The rising number of U.S. households with burdensome student debt calls for a federal response

Overview

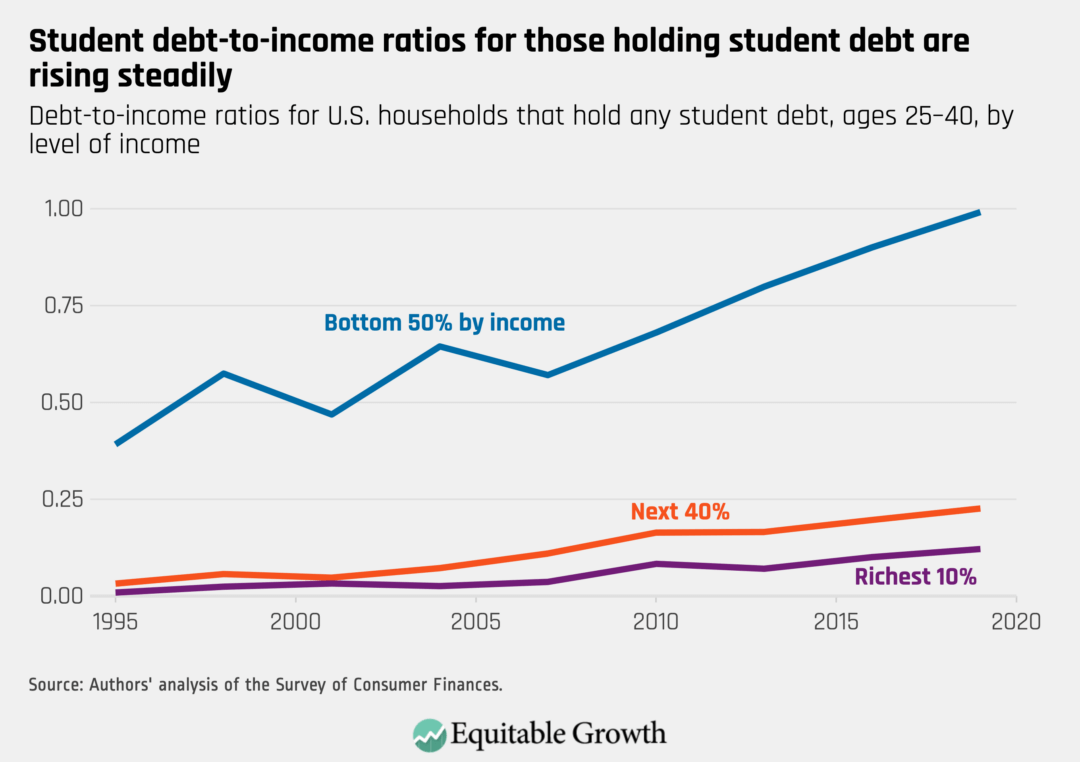

Today, about 43 million adults in the United States collectively hold $1.5 trillion in federal student loan debt and an additional $119 billion in private student loans not backed by the federal government. Student loan debt is an issue for many U.S. households, but it is becoming an especially acute problem for heads of households who are low-income, Black, or Hispanic. The Federal Reserve's 2019 Survey of Consumer Finances shows that student debt-to-income ratios are rising, saddling millions of U.S. households with a persistent drag on their incomes that could last 20 years.

The new data show that student debt-to-income ratios crept up over the past two decades and now average 0.56 among adults who have any student debt. In this issue brief, we report mean (average) income divided by mean (average) debt to reduce the influence of large outliers and look at people between the ages of 25 and 40 to roughly capture the generation that has been most affected by climbing college costs while excluding those who are just starting out their careers and therefore have especially low incomes. Excluding older households also addresses, in part, known weaknesses of using SCF data to analyze student debt. Although we think this age restriction is a reasonable frame for analyzing the data, removing it or using different age brackets does not substantially change the results we give here.

