Everything You Thought You Knew About Western Civilization Is Wrong: A Review of Michael Hudson's New Book, And Forgive Them Their Debts

To say that Michael Hudson's new book And Forgive Them Their Debts: Lending, Foreclosure, and Redemption from Bronze Age Finance to the Jubilee Year (ISLET 2018) is profound is an understatement on the order of saying that the Mariana Trench is deep. To grasp his central argument is so alien to our modern way of thinking about civilization and barbarism that Hudson quite matter-of-factly agreed with me that the book is, to the extent that it will be understood, "earth-shattering" in both intent and effect. Over the past three decades, Hudson gleaned (under the auspices of Harvard's Peabody Museum) and then synthesized the scholarship of American and British and French and German and Soviet assyriologists (spelled with a lower-case a to denote collectively all who study the various civilizations of ancient Mesopotamia, which include Sumer, the Akkadian Empire, Ebla, Babylonia, et al., as well as Assyria with a capital A). Hudson demonstrates that we, twenty-first century globalists, have been morally blinded by a dark legacy of some twenty-eight centuries of decontextualized history. This has left us, for all practical purposes, utterly ignorant of the corrective civilizational model that is needed to save ourselves from tottering into bleak neo-feudal barbarism.

This corrective model actually existed and flourished in the economic functioning of Mesopotamian societies during the third and second millennia B.C. It can be termed Clean Slate amnesty, a term Hudson uses to embrace the essential function of what was called amargi andníg-si-sáin Sumerian, andurārumand mīšarumin Akkadian (the language of Babylonia), šudūtu andkirenzi in Hurrian, para tarnumarin Hittite, and deror(דְּרוֹר) in Hebrew: It is the necessary and periodic erasure of the debts of small farmers — necessary because such farmers are, in any society in which interest on loans is calculated, inevitably subject to being impoverished, then stripped of their property, and finally reduced to servitude (including the sexual servitude of daughters and wives) by their creditors, creditors. The latter inevitably seek to effect the terminal polarization of society into an oligarchy of predatory creditors cannibalizing a sinking underclass mired in irreversible debt peonage. Hudson writes: "That is what creditors really wanted: Not merely the interest as such, but the collateral — whatever economic assets debtors possessed, from their labor to their property, ending up with their lives" (p. 50).

And such polarization is, by Hudson's definition, barbarism. For what is the most basic condition of civilization, Hudson asks, other than societal organization that effects lasting "balance" by keeping "everybody above the break-even level"?

"Mesopotamian societies were not interested in equality," he told me, "but they were civilized. And they possessed the financial sophistication to understand that, since interest on loans increases exponentially, while economic growth at best follows an S-curve. This means that debtors will, if not protected by a central authority, end up becoming permanent bondservants to their creditors. So Mesopotamian kings regularly rescued debtors who were getting crushed by their debts. They knew that they needed to do this. Again and again, century after century, they proclaimed Clean Slate Amnesties."

Hudson also writes: "By liberating distressed individuals who had fallen into debt bondage, and returning to cultivators the lands they had forfeited for debt or sold under economic duress, these royal acts maintained a free peasantry willing to fight for its land and work on public building projects and canals…. By clearing away the buildup of personal debts, rulers saved society from the social chaos that would have resulted from personal insolvency, debt bondage, and military defection" (p. 3).

Marx and Engels never made such an argument (nor did Adam Smith for that matter). Hudson points out that they knew nothing of these ancient Mesopotamian societies. No one did back then. Almost all of the various kinds of assyriologists completed their archaeological excavations and philological analyses during the twentieth century. In other words, this book could not have been written until someone digested the relevant parts of the vast body of this recent scholarship. And this someone is Michael Hudson.

