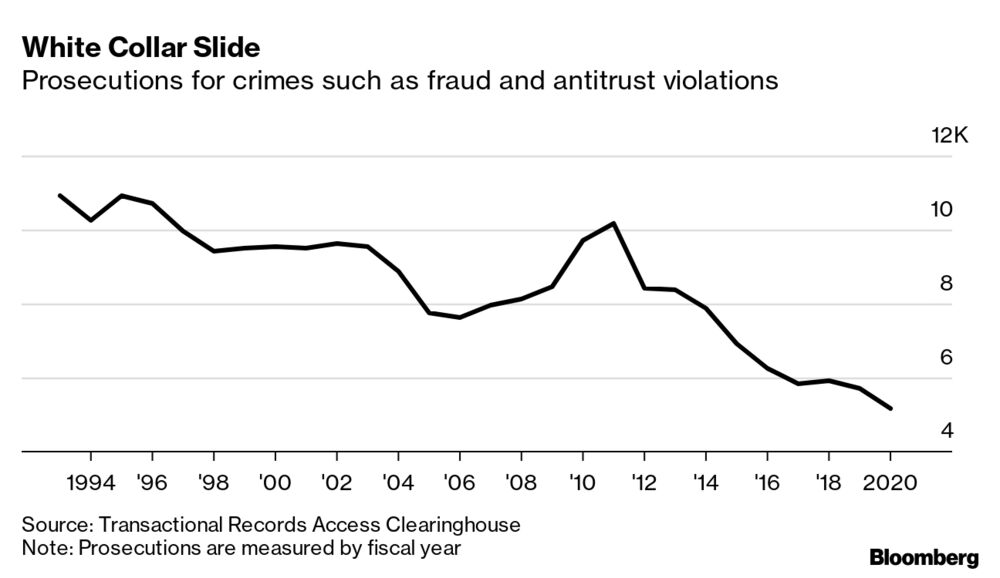

The prosecution of securities fraud, antitrust violations and other such crimes has hit a record low as the pandemic slows the courts, according to one tracking service. But even before the coronavirus, the numbers were falling under the Trump administration.

The average annual number of white collar defendants was down 26% to 30% for Trump's first three years in office from the average under President Barack Obama, according to data from the Justice Department and Syracuse University, respectively. The trend also shows up in fines on corporations, which fell 76% from Obama's last 20 months to Trump's first 20 months, according to Duke University law professor Brandon Garrett.

"Mr. Trump sets the tone," said John Coffee, a professor at Columbia Law School whose new book, "Corporate Crime and Punishment: The Crisis of Underenforcement," analyzes the decline.

Trump's Justice Department has even presided over a plunge in deferred-prosecution agreements, Coffee said. In a DPA, a company is charged with a crime but prosecutors agree to drop the case later if it admits wrongdoing, pays a penalty and makes required reforms. The administration has also brought fewer white collar racketeering and money-laundering cases, crimes that carry harsher penalties, he said.

"All that is an indication that white collar crime is not a priority," Coffee said. "If you want to celebrate corporations as leading our economy and the stock market up higher and higher, you don't want to indict them."

Read More: Goldman Nears 1MDB Resolution With Effort to Avoid Guilty Plea

The Justice Department says it hasn't eased up at all.

Prosecutors "continue to bring federal charges in white collar and other cases according to facts, the law and the principles of federal prosecution," said Peter Carr, who was a spokesman for the department's Criminal Division until moving recently to the Department of Homeland Security.

The Department of Justice "can't vouch for TRAC's methodology," Carr said, referring to Syracuse University's Transactional Records Access Clearinghouse, which monitors trends in federal law enforcement and whose records reflect a decline of about 30% in prosecutions under Trump. He added that TRAC data "routinely differs" from the reports of the U.S. attorney offices, the U.S. Sentencing Commission and the U.S. Courts, among others.

TRAC's tallies are based on "hundreds of millions of records" from each U.S. attorney's office, said the group, which has been following the data for more than two decades. Cases are counted based on when they're recorded in a prosecutor's database, following the DOJ's own practice, it said.