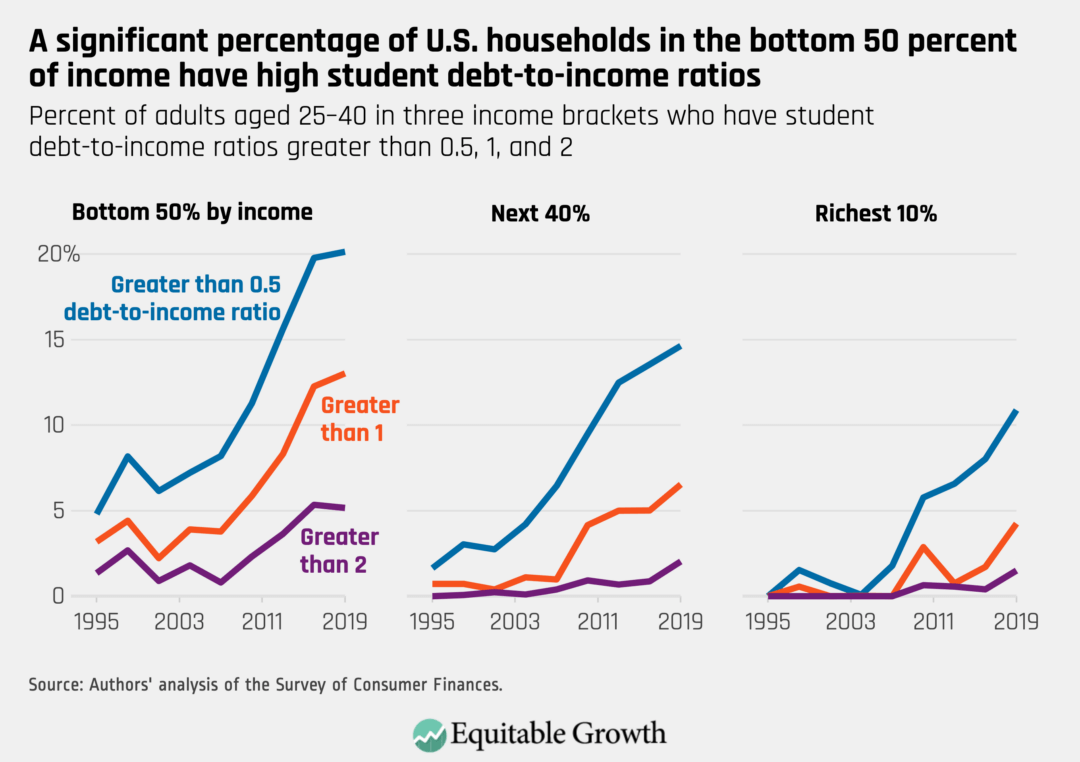

Our analysis demonstrates that the student debt burden in the United States falls most heavily on those U.S. households in the bottom 50 percent of the income distribution—and even more on Black American households. Measures to alleviate these student debt burdens—via income-based repayment plans and one-time forbearance policies enacted by Congress amid the coronavirus recession—mitigate these burdens only on the margins. We detail these findings from the new 2019 Survey of Consumer Finances and conclude with some analysis of student debt forgiveness programs based in these data.

