https://www.cbpp.org/blog/presidents-health-reform-vision-1-trillion-in-cuts-no-plan-to-protect-people-with-pre-existing

Wednesday, February 12, 2020

President’s “Health Reform Vision”: $1 Trillion in Cuts, No Plan to Protect People With Pre-Existing Conditions [feedly]

https://www.cbpp.org/blog/presidents-health-reform-vision-1-trillion-in-cuts-no-plan-to-protect-people-with-pre-existing

Tuesday, February 11, 2020

Tim Taylor: South Africa: Mired in Stagnation [feedly]

http://conversableeconomist.blogspot.com/2020/02/south-africa-mired-in-stagnation.html

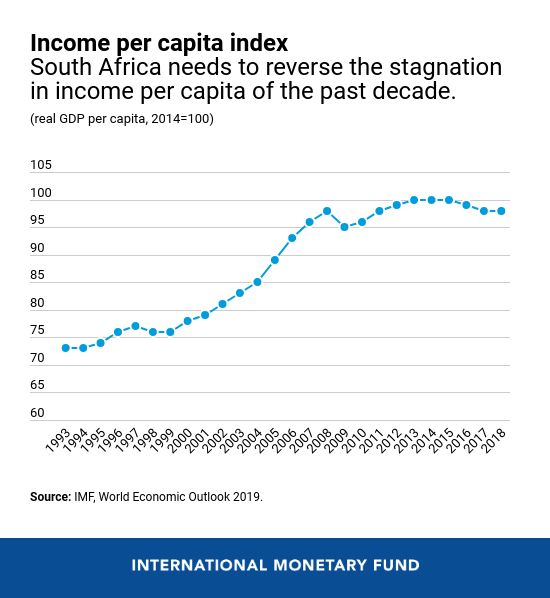

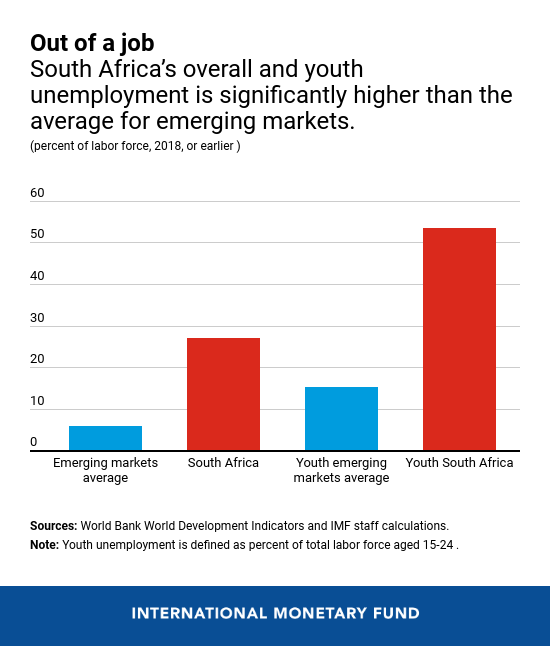

Other IMF stats show that overall unemployment is 25% and youth unemployment exceeds 50%. A combination of high-income cities like Johannesburg and Pretoria and low-income urban slums and rural areas have also combined to make South Africa one of countries with highest levels of income inequality.

The IMF just completed an evaluation of South Africa's economic situation a few weeks ago. Also, in August 2019, South Africa's Treasury department published a list of suggested reforms. What are some themes that emerge about what has gone wrong and what needs to be done?

1) Many of South Africa's state-owned enterprises (SOEs) seem to be in disastrous shape, and the biggest disaster is ESKOM, the electricity public utility. The IMF writes:

Most SOEs face elevated costs arising from bloated wage bills and costly procurement. Cost increases have outstripped tariff increases and cuts in capital expenditure, and debt service burden has risen, keeping SOEs net cash flows negative. Eskom is by far the largest SOE and its position is particularly critical, with an operational balance insufficient to service its high debt—around 10 percent of GDP. ... Corruption, delays in debt-financed investments, and expensive procurement have generated cost-overruns and left Eskom reliant on outdated plants vulnerable to breakdowns (the average age of the fleet is 37 years).

