President Donald Trump's move to halt the collection of taxes that fund America's main support programs for the elderly spurred a wave of political opposition and threatens to generate tension between employers and workers.

Trump in a memorandum on Saturday instructed the deferral of payroll tax collections for some workers. The taxes are paid by both employees and their employers, and fund Social Security and Medicare for those already using those programs.

But because congressional approval is needed to enact changes in federal levies, the amounts foregone under the order will still come due next year, unless legislators act.

Initial reaction reinforced the message that both Democrats and Republicans had sent the White House during the talks on a coronavirus relief package that collapsed on Friday: don't do it. Underlying that opposition is concern that hurting the finances of the massive programs that pay retirement and health care benefits for the aged, along with disability income, will be punished by voters.

Changes to Social Security, a program with widespread support that's been around since 1935, were once called the "third rail" of American politics -- an allusion to the danger of electrocution.

Vital Program

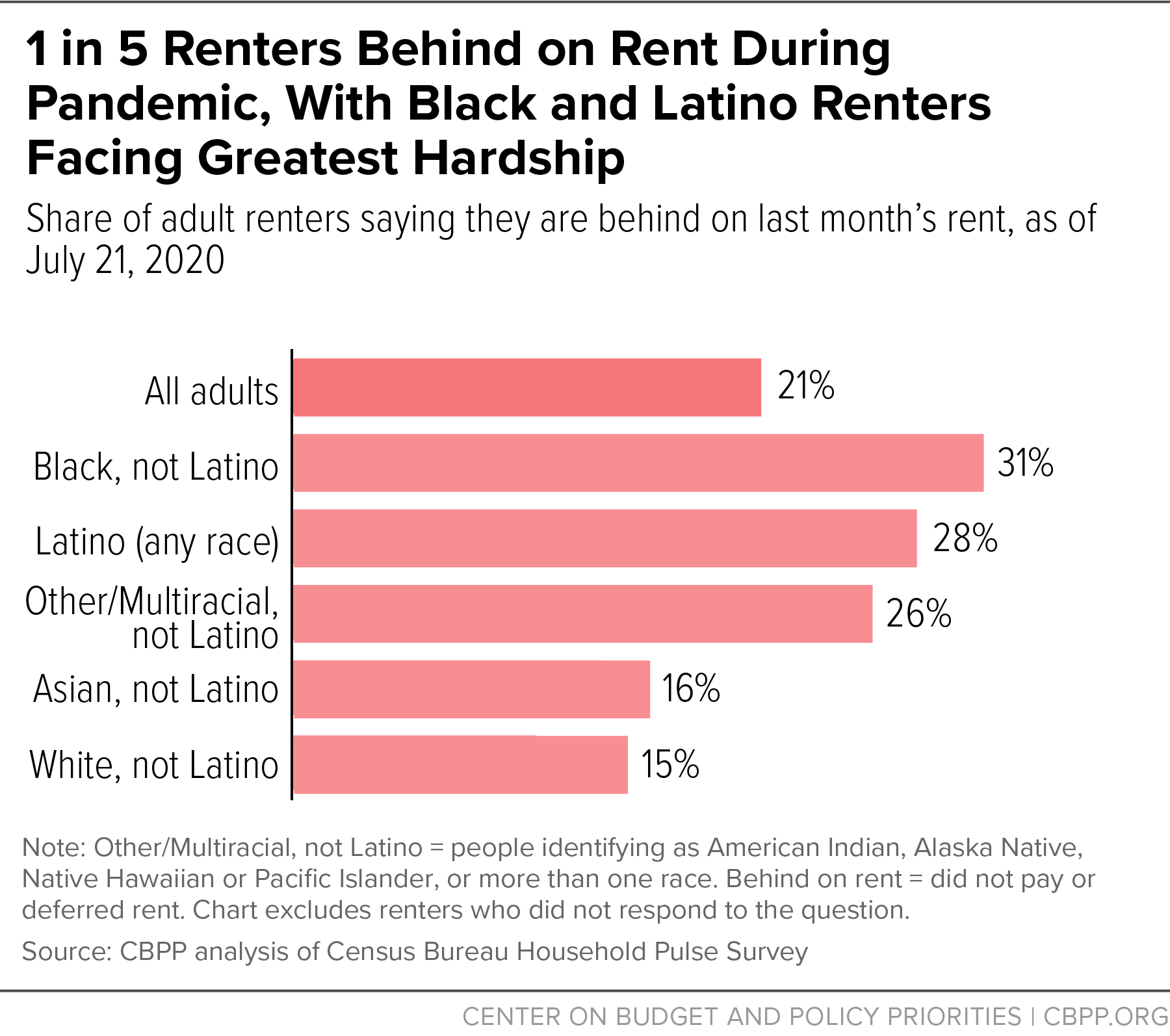

The program that emerged from the Great Depression is the largest single source of income for older Americans, providing the majority of income for half of retirees, and at least 90% of income for 18% of retirees, according to the Center on Budget and Policy Priorities, a progressive think-tank. It's particularly important to women and people of color. Politicians meddle with it at their peril.