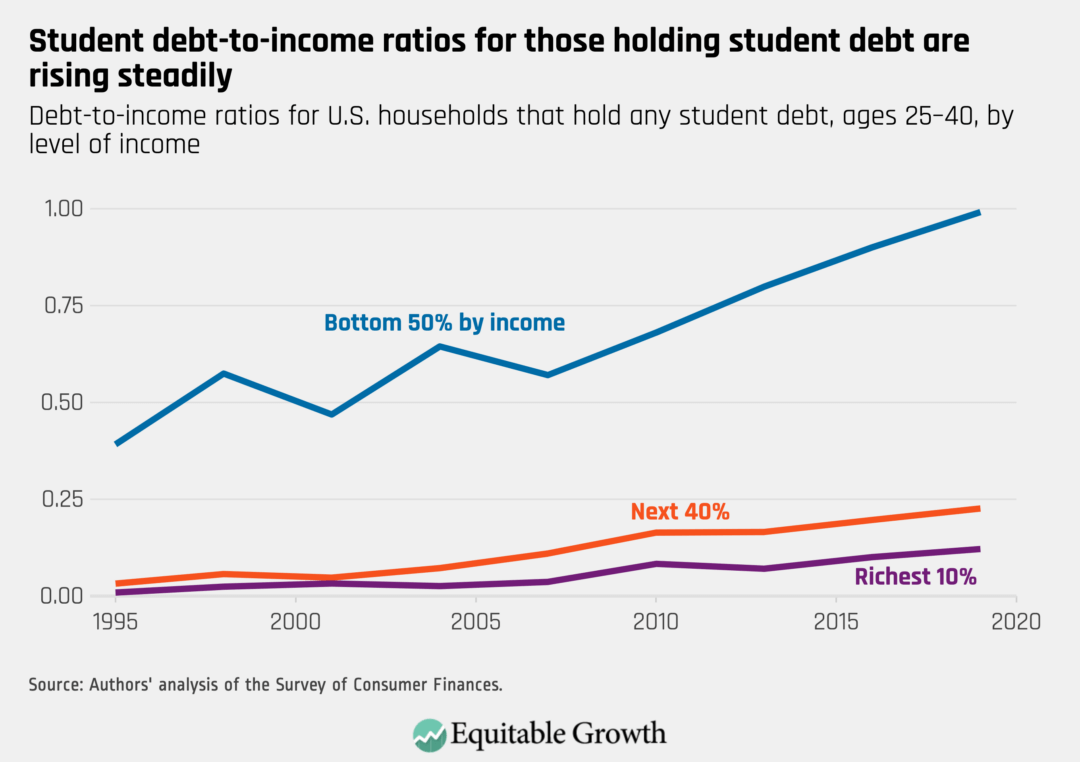

Student debt burdens are on the rise

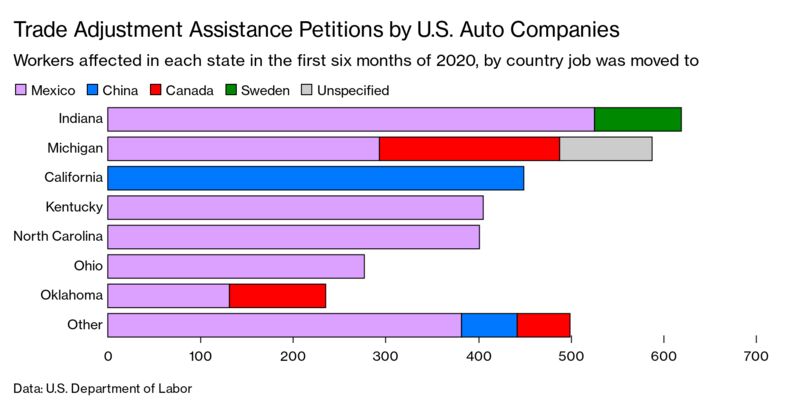

Disaggregating households by their income, the data show that adults in the bottom 50 percent of the income distribution with any debt have an average debt-to-income ratio of 1.03—more than double the ratio of 0.5 that same group held in 2001. Debt ratios are also rising for those in the next 40 percent of individuals by income, indicating that student debt is a problem of growing significance for a broad swathe of working- and middle-class households. Notably, these trends are for households that hold student debt and have therefore attended some college, so the trend is not being driven by increased college attendance. (See Figure 1.)