So let us reconsider Hudson's fundamental insight in more vivid terms. In ancient Mesopotamian societies it was understood that freedom was preserved by protecting debtors. In what we call Western Civilization, that is, in the plethora of societies that have followed the flowering of the Greek poleis beginning in the eighth century B.C., just the opposite, with only one major exception (Hudson describes the tenth-century A.D. Byzantine Empire of Romanos Lecapenus), has been the case: For us freedom has been understood to sanction the ability of creditors to demand payment from debtors without restraint or oversight. This is the freedom to cannibalize society. This is the freedom to enslave. This is, in the end, the freedom proclaimed by the Chicago School and the mainstream of American economists. And so Hudson emphasizes that our Western notion of freedom has been, for some twenty-eight centuries now, Orwellianin the most literal sense of the word: War is Peace • Freedom is Slavery• Ignorance is Strength. He writes: "A constant dynamic of history has been the drive by financial elites to centralize control in their own hands and manage the economy in predatory, extractive ways. Their ostensible freedom is at the expense of the governing authority and the economy at large. As such, it is the opposite of liberty as conceived in Sumerian times" (p. 266).

And our Orwellian, our neoliberal notion of unrestricted freedom for the creditor dooms us at the very outset of any quest we undertake for a just economic order. Any and every revolution that we wage, no matter how righteous in its conception, is destined to fail.

And we are so doomed, Hudson says, because we have been morally blinded by twenty-eight centuries of deracinated, or as he says, decontextualized history. The true roots of Western Civilization lie not in the Greek poleis that lacked royal oversight to cancel debts, but in the Bronze Age Mesopotamian societies that understood how life, liberty and land would be cyclically restored to debtors again and again. But, in the eighth century B.C., along with the alphabet coming from the Near East to the Greeks, so came the concept of calculating interest on loans. This concept of exponentially-increasing interest was adopted by the Greeks — and subsequently by the Romans — without the balancing concept of Clean Slate amnesty.

So it was inevitable that, over the centuries of Greek and Roman history, increasing numbers of small farmers became irredeemably indebted and lost their land. It likewise was inevitable that their creditors amassed huge land holdings and established themselves in parasitic oligarchies. This innate tendency to social polarization arising from debt unforgiveness is the original and incurable curse on our post-eighth-century-B.C. Western Civilization, the lurid birthmark that cannot be washed away or excised. In this context Hudson quotes the classicist Moses Finley to great effect: "…. debt was a deliberate device on the part of the creditor to obtain more dependent labor rather than a device for enrichment through interest." Likewise he quotes Tim Cornell: "The purpose of the 'loan,' which was secured on the person of the debtor, was precisely to create a state of bondage"(p. 52 — Hudson earlier made this point in two colloquium volumes he edited as part of his Harvard project: Debt and Economic Renewal in the Ancient Near East, and Labor in the Ancient World).

Hudson is able to explain that the long decline and fall of Rome begins not, as Gibbon had it, with the death of Marcus Aurelius, the last of the five good emperors, in A.D. 180, but four centuries earlier, following Hannibal's devastation of the Italian countryside during the Second Punic War (218-201 B.C.). After that war the small farmers of Italy never recovered their land, which was systematically swallowed up by the prædia(note the etymological connection with predatory), the latifundia, the great oligarchic estates: latifundia Italiam ("the great estates destroyed Italy"), as Pliny the Elder observed. But among modern scholars, as Hudson points out, "Arnold Toynbee is almost alone in emphasizing the role of debt in concentrating Roman wealth and property ownership" (p. xviii) — and thus in explaining the decline of the Roman Empire.

"Arnold Toynbee," Hudson writes, "described Rome's patrician idea of 'freedom' or 'liberty' as limited to oligarchic freedom from kings or civic bodies powerful enough to check creditor power to indebt and impoverish the citizenry at large. 'The patrician aristocracy's monopoly of office after the eclipse of the monarchy [Hudson quotes from Toynbee's book Hannibal's Legacy] had been used by the patricians as a weapon for maintaining their hold on the lion's share of the country's economic assets; and the plebeian majority of the Roman citizen-body had striven to gain access to public office as a means to securing more equitable distribution of property and a restraint on the oppression of debtors by creditors.' The latter attempt failed," Hudson observes, "and European and Western civilization is still living with the aftermath" (p. 262).