Social Security and Medicare already face a dire outlook. Though payroll taxes ostensibly go to "trust funds" that build up assets from which the benefits are paid, the demographic challenge posed by the large, rapidly-retiring baby-boomer generation means there's not enough money for the government's obligations. Further starving the programs through a payroll-tax deferral makes Trump's move a risky gambit.

Read more: Social Security Trust Fund Seen Running Dry Early on Virus Drain

Democratic presidential candidate Joe Biden said Saturday that Trump was "putting Social Security at grave risk." With no suggestion of how the forgone funding will be made up, the president's move is the "first shot in a new, reckless war" on the program, Biden said.

Representative Richard Neal of Massachusetts, chairman of the House Ways and Means Committee, said Trump's "decree is a poorly disguised first step in an effort to fully dismantle these vital programs by executive fiat."

Four-Month Deferral

The Trump campaign has made similar criticisms of Biden, drawing on some of his positions from decades in the Senate to argue that he had advocated cutting Social Security. But the president is now the one raising questions about the government's ability to pay full benefits, with Trump indicating Saturday that if re-elected he would propose a permanent payroll tax elimination.

Saturday's executive action suspends the payroll tax for those making less than $100,000 a year from Sept. 1 through the end of 2020. Trump said that if re-elected he'll "extend it beyond the end of the year and terminate the tax." He didn't mention Social Security and Medicare or indicate how the funds would be made up.

Republicans in Congress have preferred another round of stimulus checks that left the government's social safety nets untouched. A number of them, including Senator Mitt Romney, the former Republican presidential candidate, in recent days moved to insert text into Covid-19 stimulus legislation that would set up committees charged with crafting bills to secure the long-term funding of Social Security along with other key programs.

Read more: Stimulus Talks Could Snag on Social Security Review Panels

Bipartisan criticism of Trump's move was quick to emerge.

"Trump does not have the power to unilaterally rewrite the payroll tax law," Republican Senator Ben Sasse said in a statement Saturday. "Under the Constitution, that power belongs to the American people acting through their members of Congress."

Larry Kudlow, Trump's top White House economic adviser, recognized that a legal battle may now ensue over the grounds raised by Sasse. "We're going to go ahead with our actions anyway. Our counsel's office, the Treasury Department believes it has the authority to temporarily suspend tax collections," he said on ABC's "This Week."

Treasury Secretary Steven Mnuchin said there will be no cuts to Social Security or Medicare from the deferred payroll tax collection, and that they would be paid out from the general federal budget. "The president in no way wants to hurt those trust funds," he said on Fox News Sunday.

Payroll tax cuts have been embraced by both Republicans and Democrats in the past to give consumer spending a boost, but they haven't been big political winners.

Not Impactful

Congress temporarily cut the payroll tax by two percentage points under President Barack Obama in 2011 and 2012. However, most people didn't really notice a change to their take-home pay, according to research by the left-leaning Center for Economic and Policy Research. More than half of the respondents said they didn't know their tax payments had changed.

President George W. Bush, when faced with a slowdown, opted for stimulus checks, similar to the $1,200 payments Congress approved earlier this year. Republicans and Democrats have both said they support a second round, but negotiations on a broader deal have stalled. Trump can't order more payments with executive authority.

For businesses, Trump's Saturday move presents other challenges. If Congress doesn't ultimately cancel the amounts due and not paid in 2020, they could be on the hook to pay the Treasury next year.

'Steer Clear'

"Without detailed answers to some of these questions, employers might just steer clear of all of it by continuing to do what they've always done, blunting the desired economic impact of reducing taxes," the National Taxpayers Union Foundation said in a statement.

If firms pass on the temporary savings to their staff, they could face difficulties clawing back the money in 2021 -- all the more so if some workers have moved on. And any move to continue collecting the fees could mean tensions with employees whose household incomes have already been hit by the coronavirus pandemic.

Employees would also owe more income taxes because their wages would be higher, meaning that some could see a smaller tax refund in 2021 -- or owe money to the government -- if they don't adjust their IRS withholding.

The U.S. Chamber of Commerce said Saturday that Trump's executive actions aren't a full solution.

"There is no alternative to Congress legislating and no excuse for their inaction," Neil Bradley, the chamber's chief policy officer, said in a statement.

-- via my feedly newsfeed