Figure 1

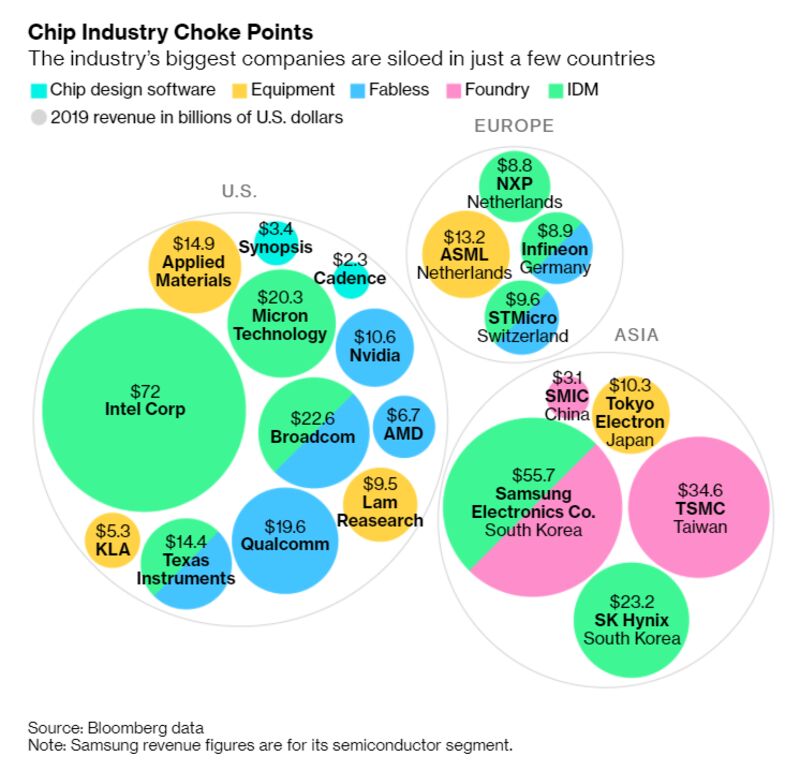

Heightened levels of student debt are often downplayed. Analysts point out that many of the largest balances are accrued by doctors and lawyers who will find high-paying jobs and have no trouble paying down their debt. But there are a large number of workers with relatively low balances on the student debt they owe who are nonetheless struggling to pay because they are stuck in low-income jobs. In fact, about 500,000 U.S. households with heads between the ages of 25 and 40 in the bottom 50 percent of the income distribution have a debt ratio greater than 1, and 2.5 million have a debt-to-income ratio greater than 0.5. Twenty percent of all households in this age group in the bottom half of the income distribution have a debt-to-income ratio of 0.5 or greater, not just those who have any student debt. (See Figure 2.)

