Tuesday, February 4, 2020

The facebook socialist economics group

Review of Strong Towns [feedly]

http://dollarsandsense.org/blog/2020/01/review-of-strong-towns.html

Strong Towns: A Bottom-Up Revolution to Rebuild American Prosperity

by Charles L. Marohn, Jr

Review by Polly Cleveland

Along with the automobile, Detroit pioneered a new American way of living: the auto-dependent housing development consisting of single-family houses arrayed around cul-de-sac streets. After World War II, the Detroit model subdivision exploded into the suburbs around the country. A post-war return to normal life, federal subsidies for veterans and new highways leading out of town—all combined to create a huge boom in suburban housing demand. Aided by federal and local subsidies for utilities, developers could build complete huge new single-family housing subdivisions outside existing cities—such as the famous Levittowns. Middle class white families moved out into these shiny new developments, leaving behind poorer and often minority families in older inner-city neighborhoods.

Before that time, most houses were built one by one, adjoining or replacing existing housing. Neighborhoods therefore represented a mix of older and newer, smaller and larger buildings. Limited transportation kept housing relatively dense. The high density in turn made it inexpensive for city governments to maintain services—police, fire, garbage, schools—and infrastructure—roads, sidewalks, sewers, water supplies, and other utilities. Moreover, due to the mixed age of structures, there were not unexpected peaks in costs.

All that changed with the new subdivisions. At first, they generated substantial tax revenues, making cities eager to encourage and subsidize more of them by extending utilities. But this pattern of growth contained a fatal flaw: Because all the utilities and houses in a subdivision were built at the same time, they all aged at the same rate. After 25 years or so of fiscal surplus, costs began to rise steeply for repairing infrastructure. In wealthier subdivisions, the city could raise property taxes to cover costs. In ordinary middle-class subdivisions, when city maintenance lagged, those residents who could afford it moved to newer subdivisions further out, leaving shabby houses on crumbling streets inhabited by ever poorer and often minority residents. This happened first in Detroit, where huge areas now lie abandoned. It is now happening in inner suburbs around the nation. Yet as inner suburbs crumble, towns pursue the same old financial fix: subsidizing brand-new subdivisions on raw land.

Ferguson, a suburb of St. Louis Missouri, makes a good example. In 1970 the population of some 29,000 was 99% white. By 2010, the population had fallen to 21,000, only 29% white. Ferguson came to national attention in 2014 when a police officer shot and killed an unarmed black teenager, setting off widespread protests. Investigative reporters found that the financially-strapped local government, still largely run by white officials, funded itself in part by imposing fines on the poor residents for minor offenses like driving with a broken headlight, jailing them when they couldn't pay. Ferguson turned out to typify many aging suburbs.

Today the tragedy comes full circle: the more affluent members of the younger generation are moving back into the run-down central city neighborhoods that their grandparents abandoned. In part, that's because today's families need both parents to work, making central locations more desirable. As these people return, they gentrify old neighborhoods, pricing out seniors as well as working-class or poorer residents. The local residents of course fight back, with rent control and severe restrictions on new construction or modifications of old buildings. New York City's newly-fortified rent control laws essentially forbid landlords from raising rents to cover the cost of renovations. California has seen an explosion of homeless and "housing insecure" people, including people with steady jobs.

The author of Strong Towns, Charles Marohn, is a civil engineer and planner. He began his career advising towns on how to attract and support those so-desirable new subdivisions. Eventually the numbers caught his attention, particularly the staggering cost of maintaining the infrastructure in aging single-family subdivisions. He came to recognize that much of this infrastructure was simply long run unsustainable, and that towns were committing financial suicide in their pursuit of "growth."

Marohn also found that in their pursuit of "shiny and new," towns may destroy the most financially productive parts of their tax bases. These are often not the most valuable properties, but roughly those that yield the most revenues per acre. He gives an example from his home town of Brainerd, Minnesota. There were two identical adjoining blocks in an area the town had labeled "blighted." Aided by municipal subsidies, one block was razed and replaced with a Taco John's franchise with plenty of parking. But while the Old and Blighted block had a tax value of $1.1 million, this Shiny and New block had a value of only $620,000. Moreover, Old and Blighted housed 11 small businesses with local owners plus 6 extra full-time workers. On Shiny and New, Taco John's provided 20 to 25 part-time jobs. Not even new jobs, because Taco John's had merely relocated from three blocks away.

