Saturday, September 21, 2019

Enlighten Radio:Great Big Sea Festival NOW on Enlighten Radio

Blog: Enlighten Radio

Post: Great Big Sea Festival NOW on Enlighten Radio

Link: http://www.enlightenradio.org/2019/09/great-big-sea-festival-now-on-enlighten.html

--

Powered by Blogger

https://www.blogger.com/

In Case You Missed It... [feedly]

https://www.cbpp.org/blog/in-case-you-missed-it-474

This week at CBPP, we focused on the federal budget, health, state budgets and taxes, federal taxes, and the economy.

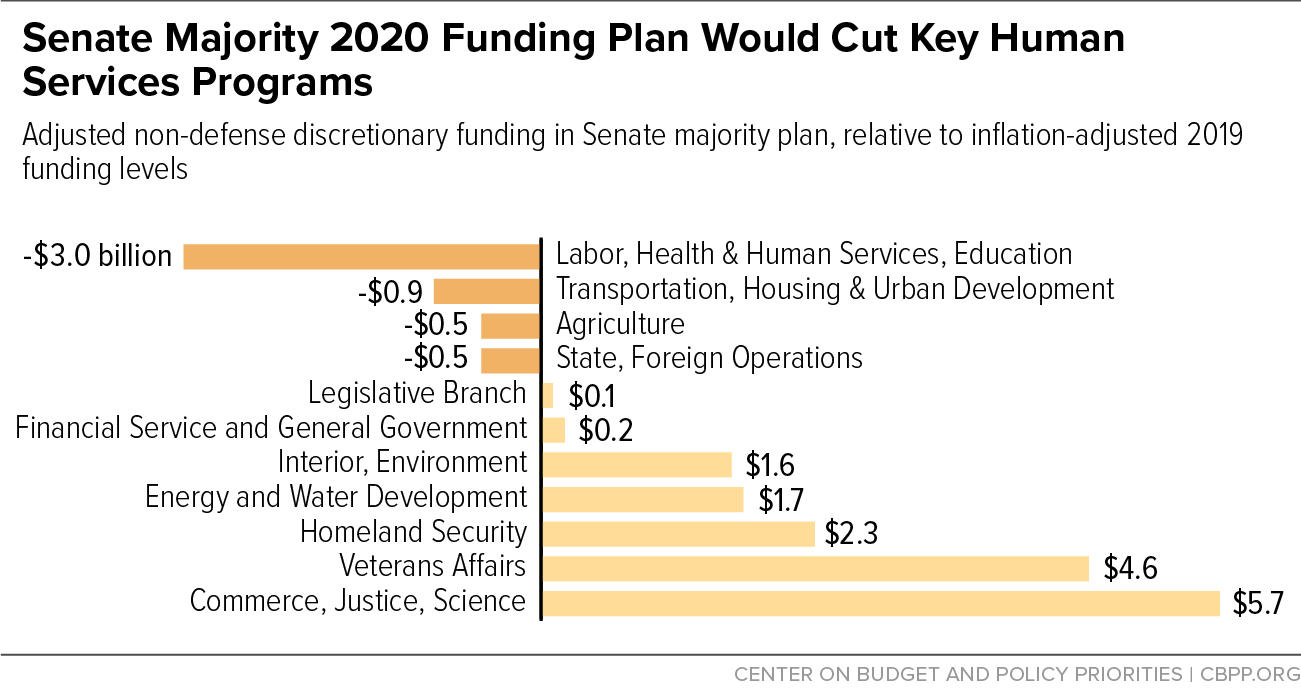

- On the federal budget, Richard Kogan explained that the Senate majority plans to cut funding for the two appropriations bills that cover key human services programs.

- On health, Judith Solomon and Matt Broaddus detailed how new claims by opponents of Medicaid expansion rest on faulty analysis.

- On state budgets and taxes, Elizabeth McNichol stressed that state taxes on inherited wealth can be a powerful tool for building a more broadly shared prosperity.

- On federal taxes, we concluded that the expansions to the Earned Income Tax Credit and Child Tax Credit in the Working Families Tax Relief Act would benefit millions of Asian American households. We also updated our fact sheets on that legislation's benefits to Black and Latino households.

- On the economy, we updated our backgrounder on how many weeks of unemployment compensation are available and our chart book tracking the post-Great Recession economy.

Chart of the Week – Senate Majority 2020 Funding Plan Would Cut Key Human Services Programs

A variety of news outlets featured CBPP's work and experts this week. Here are some of the highlights:

Tennessee Reveals $7.9B Plan To Shift Medicaid Into Controversial Block Grant System

Kaiser Health News

September 18, 2019

Trump is starting to undermine health coverage, but the real danger is on the horizon

Business Insider

September 18, 2019

Trump's California trip marked by pair of clashes

CNN

September 18, 2019

How to Keep Teachers From Leaving the Profession

The Atlantic

September 19, 2019

Don't miss any of our posts, papers, or charts – follow us on Twitter, Facebook, and Instagram.

