https://economicupdate.podbean.com/e/economic-update-the-feds-rigged-money-management/

-- via my feedly newsfeed

China's economy, as shown by multiple mid-year indicators, has ridden out its downturn due to COVID-19 strains and bounced back to growth in the second quarter (Q2). Economists believe that the country's V-shaped recovery is only getting started.

In Q2, China's gross domestic product expanded by 3.2 percent year on year, reversing a 6.8-percent contraction in the previous quarter. China's fiscal revenue marked the first expansion this year by gaining 3.2 percent year on year in June, while the contraction of the retail sector declined markedly.

BACK IN THE GAME

"China's economy has gradually emerged from the slump and returned to the level it was roughly at prior to the outbreak, backed by the stimulation that has delivered burgeoning signs of work resumption, industrial chains and services sector," said Shao Yu, chief economist at Orient Securities.

Latest data showed that the purchasing managers' index (PMI) for China's manufacturing sector rose to 51.1 in July from 50.9 in June, remaining in expansion territory for the fifth month in a row, indicating stronger confidence of market entities.

"The steadily firming recovery points to the effectiveness of China's epidemic prevention and pro-growth policies to boost production and domestic consumption," said Sheng Hai, a macro analyst with China Industrial Securities.

His point was echoed by Steven Zhang, chief economist at Morgan Stanley Huaxin Securities. "China has its institutional advantages that enable a more agile and rapid response to public safety emergencies like COVID-19."

The prompt introduction and implementation of an array of measures, including higher fiscal spending, tax relief and cuts in lending rates and banks' reserve requirements to revive the economy and support employment, according to Zhang, is one of the major reasons behind the Q2 positive growth.

SHARED OPPORTUNITIES

As recent data showed that China's imports from emerging countries increased significantly, the recovery of the world's second-largest economy is expected to boost the pace of other economies' restoration, according to Zhang.

In H1, China's trade with ASEAN went up 5.6 percent year on year to 2.09 trillion yuan (about 301.12 billion U.S. dollars), while that with countries along the Belt and Road (B&R) accounted for 29.5 percent of the total trade, up 0.7 percentage points year on year.

Zhang said that trade between China and other parts of Asia, B&R countries and ASEAN is expected to further expand as the spillover effects will be more notable due to shorter distance and lower logistics costs.

To mitigate the impact of the COVID-19 outbreak, China has been investing heavily in infrastructure projects through local government bond issuance, which is expected to buoy demand for bulk commodities in the global market, thereby benefiting B&R countries, as major bulk commodity exporters, Zhang noted.

"Such effects came in as a demonstration of the new development pattern, or 'dual circulation', proposed in last week's meeting of the Political Bureau of the Communist Party of China Central Committee, which underscores the domestic market as the mainstay while domestic and foreign markets can boost each other," said Zhang.

SOLID FOOTING

"China's economy has mostly ridden out the COVID-19 blow and is entering a V-shaped rebound trajectory," said Zhang, forecasting the recovery to further consolidate in the third and fourth quarters with a 2.5-percent to 3-percent year-end growth.

In the backdrop of the economic rebound, last week's Political Bureau meeting stressed ramping up nationwide efforts to foster new opportunities amid challenges and make new advances amid changes.

As one of the key forces driving economic growth, consumption will catch up with the momentum in overall recovery and see some pent-up demand unleashed during the second half of the year as service sector picks up pace amid further containment of COVID-19, Zhang said.

Thanks to policies aiming to ensure stability in employment, consumer spending will be further propelled as the two factors underpinning the consumption revival, namely the urban unemployment rate and resident income, are stabilizing.

Official data showed that China's surveyed unemployment rate in urban areas stood at 5.7 percent in June, down 0.2 percentage points from May.

Resident income is also expected to hold steady on the back of firming economic data. In H1, the urban per capita disposable income came in at 21,655 yuan, up 1.5 percent in nominal terms and down 2 percent in real terms.

While economic fundamentals are solidifying, new growth drivers, such as new infrastructure like 5G, AI and cloud computing that has attracted big sums from investors, will also become a bright spot fueling economic growth, Shao noted.