2) In substantial part because of subsidies to the state-owned enterprises, South Africa's government is already running large fiscal deficits--which of course makes it difficult to focus resources on social spending. The IMF writes:

In the early and mid-2000s, annual output growth averaged about 4 percent, fiscal deficits turned to small surpluses, and public debt declined to 27 percent of GDP. By contrast, starting in the late-2000s, private investment's contribution to growth fell considerably, and total factor productivity (TFP) growth became negative, dampening growth to slightly above 1 percent. Following the countercyclical easing at the time of the global financial crisis, fiscal deficits have remained wide at around 4½ percent of GDP, more than doubling public debt to close to 60 percent of GDP.

3) Product markets in South Africa strongly favor large incumbent firms, and choke off new competitors. The IMF again:

Several economic sectors, including manufacturing and banking, are dominated by a handful of big players with significant market power. High concentration has inhibited the emergence of smaller firms, which are powerful job creators in other EMs [emerging markets]. SMEs [small and medium enterprises] have shrunk in importance relative to large firms in the past decade. Staff analysis suggests that rising input costs and markups are associated with declining economic growth. This is clearly the case of large SOEs that pass-on high costs to businesses, thus sustaining elevated priceOne striking comparison looks at "mark-ups" across countries--that is, how much are the prices that countries charge above marginal cost of production? Here's a study that looks at the change in mark-ups over time, compared to the rise in marginal costs.

levels and reducing the economy's competitiveness. Firms subject to restrictive procurement and labor regulations also suffer from high costs and low productivity. A distributional analysis suggests that the poor are more affected as they face both fewer employment opportunities and higher prices.

Here's another figure looking at concentration in the retail industry, which is often an industry that can be friendly to new entrants. South African retail is far more concentrated than the comparison countries.

4) South Africa is experiencing a labor market mismatch, where much of the job growth is in higher-skilled jobs and much of the unemployment is among lower-skilled workers. Moreover, requiring that state-owned enterprises pay high wages means that these firms try not to hire lower-skilled workers. As the IMF writes:

South Africa has a higher level of unemployment and lower labor force participation than both regional and emerging economies. With skill mismatches and economic growth tilted toward the most sophisticated sectors (finance, information technology, and specialized business services), the bulk of job creation benefits high-skilled workers as opposed to low-skilled workers and labor-intensive industries including agriculture, tourism, and manufacturing. Further, labor cost increases exceed productivity improvements—largely a reflection of the centralized wage bargaining that transmits labor cost increases to the rest of the economy—systematically keeping demand for labor (including for new entrants) significantly below employment needs. Firm closures further worsen the dynamics. ... Regulatory constraints that inhibit firms' ability to hire on a need basis limit employment opportunity, particularly for the inexperienced and the youth. To justify payment of centrally bargained wage levels, firms prefer to hire skilled and experienced workers, who represent a small percentage of the population.This is why one of the main recommendations from the report of South Africa's Treasury focuses on "prioritizing labour-intensive growth in sectors such as agriculture and services, including tourism."

5) In the long run, a key element for South Africa will be its education system and other methods of getting future employees the skills they need. South Africa's education system is not performing well. From the IMF, here's a figure showing spending on education on the horizontal axis, and performance on the international PISA tests on the vertical axis. South Africa's performance lags far behind other countries with a similar level of spending.

The South African Treasury, before starting its discussion of reforming state-owned enterprises and all the rise, first emphasizes the importance of education in its report:

However, any attempt to raise South Africa's potential growth rate must include progress on the fundamental building blocks of long-run sustainable growth. First, there must be an emphasis on improving educational outcomes throughout the educational life-cycle ... The South African education system, which other countries have used to promote equality of opportunity, perpetuates inherited socio-economic disadvantage: if your parents are poor, the chances of your being poor are about 90 per cent (Finn et al. 2016). The lack of a transformative education system is a key factor in this persistence. Our educational outcomes are poor, even when compared to other less well-resourced countries in the region. This is a major driver of intergenerational inequality and inhibits the inclusivity of growth and global competitiveness. Since the highest return to human capital investments are associated with the earliest interventions, an educational life-cycle approach must include a strong emphasis on early childhood development, which has demonstrated the ability to: (i) improve long-term health outcomes (Campbell et al. 2014); (ii) boost earnings by as much as 25 per cent (Gertler et al. 2014); and (iii) generate a rate of return on investment of 7 to 10 per cent through better outcomes in education, health, and productivity (Heckman et al. 2010). Evidence of inadequate

teacher content knowledge (see Venkat and Spaull 2015) and significant reading deficits in primary schools (see Spaull and Kotze 2015) points to the need for a comprehensive reading plan for primary school learners drawing on successful experiences such as the provision of reader anthologies.