-- via my feedly newsfeed

Electric Vehicle Market So Far Belongs to China [feedly]

https://www.bloomberg.com/opinion/articles/2019-09-20/electric-vehicle-market-so-far-belongs-to-china

First things first: The global auto market is not only not growing, but it is also shrinking. Sales peaked in 2017 at nearly 86 million on a trailing-12-months basis; right now in 2019, sales are closer to 76 million.

Past the Peak

Global passenger vehicle sales, trailing 12 months

Source: Bloomberg

But electric vehicles are a growth market. Take Germany and the contrast between EV sales and all auto sales:

A Tale of Two Trends

Germany's EV sales vs. all automobile sales, trailing 12 months

Source: Bloomberg

The growth of EV sales combined with the decline in overall auto sales means electric vehicles now make up almost 5% of total sales.

Hard to Ignore

Germany's electric passenger vehicle sales as a percentage of total auto sales, trailing 12 months

Source: Bloomberg

Or take China, the world's largest auto market (and one where, incidentally, GM is a major player). China's sales of "alternative energy vehicles" — mostly electric, with some hybrids and a small number of natural gas combustion engines — are nearly 1.5 million. Meanwhile, sales of all passenger vehicles peaked at close to 25 million in the middle of 2018, and are now below 22 million.

Meanwhile, in China ...

Alternative energy vehicle sales vs. all passenger vehicle sales, trailing 12 months

Source: Bloomberg

That change in buying cars also means a change in fuel consumption. China's gasoline demand, after almost doubling between 2010 and July 2019, is now essentially flat. China diesel demand, meanwhile, peaked several years ago.

One Flattening, the Other Falling

China gasoline and diesel apparent demand, trailing 12 months

Source: Bloomberg

Electric vehicles certainly do look like a significant part of the future in these key markets, given their trajectories. A recent analysis by my BloombergNEF colleagues Nick Albanese and Josh Landess delineates that future by company using a new Automaker EV Exposure Score. For those used to seeing global auto giants at the head of any league table, it's striking.

Related: BloombergNEF's outlook for road transport fuels

Bayerische Motoren Werke AG leads all major automakers in revenue from electric passenger vehicle sales. 1 Its fellow Germans Volkswagen AG and Daimler AG are third and eighth, respectively. Nissan Motor Co. is seventh; GM is ninth. The rest of the top 10 automakers by revenue from electric vehicles are Chinese.

A German and Chinese Game

Estimated 2018 revenue from electric passenger vehicle sales

Source: BloombergNEF

Note: Excludes Tesla. Includes joint venture activity.

Look at the data from the perspective of EV revenue as a percentage of the total, and it's even more of a Chinese game. There is only one company in the top 10 by percent of electric passenger vehicle revenue that isn't Chinese: Japan's Mitsubishi Corp. Two Chinese automakers get more than 40% of revenue from electric vehicle sales; a third gets nearly a quarter of its revenue from EVs.

Chinese Domination

Estimated 2018 revenue from passenger EV sales, percentage of total

Source: BloombergNEF

Note: Excludes Tesla. Includes joint venture activity.

Albanese and Landess conclude their analysis with a score, which weights electric passenger vehicle sales volumes, revenue, and current and future model count, then assigns greater value to pure electric as opposed to plug-in sales. Of the top 10 automakers, nine are Chinese. BMW is the only international automaker in the top 10 today.

China Runs the Table

Top 10 automakers by BloombergNEF electric passenger vehicle exposure score

Source: BloombergNEF

But GM isn't the only global auto major with significant plans for electric vehicles. Each one sees not just a future in EVs, but also their company's place in that future. And lots of other major companies see electric vehicles as integral to the future of their businesses, too, even if their business isn't automobiles. It'll be every large automaker's challenge to see which companies can electrify their offerings on a global scale.

Weekend reading

More than 630 companies from 43 countries have pegged their corporate emissions targets to the Science-Based Targets Initiative.

The University of California's $13.4 billion endowment will be "fossil free" by the end of September, according to university officials.

Harvard University's $38 billon endowment is joining Climate Action 100+ in order to directly engage with more than 100 "systematically important emitters" that account for two-thirds of global emissions.

Tim Harford on why climate change economist Martin Weitzman "rocked my world."

Wealthy families are putting environmental, social and governance charters into the founding principles of their private investment firms.

An explainer on repo, the Federal Reserve repurchase agreements that allow banks to meet their short-term funding needs (and sprung back into action this week).

