--via sam -- the times bar on text cut and paste makes me want to boycott them

saw a followup, but can't find it

On Mon, Feb 12, 2018 at 4:46 PM, John Case <jcase4218@gmail.com> wrote:

--Bosses get Raises, workers get Stiffed

Stock markets have been swooning, in no small part because last Friday's U.S. employment report showed that average hourly earnings (AHE)—the average wage, excluding benefits, received by private sector workers—rose smartly in January. This prompted fears that inflationary pressures are mounting, wages will eat into profits, and the Federal Reserve might raise interest rates more aggressively than had been thought as recently as last Thursday. Or, as the New York Times put it in a headline, with its patented mix of dullness and alarm:--What these scaremongers aren't telling you is that it's only bosses that are getting the raises.

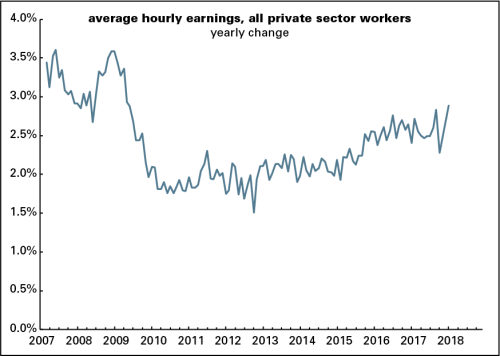

Here's a graph of the yearly growth in AHE.

You may notice that this series begins in March 2007. That's because the Bureau of Labor Statistics (BLS) only started reporting hourly earnings for "all workers" in March 2006. It has been reporting monthly AHE stats for "nonsupervisory" or "production" workers since 1964. Nonsupervisory workers—defined by the BLS as "those who are not owners or who are not primarily employed to direct, supervise, or plan the work of others"—are about 82% of the private sector workforce, a share that has hardly changed over the last 53 years.

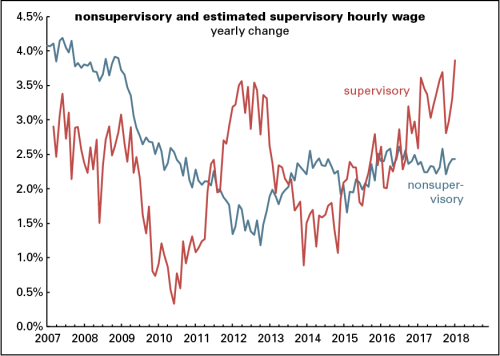

The BLS doesn't report AHE for supervisory workers. But since we know the nonsupervisory share of the workforce and the all-worker and nonsupervisory AHE numbers, we can estimate what the supervisory wage looks like with some middle-school math. Here's a graph:

Most Wall Street analysts have been focusing on the all worker series, because it's broader, and because many of them have a hard time thinking about more than one thing at a time. And if you're looking to alarmed about something, you can find a rising trend in the graph above. Yearly wage growth (not adjusted for inflation) hit a post-recession low of 1.5% in October 2012; in January 2018, it rose to 2.9%, the highest in almost nine years. Yes, the number is noisy, but there's no mistaking the rising trend.

But those who've been panicking about a wage explosion haven't bothered to look at the nonsupervisory series. That has shown no rising trend at all over the last two years. AHE for nonsupervisory workers were up 2.4% for the year ending in January—just as they were in December, and less than September 2017's 2.6%. In January 2016, the gain was 2.4%. In other words, for more than four out of five private sector workers, there's been no acceleration in wage growth—which, by the way, is barely ahead of inflation.For the year ending in January, supervisory wages were up 3.9%, compared with 3.0% in December. Over the last three months, supervisory wages are up 6.4% at an annual rate. (In January, nonsupervisory wages averaged $22.34, and the lbo-news estimate of supervisory earnings was $47.35.) In 2015 and 2016, both series moved pretty much together, but the boss sector began pulling ahead of the bossed in early 2017, and the gap has been widening since.

The series does bounce around a lot, and it's quite possible that some of the January spike will be reversed in February. But the central point is this: the alarming acceleration in wages is not a mass phenomenon. It's for the $95,000 a year set, not the $45,000 crew.*

________________________________

*Yearly earnings are based on 2,000 hours a year times the relevant hourly wage.