Second, we need to continue to implement youth employment interventions, including training opportunities that remove barriers to entering the labour market and apprenticeships based on close cooperation between technical, vocational, and other training institutions and the private sector to ensure that training needs are demand-driven (Bhorat et al. 2014). Investing in the capabilities and educational and health outcomes of young people is unlikely to yield a dividend unless the youth are absorbed by labour markets (Mlatsheni 2014).6) A separate report from the IMF also added a discussion of the problem of crime in South Africa. For illustration, here's the homicide rate in South Africa, which has dropped a bit since 2000 but remains very high.

Surveys of business in South Africa see the crime rate as one of the biggest problems.

International comparisons of businesses also suggest that crime is a particular problem in South Africa.

Overall, the in-depth discussion of policy steps by South Africa's Treasury sums up this way:

These growth reforms are organized according to the following themes: (i) modernizing network industries; (ii) lowering barriers to entry and addressing distorted patterns of ownership through increased competition and small business growth; (iii) prioritizing labour-intensive growth in sectors such as agriculture and services, including tourism; (iv) implementing focused and flexible industrial and trade policy; and (v) promoting export competitiveness and harnessing regional growth opportunities. We estimate the economy-wide impact of the proposed interventions over time based on when they can realistically be implemented, and find they can raise potential growth by 2–3 percentage points and create over one million job opportunities.There used to be a hope that South Africa's economy could provide provide both an example and an engine for lifting standards of living across sub-Saharan Africa. Back around 1995, for example, South Africa had about 7% of the total population of sub-Saharan Africa, but the GDP of South Africa was about one-third of total GDP for the region. By 2018, however South Africa had about 5% of the population of sub-Saharan Africa, but 21% of the total GDP of sub-Saharan Africa. The blunt truth seems to be that South Africa's government has not delivered in the last decade on many important outcomes: not in education and training, running state-owned enterprises, providing a climate for new businesses to start, not in reducing inequality, getting crime under control, or keeping government debt manageable

-- via my feedly newsfeed

Monday, February 10, 2020

Branko Milanovic: Transcending Capitalism: Three Different Ways? [feedly]

https://www.globalpolicyjournal.com/blog/10/02/2020/transcending-capitalism-three-different-ways

-- via my feedly newsfeed

Sunday, February 9, 2020

Economic Update - Capitalism's Uneven Development [feedly]

https://economicupdate.podbean.com

-- via my feedly newsfeed

Global R&D:The Stagnant US Position [feedly]

http://conversableeconomist.blogspot.com/2020/02/global-r-stagnant-us-position.html

In the US, government spending on R&D has been pretty flat for the last decade or so; instead, it has been business spending on R&D leading the way. Business involvement in R&D spending is clearly a good thing, because it suggests that business are seeing ways to bring new discoveries into the day-to-day operations. However, there are also concerns that when it comes to research and development, business can be heavier on the "D" and lighter on the "R." The giant corporate laboratories of the past like AT&T's Bell Labs, Xerox's Palo Alto Research Center, IBM's Watson Labs, and DuPont's Purity Hall have diminished in scope or closed altogether. Relatively few modern companies finance research in basic science, or in long-horizon, high-risk projects that may turn out to be central to whole new industries.

When confronted with these kinds of issues, a standard US response is to raise suspicions that the quality of R&D being done in China or across other countries of east and south Asia may not be very high. It's of course hard to measure the quality of research, but one method is to look at whether research articles are heavily cited by follow-up research. The NSF report explains:

The impact of an economy's S&E [science & engineering] research can be compared through the representation of its articles among the world's top 1% of cited articles, normalized to account for the size of each country's pool of S&E publications. This normalized value is referred to as an index and is similar to a standardized score. For example, if a country's global share of top articles is the same as its global share of all publication output, the index is 1.0. The U.S. index was 1.9 in 2016, meaning that its share of the top 1% of cited articles was about twice the size of its share of total S&E articles (Figure 22). Between 2000 and 2016, the EU index of highly cited articles grew from 1.0 to 1.3 while China's index more than doubled, from 0.4 to 1.1, indicating rising impact from both areas.