Because Hudson brings into focus the big picture, the pulsing sweep of Western history over millennia, he is able to describe the economic chasm between ancient Mesopotamian civilization and the later Western societies that begins with Greece and Rome: "Early in this century [i.e. the scholarly consensus until the 1970s] Mesopotamia's debt cancellations were understood to be like Solon's seisachtheia of 594 B.C. freeing the Athenian citizens from debt bondage. But Near Eastern royal proclamations were grounded in a different social-philosophical context from Greek reforms aiming to replace landed creditor aristocracies with democracy. The demands of the Greek and Roman populace for debt cancellation can rightly be called revolutionary[italics mine], but Sumerian and Babylonian demands were based on a conservative tradition grounded in rituals of renewing the calendrical cosmos and its periodicities in good order. The Mesopotamian idea of reform had 'no notion [Hudson is quoting Dominique Charpin's book Hammurabi of Babylonhere] of what we would call social progress. Instead, the measures the king instituted under his mīšarum were measures to bring back the original order [italics mine]. The rules of the game had not been changed, but everyone had been dealt a new hand of cards'" (p. 133). Contrast the Greeks and Romans: "Classical Antiquity," Hudson writes, "replaced the cyclical idea of time and social renewal with that of linear time. Economic polarization became irreversible, not merely temporary" (p. xxv). In other words: "The idea of linear progress, in the form of irreversible debt and property transfers, has replaced the Bronze Age tradition of cyclical renewal" (p. 7).

After all these centuries, we remain ignorant of the fact that deep in the roots of our civilization is contained the corrective model of cyclical return – what Dominique Charpin calls the "restoration of order" (p. xix). We continue to inundate ourselves with a billion variations of the sales pitch to borrow and borrow, the exhortation to put more and more on credit, because, you know, the future's so bright I gotta wear shades.