An examination of another kind of repo — repossession agents — and the private surveillance network they use to track automobile movements across the U.S.

Shira Ovide looks at Big Tech and the hunt for the "magic number."

Andreessen Horowitz general partner Alex Rampell has a fascinating history of the most valuable network of all time: the credit card.

Ford Motor Co. unveils a master plan to transform its Research & Engineering Center in Dearborn, Michigan.

A former Tesla engineer has set out to re-invent the humble home electrical panel.

Vikings probably hunted Iceland's walruses to extinction for their ivory.

YouTube is a revolutionary and hugely effective medium for transferring complex tacit knowledge.

"The Terraforming," an experimental postgraduate program at the Strelka Institute for Media, Architecture and Design.

Get Sparklines delivered to your inbox. Sign up here. And subscribe to Bloomberg All Access and get much, much more. You'll receive our unmatched global news coverage and two in-depth daily newsletters, the Bloomberg Open and the Bloomberg Close.

This analysis excludes Tesla Inc., as its 2018 production volume is not sufficient to qualify it as a major automaker. Being a wholly electric automaker, Tesla naturally has the highest revenue from EV sales of any automaker of any size.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Nathaniel Bullard at nbullard@bloomberg.net

To contact the editor responsible for this story:

Brooke Sample at bsample1@bloomberg.net

-- via my feedly newsfeed

Friday, September 20, 2019

Harvest of Discontent: Trump’s trade war and the rural fight for survival [feedly]

https://www.peoplesworld.org/article/harvest-of-discontent-trumps-trade-war-and-the-rural-fight-for-survival/

There is nothing normal about this September for farmers in the U.S. Midwest

Typically, at this midpoint in the month, farmers would be finishing up their small grains harvest and begin taking stock of other crops planted later in the season.

Harvest season this year, though, is well behind schedule.

The U.S. Department of Agriculture's September crop report, while slightly higher than the August estimates, shows corn and soybean yields are down from 2018 and lower than the projections shown in the last month's crop production report.

Chinese responses to U.S. tariffs have been substantive, but not proportional, so far. Here, the amounts of tariffs now in place and those threatened are shown. | U.S. Census Bureau and Stats.com

Chinese responses to U.S. tariffs have been substantive, but not proportional, so far. Here, the amounts of tariffs now in place and those threatened are shown. | U.S. Census Bureau and Stats.comAnd while yes, excessive spring rains and flooding across the Midwest can be blamed for delayed and prevented plantings, it's only one half of the issue.

For soybean farmers, in particular, their crop's supply and demand all depend on how the "Trump" card is played.

It's a high-stakes economic gambling match between the U.S. and China; a trade war fueled by the president's ego and a desire to contain growing Chinese power in the global economy.

The problems with political gambles like this one are simple and cruel: Human beings and their economic survival are the bargaining chips. And the "success" of such a strategy does not require a workable solution for all—just one side repeating the lie "We're winning!" while whittling away at peoples' livelihoods in pursuit of imperial ambition.

"We're tightening our belt, said farmer and president of the Iowa Farmers Union Aaron Lehman. "We're talking to our lenders, our landlords, and our input suppliers."

The IFU says its members are trying to cut costs any way they can just to make ends meet. The escalating trade war is their biggest concern now.

Instead of negotiating over trade disagreements, the U.S. has chosen "to insult our trade allies, pick all sorts of fights with our trade allies," said Lehman. "And then go to China and make outrageous demands that we knew were not going to be met."

A body blow to farmers and ranchers

For the last two years, the Trump administration has been in a tit-for-tat with the People's Republic of China, an ever-escalating battle of tariffs and import penalties. Trump has long accused China of unfair trading practices and intellectual property theft—actions which China of course disputes.

The fights over trade are episodes in a much bigger and longer-term campaign by the U.S.—no matter whether Republicans or Democrats are in power—to contain the growth of Chinese influence globally and maintain U.S. imperial dominance in East Asia.

Currently, the U.S. has hit China with tariffs on almost $550 billion worth of Chinese products, while China has hit back with tariffs on $185 billion worth of U.S. goods, primarily agricultural ones.

In a recent "gesture of goodwill," signaling the start of another ceasefire, Trump announced through Twitter the delay of a 5% tariff hike on another $250 billion worth of Chinese goods by two weeks—a departure from last month's plan to increase the tariff from 25% to 30%.

The gesture was not initiated by the Trump administration. The decision to delay followed China's decision to exempt more tariffs on 16 American products—fish meal, shrimp, and cancer treatment drugs, but did not spare the major goods subject to tariffs: soybeans and meat.

China did, however, buy $67 million worth of soybeans, but that's pennies compared to their $12.2 billion purchase in 2017.