John Case

Harpers Ferry, WV

The Winners and Losers Radio Show7-9 AM Weekdays, The Enlighten Radio Player Stream,Sign UP HERE to get the Weekly Program Notes.Check out Socialist Economics, the Enlighten Radio website, and

You received this message because you are subscribed to the Google Groups "Socialist Economics" group.

To unsubscribe from this group and stop receiving emails from it, send an email to socialist-economics+unsubscribe@googlegroups.com .

To post to this group, send email to socialist-economics@googlegroups.com .

Visit this group at https://groups.google.com/group/socialist-economics .

To view this discussion on the web visit https://groups.google.com/d/msgid/socialist-economics/CADH2i .dLVMLMD%2BR4Q-M090G5RQj1QYm90J idhKCi%3DkY4wkW%2BTHw%40mail. gmail.com

For more options, visit https://groups.google.com/d/optout .

--

John Case

Harpers Ferry, WV

The Winners and Losers Radio Show7-9 AM Weekdays, The Enlighten Radio Player Stream,Sign UP HERE to get the Weekly Program Notes.Check out Socialist Economics, the Enlighten Radio website, and

You received this message because you are subscribed to the Google Groups "Socialist Economics" group.

To unsubscribe from this group and stop receiving emails from it, send an email to socialist-economics+unsubscribe@googlegroups.com.

To post to this group, send email to socialist-economics@googlegroups.com.

Visit this group at https://groups.google.com/group/socialist-economics.

To view this discussion on the web visit https://groups.google.com/d/msgid/socialist-economics/CADH2idJovFYQ2ousfSqs0n1%2BgcU3QY%3DprPvAVViXRMcB%2B_jSmw%40mail.gmail.com.

For more options, visit https://groups.google.com/d/optout.

Monday, February 12, 2018

Re: Fwd: [socialist-econ] Henwood: Bosses get Raises, workers get Stiffed

Fwd: [socialist-econ] Henwood: Bosses get Raises, workers get Stiffed

--Bosses get Raises, workers get StiffedStock markets have been swooning, in no small part because last Friday's U.S. employment report showed that average hourly earnings (AHE)—the average wage, excluding benefits, received by private sector workers—rose smartly in January. This prompted fears that inflationary pressures are mounting, wages will eat into profits, and the Federal Reserve might raise interest rates more aggressively than had been thought as recently as last Thursday. Or, as the New York Times put it in a headline, with its patented mix of dullness and alarm:--What these scaremongers aren't telling you is that it's only bosses that are getting the raises.

Here's a graph of the yearly growth in AHE.

You may notice that this series begins in March 2007. That's because the Bureau of Labor Statistics (BLS) only started reporting hourly earnings for "all workers" in March 2006. It has been reporting monthly AHE stats for "nonsupervisory" or "production" workers since 1964. Nonsupervisory workers—defined by the BLS as "those who are not owners or who are not primarily employed to direct, supervise, or plan the work of others"—are about 82% of the private sector workforce, a share that has hardly changed over the last 53 years.

The BLS doesn't report AHE for supervisory workers. But since we know the nonsupervisory share of the workforce and the all-worker and nonsupervisory AHE numbers, we can estimate what the supervisory wage looks like with some middle-school math. Here's a graph:

Most Wall Street analysts have been focusing on the all worker series, because it's broader, and because many of them have a hard time thinking about more than one thing at a time. And if you're looking to alarmed about something, you can find a rising trend in the graph above. Yearly wage growth (not adjusted for inflation) hit a post-recession low of 1.5% in October 2012; in January 2018, it rose to 2.9%, the highest in almost nine years. Yes, the number is noisy, but there's no mistaking the rising trend.