Figure 2

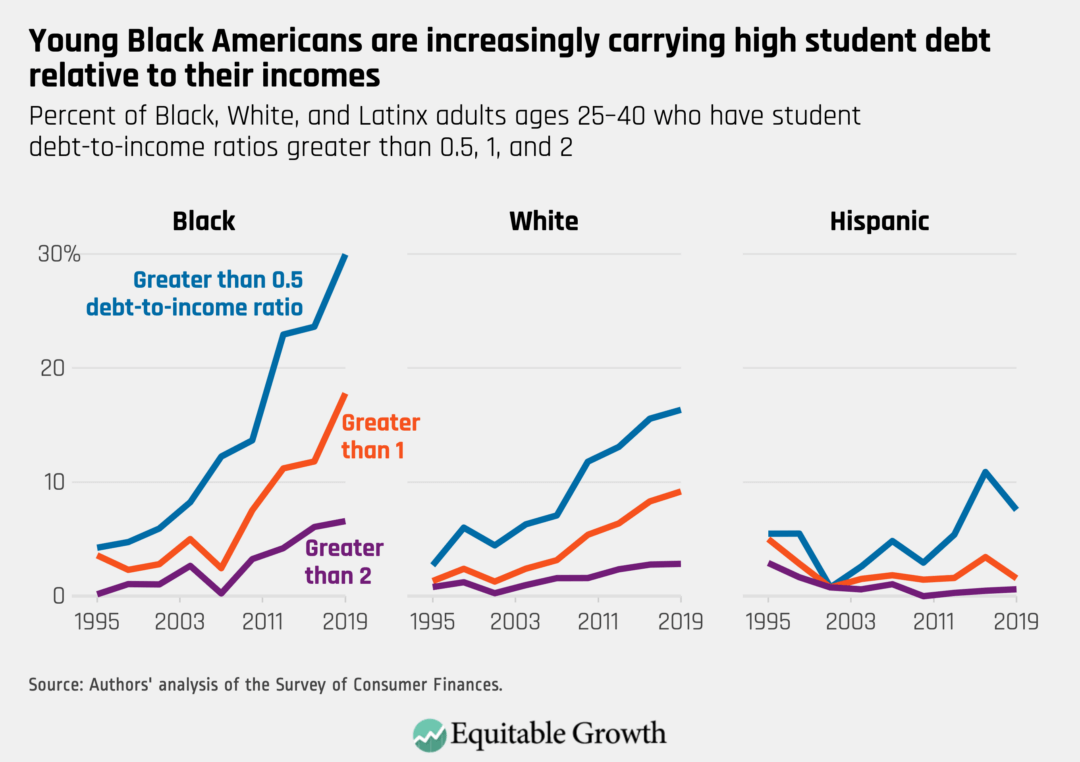

Black borrowers are struggling most

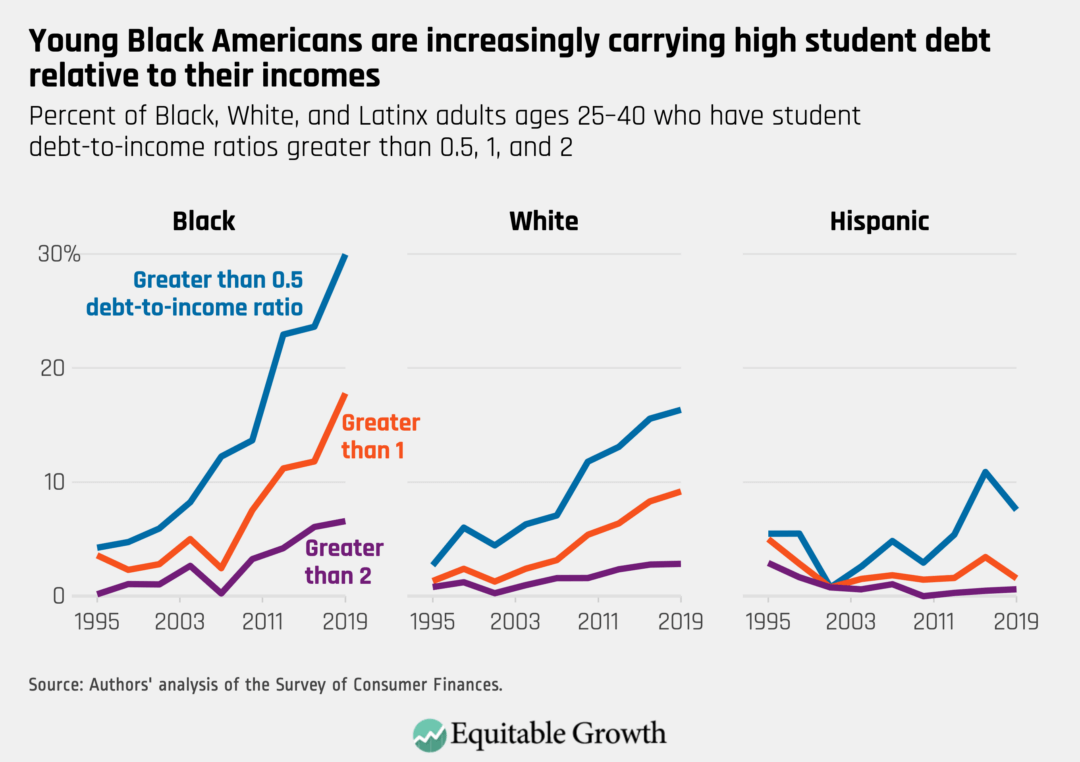

Because the U.S. labor market continues to discriminate against Black Americans, the result is Black student debtholders are likely to have lower-paying jobs than their White peers. Black student loan borrowers also have less family wealth to draw on to pay for college, leaving them with higher debt balances too. The result is that nearly 30 percent of Black Americans between the ages of 25 and 40 have a student debt-to-income ratio exceeding 0.5. Latinx student loan borrowers are less likely to have high debt, although this is in part because they are less likely to have attended college than other groups. (See Figure 3.)