DOJ spokesman Matt Lloyd said the Criminal Division's Fraud Section, which focuses on white collar crime, "has achieved record numbers of individual and corporate criminal cases and resolutions over the past three years," including a 59% increase in individuals charged between 2016 and 2019 and a jump of more than a quarter in those convicted. He didn't comment specifically on the 26% decline reflected in the data published by the U.S. attorney offices nationwide, which cover a much larger set of white collar prosecutions, but called the Fraud Section's achievements "a key indicator of the department's commitment" to the issue.

Read More: U.S. Charges Four Chinese Military Members Over Equifax Hack

Prosecutions have been declining for the past decade but have never been so low.

The Justice Department under Trump has shifted its focus from traditional white collar cases, like big securities prosecutions, to immigration and the sort of corporate espionage targeted by the DOJ's China Initiative, said Robert Anello, a white collar defense lawyer in New York. Immigration-related offenses accounted for more than half of federal prosecutions in fiscal 2018, Anello said.

A crackdown on financial fraud starting decades ago spurred reforms and increased corporate compliance, which became "one of the trademarks of American companies abroad," Anello said. He warned that could now fade with waning vigilance.

The change is clear, according to seven ex-prosecutors who handled securities fraud and asked not to be identified in discussing their former offices' work. Veterans of the DOJ's antitrust and fraud divisions have left, and younger lawyers need time to learn how to build a complicated case, they said.

Earlier: Rajaratnam and 75 Other Reasons Hedge Funds Are Scared Straight

The Internal Revenue Service, too, has suffered from attrition over the years, although it got a budget increase last year. Its Criminal Investigation division helps send people to prison for crimes such as tax evasion, money laundering and identity theft. The agency saw a 36% decrease in new criminal investigations from fiscal 2015 to 2019, IRS records show.

One factor in the decline in traditional white collar prosecutions is an important change to what's known as the Yates memo.

In 2015, under Obama, Deputy Attorney General Sally Yates required companies seeking leniency to help develop evidence against their employees and turn over possible suspects. In 2018, under Trump, the Justice Department softened the criteria. For instance, in the Yates memo, a company in a price-fixing case had to be the first to cooperate. Now it doesn't, said Columbia Law's Coffee.

"The old rule was, we're gonna be really tough," he said. "You can get off, and your officers can get off, if you turn the co-conspirators in and confess." Now, Coffee said, companies are getting "tremendous sentencing credits" simply for having a corporate compliance plan.

"Those things just require a good lawyer to spend two nights writing one up," he said.

—With assistance by Chris Strohm and Justin Sink

-- via my feedly newsfeedBillionaires are watching China. So should we.

Across the swamps of time, revolutions, colonialism, neo-colonialism, imperialism, world wars, industrializations; through the trials and zig-zags of both socialist and social-democratic experiments in working class leadership in society, comes an idea of Vladimir Lenin. In 1921, the "command" economy of the Russian revolution and civil war was in collapse, forcing a retreat to a socialist form of state monopoly capitalism. This model, called the New Economic Program, lasted until 1928 in the USSR, when it was terminated under Stalin's leadership.

The essential idea was that Communists armed with science could manage market successes and failures better than capitalisms. A basic premise of the proposal was that mixed economies – advancing public and market/capitalist sectors – were unavoidable, and indeed necessary for the transition and development of conditions permitting fully humane relations.

This idea has more than once been treated as heresy within the Communist movement. To some, the compromises of the New Economic Policy compromised the the socialist ideal of abolishing capitalism and feudalism, and was unprincipled. Even Deng Xiaoping, who would later lead the Chinese Communist Party in expanding and developing Lenin's idea, was branded a "capitalist-roader" during Mao's Cultural Revolution.

In China's transformation, Lenin's intuition bore fruit. The socialist goal of a "harmonious and moderately prosperous society" adopted by the CCP gave state-led capitalist development a purpose that the essential anarchism of markets alone cannot achieve.

Socialist-led vs capitalist-led industrial policy

Thus was born a concept of market socialism, and more generally socialist-motivated industrial policy in mixed economies.