But those who've been panicking about a wage explosion haven't bothered to look at the nonsupervisory series. That has shown no rising trend at all over the last two years. AHE for nonsupervisory workers were up 2.4% for the year ending in January—just as they were in December, and less than September 2017's 2.6%. In January 2016, the gain was 2.4%. In other words, for more than four out of five private sector workers, there's been no acceleration in wage growth—which, by the way, is barely ahead of inflation.For the year ending in January, supervisory wages were up 3.9%, compared with 3.0% in December. Over the last three months, supervisory wages are up 6.4% at an annual rate. (In January, nonsupervisory wages averaged $22.34, and the lbo-news estimate of supervisory earnings was $47.35.) In 2015 and 2016, both series moved pretty much together, but the boss sector began pulling ahead of the bossed in early 2017, and the gap has been widening since.

The series does bounce around a lot, and it's quite possible that some of the January spike will be reversed in February. But the central point is this: the alarming acceleration in wages is not a mass phenomenon. It's for the $95,000 a year set, not the $45,000 crew.*

________________________________

*Yearly earnings are based on 2,000 hours a year times the relevant hourly wage.John Case

Harpers Ferry, WVThe Winners and Losers Radio Show7-9 AM Weekdays, The Enlighten Radio Player Stream,Sign UP HERE to get the Weekly Program Notes.Check out Socialist Economics, the Enlighten Radio website, and

You received this message because you are subscribed to the Google Groups "Socialist Economics" group.

To unsubscribe from this group and stop receiving emails from it, send an email to socialist-economics+unsubscribe@googlegroups.com .

To post to this group, send email to socialist-economics@googlegroups.com .

Visit this group at https://groups.google.com/group/socialist-economics .

To view this discussion on the web visit https://groups.google.com/d/msgid/socialist-economics/CADH2i .dLVMLMD%2BR4Q-M090G5RQj1QYm90J idhKCi%3DkY4wkW%2BTHw%40mail. gmail.com

For more options, visit https://groups.google.com/d/optout .

Harpers Ferry, WV

Henwood: Bosses get Raises, workers get Stiffed

Here's a graph of the yearly growth in AHE.

You may notice that this series begins in March 2007. That's because the Bureau of Labor Statistics (BLS) only started reporting hourly earnings for "all workers" in March 2006. It has been reporting monthly AHE stats for "nonsupervisory" or "production" workers since 1964. Nonsupervisory workers—defined by the BLS as "those who are not owners or who are not primarily employed to direct, supervise, or plan the work of others"—are about 82% of the private sector workforce, a share that has hardly changed over the last 53 years.

Most Wall Street analysts have been focusing on the all worker series, because it's broader, and because many of them have a hard time thinking about more than one thing at a time. And if you're looking to alarmed about something, you can find a rising trend in the graph above. Yearly wage growth (not adjusted for inflation) hit a post-recession low of 1.5% in October 2012; in January 2018, it rose to 2.9%, the highest in almost nine years. Yes, the number is noisy, but there's no mistaking the rising trend.

But those who've been panicking about a wage explosion haven't bothered to look at the nonsupervisory series. That has shown no rising trend at all over the last two years. AHE for nonsupervisory workers were up 2.4% for the year ending in January—just as they were in December, and less than September 2017's 2.6%. In January 2016, the gain was 2.4%. In other words, for more than four out of five private sector workers, there's been no acceleration in wage growth—which, by the way, is barely ahead of inflation.

The series does bounce around a lot, and it's quite possible that some of the January spike will be reversed in February. But the central point is this: the alarming acceleration in wages is not a mass phenomenon. It's for the $95,000 a year set, not the $45,000 crew.*

________________________________

*Yearly earnings are based on 2,000 hours a year times the relevant hourly wage.

Harpers Ferry, WV

Friday, February 9, 2018

Sam Webb: Democracy at risk

- FEBRUARY 5, 2018

I lived through Watergate, but I can't recall that I felt that democratic norms, institutions, and traditions were in such danger as they are now. Not for a long time, maybe never has the country experienced the likes of what we are living through at this moment.

Nearly every day there is something new. The Nunes memo, released a few days ago with the full support of Trump, is but the latest. And notwithstanding denials from House leader Paul Ryan, its obvious intention is to set the table to fire Depute Attorney General Rod Rosenstein and shutdown the Mueller investigation.