These peaceful overtures come as the U.S. and China prepare to go back to the negotiation table in Washington in early October. Tensions remain high and substantial progress isn't likely, yet.

The lowering of crop prices, rainfall, and the trade war have created a perfect storm for farmers—leaving many without a roof over their heads.

"It already has driven some farmers off the farm, which not only hurts the farming community, but it hurts rural—small rural communities," said Gary Wertish president of the Minnesota Farmers Union. "It's been very devastating to rural America."

Farmers work to live, not to get rich.

They have high fixed costs, including the land they own, the tools and equipment, and the seed they need to grow crops. And while people can't control the weather, they can control the policies and tactics putting the squeeze on farmers and farm workers—it's a self-inflicted injury courtesy of the Trump administration.

How bad is it?

A report in July by the American Farm Bureau Federation revealed farm bankruptcy filings had risen by 13%. The report also found "the delinquency rates for commercial agricultural loans in both the real estate and non-real estate lending sectors are at a six-year high" and "above the historical average of 2.1 percent."

The Midwest and Southeast had the highest number of Chapter 12 farm bankruptcy filings. The Midwest is up from 215 filings in all of 2018 to 240 so far this year, a 12% increase. The biggest increase in bankruptcies, about 50%, happened in the Northwest, including Washington, Oregon, Idaho, Montana, and Wyoming.

"The deteriorating financial conditions for farmers and ranchers are a direct result of several years of low farm income, a low return on farm assets, mounting debt, more natural disasters, and the second year of retaliatory tariffs on many U.S. agricultural products," said Farm Bureau chief economist John Newton.

Newton also found that farm income should increase by 10% in 2019 from 2018, but those results would still be in the bottom quarter of annual results for the past 90 years. And the number includes direct payments from Trump's bailout package.

All roads, it seems, lead to a farm crisis not seen since the 1980s.

What about government aid?

Well, a cotton farmer in Texas gets $145 an acre for financial distress caused by the president. But a Minnesota farmer only gets $35 an acre for the hardest-hit crop.

"It makes no sense," said Betsy Jensen, the soybean farmer, in an interview with Reuters.

The payment discrepancies can be traced to the system set up to allocate the funds.

During the first round of bailouts, $12 billion total in 2018, farmers received money based on estimated lost sales by crop. Soybean farmers benefitted much more than others less impacted by the tariffs.

For the second round, payments are distributed based on the overall impact on agriculture in a particular county, and even with a rule preventing corporate farms from disproportionally benefiting from the plan, "the USDA's $16 billion bailout would still make rich farmers richer, thereby hurting small farmers," says the Environmental Working Group.

The National Farmers Union sees only one solution to this current crisis: "The president's erratic and destructive actions must end. All countries must be treated with respect and dignity and America's reputation as a reliable trading partner must be restored. Further, actions that have undermined the RFS must be rectified.

"Until these actions are corrected, and the markets rebound, we urge the administration to work with Congress to fundamentally reform and significantly strengthen the existing farm safety net."

Elections 2020: Candidates come courting

It's no secret rural voters helped elect Donald Trump in 2016.

Democratic presidential candidates are all pitching their solutions to the rural Midwest. Here, Sen. Bernie Sanders speaks at the Des Moines Register Soapbox during a visit to the Iowa State Fair, Aug. 11, 2019, in Des Moines, Iowa. | Charlie Neibergall / AP

Democratic presidential candidates are all pitching their solutions to the rural Midwest. Here, Sen. Bernie Sanders speaks at the Des Moines Register Soapbox during a visit to the Iowa State Fair, Aug. 11, 2019, in Des Moines, Iowa. | Charlie Neibergall / APHis campaign rhetoric of "being an outsider," focused on "draining the swamp and running the country like a business" resonated with a lot of rural voters.

They feel their communities are dying while their needs continue to be ignored.

Exit poll breakdowns from 2016 showed Trump winning between 65-70% of the vote in rural areas with populations less than 20,000, not near metro areas.

And despite the pain and further looming threats of financial and personal ruination caused by Trump's trade war, his presidential approval rating in rural areas is better than his nationwide standing.

Currently, Trump's favorable rating in rural areas is 55%, with 40% unfavorable in the nine states polled by a Change Research survey sponsored by the American Federation of Teachers and One Country Project, a rural voter outreach group.

The survey also found a plurality of rural voters, 39%, who said the trade war with China is hurting small towns in the short term, but it's necessary to restore a global trade balance. On the other side, 36% said the trade war is harmful in the short and long term, and it should be ended immediately.