Marohn advises towns first of all to prioritize maintenance of the most financially productive areas, whether blighted or not. As he writes, "Mow the grass. Sweep the streets. Patch the sidewalks. Pick up the trash. Fill the potholes…See a streetlight out: replace it. See a weed: pull it. See a crosswalk faded: repaint it…The neighborhoods that are generating such wealth for the community need to be showered with love."

But then Marohn makes a recommendation that will shock most communities: reconsider the policies that restrict change and discourage denser development. Oversized new buildings pop up in the wrong places, he says, because it's so difficult, time-consuming and expensive for developers to battle all the restrictions that when they do finally get a permit, they build as high as they can. Property owners, he says, should have the right to develop their properties to the next level without their neighbors' permission. That is, an owner in a single-family neighborhood should have a right to install a mother-in-law unit, or even build two or three units. In a neighborhood of three units, owners should have a right to build low-rise apartment buildings. And so forth. Meantime, towns should scrap those off-street parking requirements, which waste land, raise housing costs and encourage reliance on cars.

In all his compelling case for allowing higher density, I wish Marohn had addressed the role of property taxes. As I wrote in How a Progressive Tax System Made Detroit a Powerhouse (and Could Again), a tax system that relies heavily on taxing land is both highly progressive and pro-density. Detroit collapsed not just due to unsustainable low density subdivisions, but also due to the loss of such a system. But the book is essential reading for local officials and all of us who love cities.

Marohn now spends his time on his Strong Towns non-profit media organization, setting up events and webinars to discuss growth, development and the future of cities.

-- via my feedly newsfeed

Monday, February 3, 2020

How Zombies Ate the G.O.P.’s Soul [feedly]

https://www.nytimes.com/2020/02/03/opinion/republican-party-trump.html

Is this the week American democracy dies? Quite possibly.

After all, everyone in Washington understands perfectly well that Donald Trump abused the powers of his office in an attempt to rig this year's presidential election. But Senate Republicans are nonetheless about to acquit him without even pretending to look at the evidence, thereby encouraging further abuses of power.

But how did we get to this point? Part of the answer is extreme partisanship and right-wing political correctness (which is far more virulent than anything on the left). But I also blame the zombies.

A zombie idea is a belief or doctrine that has repeatedly been proved false, but refuses to die; instead, it just keeps shambling along, eating people's brains. The ultimate zombie in American politics is the assertion that tax cuts pay for themselves — a claim that has been proved wrong again and again over the past 40 years. But there are other zombies, like climate change denial, that play an almost equally large role in our political discourse.

ADVERTISEMENT

Continue reading the main story

And all of the really important zombies these days are on the right. Indeed, they have taken over the Republican Party.

It was not always thus. Back in 1980 George H.W. Bush called Ronald Reagan's extravagant claims about the effectiveness of tax cuts "voodoo economic policy." Everything that has happened since has vindicated his original assessment. Deficits ballooned after Reagan cut taxes; they shrank and eventually turned into surpluses after Bill Clinton raised taxes, then ballooned again after George W. Bush's tax cuts.

Voodoo has also crashed and burned at the state level: The Kansas experiment in radical tax cuts was a dismal failure, while California's tax hike under Jerry Brown, which conservatives declared a case of "economic suicide," was followed by a revenue and economic boom.

Yet voodoo economics has become unchallengeable doctrine within the Republican Party. Even fake moderates like Susan Collins justified their support for the 2017 Trump tax cut by claiming that it would reduce the budget deficit. Predictably, the deficit actually exploded, and now exceeds $1 trillion a year.

The politics of climate change have followed a similar trajectory. Global temperature keeps setting records, while climate-related catastrophes like the Australian wildfires are proliferating. Yet a majority of Republicans in Congress are climate deniers — many of them buying into the notion that climate change is a hoax perpetrated by a vast international scientific conspiracy — and even those, like Marco Rubio, who grudgingly admit that global warming is real oppose any significant action to limit emissions.

It's important to realize that the zombification of the G.O.P. isn't a recent phenomenon, something that happened only with Trump's election. On the contrary, zombies have been eating Republican brains for decades. Voodoo economics had completely taken over the party by the early 2000s, when then-House majority leader Tom DeLay declared, "Nothing is more important in the face of war than cutting taxes." Climate deniers have ruled since at least 2009, when only eight House Republicans supported a bill to limit greenhouse gas emissions.