The aim of these constant lacerations to the fabric of democracy by Trump and his enablers isn't to "smash the state," but to recast it into his own personal fiefdom — a fiefdom that is corrupt, bellicose, hyper nationalist, racist, misogynist, nativist, billionaire friendly, and hostile to democracy, the rule of law, an independent media, and even a scintilla of opposition from within or beyond the state.

Needless to say, this is no time for summer patriots. Indeed, resistance to this assault on democracy is the overarching challenge today. Nothing else rises to its importance. To cede this ground will surely foreclose any hope of moving to the higher ground of substantive justice, equality, peace, and sustainability later on.

One difference that immeasurably contributes to the present peril is the willingness of the Republican to do Trump's bidding. During Watergate that wasn't the case. Some daylight existed between Nixon and some of his Republican counterparts in Congress. It wasn't everyone, but enough to allow the investigation of Nixon to go forward without extreme interference and partisan attack. That isn't the case now. The GOP is the zealous fullback for Trump's brand of authoritarian and obstructionist politics.

But this shouldn't surprise anyone. The Republican Party is a party of the extreme right. And has been for nearly four decades. What is more, Trump, is, more than anything else, a product of this retrograde movement that is animated by power — not free markets, not small government, not collective security — first of all. Their accommodation to his brand of authoritarian politics, therefore, didn't require any back flips. If anything, it is the logical end game of right wing extremism.

In making this pact, however, the GOP is endangering the foundations of democracy as well as making a big bet that it won't come back to bite them in November and long after.

But they could be very wrong here. The elections could turn into a Democratic wave as voters, worried sick over Trump overreach, chaotic governance, and authoritarian tendencies and well aware of Republican complicity, go to the polls and elect a new Congress that will stand up to Trump and address other pressing concerns as well.

In these circumstances, an obvious question is: what can we do to register our strenuous opposition to systematic breaches of our country's democratic forms, rights, and institutions — not least of which is attempts to shutdown the Mueller investigation — by Trump and his fifth column in the Congress?

For those of us who are at a distance from the seats of power nor leaders of the Democratic Party or the anti-Trump movement, the answers aren't so hard to divine.

Call Congress people. Talk to family, friends, coworkers, and strangers. Letters to the editor. Make a fuss on social media as well as in community organizations, churches, unions, student councils, etc. Join (and help organize if possible) the collective actions that bring together the far flung, diverse, and majoritarian coalition that opposes Trump. And, above all, become activists in the coming elections.

And, all the while, we should keep in mind that that Trump is the most unpopular president after one year in office in our country's history. In other words, we're the many.

Harpers Ferry, WV

Tuesday, February 6, 2018

Links, High vs. Low Wages

----

Links, High vs. Low Wages // Jared Bernstein | On the Economy

http://jaredbernsteinblog.com/links-high-vs-low-wages/

The stock market opened way down, continuing last Friday's selloff, though it has climbed back since the open–implying the return of volatility–as skittish investors continue to fear the sequence I describe in this AM's WaPo: tight labor market, wage pressures, higher interest rates, inflation, lower profit margins. Underneath these swings is an unsustainable, inequitable economic model with serious political implications.

BTW, in discussing last Friday's 2.9% wage pop–which I tried to put in perspective here (Don't Fear Wage Growth! Embrace It!)–many of us noted that the wage gains of the 80% of the workforce that's blue-collar production workers or non-mangers in service jobs went up only 2.4% (call this the PNS wage, for production, non-supervisory). Well, given that we know the average private sector wage, the PNS wage, as well as PNS employment, we can back out the white-collar (WC) wage. (Caveat: I once asked BLS is they viewed this as kosher and they didn't say 'yes.' Nor did they say 'no' or explain why not. At any rate, it's gotta be ballpark, I think.)

Over the past year, here are the three rates of nominal wage growth:

All: 2.9%

PNS: 2.4%

WC: 3.9%

It's a noisy series and I'd want to see other evidence before concluding there's much here, but the figure below shows the ratio of the backed-out WC wage to the PNS wage. It's been growing lately and spiked last month, implying rising wage inequality.

Source: BLS, my calculations.