All governments have an industrial policy: the state's plan for essential manufacture and resource development. Whether for profit, or paid whole or in part by the state, the priorities for national investment, if not a purely market model, must provide: defense, security, food, shelter, clothing, and a plan for future progress. If you cannot produce them, you must acquire them from someone who does.

Billionaires, even the liberal ones, despise state-led investment, both in theory and by intuition: bourgeois liberty was founded historically in opposition to Royal monopolies, taxes, and regulation. "Governments are bad at picking winners", they like to chant. But they are learning otherwise. In the current pandemic depression, the socialist enhancement of industrial policy proved in China, Vietnam, and most of the social democracies that it can out-perform capitalist-led societies, in both growth and especially in recovery from crisis. One thing billionaires are good at is sensing power. They sense it with China. They are indeed inspired to emulate its inevitable successes.

What does that mean?

It means there is more than one enlightened billionaire, not just fascists, who are thinking "authoritarian" thoughts about this crisis, and about the paralysis of US democracy. They are drawing the conclusion that more powerful, directed, supervised, industrial policy, like China,'s, can save America. In their vision, that policy would be benign, rational, pro-science, cosmopolitan rather than racist, free from Trumpism but also without the socialist ideals of harmony and equality.

Let's look at a couple of examples.

About eight years ago, Bill Gates wrote a tribute to a celebrated biography of Deng Xiaoping. The biography charts Deng's struggle to develop an economic and political recovery strategy following the failures of the Great Leap Forward. His theories were heavily influenced by Lenin's New Economic Program, and the results were staggering: exceeding 10% annual growth rates uninterrupted by business cycles or externalities for more than 20 years! But neither Deng nor China would not call it a miracle: it is demonstration, that a scientific, fact-based industrial policy guided by socialist goals can outperform capitalist led societies.

Gates' greatest praise is not for Deng's market reforms but his advances in state-directed education, health care and technology innovation.

Here is Gates' assessment of Deng Xiaoping:

Although Deng's transformation of China cannot be separated from the violent attacks that he administered under Mao's rule or the brutal approach he took to stopping the Tiananmen Square student protests, the economic reforms have improved the livelihoods of millions of people. China has capitalized on advances in education, healthcare, agriculture and innovative technology to help accelerate their own development and transition beyond the need for aid. To have done this essentially in one generation is an unbelievable accomplishment and is unique in the history of the world.

The most important sentence is the last. It shows that one of the world's wealthiest men has broken with the presumption of socialism's failure following the collapse of the USSR. Gates replaces that narrative with a new one: socialism with Chinese characteristics is an astounding success. (We should note, too, that there is more than one way to read Gates' caveat about the Tiananmen repression – and not necessarily as a criticism).

Not long after, in 2015, Thomas Piketty was a panelist at an American Economics Association meeting in Boston. After being artlessly red-baited by Harvard economist Greg Mankiw (Chair of the Council of Economic Advisors under Bush), the renowned French economist countered by recounting a dialog with Bill Gates on the subject of the wealth tax, a reform Piketty considers essential to "manage aggravated inequality tendencies" in capitalism.

Gates: I agree with nearly everything in your masterpiece, except the wealth tax. I support a progressive income tax. But why will the government make better use of my wealth than I have, or will, through my foundation, and company?

Piketty: If you are right, perhaps we should just eliminate all taxation on ALL billionaires, in the national interest?

Gates: [after pause]: You may have a point. I will think about it. Did you know I am a fan of China's leader, Deng Xiaoping?

Piketty: As am I.

As Piketty's example illustrates, the curse of the billionaires, even the ones more humanistic in outlook, is that their main adversaries in pursuing a humanistic vision are the reactionary billionaires. But they cannot destroy them without undermining their own position with regard to the privileges of wealth.