Figure 3

A contributing factor to these trends is that more Black Americans are now attending college. But if we confine our analysis to only those who have attended at least some college, the results are very much the same. In 2001, about 5.5 percent of Black Americans who attended at least some college had a debt-to-income ratio greater than 1. In 2019, it was a whopping 24 percent.

Other data points echo our findings here. Analysis by the Institute for College Access and Success based on voluntary reporting by colleges found that Black recent graduates have the highest difficulty (about 40 percent of Black respondents) making federal student loan payments 12 months after graduation. Racial wealth divides between Black and White households mean that Black college graduates may not have a secure financial safety net in the event of financial crises, such as the one our nation is experiencing currently.

Institutional racism and discriminatory financial practices up until the 1970s suppressed the growth of household wealth among non-White families, with long-lasting implications for today's non-White millennial and zoomer students. Today, without the same financial cushion of generational wealth that is available to average White households, college graduates in Black and Latinx households may run the risk of defaulting on their student debt when the U.S. economy faces shocks, such as amid the current coronavirus recession and future economic downturns.

Policy implications

U.S. policymakers should be concerned by these trends. Income-based repayment plans enable some of these student loan borrowers to manage the repayment burden month to month. And many of these borrowers will be able to get forbearance from the U.S. Department of Education so they can pay $0 during periods where they are unemployed or have suffered serious declines in income. But even modest payment amounts (income-driven repayment plans cap out at 10 percent of discretionary income) are a drag on the ability of these individuals to buy houses, start families, become entrepreneurs, and engage in other activities that previous generations took for granted.

This drag, no matter how modest, was not faced by previous generations of college graduates and their families. Student debt will continue to weigh on the balance sheets of these households for 20 years in most cases. And although the overall ratio of debt payment-to-income has not increased in the way the ratio of debt balances-to-income have, this reflects, in part, the fact that debt has actually become more burdensome, and many students are in forbearance or are more likely to use income-based repayment than in the past.

One-time student debt forgiveness, proposed by both policymakers and academics, is one way to reverse the trends discussed above. As economist Darrick Hamilton at The New School and social scientist Naomi Zewde at the City University of New York's Hunter College argued earlier this year, full forgiveness of all existing student debt would significantly reduce the Black-White wealth gap, because Black households face higher balances and are far more likely to struggle to pay those balances back. It also has the significant advantage of being relatively simple to carry out, at least relative to proposals that include complicated eligibility requirements. These kinds of requirements have been problematic in the past. The Public Service Loan Forgiveness program, for example, approved only 3,400 out of 200,000 applicants for forgiveness in 2017, because the requirements proved complicated, and borrowers did not fully understand the program.