What recent events make clear, however, is that zombie ideas haven't eaten just Republicans' brains. They have also eaten the party's soul.

Think about what is now required for a Republican politician to be considered a party member in good standing. He or she must pledge allegiance to policy doctrines that are demonstrably false; he or she must, in effect, reject the very idea of paying attention to evidence.

It takes a certain kind of person to play that kind of game — namely, a cynical careerist. There used to be Republican politicians who were more than that, but they were mainly holdovers from an earlier era, and at this point have all left the scene, one way or another. John McCain may well have been the last of his kind.

What's left now is a party that, as far as I can tell, contains no politicians of principle; anyone who does have principles has been driven out.

Now, the news media, with its constant urge to seem "balanced," has a hard time coping with this reality; it's always looking for ways to portray at least some Republicans as admirable figures. This has made it easy prey for charlatans like Paul Ryan, who pretended to be serious about his fiscal principles. But he was always an obvious flimflam man.

Anyway, a result of decades of zombification is a Republican caucus that consists entirely of soulless opportunists (and no, the fact that some of them like to quote Scripture doesn't change that fact).

I guess you might have hoped that there would be some limits to what these apparatchiks would accept, that even they would draw the line at gross abuses of power and collusion with foreign autocrats. What we've learned, however — and perhaps more important, what Trump has learned — is that there is no line. If Trump wants to dismantle democracy and rule of law (which he does), his party will stand with him all the way.

The Times is committed to publishing a diversity of letters to the editor. We'd like to hear what you think about this or any of our articles. Here are some tips. And here's our email: letters@nytimes.com.

Follow The New York Times Opinion section on Facebook, Twitter (@NYTopinion) and Instagram.

Paul Krugman has been an Opinion columnist since 2000 and is also a Distinguished Professor at the City University of New York Graduate Center. He won the 2008 Nobel Memorial Prize in Economic Sciences for his work on international trade and economic geography.

-- via my feedly newsfeed

How US Science and Engineering Depends on Immigrants [feedly]

http://conversableeconomist.blogspot.com/2020/02/how-us-science-and-engineering-depends.html

Foreign-born workers—ranging from long-term U.S. residents with strong roots in the United States to more recent immigrants—account for 30% of workers in S&E occupations. The number and proportion of the S&E workforce that are foreign born has grown. In many of the broad S&E occupational categories, the higher the degree level, the greater the proportion of the workforce who are foreign born. More than one-half of doctorate holders in engineering and in computer science and mathematics occupations are foreign born (Figure 9).

Within the US higher education system, a disproportionate number of the science and engineering degrees go to immigrants--many of whom then remain in the US economy at least for a time

In the United States, a substantial proportion of S&E doctoral degrees are conferred to international students with temporary visas. In 2017, temporary visa holders earned one-third (34%) of S&E doctoral degrees, a relatively stable proportion over time. They account for half or more of the doctoral degrees awarded in engineering, mathematics and computer sciences, and economics. Three Asian countries—China, India, and South Korea—are the largest source countries and accounted for just over half (54%) of all international recipients of U.S. S&E research doctoral degrees since 2000. By comparison, students on temporary visas earn a smaller share (6% in 2017) of S&E bachelor's degrees. However, the number of these students has more than doubled over the past 10 years.

A majority of the S&E doctorate recipients with temporary visas—ranging between 64% and 71% between 2003 and 2017—stayed in the United States five years after obtaining their degree. Those from China and India, however, saw a decline in their respective "stay rates" from 93% and 90%, respectively, in 2003 to 84% and 85%, respectively, in 2013; the rates remained stable from 2013 through 2017. The stay rate increased for those from South Korea (from 36% in 2003 to 57% in 2017). Stay rates also vary by field of doctoral degree. Among S&E doctorate recipients, social sciences (52%) has a lower stay rate than the average across all fields (71% in 2017).I know that we live in times of substantial concern about how technology may be transferred from the United States to other countries. Whatever one's concerns in that area, there is also another side to consider, which is that in raw numerical terms the US has a heavy dependence on imported science and engineering workers and American universities in science and engineering fields maintain their status and preeminence thank in substantial part to their foreign students.