Bill Gates is not the only billionaire taking a new look at China. Bloomberg News published the following in an unsigned editorial (which we can interpret, I think, as approved by Michael Bloomberg, the firms's owner and fourth-richest man in the world):

When China began allowing private businesses and foreign investment four decades ago, many outside the communist country expected that as its economy became more capitalist, its politics also would become more democratic. They didn't. Instead, the Chinese system, which puts stability and cohesion ahead of individual freedoms, became adept at delivering prosperity, with the Communist Party still firmly in control. For Beijing, its success legitimizes its model as an alternative to the liberal values of the West, an idea the U.S. and its allies have resisted. It's a debate that's been intensified by the Covid-19 pandemic.

It's striking how the terms of the debate have changed in the current health and economic crisis, from socialism vs. capitalism to "authoritarianism" vs. liberalism. And the conclusion seems to be that "authoritarianism" is now a legitimate political model. Here again, though, it is important to recognize that state-led investment for U.S. billionaires would not be inspired not by the socialist vision of "a harmonious and moderately prosperous society," but by Microsoft, Google, and Amazon.

The paths forward

U.S. progressives, too, are challenged by Chinese socialism to confront basic issues of democracy and national unity in the midst of economic and institutional collapse. The formation of the "more perfect union" proclaimed by President Barack Obama is not far in spirit from the Chinese Communist Party's goal of "a harmonious and moderately prosperous society."

Under the weight of gaping class, racial, gender and nationality inequities, and injustices, it is difficult to imagine other than a strong mission guiding strong hands to return in earnest to the "more perfect union" path. The two-party system may not survive this trial unless a new equilibrium is achieved. The limits of civil division in the US have been reached, if not breached.

I think economist Dani Rodrik adequately summarizes the progressive adaptation of the idea behind Lenin's New Economic Policy, though without attribution and using the lingo of progressive capitalism more than market socialism. He is a serious student of Chinese development, however. As he often writes, the choices of political models tend to be "path dependent." In other words, history matters; what has occurred in the past persists because of resistance to change. As Rodrik puts it:

For starters, we must recognize that a mixed, state-driven economic model has always been at the root of Chinese economic success. If one-half of China's economic miracle reflects its turn to markets after the late 1970s, the other half is the result of active government policies that protected old economic structures – such as state enterprises – while new industries were spawned through a wide array of industrial policies.

The path of recovery for the United States will depend on how much our current path gets wrecked, and how much can be salvaged. Looking down the path we are now on, the wreckage is not over. The project of recovery, to say nothing of the larger task of transformation, requires political harmony to achieve, and that is something capitalist billionaire-led approaches are unlikely to produce.

L'Humanite in English: New cold war will not stop US decline [feedly]

http://www.humaniteinenglish.com/spip.php?article3353

Why has the US attitude toward China changed so profoundly?

The origins lie in the 2008 financial crisis. The relatively stable and benign period of US-China relations between 1972 and 2016 was underpinned by two American assumptions.

First, China would never pose a threat to the US' global economic dominance; and second, China's rise would become unsustainable unless it adopted a Western-style political system.

Neither of these things happened.

On the contrary, the financial crisis took place in the US, not in China, and China's political system has proved highly successful and sustainable. The 2008 crisis led to the undermining of support in the American governing elite for its previous policy toward China. A growing mood of hegemonic angst concerning China took hold in the US. China was increasingly seen as a threat to the US' global dominance, a process that culminated in US President Donald Trump's election in 2016 and China coming to be seen as the enemy.

It is abundantly clear that the US cannot accept any threat to its global hegemony. The US as number one is regarded as fundamental to its DNA. But this is unsustainable.

The US is in relatively rapid decline. It can no longer enjoy a monopoly of primacy in the world. It is determined, however, to resist any diminution in its authority. We have entered a dangerous, volatile and unpredictable period as the US seeks at all costs to resist the inevitable.

As a result, we can no longer take world peace for granted. World peace is at risk for the first time since the Cold War. The COVID-19 crisis, furthermore, will surely result in an even bigger shift in power from the US to China than happened after 2008. That could result in an even more desperate American response. Until the US comes to terms with the new reality - that it must share primacy with China - the global situation will be very unstable. Declining imperial powers find it extraordinarily difficult to come to terms with their diminished position, as Britain since 1945 exemplifies. The same is true with the US but in a much more dramatic and dangerous way.