"I am hearing from farmers in communities in North Dakota, and rural Americans across the United States, that the president's trade war is devastating their family farms and manufacturing communities—closing markets and leaving harvests to rot," said former North Dakota Senator and One Country Project founding board member Heidi Heitkamp. "Farmers are fed up, and I believe it is clear that rural Americans are looking for an alternative to Trump's failed leadership."

Democratic presidential hopefuls will need to learn from the mistakes of 2016 and do a better job addressing rural communities' common concerns and be able to talk to rural voters directly.

And as Democratic candidates begin flocking to Iowa to present their plans, there are signs that the large number of competing hopefuls in the primary may force them to pay attention to forging new connections to rural America. Candidates are eager to show they understand rural communities' economic pain; they're offering solutions and trying to show they are far removed from the preconceived notions rural voters have regarding the Democratic Party—and Republican Party for that matter, as distrust in both institutions was also seen in the Change Research survey.

"We cannot create an economy that works for all Americans if we continue to neglect the needs of rural America," Sen. Bernie Sanders said back in May during a visit to Osage, Iowa, going furthest in pointing out who some of the real enemies of small farmers are.

"In rural America, we are seeing giant agribusiness conglomerates extract as much wealth out of small communities as they can, while family farmers are going bankrupt and, in many cases, treated like modern-day indentured servants."

Meanwhile, it was just reported that fifteen members of Trump's 2016 campaign Agriculture and Rural Advisory Committee have collectively received over $2 million in trade war bailout payments. These payouts are among the billions of dollars that have flowed to owners of mega-farms rather than family farmers.

-- via my feedly newsfeed

Krugman: Trump Declares War on California [feedly]

https://www.nytimes.com/2019/09/19/opinion/trump-california.html

Sure enough, this week Donald Trump effectively declared war on California on two fronts. He's trying to take away the Golden State's ability to regulate pollution generated by its 15 million cars, and, more bizarrely, he's seeking to have the Environmental Protection Agency declare that California's homeless population constitutes an environmental threat.

More about these policy moves in a moment. First, let's talk about two Californias: the real state on America's left coast, and the fantasy state of the right's imagination.

The real California certainly has some big problems. In particular, it has sky-high housing costs, which in turn are probably the main reason it has a large population of homeless residents.

But in many other dimensions California does very well. It has a booming economy, which has been creating jobs at a much faster pace than the nation as a whole.

It has the nation's second-highest life expectancy, comparable to that in European nations with much higher life expectancy than America as a whole. This is, by the way, a relatively new development: Back in 1990, life expectancy in California was only average.

At the same time, California, having enthusiastically implemented Obamacare and tried to make it work, has seen a sharp drop in the number of residents without health insurance. And crime, although it has ticked up slightly in the past few years, remains near a historic low.

That is, as I said, California's reality. But it's a reality the right refuses to accept, because it wasn't what was supposed to happen.

You see, modern California — once a hotbed of conservatism — has become a very liberal, very Democratic state, in part thanks to rapidly rising Hispanic and Asian populations. And since the early years of this decade, when Democrats won first the governorship, then a supermajority in the State Legislature, liberals have been in a position to pursue their agenda, raising taxes on high incomes and increasing social spending.

Conservatives confidently predicted disaster, declaring that the state was committing "economic suicide." You might think that the failure of that disaster to materialize, especially combined with the way California has outperformed states like Kansas and North Carolina that turned hard right while it was turning left, might induce them to reconsider their worldview. That is, you might think that if you haven't been paying any attention to the right-wing mind-set.

[For an even deeper look at what's on Paul Krugman's mind, sign up for his weekly newsletter.]

What is happening instead, of course, is that the usual suspects are trying to portray California as a terrible place — beset by violent crime and rampant disease — in sheer denial of reality. And they have seized on the issue of homelessness, which is, to be fair, a genuine problem. Furthermore, it's a problem brought on by bad policy — not high taxes or excessively generous social programs, but the runaway NIMBYism that has prevented California from building remotely enough new housing to accommodate its rising population.

The striking thing about the right's new focus on homelessness, however, is that it's hard to detect any concern about the plight of the homeless themselves. Instead, it's all about the discomfort and alleged threat the homeless create for the affluent.

Which brings me to Trump's war on California.

The attempt to kill the state's emissions rules makes a kind of twisted sense given Trump's policy priorities. His administration is clearly dedicated to the cause of making America polluted again, and in particular to ensuring that the planet cooks as quickly as possible. California is such a big player that it can effectively block part of that agenda, as shown by the willingness of automakers to abide by its emissions rules. Hence the attempt to strip away that power, never mind past rhetoric about states' rights.

Declaring the homeless an environmental threat, however, aside from being almost surreal coming from an administration that in general loves pollution, is pure nonsense. It can be understood only as an attempt both to punish an anti-Trump state and to blacken its reputation.