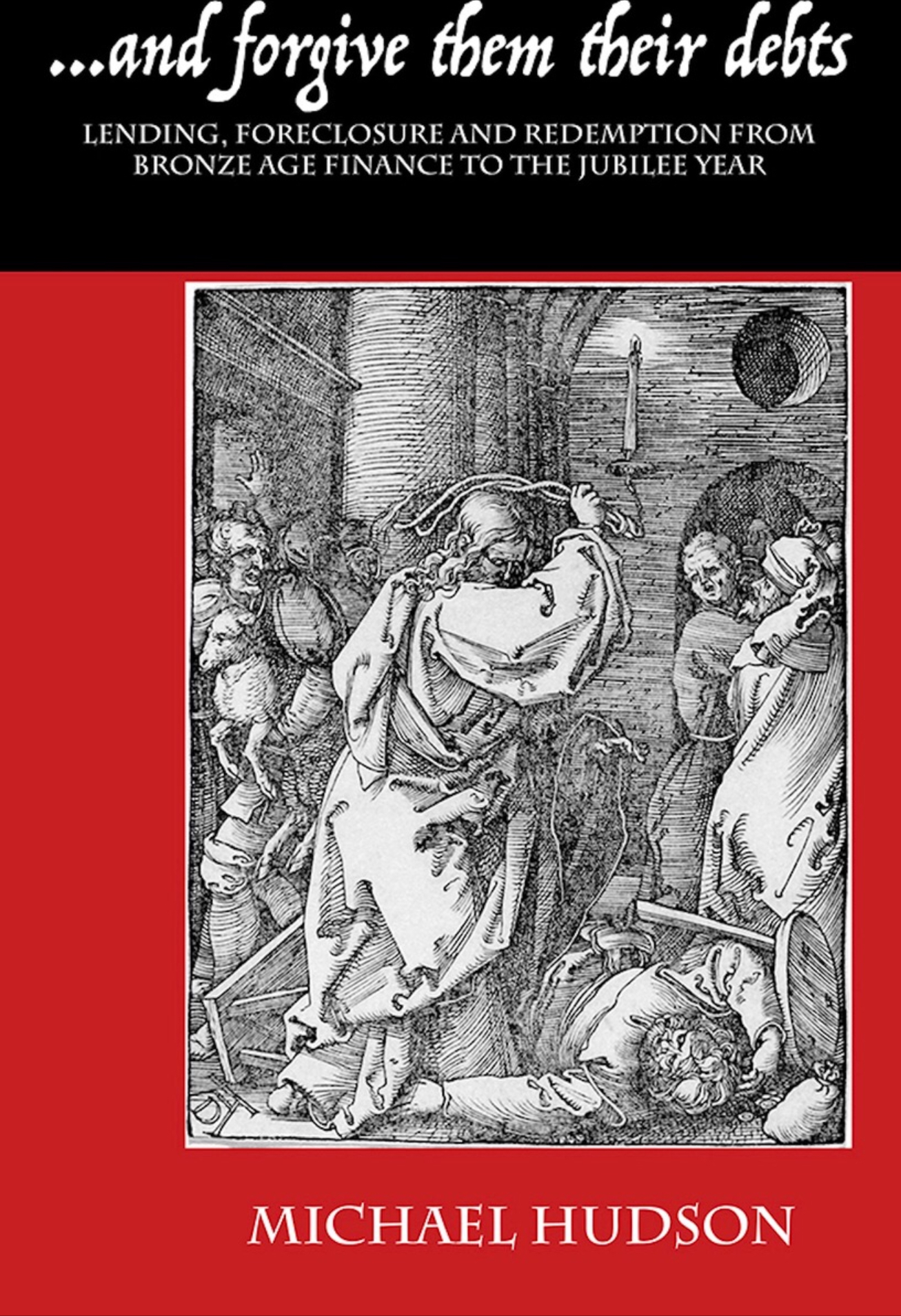

Nowhere, Hudson shows, is it more evident that we are blinded by a deracinated, by a decontextualizedunderstanding of our history than in our ignorance of the career of Jesus. Hence the title of the book: And Forgive Them Their Debts and the cover illustration of Jesus flogging the moneylenders — the creditors who do not forgive debts — in the Temple. For centuries English-speakers have recited the Lord's Prayer with the assumption that they were merely asking for the forgiveness of their trespasses, their theological sins: "… and forgive us our trespasses, as we forgive those who trespass against us…." is the translation presented in the Revised Standard Version of the Bible. What is lost in translation is the fact that Jesus came "to preach the gospel to the poor … to preach the acceptable Year of the Lord": He came, that is, to proclaim a Jubilee Year, a restoration of deror for debtors: He came to institute a Clean Slate Amnesty (which is what Hebrew דְּרוֹר connotes in this context).

So consider the passage from the Lord's Prayer literally: … καὶ ἄφες ἡμῖν τὰ ὀφειλήματα ἡμῶν: "… and send away (ἄφες) for us our debts (ὀφειλήματα)." The Latin translation is not only grammatically identical to the Greek, but also shows the Greek word ὀφειλήματα revealingly translated as debita: … et dimitte nobis debita nostra: "… and discharge (dimitte) for us our debts (debita)." There was consequently, on the part of the creditor class, a most pressing and practical reason to have Jesus put to death: He was demanding that they restore the property they had rapaciously taken from their debtors. And after His death there was likewise a most pressing and practical reason to have His Jubilee proclamation of a Clean Slate Amnesty made toothless, that is to say, made merely theological: So the rich could continue to oppress the poor, forever and ever. Amen.