In the second half of the year, China, on top of stabilizing measures, will invest more in domestic demand, new infrastructure, online industries and independent innovation for stronger recovery despite global uncertainties, Shao added.

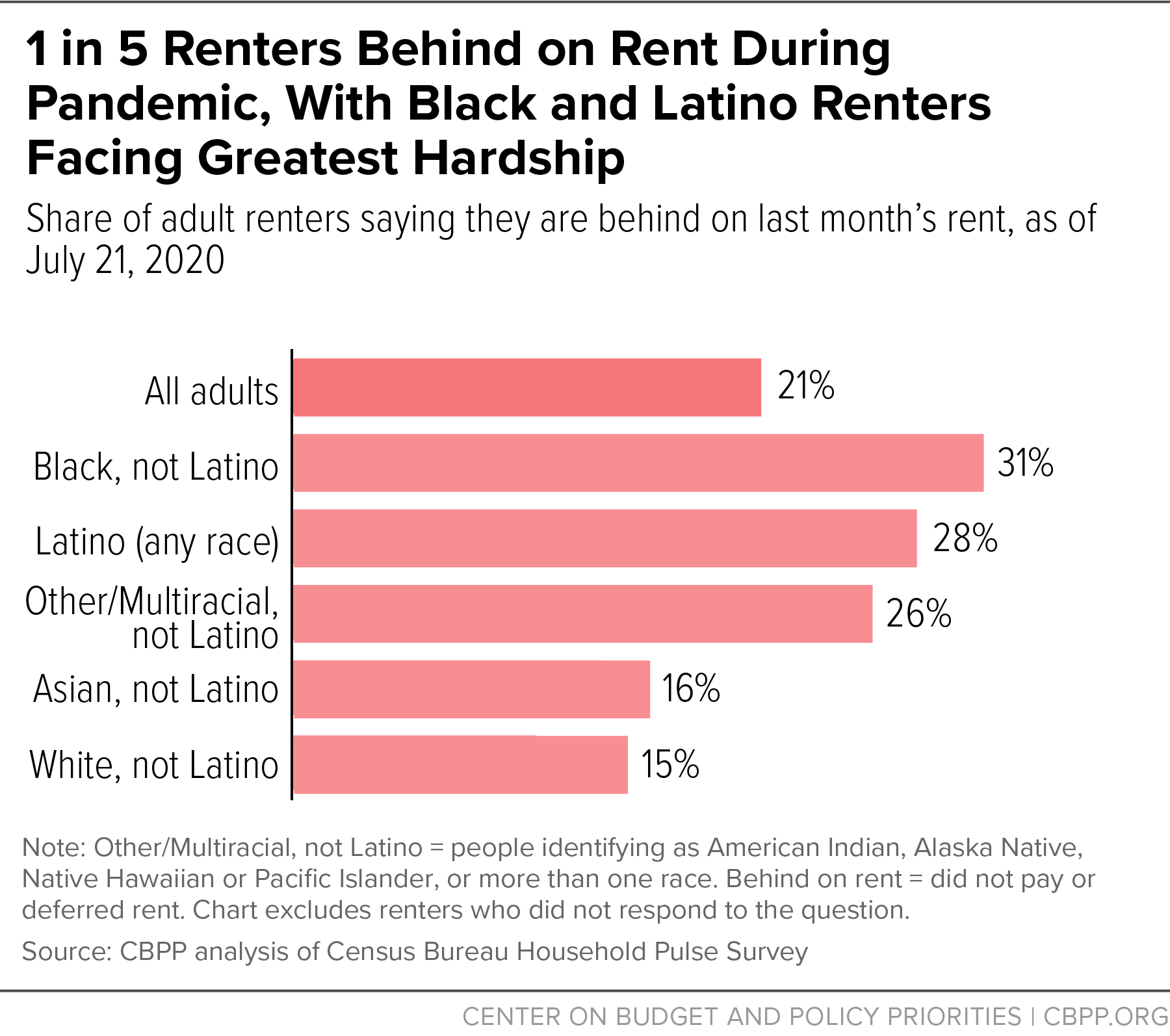

President Trump's expected executive order to extend, if not expand, the CARES Act's federal ban on evictions, which recently expired, very likely will prove woefully inadequate to help people experiencing homelessness or the millions of renters struggling to pay rent.