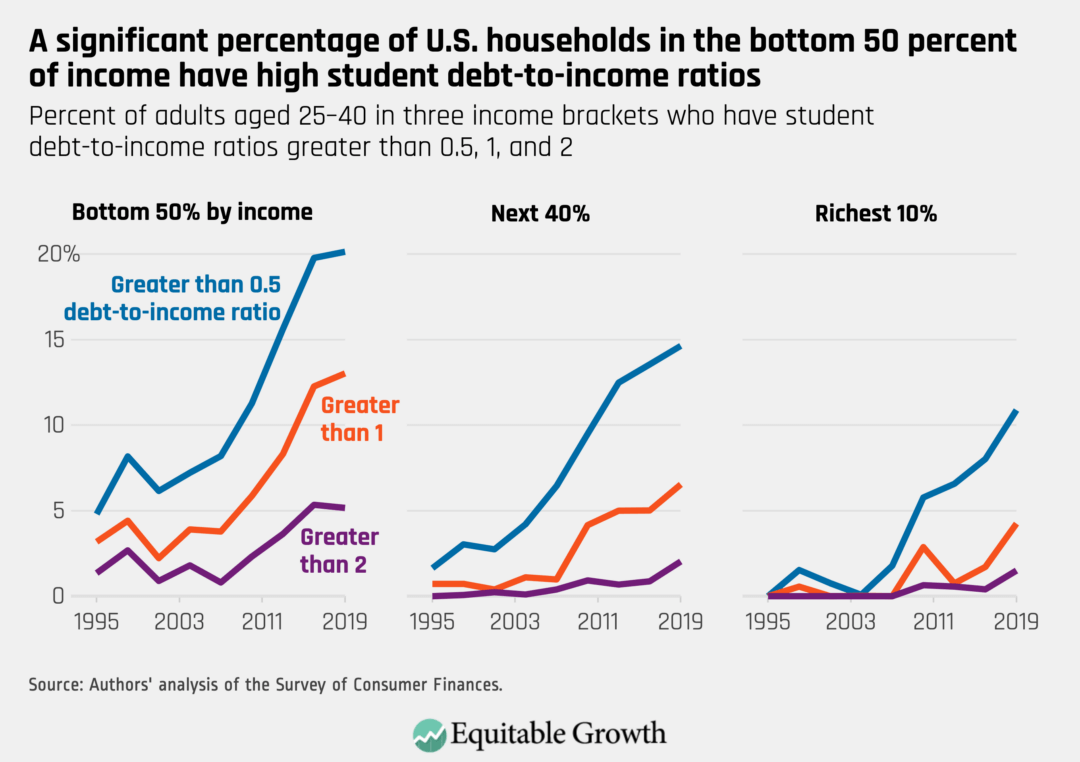

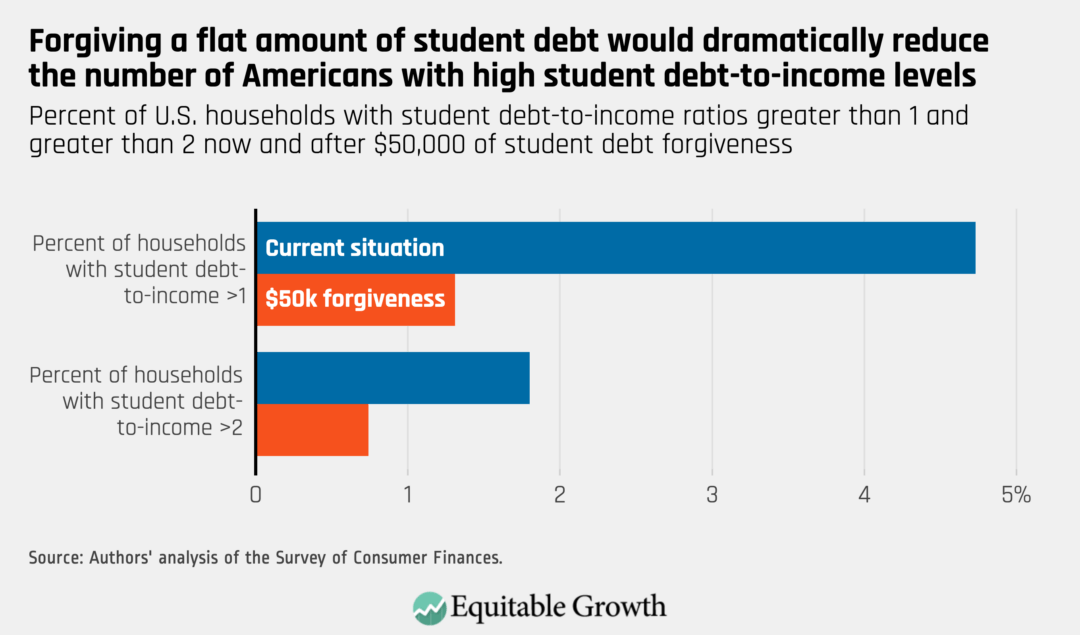

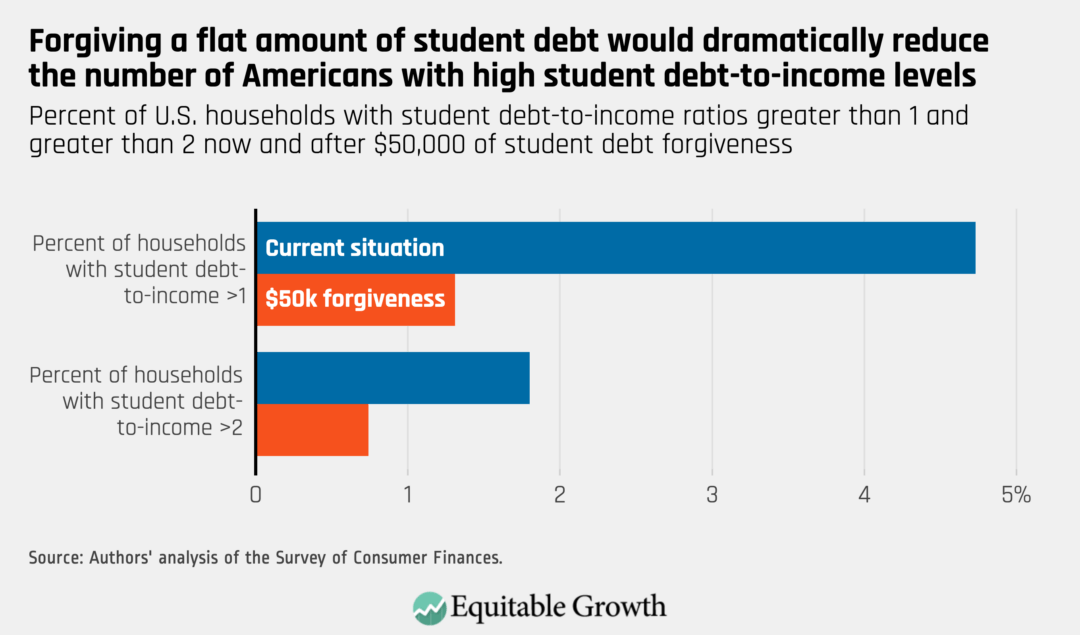

Other proposals have focused on forgiving a flat, across-the-board sum. Sen. Elizabeth Warren (D-MA), in her 2020 presidential campaign, for example, proposed eliminating $50,000 of debt. This would dramatically reduce the number of households with high student debt-to-income ratios. (See Figure 4.)

Figure 4

One-time debt forgiveness of any sort, however, is not a sufficient solution to the broader problem of increasing college costs. To prevent a recurrence of the creeping debt situation happening now, a college education needs to be made affordable for lower- and middle-class households. As demand for college has risen, per-student funding provided by states to public universities has fallen. Whereas tuition once accounted for just a bit more than 20 percent of revenue at public institutions, in 2017, it accounted for almost half of all revenue. Cuts in state budgets as a result of the Great Recession also exacerbated the issue, with some states still funding far less than they did before the crisis. States likely do not have the ability to reverse this trend themselves. To make college affordable, the federal government will have to step in and jointly fund public institutions with states.

As of fiscal year 2017, ending in September 2017, only 2 percent of the federal budget was allocated toward higher education. Since 2007, there has been no growth in federal and state education expenditures. In order to curb rising student loan debt, policymakers at both the state and federal level should invest in affordable and accessible higher education, especially 2- and 4-year programs. Prioritizing need-based student financial aid over merit-based aid benefits students who grow up in communities with poorly funded public Kindergarten through 12th grade education, allowing these students to experience economic mobility without the heavy burden of student loan debt after graduation. The Debt-Free College Act is an example of one bill that would implement some of these recommendations.

Much of the analysis of student loan debt fails to acknowledge that even when the burden of student loans is modest, it is a drag on income that previous generations did not face. The creeping increase in student debt-to-income ratios is evidence that the problem should be tackled now, before the student financial aid system becomes more dysfunctional. Federal support would ensure that no one is unable to get a college education due to their parents' financial circumstances, and that the nation continues to build a well-educated workforce.

-- via my feedly newsfeed