What should you take away from Trump's war on California?

First, it's yet another illustration of the intellectual imperviousness of the modern right, which never, ever lets awkward facts disturb its preconceptions.

More ominously, the apparent weaponization of the Environmental Protection Agency is more evidence that Trump — whose party fundamentally doesn't believe in democracy — is following the modern authoritarian playbook, in which every institution is corrupted, every function of government is perverted into a tool for rewarding friends and punishing enemies.

It's an ugly story, and it's scary, too.

The Times is committed to publishing a diversity of letters to the editor. We'd like to hear what you think about this or any of our articles. Here are some tips. And here's our email: letters@nytimes.com.

Follow The New York Times Opinion section on Facebook, Twitter (@NYTopinion) and Instagram.

Paul Krugman has been an Opinion columnist since 2000 and is also a Distinguished Professor at the City University of New York Graduate Center. He won the 2008 Nobel Memorial Prize in Economic Sciences for his work on international trade and economic geography. @PaulKrugman

-- via my feedly newsfeed

Thursday, September 19, 2019

Piketty: What is a fair pension system? [feedly]

Even if the timing remains vague and the conditions uncertain, the government does seem to have decided to launch a vast reform of the retirement pensions system, with the key element being the unification of the rules applied at the moment in the various systems operating (civil servants, private sector employees, local authority employees, self-employed, special schemes, etc).

Let's make it clear: setting up a universal system is in itself an excellent thing, and a reform of this type is long overdue in France. The young generations, particularly those who have gone through multiple changes in status (private and public employees, self-employed, working abroad, etc.,), frequently have no idea of the retirement rights which they have accumulated. This situation is a source of unbearable uncertainties and economic anxiety, whereas our retirement system is globally well financed.

But, having announced this aim of clarification and unification of rights, the truth is that we have not said very much. There are in effect many ways of unifying the rules. Now there is no guarantee that those in power are capable of generating a viable consensus in this respect. The principle of justice invoked by the government seems simple and plausible: one Euro contributed should give rise to the same rights to retirement, no matter what the scheme, and the level of salary or of earned income. The problem is that this principle amounts to making the inequalities in income as they exist at present sacrosanct, including when they are of mammoth proportions (under-paid piece work for some, excessive salaries for others), and to perpetuating them at the age of retirement and dependency which is in no way particularly "fair".

Aware of the difficulty, the High Commissioner Jean-Paul Delevoye's Plan stipulates that a quarter of the contributions will continue to be allocated to "solidarity', that is to say, for example, to subsidies for children and interruptions of career, or to finance a minimum retirement pension for the lowest salaries. The difficulty is that the way this calculation has been made is highly controversial. In particular, this estimate purely and simply takes no account of social inequalities in life expectancy. For example, if a low wage earner spends 10 years in retirement while a highly-paid manager spends 20 years, we have forgotten to take into account the fact that a large share of the contributions of the low wage earner serves in practice to pay the retirement of the highly-paid manager (which is in no way compensated for by the allowance for strenuous and tedious work)

More generally, there are naturally multiple parameters to be fixed to define what one considers to be "solidarity". The government's proposals are respectable but they are far from being the only ones possible. It is essential that a broad public debate take place and that alternative proposals should emerge. The Delevoye Plan for example provides for a replacement rate equal to 85% for a full career (43 years of contributions) at Minimum Wage level. This rate would then very rapidly fall to 70%, to only 1,5 Smic (Minimum Wage) before stabilising at this precise level of 70% until approximately 7 Smic ( 120,000 Euros gross annual salary). This is one possible choice, but there are others. One could thus imagine that the replacement rate would go gradually from 85% of the Smic to 75%-80% around 1.5 – 2 Smic, before gradually falling to around 50%-60%, approximately 5-7 Smic.

Similarly the government's project provides for a financing of the system by a retirement contribution of which the global rate would be fixed at 28.1% on all the gross incomes below 120,000 Euros per annum, before falling suddenly to only 2.8% beyond this threshold. The official justification is that retirement rights in the new system would be capped at this wage level. The Delevoye Report goes as far as congratulating themselves because the super-managers will nevertheless be subject to this contribution (which will not be capped) of 2.8%, to mark their solidarity with the older generations. In passing, once again no account is taken of the salaries between 100,000 Euros and 200,000 Euros which usually correspond to very long life expectancies and which benefit greatly from the contributions paid by the lower waged with shorter life expectancies. In any event, this contribution of 2.8% to solidarity by those earning over 120,000 Euros is much too low, particularly given the levels of remuneration; their very legitimacy is open to challenge.