President Donald Trump signed an array of executive actions on Saturday to bypass Congress and implement economic relief measures on his own.

Among them was a $400 weekly supplement to federal unemployment insurance through December 6. Trump claimed the relief would reach Americans in a "very rapid" manner, but neglected to say how.

It's a significant cut from the $600 level once in effect during the coronavirus pandemic under the CARES Act. That benefit expired in late July, and Republicans are under mounting pressure to replace it with another boost to state payouts.

But a closer reading of the memorandum reveals that the Trump administration is attempting to set up a "lost wages assistance" program outside of the traditional unemployment system.

Since it's being funded with $44 billion from the Department of Homeland Security's disaster relief fund, governors are ordered to work with the Federal Emergency Management Administration to manage the new initiative. FEMA is usually the agency responsible for doling out government relief after natural disasters like hurricanes and wildfires.

Trump's memo says states should kick in 25% of the funding, and the federal government will pick up the rest. It means states would fund $100 of the benefit, and the federal government's contribution is capped at $300.

But there are strings attached: jobless people only qualify for federal aid if they already receive at least $100 from their state in weekly benefits.

In other words, it's a new program that state governments are being tasked to design from the ground up — and experts say they likely won't be able to implement it for months.

Plus, the executive branch assembling a new benefit program is all but certain to spark court challenges. During his press conference, Trump said he believed such challenges would go "very rapidly through the courts, if we get sued — maybe we won't get sued."

Reuters

Reuters

"States have to follow federal law to pay unemployment insurance benefits," Michele Evermore, a prominent unemployment expert at the National Employment Law Project, told Business Insider on Saturday. "[The administration] can't call it unemployment insurance since it's a whole other program."

"This is outside the UI system entirely," Evermore said, adding "this will be difficult" for states to carry out, since state agencies are still overwhelmed with a massive backlog of claims. She estimated it could take "months."

The funding mechanism also raised concerns. The memo outlines states can draw from existing relief funds under the CARES Act.

But experts say many states already tapped most of that federal money.

Michael Leachman, vice president for state fiscal policy at the Center on Budget and Policy Priorities, noted in a blog post that states such as California, Colorado, and Mississippi had allocated all their money. Others — including South Carolina, Kentucky, and Louisiana — already distributed significant portions of it.

Getting an entirely new benefit program up and running would delay aid to unemployed Americans struggling to make ends meet. Nearly 31 million Americans are on unemployment, drawing state benefits averaging $330 a week nationwide.

Meanwhile, Democrats blasted Trump's executive orders. House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer said in a statement on Saturday that the administration's moves amounted to little more than empty gestures.

"These policy announcements provide little real help to families," Pelosi and Schumer said. "Instead of passing a bill, now President Trump is cutting families' unemployment benefits and pushing states further into budget crises, forcing them to make devastating cuts to life-or-death services."

NOW WATCH: How billionaires got $637 billion richer during the coronavirus pandemic

See Also:

President Donald Trump's move to halt the collection of taxes that fund America's main support programs for the elderly spurred a wave of political opposition and threatens to generate tension between employers and workers.

Trump in a memorandum on Saturday instructed the deferral of payroll tax collections for some workers. The taxes are paid by both employees and their employers, and fund Social Security and Medicare for those already using those programs.

But because congressional approval is needed to enact changes in federal levies, the amounts foregone under the order will still come due next year, unless legislators act.

Initial reaction reinforced the message that both Democrats and Republicans had sent the White House during the talks on a coronavirus relief package that collapsed on Friday: don't do it. Underlying that opposition is concern that hurting the finances of the massive programs that pay retirement and health care benefits for the aged, along with disability income, will be punished by voters.

Changes to Social Security, a program with widespread support that's been around since 1935, were once called the "third rail" of American politics -- an allusion to the danger of electrocution.

