If we are going to give them 50 Billion, shouldn't we, the taxpayers, get a stake?

It's Time to Nationalize the Airlines

MARCH 18, 2020

In a world free of coronavirus, today might have been a day like any other for the airlines. It may well have been a good day—the past ten years have been full of them. Indeed, American carriers have posted record profits for multiple years running, while boasting sky-high stock prices. Things have been so good, in fact, that in 2017, American Airlines CEO Doug Parker put it succinctly: "I don't think we're ever going to lose money again."

The 2010s were prosperous times for the domestic airline industry thanks in large part to merger-driven consolidation and the sheer innovative force of baggage fees. According to the U.S. Department of Transportation's most recent airline baggage fee report, domestic carriers bloated their profit margins with nearly $5 billion in baggage fees in 2018, up from $4.5 billion in 2017, and a mere $1.1 billion a decade ago. American Airlines set the pace with $1.2 billion in baggage fees alone, followed closely by United, with $889 million. They also increased fees for changing one's flight, got rid of meals and seat-back entertainment systems, and created a new class of ticket, the universally reviled "basic economy" seat.

Meanwhile, in just over a decade the number of large and midsize U.S. carriers shrank from 18 to 10, as American bought US Airways, Continental merged with United, and Northwest merged with Delta. Today, the four largest airlines control about 80 percent of total domestic passenger traffic. (In many cities, it's even more extreme: At 93 of the top 100 airports, one or two airlines control a majority of the seats for sale.)

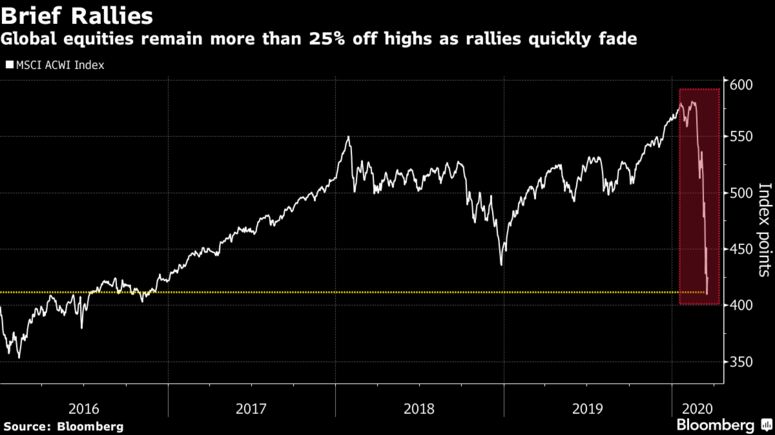

One might think, with all that extra profit wrung out of thin air and little competition to speak of, the airlines would be in strong shape to weather an exogenous crisis, something like a global pandemic that zaps travel and forces temporary cutbacks in seat purchases and flights. But that is not what has happened. Between 2014 and 2020, in an attempt to boost its earnings per share, American spent more than $15 billion buying back its own stock. The company managed not only to spend down its cash reserves in a stock-buying spree, but it simultaneously engorged itself on cheap loans. It now has debt obligations of nearly $30 billion, almost five times its current market value. And while American was the most egregious of the airline behemoths, it certainly wasn't the only one: Over the past ten years, the biggest U.S. airlines spent an unfathomable 96 percent of free cash flow on buying back their own shares.

Like what you're reading? Chip in...

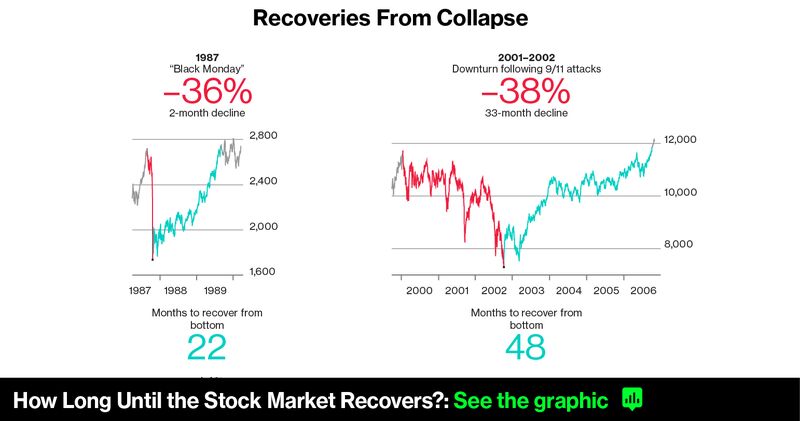

Of course, shareholders saw no problem when the airlines were funneling money back to them at breakneck speed, goosing the stock price to the detriment of investments in equipment, worker pay, and passenger comfort. But now that the full economic impact of the coronavirus has begun to reveal the extreme folly of that approach, the airlines have stuck their hands out for an unprecedented bailout of at least $58 billion. That figure is more than three times the size of the industry's bailout after the September 11 attacks. The bill has come due for the shareholder frenzy, and those same shareholders expect to avoid a bludgeoning with the help of taxpayer dollars.

