From L'Humanite [French CP Blog]. I do not know enough of Russian politics to eval this, but it makes some sense, and perhaps shows that the Russian CP is not dead yet.

The Communist Party of the Russian Federation and Socialist China

Translated Thursday 7 January 2021

Let's hope that the French Communist Party, and the French daily L'Humanité, will adopt a similar position!

Official website of the Communist Party of the Russian Federation

Statement by the Presidium of the CC CPRF

The Trump Administration is stepping up its policy of counteracting the development of socialist China. This takes place against the background of the deepening world crisis, the growth of the coronavirus pandemic and approaching Presidential elections in the USA. Measures aimed at undermining the PRC's economic and political stability are multiplying at a feverish pace. "Soft power" instruments have proved to be signally ineffective in the struggle against Beijing. Yet Washington has not embarked on the path of wide-ranging dialogue and cooperation. On the contrary, it is becoming increasingly aggressive in its China policy.

For many years the American strategists have concentrated on attempts to undermine the territorial integrity and weaken China's economy. The USA suffered a series of setbacks in trying to destabilize the situation in the Xingjiang-Uigur and Tibet Autonomous Regions and Ao Ming and Xiangang regions. Washington met with a fitting rebuff during the course of its provocations in Hong Kong. Attempts to undermine China's power by introducing high custom duties contrary to WTO rules have failed. Discrimination against Huawei and other Chinse companies did not help.

At this stage an openly "hawkish" line towards the PRC has prevailed in Washington. Sabre-rattling is growing louder and bellicose statements have become more frequent. The Communist Party of China has been declared to be "one of the main threats" to the existence of the United States.

In its attempts to drag the world into a new Cold War and retain its hegemony the USA leadership is ready for new provocations and adventures. The US Secretary of State and former director of the CIA, Mike Pompeo, openly proclaimed Washington's desire to drag Russia into a confrontation with China. He said this possibility flowed "naturally" from the relationship between Beijing and Moscow. These disingenuous hints should not be underestimated.

In its relations with China the United States follows the same logic as was used to destroy the Soviet Union. Like then, an enemy image is moulded of a country that has become "a mortal threat to the free world." Pompeo's speech at the Richard Nixon presidential library is a carbon copy of Churchill's Fulton speech. Only now the US is calling for a crusade against the PRC.

The head of the US diplomacy declares that "unless the free world changes Communist China Communist China will change us. The free world must prevail over the new tyranny." And Pompeo called for an "alliance of democratic states" and is beginning to pull Russia into it. He said that if Washington and Moscow together responded to major strategic challenges the world would become a safer place.

It is an extremely dangerous and destructive proposal. It aggravates international tensions and intensifies the arms race. At the same time it seeks to drive a wedge into the strategic partnership between the Russian Federation and the People's Republic of China.

The American initiative of building a global alliance against China stems from the fact that the USA cannot overcome China by itself. The rickety NATO structure does not suit that purpose. A number of European countries are actively cooperating with China economically and stand to lose from a confrontation with Beijing. Besides, the course for isolating China is simply impossible without Russia's participation in this criminal alliance.

Of late the US administration has been increasingly revealing its true face disfigured by anti-Communism, Russophobia and anti-China anger. The White House is persistently bringing back its aggressive policy at its worst. The people of the world have no right to forget American imperialism's adventures in Korea and Vietnam, Yugoslavia and Iraq, Afghanistan and Libya. Among the latest victims are the people of Ukraine which has been put at the mercy of the most reactionary forces, and the population of Donbass which is suffering from cruel slaughter and semi-starved existence.