I often see proposals for the US to focus on building its transportation infrastructure, like roads, bridges, railroads, and airports. One can certainly make a reasonable case for such investments. But I also suspect that transportation spending is not going to be the main driver for leading global economies for the remaining four-fifths of the 21st century. A serious national conversation on how best to expand US R&D spending substantially is overdue.

-- via my feedly newsfeed

Saturday, February 8, 2020

Cosatu Wants Workers to Have $6.9 Billion Stake in Eskom [feedly]

https://www.bloomberg.com/news/articles/2020-02-08/cosatu-wants-workers-to-have-6-9-billion-stake-in-eskom

The Congress of South African Trade Unions, the country's biggest labor federation and a key ally of the ruling party, said it wants the 104 billion rand ($6.9 billion) of Eskom Holdings SOC Ltd.'s debt held by the state pension fund manager to be converted into equity owned by workers.

The proposal, made in an opinion piece in Business Day newspaper by Cosatu's General Secretary Bheki Ntshalintshali, is part of a deal the labor federation is trying to reach with business and government to rescue Eskom. The utility can't supply sufficient power to the country and has 454 billion rand in debt.

"This will result in workers becoming shareholders in the power utility," he said, without giving further details.

Eskom is seen as key to South Africa's economic performance and the country's ability to hold onto its last investment grade credit rating. Regular power cuts are hindering output in Africa's most industrialized economy.

Ntshalintshali also recommended that at least 10% of all pension funds, whether private or government owned, be invested in government bonds geared toward social investment and employment creation.

"Workers believe that their retirement funds can contribute toward economic growth, socially desirable investments and employment creation," he said.

The raising of the possibility of so-called prescribed assets is likely to anger investors who are opposed to having their investments dictated by government.

-- via my feedly newsfeed

Friday, February 7, 2020

Another solid jobs report, with lots of evidence that there’s still room-to-run in this labor market. [feedly]

http://jaredbernsteinblog.com/another-solid-jobs-report-with-lots-of-evidence-that-theres-still-room-to-run-in-this-labor-market/

Employers added 225,00 jobs last month as the unemployment rate ticked up slightly to 3.6 percent, largely due to more people entering the job market, yet another sign that there's still room-to-run in this long labor-market expansion. Wage growth, a perennial soft spot in recent jobs reports, ticked up slightly to a yearly rate of 3.1 percent, around where it has been for much of the past year. That's ahead of inflation, last seen running at 2.3 percent, but the fact that the wages have not accelerated suggests some degree of slack remains in the job market (other wage and compensation series show roughly similar stability).

Our monthly smoother pulls out trends in job growth by averaging monthly gains over 3, 6, and 12 months. The pattern it shows is interesting and revealing. Over the past 12 months, job gains average 171,000 per month. Yet that average has accelerated over the past 3 months. Typically, as the job market closes in on full capacity, job gains tend to decelerate, much the way you have to pour more slowly as you reach the brim of a glass to avoid spillage (which, in this analogy, is inflation). Instead, we're seeing no such deceleration, another sign of room-to-run.

In a similar vein, the closely watched employment rate for prime-age workers (25-54) continues to rise, and at 80.6 percent now stands above its 2007 peak of 80.3 percent. However, that's more of function of job gains for women than for men. Prime-age men's employment rate is still 1.4 percentage points short of its 2007 peak, while women have surpass their peak by almost 2 points. This partially reflects job gains is services versus recent job losses in manufacturing.

Factory employment fell again last month, down 12,000. Over the past 12 months, factory jobs are up just 26,000, one-tenth their gains over the prior 12 months (267,000). This clearly relates to Trump's trade war, and while the recent "phase one" agreement with China may improve conditions in the sector–though I doubt it will have much impact–it will take time for trade flows to recover. Note also that blue-collar weekly earnings in the sector are up just 1.3 percent over the past year, a full point below inflation, meaning weekly paychecks for blue-collar factory workers are falling in real terms.