The economic headwinds facing the industry are certainly significant. United announced it would cut its flights by at least half in April and May, and is currently in talks with its unions about steps that could include furloughs, pay cuts, and more. American and Delta, too, have announced severe cuts in flying, hiring freezes, and voluntary unpaid leave for employees. But to simply bail out the airlines would represent a grave missed opportunity to reverse four decades of catastrophic consolidation and help mitigate the climate crisis on a crucial front. It's time to nationalize the airlines.

The airline industry has become another cautionary tale of the pitfalls of deregulation, the result of extremely misguided policy set loose over decades. Air travel wasn't always like that. In its early days, between 1937 and 1978, air travel was treated as a public utility. The Civil Aeronautics Board (CAB) managed domestic flights and was responsible for establishing schedules, fares, and routes. But in 1978, under the guidance of the Jimmy Carter administration, the industry was deregulated, in the name of increasing competition and driving down prices.

What claim do the airlines have to public assistance? If they are going to be on the receiving end of a massive public bailout, it's time first to admit that deregulation has been a colossal failure.

Initially, that decision was ballyhooed as a free-market triumph, a true success story that made the case for deregulation and privatization. A smattering of startup airlines joined the skies; the price of a plane ticket fell; the number of fares sold increased dramatically.

But quickly, the airlines began to merge, and the industry became an oligopoly (if you're feeling charitable) or a cartel. The airlines dropped unprofitable routes, many of them direct flights, and went to work upping bag fees and cutting back on meals, entertainment, and the size of their seats in coach, infuriating consumers while racking up massive profits. Study after study began to find that airfares had actually fallen more rapidly before Carter's Airline Deregulation Act, and that, if the CAB had been allowed to continue enforcing its long-standing formulas for setting maximum fares, prices would have been considerably less than the free-market offering. As a result, U.S. airlines currently pull in net profit margins of 7.5 percent, which is twice the average for airline companies internationally. Meanwhile, the U.S. hasn't seen a new scheduled passenger airline come into existence since 2007.

Like what you're reading? Chip in...

So what claim do those airlines have to public assistance? If they are going to be on the receiving end of a massive public bailout, it's time first to admit that deregulation has been a colossal failure and begin to reverse its course. And if the federal government is going to assume financial responsibility, it should do so only on the grounds that the airlines will be again treated as public utilities, providing a narrowly defined public service that society needs to function.

That could take a number of different forms. The government could set the stock price at zero, while assuming the operations and the debt obligations of the major carriers. Such a decision might make investors howl, but they have little claim to being made whole: They reaped massive financial benefit, in the form of dividends and escalating stock prices, from a risky, self-sabotaging management scheme that they could have sold out of at any time. Already, they benefit from massive public investments in air travel infrastructure and lax environmental standards, and could not exist without them. A refusal to pay them off would help discourage the runaway financialization that has wreaked havoc in the U.S. economy. But even a more generous package—a financial bailout package that results in the public holding a majority of shares—could have a similar salubrious effect on air travel in America.

Such a move would allow the government to rein in an industry that is already abhorred by consumers nationwide, while also, simultaneously, affording the American public a head start on tackling the exorbitant environmental impact of the airline companies, which are some of the most flagrant polluters on the planet. The United Nations has forecasted that greenhouse gas emissions from airplanes would triple by 2050, a figure that recent estimates say is an undercount. The International Council on Clean Transportation found in September that emissions from global air travel may be increasing more than 1.5 times as fast as the U.N.'s estimate. By one count, aviation could take up a quarter of the world's carbon budget by 2050.

Not only does the U.S. airline industry deliver miserable customer service, but it is also a unique environmental hazard. Last year, flights from airports in the United States were responsible for almost one quarter of global passenger flight–related carbon dioxide emissions. On this metric, we're number one, above China and Japan.

The nationalization of the American airline industry could not only deliver travelers from the horrors of air travel, but it could also forge a path out of our 2008-grade thinking when it comes to public intervention in the market. The airlines now present an opportunity to remedy some of the most misguided policy decisions, not just of the past decade, but the past 40 years. And instead of wasting our time with marginal environmental improvements like carbon offsets and tighter emissions standards, returning the airlines to public-utility status could set the tone for decarbonization in other industries as well, including the energy system, where it's sorely needed. As the climate crisis becomes increasingly urgent, these sorts of steps have become essential. It might even bring the end of the basic economy seat.