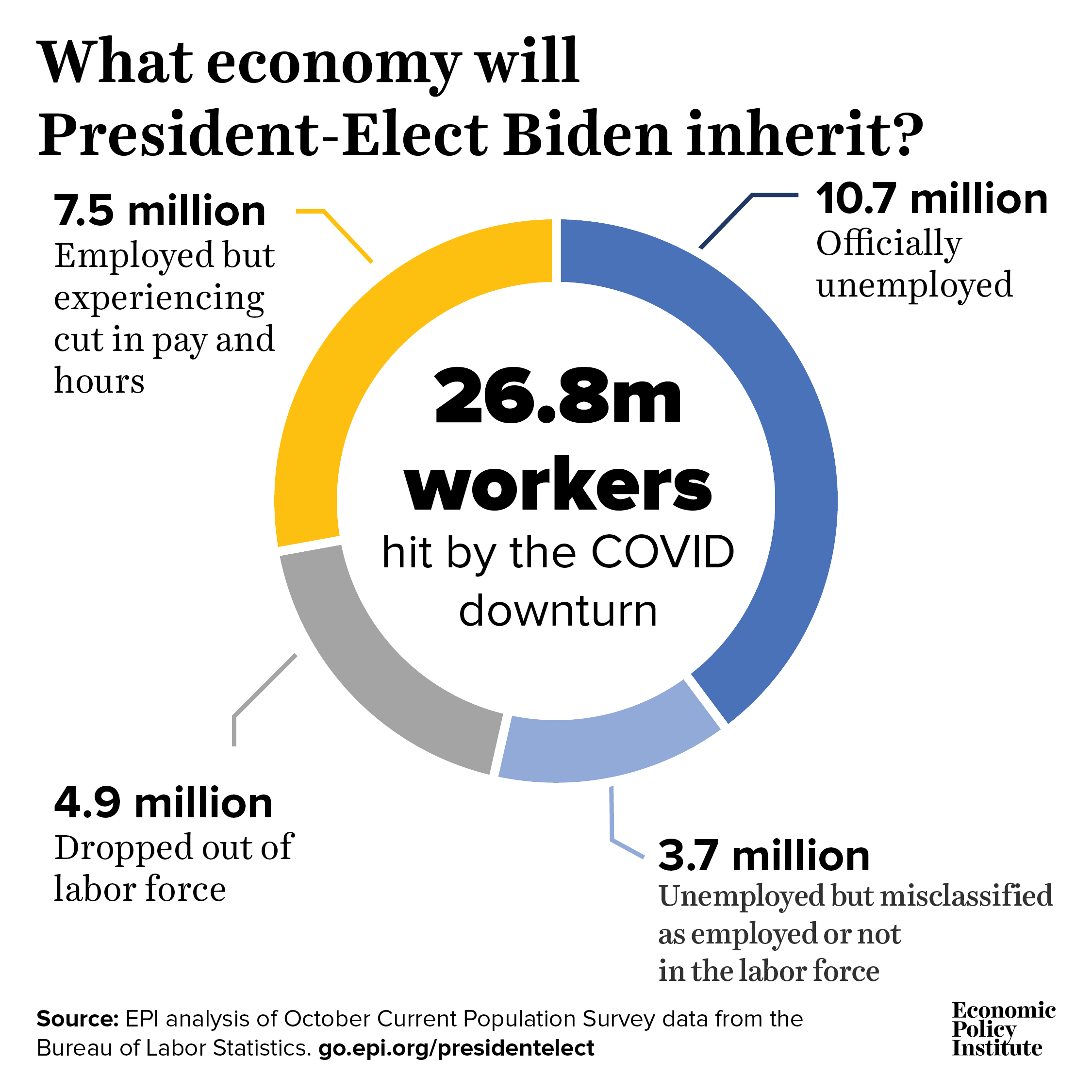

The globalists' growing fury is understandable. China, led by its Communist Party, is successfully building socialism. It is confidently overcoming the aftermath of the coronavirus pandemic. Unlike most major countries, the Chinese economy has reported growth at the end of the year. The Chinese leadership is demonstrating to the whole world how abject poverty can be eliminated and high technology developed. Beijing has every chance to become the leader of the world economy, scientific and technical development and in the innovation sphere.

The model of international relations proposed by China is growing ever more attractive. It has no place for the vices of globalism with its horrifying inequality, sharpening confrontation and worldwide expansion of the new colonizers. The concept of the PRC Chairman Xi Jinping, Community of Shared Destiny for Mankind, articulates highly promising principles of equal cooperation among nations for the common good.

The CPRF welcomes the fact that Russia and China have confidently extended the hand of friendship and close cooperation to each other. Growing trade and large-scale joint projects, shared views on key world historic events, their common victory over German Fascism and Japanese militarism, similar views on events and phenomena in international politics – these are strong bonds between our countries.