-- via my feedly newsfeed

Primer—The state of the union for working people [feedly]

https://www.epi.org/blog/primer-the-state-of-the-union-for-working-people/

In preparation for President Trump's State of the Union speech, the Economic Policy Institute has assembled research from the last year that examines the real state of the union for working people on wages, manufacturing and trade, taxes, labor standards, housing, and immigration.

Wages and employment

- 2019 had solid job growth, but wage growth slowed. Average monthly job creation has held remarkably steady for the past nine years, but it did soften in the last year, from 223,000 in 2018 to 176,000 in 2019. Wage growth slowed for much of the year, providing further evidence that we are not yet at genuine full employment. After hitting a recent high point of 3.4% year-over-year wage growth, the growth rate has measurably decelerated and wage growth closed out the year at only 2.9% in December.

- Wage growth for low-wage workers has been strongest in states with minimum wage increases

- More on longer wage trends in our Nominal Wage Tracker.

Manufacturing and trade

- Jobs lost to China. Recent EPI research found that 700,000 jobs were lost to China in the first two years of Trump's presidency—many of them manufacturing jobs.

- China trade deal will not restore 3.7 million U.S. jobs lost since China entered the WTO in 2001

- U.S.-Mexico-Canada Agreement—Weak tea, at best

- What's good for Wall Street is often bad for American workersand manufacturing

Taxes

- Tax Cuts and Jobs Act (TCJA) has been a policy failure. Notably, business investment contracted for the third straight quarter—the first time this has happened since the Great Recession in 2009. Given that boosting business investment was the primary stated goal of the Tax Cuts and Jobs Act (TCJA) passed in 2017, this seems like an unambiguous policy failure.:

- On its second anniversary, the TCJA has cut taxes for corporations, but nothing has trickled down

Labor standards

- The Trump administration has systematically weakenedworkers' rights

- More than eight million workers will be left behind by the Trump overtime rule

- New Trump administration joint-employer rule has $1 billion price tag for workers

- Workers will lose more than $700 million annually under proposed Trump DOL rule

- Graduate student workers' rights to unionize are threatened by Trump administration proposal

Housing

- The Trump administration's new housing rules will worsen segregation

Immigration

- Trump and Kushner's 'merit-based' immigration plan fails to propose the smart reforms needed to modernize and improve U.S. labor migration

- Trump's national emergency declaration over the border wall is dangerous and not justified by the facts

- Congress and Trump discover bipartisanship on immigration—but only to increase H-2B visas for captive and underpaid migrant workers

-- via my feedly newsfeed

Sunday, February 2, 2020

China is closing gap with United States on research spending

China's per-capita spending on research and development is close to overtaking that of the United States.Credit: Qilai Shen/Bloomberg/Getty

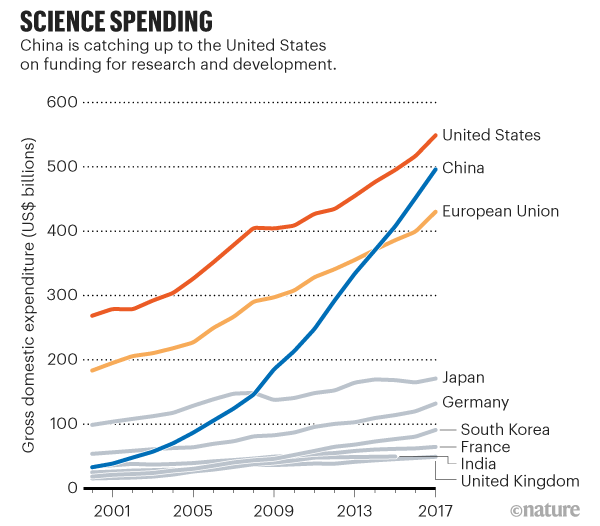

The gap in research and development (R&D) funding between the United States and China is closing fast, despite modest increases in US funding since 2000, according to statistics assembled by the US National Science Foundation (NSF).

The United States is increasingly "seen globally as an important leader rather than the uncontested leader" in science and engineering, the agency said in the latest edition of its biennial Science and Engineering Indicators report, which compiles metrics on the state of science and engineering in the country.

From 2000 to 2017, R&D spending in the United States grew at an average of 4.3% per year, found the report, which the NSF released on 15 January. But spending in China grew by more than 17% per year during the same period. Several other countries, including Germany and South Korea, also increased their spending at rates that outstripped that of the United States, but they remain solidly behind the two global leaders in terms of total funding. The United States accounted for 25% of the US$2.2 trillion spent on R&D worldwide in 2017, and China made up 23%.