Today's report includes the BLS's annual benchmark revision to the payroll jobs data. In order to adjust the jobs data to more closely reflect a true census of the underlying jobs count, once a year the Bureau adjusts the level of jobs in the previous March up or down by factor based on more complete data. That factor this year was -514,000, a larger than average downward revision (the average revision, without regard to its sign, is 0.2% of payrolls; this one was 0.3%). The revision is "wedged" into the jobs data at a rate of -43,000 per month between April 2018 and March 2019. The negative revision for retail trade was particularly large, at -159,000, or 1 percent, likely a symptom of the accelerating loss of brick-and-mortar retail outlets at the hands of online competition.

The figure shows the difference between the level of payrolls before and after the revision. The new results do not change the fact that the historically long jobs recovery has been solid in terms of job quantity (job quality remains a significant problem). But the new trend is notably less robust than was previously recognized.

The wage-growth story remains much the same as it has been in recent months: stable gains but, despite the tight job market, no acceleration. The figures show annual, nominal wage gains for all and middle-wage private sector workers (the dark lines are 6-month trends). In both cases, we see clear evidence of slowing gains. Both series are beating inflation, so hourly wages are growing in real terms, but the pause in their upward trajectory is evidence that there's still slack in the job market. Other wage series show similar, though less stark, stabilization in recent months.

Another critique of recent wage trends is that while they're clearly being nudged up by the tight labor market, the trends are not as positive as you'd expect given the lowest unemployment rate in 50 years. One way to investigate this claim is to construct a statistical model, including labor market slack, to predict wage growth. If the predictions map closely onto the actual series, then perhaps wage growth is about where you'd expect, i.e., not too low, even given the tight job market.

Source: BLS, see text

The "full smpl" line in the figure below shows the results of such a model for mid-wage workers. The line cuts right through the actual trend in hourly wage growth, suggesting there's no gap between expected and actual wage gains.

However, this isn't quite the right way to do test this question. If the relationship between unemployment and wage gains has diminished over time, that change gets built into model estimates like this one. The way to account for that potential problem is to run the model through an earlier year and predict "out-of-sample." The "smpl thru 2010" line shows the result from this approach. Sure enough, it predicts wage growth closer to 4 percent than the current growth rate of X percent. In other words, at least by this simple model, it's not unreasonable to expect faster wage gains than we're seeing.

See the data note below for details and caveats.

Summing up, labor demand remains admirably strong in the US job market, which shows few signs of age. And equally importantly, labor supply is responding to the demand, as the job market continues to pull people in. On the down side, the trade war has clearly damaged export-oriented sectors, especially manufacturing, both on the job and wage side. Moreover, even with unemployment persistently near a 50-year low, wage growth, at least in these data, has stopped climbing. This, along with low, steady inflation data, clearly implies there's still slack left in the job market, with no rationale at all for the central bank to tap the brakes on growth.

Data note on wage model: The model's dependent variable is year-over-year quarterly hourly wage growth for production, non-supervisory workers. Regressors include a constant, the unemployment rate minus the CBO estimate of the natural rate, two lags of the DV, and "expected trend wage growth" taken from a recent Goldman-Sachs analysis. They define this variable as follows: "Trend wage growth is estimated as the sum of the Fed's measure of inflation expectations and a simple average of the backward-looking productivity growth trend and the Survey of Professional Forecasters' estimate of productivity growth over the next 10 years." The full sample goes for 1992q1 through 2019q4. The "out-of-sample" model runs through 2010.

Some analysts have correctly noted that unemployment doesn't capture slack as well as the prime-age employment rate, especially when it comes to correlating with wage growth. If I substitute the prime-age employment rate into the model, the difference between the two predictions is negligible. My point here is simply that those who think wage growth should be faster at 3.5 percent unemployment are not necessarily wrong.

-- via my feedly newsfeed

West Virginia GDP -- a Streamlit Version

A survey of West Virginia GDP by industrial sectors for 2022, with commentary This is content on the main page.

-

John Case has sent you a link to a blog: Blog: Eastern Panhandle Independent Community (EPIC) Radio Post: Are You Crazy? Reall...

-

---- Mylan's EpiPen profit was 60% higher than what the CEO told Congress // L.A. Times - Business Lawmakers were skeptical last...

-

via Bloomberg -- excerpted from "Balance of Power" email from David Westin. Welcome to Balance of Power, bringing you the late...