We are already in a new cold war - in trade and technology, and, as the closure of China's Houston consulate demonstrates, in diplomacy. Recent statements from the likes of US State Secretary Mike Pompeo amount to the declaration of a new cold war against China. The US has opened up many fronts against China.

What is deeply worrying is the unpredictability, volatility and desperation of Trump. Driven by his fear of losing the presidential election in November, Trump sees nothing is off the table as far as he is concerned. Anything is possible.

This cold war will not be a rerun of the previous one between the US and the Soviet Union. In the old Cold War, the two countries lived in almost entirely separate worlds, in hermetically sealed compartments, that economically, for example, they had very little connection with each other. Much as the hawks in the Trump administration would like to reinvent such a world by means of a complete economic decoupling, that is beyond them.

Furthermore, it is clear that in the integrated global economy of today, China is a bigger economic player than the US. Whereas in the old Cold War, the Soviet Union was always far weaker economically than the US, the situation is completely different today, with China already enjoying the upper hand in key respects and, more importantly, very much on the rise in contrast to a US in decline.

There is another important difference between the two cold wars. Wrongly, the Soviet Union sought to compete militarily with the United States, a disastrous strategy given that it was far weaker economically than the latter. China has not - and will not - make that mistake. Whatever the US spends, China will spend much less - concentrating its resources on the defense of its own borders and territory. And in the long run, economic power invariably trumps military force.

The article is an excerpt of Martin Jacques's webinar lecture on July 25 titled "A new cold war against China is against the interests of humanity." Jacques is former senior fellow at the Department of Politics and International Studies at Cambridge University. opinion@globaltimes.com.cn

RELATED ARTICLES:

The US' new cold war against China is sailing against a difficult headwind

World should unite and denounce new cold war

-- via my feedly newsfeed

Sunday, August 9, 2020

Coming Next: The Greater Recession [feedly]

https://www.nytimes.com/2020/08/06/opinion/coronavirus-us-recession.html

One pretty good forecasting rule for the coronavirus era has been to take whatever Trump administration officials are saying and assume that the opposite will happen. When President Trump declared in February that the number of cases would soon go close to zero, you knew that a huge pandemic was coming. When Vice President Mike Pence insisted in mid-June that "there isn't a coronavirus 'second wave,'" a giant surge in new cases and deaths was clearly imminent.

And when Larry Kudlow, the administration's chief economist, declared just last week that a "V-shaped recovery" was still on track, it was predictable that the economy would stall.

On Friday, we'll get an official employment report for July. But a variety of private indicators, like the monthly report from the data-processing firm ADP, already suggest that the rapid employment gains of May and June were a dead-cat bounce and that job growth has at best slowed to a crawl.

ADP's number was at least positive — some other indicators suggest that employment is actually falling. But even if the small reported job gains were right, at this rate we won't be back to precoronavirus employment until … 2027.

ADVERTISEMENT

Continue reading the main story

Also, both ADP and the forthcoming official report will be old news — basically snapshots of the economy in the second week of July. Since then much of the country has either paused or reversed economic reopening, and there are indications that many workers rehired during the abortive recovery of May and June have been laid off again.

But things could get much worse. In fact, they probably will get much worse unless Republicans get serious about another economic relief package, and do it very soon.

Give the gift they'll open every day.

Subscriptions to The Times. Starting at $25.

I'm not sure how many people realize just how much deeper the coronavirus recession of 2020 could have been. Obviously it was terrible: Employment plunged, and real G.D.P. fell by around 10 percent. Almost all of that, however, reflected the direct effects of the pandemic, which forced much of the economy into lockdown.

What didn't happen was a major second round of job losses driven by plunging consumer demand. Millions of workers lost their regular incomes; without federal aid, they would have been forced to slash spending, causing millions more to lose their jobs. Luckily Congress stepped up to the plate with special aid to the unemployed, which sustained consumer spending and kept the nonquarantined parts of the economy afloat.

Now that aid has expired. Democrats offered a plan months ago to maintain benefits, but Republicans can't even agree among themselves on a counteroffer. Even if an agreement is hammered out — and there's no sign that this is imminent — it will be weeks before the money is flowing again.