Preliminary data from 2019 suggest that China has already surpassed the United States in R&D spending, said Julia Philips, chair of the National Science Board's science and engineering policy committee, during a press briefing. The board oversees the NSF and produces the Indicators reports.

Source: National Science Foundation

The emergence of other innovation powerhouses "can only be good", says Diane Souvaine, a computer scientist at Tufts University in Medford, Massachusetts. "New knowledge benefits everyone."

Souvaine, who chairs the National Science Board, notes that the United States still leads the world in many important metrics, such as total investment in R&D, proportion of highly cited publications and enrolment of internationally mobile students.

Julia Lane, an economist at New York University, objects to the NSF's use of spending as the pre-eminent metric for measuring the strength of the US science and engineering community. Instead of worrying about spending, she says, policymakers should be thinking about whether the dollars are being spent wisely. Lane also says that the continued attraction of foreign-born students and workers to the United States is "a good signal that good science is being done here".

Enrolment dip

But the NSF report found signs that this signal might be changing. The number of foreign-born students enrolling in US universities has declined by about 4% since 2016. And the retention rates for Chinese and Indian citizens who earn doctoral degrees in the United States have decreased by 9 and 5 percentage points, respectively, since 2003.

Shulamit Kahn, an economist at Boston University in Massachusetts, suspects that the tightening of US immigration policies, as well as increasingly strong university programmes in China and elsewhere, are the root causes of these declines.

At the same time, the global movement of researchers is opening up avenues for increased international scientific collaboration. Nearly 40% of scientific papers published by US authors in 2018 included foreign co-authors, up from 19% in 2000. Chinese scientists contributed to more than one-quarter of these manuscripts.

"The US–China relationship is the most important international scientific collaborative relationship we have right now," says Kei Koizumi, a former senior adviser in science policy at the American Association for the Advancement of Science in Washington DC. It's more appropriate, he continues, "to think of China as a collaborator than as an adversary".

Increasing diversity

The NSF report also found that US laboratories have become more diverse, by some measures. The participation of women and members of under-represented minorities in the science and engineering workforce has increased across the board since 2003, especially in the life sciences, psychology and the social sciences. However, because the total science and engineering workforce has also increased significantly over this period, the proportion of women in some disciplines, such as computer sciences and mathematics, has stagnated or even slightly decreased.

Molly King, a sociologist at Santa Clara University in California, says she is "not terribly surprised by any of the statistics" regarding diversity in the workforce. She cites several factors, including negative stereotyping and disparities in the rates at which women's papers are accepted and cited, which contribute to the persistence of the participation gap.

Furthermore, King says, owing to the differences in pay between science and engineering jobs and positions in other fields, this continued under-representation "has important implications for the gender (and racial) wage gaps and differential economic well-being". According to the Indicators report, the 2017 median salary for workers in science and engineering occupations was $85,390, more than double that for all workers ($37,690).

Koizumi thinks the report offers a clear road map of steps that the United States needs to take to remain competitive in global science and engineering: further investment in science, technology, engineering and maths education; increased inclusion of people from under-represented groups; and continued funding of science and engineering R&D. "It's all right there," he says.

Saturday, February 1, 2020

The Approaching Debt Wave [feedly]

https://www.project-syndicate.org/commentary/approaching-debt-crisis-vulnerable-britain-and-india-by-kaushik-basu-2020-01

The World Bank has warned that a massive debt wave is building worldwide. There is no telling who will be hit the hardest, but if vulnerable countries, from the United Kingdom to India, do not act soon, they may face severe economic damage.

The first of these happened in the early 1980s. After a decade of low borrowing costs, which enabled governments to expand their balance sheets considerably, interest rates began to rise, making debt-service increasingly unsustainable. Mexico fell first, informing the United States government and the International Monetary Fund in 1982 that it could no longer repay. This had a domino effect, with 16 Latin American countries and 11 least-developed countries outside the region ultimately rescheduling their debts.

In the 1990s, interest rates were again low, and global debt surged once more. The crash came in 1997, when fast-growing but financially vulnerable East Asian economies – including Indonesia, Malaysia, South Korea, and Thailand – experienced sharp growth slowdowns and plummeting exchange rates. The effects reverberated worldwide.