Just as this is a profound book, it is so densely written that it is profoundly difficult to read. I took six days, which included six or so hours of delightful and enlightening conversation with the author himself, to get through it. I often availed myself of David Graeber's book Debt: The First 5,000 Years when I struggled to follow some of Hudson's arguments. (Graeber and Hudson have been friends, Hudson told me, for ten years, and Graeber, when writing Debt; The First 5,000 Years, relied on Hudson's scholarship for his account of ancient Mesopotamian economics, cf. p. xxiii). I have written this review as synopsis of the book in order to provide some help to other readers: I cannot emphasize too much that this book is indeed earth-shattering, but much intellectual labor is required to digest it.

ADDENDUM: Moral Hazard

When I sent a draft of my review to a friend last night, he emailed me back with this question:

— Wouldn't debt cancellations just take away any incentive for people to pay back loans and, thus, take away the incentive to give loans? People who haven't heard the argument before and then read your review will probably be skeptical at first.

Here is Michael Hudson's response:

— Creditors argue that if you forgive debts for a class of debtors – say, student loans – that there will be some "free riders," and that people will expect to have bad loans written off. This is called a "moral hazard," as if debt writedowns are a hazard to the economy, and hence, immoral.

This is a typical example of Orwellian doublespeak engineered by public relations factotums for bondholders and banks. The real hazard to every economy is the tendency for debts to grow beyond the ability of debtors to pay. The first defaulters are victims of junk mortgages and student debtors, but by far the largest victims are countries borrowing from the IMF in currency "stabilization" (that is economic destabilization) programs.

It is moral for creditors to have to bear the risk ("hazard") of making bad loans, defined as those that the debtor cannot pay without losing property, status or becoming insolvent. A bad international loan to a government is one that the government cannot pay except by imposing austerity on the economy to a degree that output falls, labor is obliged to emigrate to find employment, capital investment declines, and governments are forced to pay creditors by privatizing and selling off the public domain to monopolists.

The analogy in Bronze Age Babylonia was a flight of debtors from the land. Today from Greece to Ukraine, it is a flight of skilled labor and young labor to find work abroad.

No debtor – whether a class of debtors such as students or victims of predatory junk mortgages, or an entire government and national economy – should be obliged to go on the road to and economic suicide and self-destruction in order to pay creditors. The definition of statehood – and hence, international law – should be to put one's national solvency and self-determination above foreign financial attacks. Ceding financial control should be viewed as a form of warfare, which countries have a legal right to resist as "odious debt" under moral international law.

The basic moral financial principal should be that creditors should bear the hazard for making bad loans that the debtor couldn't pay — like the IMF loans to Argentina and Greece. The moral hazard is their putting creditor demands over the economy's survival.

Harpers Ferry, WV

PARIS – French President Emmanuel Macron has framed the European Parliament election in May 2019 as a battle not between the traditional right and left, but between populists and pro-European progressives like himself. Greek Prime Minister Alexis Tsipras recently adopted similar rhetoric, declaring that "all progressive, democratic, and pro-European forces have a duty to stand side by side on the same side of history." Would such a fundamental Europe-wide political shift – much like the one in France that brought Macron to power last year – actually come to pass?

The European People's Party (EPP) on the right and the Progressive Alliance of Socialists and Democrats (S&D) on the left have long shared control of the European Parliament, where they have governed by compromise. But, over time, this has produced a kind of political homogenization in Europe, leading to mass abstentionism. Those who do vote increasingly choose anti-establishment parties that often espouse extreme views.

As a result, whereas the EPP and S&D controlled 61% of the European Parliament in 2009, they won only 54% of the vote in 2014, meaning that the body was very nearly dominated by extremist parties. The 2019 election is likely to produce even more losses for the establishment parties, which are expected to win only 45% of seats.

At this stage, it is doubtful that anyone would consider running a campaign on the basis of left-right divisions – not least because of deep rifts within the parties themselves. On the right, the EPP is divided between pro-European liberals and conservative Euroskeptics, despite endorsing Manfred Weber of Germany's Christian Social Union as the EPP Spitzenkandidat.