Editors' Picks

Five-Minute Coronavirus Stress Resets

Why the Working Class Votes Against Its Economic Interests

When Marriage Is Just Another Overhyped Nightclub

Continue reading the main story

ADVERTISEMENT

Continue reading the main story

The suffering among cut-off families will be immense, but there will also be broad damage to the economy as a whole. How big will this damage be? I've been doing the math, and it's terrifying.

Unlike affluent Americans, the mostly low-wage workers whose benefits have just been terminated can't blunt the impact by drawing on savings or borrowing against assets. So their spending will fall by a lot. Evidence on the initial effects of emergency aid suggests that the end of benefits will push overall consumer spending — the main driver of the economy — down by more than 4 percent.

Furthermore, evidence from austerity policies a decade ago suggests a substantial "multiplier" effect, as spending cuts lead to falling incomes, leading to further spending cuts.

Put it all together and the expiration of emergency aid could produce a 4 percent to 5 percent fall in G.D.P. But wait, there's more. States and cities are in dire straits and are already planning harsh spending cuts; but Republicans refuse to provide aid, with Trump insisting, falsely, that local fiscal crises have nothing to do with Covid-19.

Bear in mind that the coronavirus itself — a shock that came out of the blue, though the United States mishandled it terribly — reduced G.D.P. by "only" around 10 percent. What we're looking at now may be another shock, a sort of economic second wave, almost as severe in monetary terms as the first. And unlike the pandemic, this shock will be entirely self-generated, brought on by the fecklessness of President Trump and — let's give credit where it's due — Mitch McConnell, the Senate majority leader.

The question is, how can this be happening? The 2008 financial crisis and the sluggish recovery that followed weren't that long ago, and they taught us valuable lessons directly relevant to our current plight. Above all, experience in that slump demonstrated both that economic depressions are no time to obsess over debt and that slashing spending in the face of mass unemployment is a terrible mistake.

ADVERTISEMENT

Continue reading the main story

But nobody in the White House or on the G.O.P. side of Capitol Hill seems to have learned anything from that experience. In fact, not having learned anything from the last crisis almost seems to be a requirement for Republican economic advisers.

So at the moment we seem to be headed for a Greater Recession — a worse slump than 2007-2009, overlaid on the coronavirus slump. MAGA!

The Times is committed to publishing a diversity of letters to the editor. We'd like to hear what you think about this or any of our articles. Here are some tips. And here's our email: letters@nytimes.com.

Follow The New York Times Opinion section on Facebook, Twitter (@NYTopinion) and Instagram.

Paul Krugman has been an Opinion columnist since 2000 and is also a Distinguished Professor at the City University of New York Graduate Center. He won the 2008 Nobel Memorial Prize in Economic Sciences for his work on international trade and economic geography. @PaulKrugman

A version of this article appears in print on Aug. 7, 2020, Section A, Page 26 of the New York edition with the headline: Coming Next: The Greater Recession. Order Reprints | Today's Paper | Subscribe

-- via my feedly newsfeed

Richard Wolfe: Economic Update - The FED's Rigged Money Management [feedly]

https://economicupdate.podbean.com/e/economic-update-the-feds-rigged-money-management/

-- via my feedly newsfeed

Chinese economy's V-shaped recovery becomes more prominent [feedly]

http://www.ecns.cn/news/economy/2020-08-09/detail-ifzyxfhw7469941.shtml

China's economy, as shown by multiple mid-year indicators, has ridden out its downturn due to COVID-19 strains and bounced back to growth in the second quarter (Q2). Economists believe that the country's V-shaped recovery is only getting started.

In Q2, China's gross domestic product expanded by 3.2 percent year on year, reversing a 6.8-percent contraction in the previous quarter. China's fiscal revenue marked the first expansion this year by gaining 3.2 percent year on year in June, while the contraction of the retail sector declined markedly.

BACK IN THE GAME

"China's economy has gradually emerged from the slump and returned to the level it was roughly at prior to the outbreak, backed by the stimulation that has delivered burgeoning signs of work resumption, industrial chains and services sector," said Shao Yu, chief economist at Orient Securities.