But it is not only emerging economies that are vulnerable to such crashes, as America's 2008 subprime mortgage crisis proved. By the time people figured out what "subprime" meant, the US investment bank Lehman Brothers had collapsed, triggering the most severe crisis and recession since the Great Depression.

The World Bank has just warned us that a fourth debt wave could dwarf the first three. Emerging economies, which have amassed a record debt-to-GDP ratio of 170%, are particularly vulnerable. As in the previous cases, the debt wave has been facilitated by low interest rates. There is reason for alarm once interest rates begin to rise and premia inevitably spike.

The mechanics of such crises are not well understood. But a 1998 paper by Stephen Morris and Hyun Song Shin on the mysterious origins of currency crises, and how they are transmitted to other economies, shows that a financial tsunami can make landfall far from its source.

How the source of financial trouble can vanish, leaving others stranded, was illustrated in the delightful short story "Rnam Krttva" by the celebrated twentieth-century Indian writer Shibram Chakraborty. In the story – which I translated into English and included in my book An Economist's Miscellany – the desperate Shibram asks an old school friend, Harsha, to lend him 500 rupees ($7) on a Wednesday, to be repaid the following Saturday. But Shibram squanders the money, so on Saturday, he has little choice but to ask another school friend, Gobar, for a loan of 500 rupees, to be repaid the next Wednesday. He uses the money to repay Harsha. But when Wednesday rolls around, he has no way of repaying Gobar. So, reminding Harsha of his excellent repayment record, he borrows from him again.

This becomes a routine, with Shibram repeatedly borrowing from one friend to repay the other. Then Shibram runs into both Harsha and Gobar one day at a crosswalk. After a moment of anxiety, he has an idea: every Wednesday, he suggests, Harsha should give Gobar 500 rupees, and every Saturday, Gobar should give the same amount to Harsha. Shibram assures his former school friends that this will save him a lot of time and change nothing for them, and he vanishes into Kolkata's milling crowds.

So who are the likely Harshas and Gobars in today's debt wave? According to the World Bank, they could be any country with domestic vulnerabilities, a stretched fiscal balance sheet, and a heavily indebted population.

There are several countries that fit this description and run the risk of being the conduit that carries the fourth debt wave to the world economy. Among advanced economies, the United Kingdom is an obvious candidate. In 2019, the UK narrowly avoided a recession, with a growth rate a shade above zero – the weakest growth in a non-recession period since 1945. The country is also about to undertake Brexit. Conservatives in Britain have promised that a "tidal wave" of business investment will follow. This is unlikely: if there is a tidal wave, it will probably be one of debt instead.

Among emerging economies, India is especially vulnerable. In the 1980s, India's economy was fairly sheltered, so the debt wave back then had little impact. At the time of the East Asian crisis in 1997, India had just begun to open up, and it experienced some slowdown in growth. By the time of the debt wave in 2008, the country had become globally integrated and was severely affected. But its economy was strong and growing at nearly 10% annually, and it recovered within a year.

Today, India's economy is facing one of its deepest crises in the last 30 years, with growth slowing sharply, unemployment at a 45-year high, close to zero export growth over the last six years, and per capita consumption in the agricultural sector decreasing over the last five years. Add to this a deeply polarized political environment and it is little wonder that investor confidence is rapidly declining.

It is not too late for countries to build seawalls to protect against debt tsunamis. While India's political problems will take time to solve, the Union budget – to be presented on February 1 – is an opportunity for preemptive action. The fiscal deficit needs to be controlled in the medium term, but the government would be wise to adopt expansionary fiscal policy now, with money channeled into shoring up infrastructure and investment. Managed properly, this can boost demand without increasing inflationary pressures, and strengthen the economy in order to withstand a debt wave.

The country's leaders must seize this opportunity. The alternative is to adopt the brace position.

-- via my feedly newsfeed

West Virginia GDP -- a Streamlit Version

A survey of West Virginia GDP by industrial sectors for 2022, with commentary This is content on the main page.

-

John Case has sent you a link to a blog: Blog: Eastern Panhandle Independent Community (EPIC) Radio Post: Are You Crazy? Reall...

-

---- Mylan's EpiPen profit was 60% higher than what the CEO told Congress // L.A. Times - Business Lawmakers were skeptical last...

-

via Bloomberg -- excerpted from "Balance of Power" email from David Westin. Welcome to Balance of Power, bringing you the late...