Wage inequality was already on my watch list, of course, but this is worth keeping on eye on. See this WSJ piece for more sectoral detail.

----

Read in my feedly.com

Links for 01-13-18

----

Links for 01-13-18 // Economist's View

http://economistsview.typepad.com/economistsview/2018/01/links-for-01-13-18.html

The search for the next president of the NY Fed is a big deal - Josh Bivens Tight money is not the answer to weak productivity growth - Obstfeld and Duval Does Retirement Raise the Risk of Death? - Tim Taylor Financial variables and macroeconomic forecast errors - Fed in Print Debt issuance activity after the global financial crisis - All About Finance The Fed Delivered $80.2 Billion in Profits to the Treasury in 2017 - NY Times Wall Street versus Main Street: IOER Edition - David Beckworth Ready or Not for the Next Recession? - Barry Eichengreen Measuring the "Free" Digital Economy - Tim Taylor Biased to the powerful - Stumbling and Mumbling What early-20th-century scholars got right about 21st-century politics - Vox Lowflation: Then and Now - MacroMania Now is the time for complacency: RBA vs Bank of England - Nicholas Gruen The Fed's Inflation Target and Policy Rules - John Taylor Unauthorized Immigration: Effects and Policy Responses - FRB Richmond GDP at risk - VoxEU

----

Read in my feedly.com

The bottom line on Trump and the economy: We’re not in good hands

----

The bottom line on Trump and the economy: We're not in good hands // Blog | Economic Policy Institute

http://www.epi.org/blog/the-bottom-line-on-trump-and-the-economy-were-not-in-good-hands/

If you follow the news, it's hard to avoid the constant claims that President Trump has made, taking credit for a strong economy. This claim raises a bunch of questions, but a tl;dr assessment of the Trump economy in 2018 is pretty simple: It's good, but not great. The Trump administration deserves zero credit for its pockets of strength. And everything they've done on economic policy indicates that they will be terrible macroeconomic managers, and will bungle any challenge that comes their way in the next few years.

The longer version of this is below.

The economy going into 2018: Good, but not great

By almost any measure, the economy today is stronger than it has been in a decade. But that's a really low bar! This decade began with the worst economic crisis since the Great Depression, and the economy's growth has been severely hamstrung ever since. After eight-and-a-half years of steady recovery, the unemployment rate today sits at 4.1 percent, lower even than its pre-Great Recession level. This is unambiguously good news. But other measures of health in the job market tell a bit less-rosy story.

For example, the share of "prime-age" adults (between the ages of 25 and 54) with a job remains below its pre-Great Recession peak even after years of improvement. We would need to add millions more jobs to push it back to levels it reached in the not-so-distant past of the early 2000s. Wage growth also remains distressingly weak, and this wage weakness has blunted the incentive for employers to make productivity-enhancing investments. After all, there's not much point in spending money to economize on labor costs when workers are cheap and easy to find.

If we manage to keep unemployment at its current level (or below) for another year or more, my guess is that we'll see the flywheel start to engage for wage growth. But this might be wrong—we may need to target even lower unemployment rates. Further, it's an open question (more on this below) how long we'll be able to maintain even today's low unemployment rate.

But what about the stock market, that's going gangbusters, right? It was, but that run up was irrelevant to the living standards of the vast majority of Americans. The wealthiest 10 percent of households own 85 percent of stock (with almost half of this held by just the top 1 percent). Meanwhile, just under half of Americans hold no stock at all, even indirectly through retirement accounts (see Box 6 in this report). Further, stock price increases mostly just transfer wealth from tomorrow's aspiring wealth builders (who will have to pay steep prices to invest in the stock markets) to today's wealth holders. And the past couple of days of large declines ought to make anybody (even Donald Trump) leery about claiming credit for stock market movements for a while.

In summary, the economy is stronger than it has been in a long time, and that's good. But popping champagne corks about the economic lot of typical American workers seems awfully premature.

Trump administration deserves zero credit for pockets of economic strength

How much credit does the Trump administration deserve for the economy's good news? None. This administration inherited a steadily improving economy, one that had posted 75 months of consecutive private-sector job growth. The past year has seen the recovery continue almost exactly on pre-Trump trends.