The program that emerged from the Great Depression is the largest single source of income for older Americans, providing the majority of income for half of retirees, and at least 90% of income for 18% of retirees, according to the Center on Budget and Policy Priorities, a progressive think-tank. It's particularly important to women and people of color. Politicians meddle with it at their peril.

Social Security and Medicare already face a dire outlook. Though payroll taxes ostensibly go to "trust funds" that build up assets from which the benefits are paid, the demographic challenge posed by the large, rapidly-retiring baby-boomer generation means there's not enough money for the government's obligations. Further starving the programs through a payroll-tax deferral makes Trump's move a risky gambit.

Read more: Social Security Trust Fund Seen Running Dry Early on Virus Drain

Democratic presidential candidate Joe Biden said Saturday that Trump was "putting Social Security at grave risk." With no suggestion of how the forgone funding will be made up, the president's move is the "first shot in a new, reckless war" on the program, Biden said.

Representative Richard Neal of Massachusetts, chairman of the House Ways and Means Committee, said Trump's "decree is a poorly disguised first step in an effort to fully dismantle these vital programs by executive fiat."

The Trump campaign has made similar criticisms of Biden, drawing on some of his positions from decades in the Senate to argue that he had advocated cutting Social Security. But the president is now the one raising questions about the government's ability to pay full benefits, with Trump indicating Saturday that if re-elected he would propose a permanent payroll tax elimination.

Saturday's executive action suspends the payroll tax for those making less than $100,000 a year from Sept. 1 through the end of 2020. Trump said that if re-elected he'll "extend it beyond the end of the year and terminate the tax." He didn't mention Social Security and Medicare or indicate how the funds would be made up.

Republicans in Congress have preferred another round of stimulus checks that left the government's social safety nets untouched. A number of them, including Senator Mitt Romney, the former Republican presidential candidate, in recent days moved to insert text into Covid-19 stimulus legislation that would set up committees charged with crafting bills to secure the long-term funding of Social Security along with other key programs.

Read more: Stimulus Talks Could Snag on Social Security Review Panels

Bipartisan criticism of Trump's move was quick to emerge.

"Trump does not have the power to unilaterally rewrite the payroll tax law," Republican Senator Ben Sasse said in a statement Saturday. "Under the Constitution, that power belongs to the American people acting through their members of Congress."

Larry Kudlow, Trump's top White House economic adviser, recognized that a legal battle may now ensue over the grounds raised by Sasse. "We're going to go ahead with our actions anyway. Our counsel's office, the Treasury Department believes it has the authority to temporarily suspend tax collections," he said on ABC's "This Week."

Treasury Secretary Steven Mnuchin said there will be no cuts to Social Security or Medicare from the deferred payroll tax collection, and that they would be paid out from the general federal budget. "The president in no way wants to hurt those trust funds," he said on Fox News Sunday.

Payroll tax cuts have been embraced by both Republicans and Democrats in the past to give consumer spending a boost, but they haven't been big political winners.

Congress temporarily cut the payroll tax by two percentage points under President Barack Obama in 2011 and 2012. However, most people didn't really notice a change to their take-home pay, according to research by the left-leaning Center for Economic and Policy Research. More than half of the respondents said they didn't know their tax payments had changed.

President George W. Bush, when faced with a slowdown, opted for stimulus checks, similar to the $1,200 payments Congress approved earlier this year. Republicans and Democrats have both said they support a second round, but negotiations on a broader deal have stalled. Trump can't order more payments with executive authority.

For businesses, Trump's Saturday move presents other challenges. If Congress doesn't ultimately cancel the amounts due and not paid in 2020, they could be on the hook to pay the Treasury next year.

"Without detailed answers to some of these questions, employers might just steer clear of all of it by continuing to do what they've always done, blunting the desired economic impact of reducing taxes," the National Taxpayers Union Foundation said in a statement.

If firms pass on the temporary savings to their staff, they could face difficulties clawing back the money in 2021 -- all the more so if some workers have moved on. And any move to continue collecting the fees could mean tensions with employees whose household incomes have already been hit by the coronavirus pandemic.