More generally it is perhaps time to abandon the old idea according to which reduction of inequalities should be left to income tax, while the retirement schemes should content themselves with reproducing them. In a world in which fabulous salaries and questions of retirement and dependency have taken on a new importance, the most legible norms of justice could be that all levels of salary (including the highest) should finance the retirement scheme at the same rates (even if the pensions themselves are capped) while leaving to income tax the task of applying higher levels to the top incomes

To be clear: the present government has a big problem with the very concept of social justice. As everyone knows, it has chosen from the outset to grant huge fiscal gifts to the richest (suppression of the wealth tax (the ISF), the flat tax on dividends and incomes). If today it does not demand a significant effort from the most privileged it will have considerable difficulty in convincing the public that its pension reform is well-founded.

-- via my feedly newsfeed

Josh Bivens: Why is the economy so weak? Trade gets headlines, but it’s more about past Fed rate hikes and the TCJA’s waste [feedly]

https://www.epi.org/blog/why-is-the-economy-so-weak-trade-gets-headlines-but-its-more-about-past-fed-rate-hikes-and-the-tcjas-waste/

Josh Bivens, director of research at EPI

The Federal Reserve meets this week against a backdrop of mounting evidence of a slowing economy. Since the last Federal Open Market Committee (FOMC) meeting, revised data on gross domestic product (the widest measure of the nation's economic activity) and job growth have shown that 2018 saw much slower growth than previously reported.

Between April 2018 and March 2019, for example, the economy created 500,000 fewer jobs than had originally been reported. Only 105,000 jobs were created in August if temporary Census positions are excluded: this is roughly half the pace of growth that characterized pre-revision estimates of average job growth in 2018.

These clear signs of an economic slowdown raise the obvious question, "Why has growth faltered?"

While many pundits and economists have blamed the escalating trade conflict between the Trump administration and China, there are much more obvious sources of this slowdown: the Fed's own premature interest rate increases between December 2015 and 2018 and the utter waste of fiscal resources that was the Tax Cuts and Jobs Act (TCJA) passed at the end of 2017.

To be clear, the Trump administration's trade conflict is stupid and destructive, and its attempt to pin the blame for the slowdown on the Fed is self-serving. And the Trump administration's scapegoating others for the weak economy takes real hubris given that its signature economic policy initiative—the TCJA—has been such an obvious failure in terms of spurring growth.

But the evidence is growing that the Fed did indeed raise interest rates too soon in the recovery and that this premature liftoff has begun dragging on growth. Worse, because raising rates slows growth more powerfully than lowering rates spurs growth, the Fed likely lacks the ability to offset this earlier mistake by pulling down rates going forward. The FOMC should certainly reduce rates at this week's meeting, but it will need help from other policy levers—particularly effective fiscal stimulus—in the coming year.

Evidence of premature interest rate hikes

As Figure A below shows, after seven years of holding the effective federal funds rate at essentially zero, in December 2015 the Federal Reserve raised this rate by a quarter point. While many argued that a quarter-point increase in interest rates would not snuff out the ongoing recovery, I noted that raising rates while unemployment remained elevated and there was no sign of inflation made little economic sense. Worse, by increasing interest rates before any sign of inflation appeared in the data, the Fed clearly signaled that it was not eager to aggressively plumb just how low unemployment could be allowed to fall. This was a troubling signal: the Fed's failure to aggressively target as low an unemployment rate as possible in recent decades has been a major reason why wage growth over this time has been so anemic. It took a year before the Fed followed up the December 2015 rate increase with another in December 2016, but in 2017 and 2018, it undertook seven quarter-point increases in the federal funds rate.

Given this short history of interest rates, it makes sense to look at the evidence on the effect of these rate hikes on growth. The most obvious place to look is at the performance of "interest-sensitive" components of gross domestic product since the rate hikes began in 2015. Generally, residential investment, business fixed investment, durable goods purchases, and net exports are thought to be the components of GDP that will be slowed by interest rate hikes.

Figure B charts how the average contribution of various components of GDP made to overall GDP growth changed between two time periods: the era of zero federal funds rates (from the second quarter of 2009 to the end of 2015) and the era of rising federal funds rates (from the first quarter of 2016 to the most recent quarter available, the second quarter of 2019). For three of these components (residential investment, business fixed investment, and net exports) their contributions to growth slowed notably as interest rates rose. For durable goods, the contribution to growth is roughly the same in both periods, but this is striking given that personal consumption expenditures besides durable goods saw a sharp upswing in the latter period. In short, there is ample evidence that rising interest rates have worked as expected in slowing interest-sensitive components of GDP growth.