Latest data showed that the purchasing managers' index (PMI) for China's manufacturing sector rose to 51.1 in July from 50.9 in June, remaining in expansion territory for the fifth month in a row, indicating stronger confidence of market entities.

"The steadily firming recovery points to the effectiveness of China's epidemic prevention and pro-growth policies to boost production and domestic consumption," said Sheng Hai, a macro analyst with China Industrial Securities.

His point was echoed by Steven Zhang, chief economist at Morgan Stanley Huaxin Securities. "China has its institutional advantages that enable a more agile and rapid response to public safety emergencies like COVID-19."

The prompt introduction and implementation of an array of measures, including higher fiscal spending, tax relief and cuts in lending rates and banks' reserve requirements to revive the economy and support employment, according to Zhang, is one of the major reasons behind the Q2 positive growth.

SHARED OPPORTUNITIES

As recent data showed that China's imports from emerging countries increased significantly, the recovery of the world's second-largest economy is expected to boost the pace of other economies' restoration, according to Zhang.

In H1, China's trade with ASEAN went up 5.6 percent year on year to 2.09 trillion yuan (about 301.12 billion U.S. dollars), while that with countries along the Belt and Road (B&R) accounted for 29.5 percent of the total trade, up 0.7 percentage points year on year.

Zhang said that trade between China and other parts of Asia, B&R countries and ASEAN is expected to further expand as the spillover effects will be more notable due to shorter distance and lower logistics costs.

To mitigate the impact of the COVID-19 outbreak, China has been investing heavily in infrastructure projects through local government bond issuance, which is expected to buoy demand for bulk commodities in the global market, thereby benefiting B&R countries, as major bulk commodity exporters, Zhang noted.

"Such effects came in as a demonstration of the new development pattern, or 'dual circulation', proposed in last week's meeting of the Political Bureau of the Communist Party of China Central Committee, which underscores the domestic market as the mainstay while domestic and foreign markets can boost each other," said Zhang.

SOLID FOOTING

"China's economy has mostly ridden out the COVID-19 blow and is entering a V-shaped rebound trajectory," said Zhang, forecasting the recovery to further consolidate in the third and fourth quarters with a 2.5-percent to 3-percent year-end growth.

In the backdrop of the economic rebound, last week's Political Bureau meeting stressed ramping up nationwide efforts to foster new opportunities amid challenges and make new advances amid changes.

As one of the key forces driving economic growth, consumption will catch up with the momentum in overall recovery and see some pent-up demand unleashed during the second half of the year as service sector picks up pace amid further containment of COVID-19, Zhang said.

Thanks to policies aiming to ensure stability in employment, consumer spending will be further propelled as the two factors underpinning the consumption revival, namely the urban unemployment rate and resident income, are stabilizing.

Official data showed that China's surveyed unemployment rate in urban areas stood at 5.7 percent in June, down 0.2 percentage points from May.

Resident income is also expected to hold steady on the back of firming economic data. In H1, the urban per capita disposable income came in at 21,655 yuan, up 1.5 percent in nominal terms and down 2 percent in real terms.

While economic fundamentals are solidifying, new growth drivers, such as new infrastructure like 5G, AI and cloud computing that has attracted big sums from investors, will also become a bright spot fueling economic growth, Shao noted.

In the second half of the year, China, on top of stabilizing measures, will invest more in domestic demand, new infrastructure, online industries and independent innovation for stronger recovery despite global uncertainties, Shao added.

-- via my feedly newsfeed

West Virginia GDP -- a Streamlit Version

A survey of West Virginia GDP by industrial sectors for 2022, with commentary This is content on the main page.

-

John Case has sent you a link to a blog: Blog: Eastern Panhandle Independent Community (EPIC) Radio Post: Are You Crazy? Reall...

-

---- Mylan's EpiPen profit was 60% higher than what the CEO told Congress // L.A. Times - Business Lawmakers were skeptical last...

-

via Bloomberg -- excerpted from "Balance of Power" email from David Westin. Welcome to Balance of Power, bringing you the late...