Employees would also owe more income taxes because their wages would be higher, meaning that some could see a smaller tax refund in 2021 -- or owe money to the government -- if they don't adjust their IRS withholding.

The U.S. Chamber of Commerce said Saturday that Trump's executive actions aren't a full solution.

"There is no alternative to Congress legislating and no excuse for their inaction," Neil Bradley, the chamber's chief policy officer, said in a statement.

All are examples of environmental racism, a form of systemic racism whereby communities of colour are disproportionately burdened with health hazards through policies and practices that force them to live in proximity to sources of toxic waste such as sewage works, mines, landfills, power stations, major roads and emitters of airborne particulate matter. As a result, these communities suffer greater rates of health problems attendant on hazardous pollutants.

It was African American civil rights leader Benjamin Chavis who coined the term "environmental racism" in 1982, describing it as "racial discrimination in environmental policy-making, the enforcement of regulations and laws, the deliberate targeting of communities of colour for toxic waste facilities, the official sanctioning of the life-threatening presence of poisons and pollutants in our communities, and the history of excluding people of colour from leadership of the ecology movements".

In practice, environmental racism can take many forms, from workplaces with unsound health regulations to the siting of coal-fired power stations close to predominantly non-white communities. It can mean citizens drinking contaminated groundwater or being schooled in decaying buildings with asbestos problems.

Many of these problems face low-income communities as a whole, but race is often a more reliable indicator of proximity to pollution. A landmark 2007 study by academic Dr Robert Bullard – the "father of environmental justice" – found "race to be more important than socioeconomic status in predicting the location of the nation's commercial hazardous waste facilities". He proved that African American children were five times more likely to have lead poisoning from proximity to waste than Caucasian children, while even black Americans making $50-60,000 a year were more likely to live in polluted areas than their white counterparts making $10,000. In the UK meanwhile, a government report found that black British children are exposed to up to 30% more air pollution than white children.

The case of Flint, Michigan, is a prime example of environmental racism. In 2014, to save money, the city changed its water source to the Flint river, but failed to treat the new supply adequately, exposing the city's 100,000 majority-black inhabitants to dangerous levels of lead from ageing pipes and other contaminants such as E.coli. Between 6,000 and 12,000 children drank tap water containing high levels of lead, a neurotoxin, while 12 citizens eventually died from Legionnaires' disease. However, for 18 months, residents' complaints of foul-smelling and discoloured water, of hair loss and skin rashes, were dismissed until community pressure forced the city to reconnect to the former supply and admit wrongdoing. The Michigan Civil Rights Commission concluded that the slow official reaction was a "result of systemic racism".

The case of Flint, Michigan, is a prime example of environmental racism. In 2014, to save money, the city changed its water source to the Flint river, but failed to treat the new supply adequately, exposing the city's 100,000 majority-black inhabitants to dangerous levels of lead from ageing pipes and other contaminants such as E.coli. Between 6,000 and 12,000 children drank tap water containing high levels of lead, a neurotoxin, while 12 citizens eventually died from Legionnaires' disease. However, for 18 months, residents' complaints of foul-smelling and discoloured water, of hair loss and skin rashes, were dismissed until community pressure forced the city to reconnect to the former supply and admit wrongdoing. The Michigan Civil Rights Commission concluded that the slow official reaction was a "result of systemic racism".

So what is being done? The environmental justice movement works to raise awareness of the plights of vulnerable populations through academic studies, media pressure campaigns and public activism. Grassroots movements make use of social media, along with civil disobedience and marches, to make their views heard. The European Union, where most documented cases of environmental racism affect the Romani people, has funded initiatives including the Environmental Justice Organisations, Liabilities and Trade project, which ran from 2011-2015 and brought together scientists and policy-makers from 20 countries across the world to advance the case of environmental justice. As environmental laws tighten in developed countries however, many fear that dumping activities will shift towards the global south.

Combating environmental racism may risk falling down the policy in the age of COVID-19 – and yet with non-white people more likely to die from the virus, the higher instances of complicating factors such as asthma and heart disease brought about by exposure to pollution are likely to play a part. Environmental racism is part of the broader picture of systemic racism, which must be fought to bring about a fairer society.