The Communist Party of China spearheads its rapid advance. Loyal to the socialist cause, the CPC correctly assesses the challenges and threats, and comes up with convincing answers to them. The CPRF has always worked towards stronger relations between the two countries. Our links with the CPC are aimed at bringing the two peoples closer together, strengthening security and harmony in international relations. These common aspirations were sealed by the signing of a memorandum of cooperation between our parties in December of 2019.

The path of development of the world civilization proposed by the PRC poses a threat not to the peoples, but to the imperialists with their appetites of exploiters and predators. China's enemies stop at nothing in their aggressive attacks on it. They are launching a slander campaign, waging trade wars, try to foment separatism and cause the PRC to quarrel with its neighbouring countries.

All the signs are that the US strategists seek to assign a special role to our country in these treacherous designs. They will try to provoke discord in the relations between Moscow and Beijing promising that Russia would gain from a change of its geopolitical orientation. The position of Yeltsin's underlings in the top echelons of power, the economy and finance, politics and the mass media are still very strong. Their close links with the "Washington party committee" are evidenced by the massive capital drain, recurrent "offshore scandals" and the multi-billion overseas assets of Russian tightwads. For these people the officially proclaimed "pivot to the East" is but a temporary maneuver. They see their own and their offspring's future in the "Western paradise."

The CPRF comes out for a stronger strategic partnership between Russia and China. We are sure that Washington's sugary promises are but a cover for its dangerous and perfidious plans. To bring about a quarrel between Moscow and Beijing means to defeat us one by one. Our countries are the main obstacles for the globalist elite which is striving to perpetuate its dominance. It will persist in its manic attempts to strangle Russia, with its military potential and vast resources which world capitalism would like to grab. It would gladly destroy China as a rival which is making a massive leap forward becoming the powerhouse of the world economy.

For Washington to put our countries on "opposite sides of the ring" would mean to weaken both of them. It is a means for globalists to implement their ugliest plans. In the event of success, Central Asia may be set ablaze. The Middle East may turn into one large "hot spot." The Far East may become a zone of sharp conflicts… Capital would not stop at any crime to preserve its dominance and its profits.

Russia has its own national interests. The CPRF is sure that they will be served not by the here-and-now handouts from the West but by stronger strategic relations with those who seek peace and social progress. For us the relations of friendship and partnership with China make it possible together to develop the economy and technology, to strengthen peace and security, to uphold our sovereignty in the face of any threats.

We are convinced that the deepening of strategic interaction with Beijing holds out a promise. It is based on economic and political realities and has a solid historical foundation. The strengthening of our ties will take us to a new and unprecedented level of relations and guarantee sovereign development of our two states. We are all extremely interested in an effective struggle against anti-Communism and anti-Sovietism, Russohobia and anti-China hysteria.

Washington strategists are set to pull our country into the infamous "alliance of democracies." To make it happen they are ready to promise anything: from the lifting of sanctions to granting preferences. We cannot rule out that the fact that Pompeo's anti-China speech coincides with the telephone conversation between Putin and Trump is not fortuitous. We hope that President Putin is very mindful of the adventurous nature of these proposals.

The historical experience of the destruction of the Soviet Union shows that the promises from across the ocean should not be believed. It is inconceivable to put these ephemeral pledges on a par with the deepening cooperation between Russia and China, the other BRICS and SCO countries and the strengthening of Eurasian integration. For our country to yield to the blandishments of the US would be tantamount to betraying our own interests. Yet this is precisely the aim of "the fifth column."It does not mind the mass expulsions of Russian diplomats, the seizure of Russian property in the US, the swelling lists of Russian officials and parliament deputies banned from traveling to the West or the hail of all sorts of sanctions.

Russia must not repeat former mistakes and has no right to be a bargaining chip in the geopolitical games of the USA. The Russian, Chinese and all the other peoples have the right to follow the path of sovereign development setting themselves long-term goals and confidently achieving them.

The future of the people is friendship and all-round cooperation!

Gennady Zyuganov,

Chairman of the CC CPRF, Head of the CPRF at the State Duma of the Federal Assembly of the Russian Federation