An analogy would be the Trump administration as a doctor who inherited a patient from a retiring partner in his medical practice. The patient is young, eats a healthy diet and exercises regularly. Does Dr. Trump deserve credit if this patient makes it through a year without a medical calamity? Of course not. Someday, of course, almost all of us will need a doctor to help us navigate a health crisis, and we sure hope that doctor doesn't turn out to be a quack.

Trump administration likely to bungle future economic challenges

So will we be able to rely on the Trump administration's judgement when the economic going gets tough? To answer this, we need to know the most likely crises the U.S. economy will need to navigate in coming years.

This is pretty straightforward, as recessions largely come for three reasons: first, the Federal Reserve makes a mistake and raises interest rates too far and too fast in an effort to get out in front of inflation; second, bubbles form in financial markets and then they pop; third, fiscal policymakers engage in excessive austerity.

Has the Trump administration shown much wisdom so far about avoiding these pitfalls? Nope.

The administration has made two appointments to the Fed's Board of Governors, and refused to re-appoint Janet Yellen as its Chair. The two new appointments—Randal Quarles and Marvin Goodfriend—have both been consistently wrong about the need to raise interest rates to avoid inflation in recent years. If the Fed had followed their advice, unemployment would be considerably higher today. Janet Yellen, conversely, consistently prioritized allowing unemployment to drift lower over any need to fight forecasted (as opposed to actual) inflation. In essence, the Yellen approach was "we'll fight inflation when it actually appears and not before." Given the benefits of lowering unemployment—particularly for the most vulnerable workers and communities—this approach paid huge dividends in recent years and is largely why unemployment sits at 4.1 percent today (#ThanksYellen). Trump's picks have clearly shifted the balance of the Fed towards people who have been both wrong and more callous about the impact of the Fed's actions on the economy and working people. The possibility of a Fed mistake leading to a recession is much higher now because of these picks.

The Fed is the nation's chief financial regulator, and these same appointments mean that it will likely loosen the reins on Wall Street regulations. In one of her last speeches, Janet Yellen made a full-throated call to maintain the enhanced regulatory safeguards put into place after the 2008 financial crisis. This speech could well have contributed to her replacement—the Trump administration seems determined to let Wall Street run riot again and a commitment to smart regulation doesn't really fit with this program. Besides the new finance-friendly picks at the Fed, the Trump administration also installed Mick Mulvaney as the new head of the Consumer Financial Protection Bureau (CFPB). Mulvaney was one of the largest recipients of contributions from payday lenders as a congressman, and as CFPB head he has already rolled back key regulations protecting borrowers from predatory lenders. He also issued a memo to CFPB staff informing them that they in fact "serve" payday lenders. Republicans in Congress have pushed the Financial CHOICE Act, which would strip away many of the key safeguards and protections of the Dodd-Frank Act that was passed in the wake of the financial crisis to rein in financial sector excesses. All in all, the Trump administration seems determined to let Wall Street go back to self-policing rather than engage in meaningful oversight. This is particularly worrisome given that several financial markets today, while not obvious bubbles, do look frothy. Further, the worrisome dynamic where big asset market gains lead to low savings rates and make further economic growth contingent on continued asset market inflation may have already started. 2017, in short, was a terrible time to switch to an administration that is much more lax as a financial regulator.

Finally, fiscal austerity has been holding back the U.S. recovery for several years. In the short-run, the recently passed Tax Cuts and Jobs Act (TCJA) will actually provide some mild relief from this austerity. As poorly designed and unfair as the TCJA was, anything that spread some money into the U.S. economy would have provided a mild fiscal boost. But the other side of the Republican fiscal agenda has been calls for mammoth cuts to federal spending. If these actually came to pass, this would all but guarantee a return to recession.

President Trump was handed an economy with lots of positive momentum. His administration has spent much of the first year claiming he deserved credit for these inherited trends while simultaneously chipping away at working people's ability to benefit from this improving economy. He has also given us every reason to believe that he's the wrong man for the job of leading the economy through future challenges. We deserve better leadership than this.

----

Read in my feedly.com