At the recent EPP Congress in Helsinki, European Council President Donald Tusk was explicit: breaching the rule of law is incompatible with belonging to the Christian Democrat family – a message obviously aimed at Hungarian Prime Minister Viktor Orbán. In the European Parliament, the EPP even voted in favor of invoking Article 7 of the Treaty of Lisbon against Hungary, a move that would impose sanctions in response to the Orbán government's systematic violations of judicial independence, freedom of speech, and the rights of minorities and migrants.

But the EPP's vote was largely motivated by its desire to preserve its chances of remaining the largest EU party and ensuring that Weber becomes the next European Commission leader. More broadly, strong political pressure forced the EPP's hand; under different circumstances, the party probably would have been happy to allow Orbán to continue breaching democratic norms unchecked, in order to preserve its own hegemony in the EU Parliament.

But in refusing to clarify its position on Orbán or expel him, the EPP is taking an enormous risk. If the European Council chooses Weber as the next European Commission president, both social democrats and liberals in the European Parliament could refuse to vote for a candidate from a party that keeps Orbán in its ranks. That is why Macron, who has an interest in dividing the EPP and luring its liberal wing to join him, opposes the Spitzenkandidat system.

There are three alternatives. First, the European Council could choose an EPP candidate who is less ambiguous on Hungary. Brexit chief negotiator Michel Barnier could be a serious substitute for Weber – probably the only one within the EPP.

The second alternative would be to endorse the Dutch Labour Party's Frans Timmermans, who took a very strong position against Orbán and is acceptable to German Chancellor Angela Merkel and EPP liberals. To be sure, Merkel might prefer Weber. But if the European Council is deadlocked, and the European Parliament opposes her choice, she could endorse another candidate. The decline of the S&D also makes it implausible that Weber could get their support.

The third option could be a candidate endorsed by the Alliance of Liberals and Democrats for Europe (ALDE), such as Margrethe Vestager, the EU competition commissioner. Some observers argue that the Danish government will never propose Vestager as their candidate. But Macron, who strongly supports Vestager, could endorse her as the French candidate – an unprecedented move that would accelerate the Europeanization of continental politics.

Overall, populist forces could well secure a majority in the European Parliament, though they will not operate as a unified force under a single political banner. In such a scenario, Macron would need to build political coalitions with either the EPP or the S&D, whose views largely align with his vision for EU – and, more important, eurozone – reform. In fact, like the rule of law, eurozone reform is a key fault line along which political alliances will be established.

Macron is already marshaling support among center-right leaders in Spain and the Netherlands, who are more sympathetic to his vision for European integration. He has established a good rapport with Dutch Prime Minister Mark Rutte, even though Rutte opposes the eurozone reforms Macron advocates.

Two other issues will likely shape the outcome of the European Parliament election. First, Europe's leaders will have to address the need to reinforce the EU's external frontiers, especially through the long-overdue deployment of a European border patrol. Such a proposal will undoubtedly rile nationalist populists, who will oppose the deployment of a European force, even as they rail against migration.

Second, Europe's leaders will need to commit to combating tax evasion and avoidance by major companies, especially the big tech firms. This is a high-stakes issue, as it will determine the capacity of states to remain fiscally solvent in increasingly digital economies.

Some progress has already been made on this front, thanks largely to Vestager. But stronger action is needed, not least because EU countries continue to grant corporate tax abatements. And with Germany reconsidering its support for a French-backed plan to tax the revenue of large technology companies at the EU level, further progress is far from guaranteed.

Perhaps Europe's ongoing political realignment will enable the realization of Macron's vision of a stronger, more integrated Europe. While recent challenges – not least Italy's budget battle with the European Commission – indicate that such an outcome is far from assured, it remains the most credible counterweight to the rise of populism.