To its credit, the Fed seems to have recognized that past rate hikes have dragged too much on growth and reduced rates at the last FOMC meeting in July. But research has shown that rate cuts spur growth less powerfully than equivalent rate increases restrain growth. This problem of "pushing on a string" was a prime argument made by those arguing that the Fed should err on the side of letting growth continue and letting unemployment continue to fall. If the economy continues to slow, the Fed will need help from fiscal policymakers to avert a recession; rate cuts by themselves are unlikely to do that job.

Very little sign of 'trade war' fingerprints on growth slowdown

The slight deceleration of net exports' contribution to growth shown in Figure B may make some think there is a trade war–based explanation. There may be some influence of trade conflict on slowing growth, but this influence is likely pretty weak. For one, tariffs do not reliably reduce net exports—they instead reduce both exports and imports, with their effect on the trade balance (which is what matters for short-run growth) largely ambiguous. What is not ambiguous is the effect of a strengthening dollar on net exports—it reliably slows them. And since 2014, the dollar has risen sharply, driven strongly by developments in monetary policy in both the United States and its trading partners. It is important to realize that interest rate cuts made by the European Central Bank (ECB) late last week will put further upward pressure on the dollar going forward.

Some have noted that aside from the direct effect of tariffs, policy-induced uncertainty stemming from the Trump administration's trade conflict might be holding back other components of growth, such as business fixed investment. Perhaps. But "uncertainty" is an awfully hard influence to define. And some of the only attempts to empirically measure this uncertainty actually show it is lower today than at many points in the last decade or more. Memories are short, but as recently as 2011 a Republican-led Congress seriously threatened to drive the federal government into totally unnecessary default on its debt if the Republican Party's policy preferences were not signed into law by the Obama administration. This episode, it hardly needs to be said, created plenty of policy uncertainty.

The squandered opportunity of 2018's TCJA

So if the recent economic slowdown is mostly not the fault of the Trump administration's trade conflict, and it is mostly the fault of a too-hawkish Federal Reserve, does the president have a leg to stand on in scapegoating of Fed chair Jerome Powell? Not really. The reason why is simple: if President Trump had wanted faster growth, he should not have championed the waste of fiscal resources that was the TCJA, and instead should have used those resources to do things that actually would have created jobs and growth.

The TCJA is a debt-financed tax cut that will cost $150 billion annually over the next 10 years (before interest costs are added). Because the lion's share of these tax cuts are accruing to rich households (mostly because the TCJA is primarily a corporate tax cut and owners of corporations are rich households), they have done very little to spur growth in aggregate demand (spending by households, businesses, and governments) in the short run. Rich households' spending is not constrained by too-low disposable income, so boosting this disposable income largely does not lead to more spending. Poorer and moderate-income households, on the other hand, are indeed income-constrained in their current spending, so tax cuts or direct transfers to them would have boosted demand growth significantly. Direct spending—say on infrastructure or providing needed public investments like high-quality early child care—would have stimulated demand even more.

For a time, many credited the slight acceleration in growth in 2018 to fiscal stimulus generally. But revisions to 2018 data show this acceleration was even more subdued than previously thought. Further, the growth in government spending brought forth by a budget deal in 2018 actually provided much more stimulus than the more-expensive TCJA (see Figure B for this increase in government spending's contribution to growth). The major component of GDP that has accelerated in recent years is consumption spending. Even if the entirety of the pickup in consumer spending shown in Figure B was attributed to the TCJA (and much of this pickup was surely driven by other factors, like tightening labor markets finally pushing up wage growth modestly), it would indicate that the TCJA was deeply inefficient as stimulus. TCJA proponents long argued that the main benefit stemming from it would not be short-run stimulus but a long-run increase in investment. This is awfully hard to see in the data—and as shown in Figure B investment (both business and residential) has been a prime source of weakness, not strength in recent years.

Essentially, President Trump and the Republican-led Congress largely squandered $150 billion in potential fiscal stimulus by prioritizing tax cuts for the rich over anything that would have plausibly created faster growth and jobs (see Table 1 in this report for a list of more and less effective fiscal policies to spur near-term growth). They are hence really the only economic observers in the world who have no standing to criticize the Fed for its clearly too-aggressive path of interest rate increases in recent years.

Despite bad-faith jawboning from President Trump, the Fed should cut rates

But just because President Trump calls for something—an interest rate cut in this case—doesn't always mean it's the wrong thing to do. The economy really is weakening, and this weakness has been led by sectors adversely affected by the Fed's interest rate increases in recent years. Unfortunately, we could well find, a year from now, that rate cuts alone were not sufficient to avoid a recession—or even just a prolonged slowdown that pushes up unemployment. In that case, the Fed will need help from fiscal policymakers. But in the meantime, the Fed should take its role as the early-warning system on economic slowdowns seriously by cutting rates this week. This rate cut would provide a clear alert to other policymakers.

-- via my feedly newsfeed