http://jaredbernsteinblog.com/2019-a-robust-year-for-job-growth-less-so-for-wage-growth/

Payrolls rose 145,000 last month, capping off a strong year for job gains with payrolls up 2.1 million over the year, an average of 176,000 per month. These are solid numbers, especially at this stage in a uniquely long expansion, but as we show below, their magnitude is well within historical context. In fact, in percentage terms, employment growth in 2019 posted the slowest growth rate (1.4%) since 2010. This, however, is to be expected, as such growth rates typically decelerate as recoveries grow older and the labor market closes in on full capacity (see data note at the end of this post).

The unemployment rate ended the year at 3.5%, a fifty-year low. Wage growth, however, disappointed last month, and has clearly decelerated in recent months, even at low unemployment. This important finding suggests a) job quantity in this labor market expansion is stronger than job quality, b) many workers still suffer weak bargaining clout, and c) based on both recent wage and price movements, we are not yet at full employment.

Our monthly smoother shows monthly gains using 3, 6, and 12-month averages. All three bars are of a similar height, meaning the underlying trend of monthly payroll gains is around 180,000, an impressively large number for a record-long job recovery that's been ongoing for about a decade.

The figure below provides more context, showing average monthly payroll gains since 2000. Last year was around the middle of the pack in terms of its magnitude, but the figure provides a good look at the cumulative job gains that occur in a long, robust jobs expansion compared to the much shorter one in the 2000s.

While both nominal and, more importantly from the perspective of workers' living standards, real paychecks have gotten a boost from the tight labor market over the past few years, they remain a soft spot. The figures below show hourly wage gains, year-over-year, for all private sector workers and for mid-level workers. The figure for all workers rose a lot more strongly last year than in 2019, when, despite a tight labor market, it began to decelerate (this series is more pessimistic than some, but others series show a similar flattening).

The next figure provides similar context showing nominal hourly wage gains for each year, 2000-19 (wage growth for the "all" group is only available since 2007). Last year's deceleration is clear, but the height of the bars is still commensurate with earlier periods of tight labor markets.

The next figure shows real wages (with 2019 values based on my forecast of December's inflation rate). Here again, we see real gains for workers in 2019, but less so than both last year and earlier years in this expansion (one reason for this finding is that inflation was exceptionally low in 2015). A relevant input to this real wage analysis is the fact that productivity growth has slowed over this period. Higher productivity growth allows firms to pay more while maintaining profit margins. Conversely, at lower productivity growth, workers' diminished bargaining power becomes a bigger constraint on their pay, a factor that is increasingly disadvantageous in our era of growing employer power in key industries such as retail, health care, and technology.

Another clear labor-market soft spot is the manufacturing sector. The year ended with a loss of 12,000 jobs; the sector added just 4,000 jobs per month in 2019 compared to 22,000 in 2018. As a share of total employment, manufacturing was 8.4% last month, its second lowest share of record going back to 1939. Of course, this is the result of a long-term shift from goods to service production, one that is common to advanced economies, but research clearly links the recent decline in manufacturing to Trump's trade war.

In sum, 2019 was a good year for low unemployment and job gains. Yes, the latter is down relative to earlier years in the expansion, but that's expected at this stage (see data note below). The crucial macroeconomic lesson is that the U.S. can run a much hotter for much longer labor market than many economists and Federal Reserve policy makers heretofore believed. Even at a 50-year low for unemployment, wage and price pressure remain at bay.

That said, wage trends and manufacturing employment remain conspicuous and important problems, however, and both should be addressed by policies that strengthen worker bargaining power and boost the international competitiveness of exporters.

Data note: There are various ways to calculated annual changes over calendar years. In the above analysis, we take employment and percent changes from December over December, e.g., from December 2018 to December 2019. In our view, this is the best way to summarize the growth over the year versus, say, compared the average payroll level for year t with year t-1. We also note that these payroll values will shortly be revised, though the broad trends described above will remain intact.

Evidence for the claim that employment growth eventually slows as expansions age can be seen in the figure below, which plots year-over-year percent changes in payrolls, with recession shading. As expansions age, this variable eventually decelerates. We quantify this by regressing the change in payrolls (either raw numbers or percent changes) on a trend and trend-squared that grows with each expansion (so the first month in each expansion is '1', the second is '2', etc. and recessions are '0's') we find a significantly non-linearity in this variable. That is, the trend expansion variable is positive (as expected) and the squared value is negative, with both coefficients highly significant.

Source: BLS

None of this should be taken to imply that the expansion is soon to fade to recession. First, there is no evidence of labor market or broader economy overheating, either in the wage or especially in the inflation data. Moreover, there are no obvious credit bubbles of the type that have ended recent expansions. In fact, as Goldman Sach's Jan Hatzius has pointed out, household and firm balance sheets look fairly healthy. In fact, our simple payroll model described above predicts considerably slower payroll growth right now relative to the actual growth rate—about 1% vs. the actual 1.4%–implying this expansion, even at its advanced age, is chugging along at a safe clip, at least for now.

-- via my feedly newsfeed

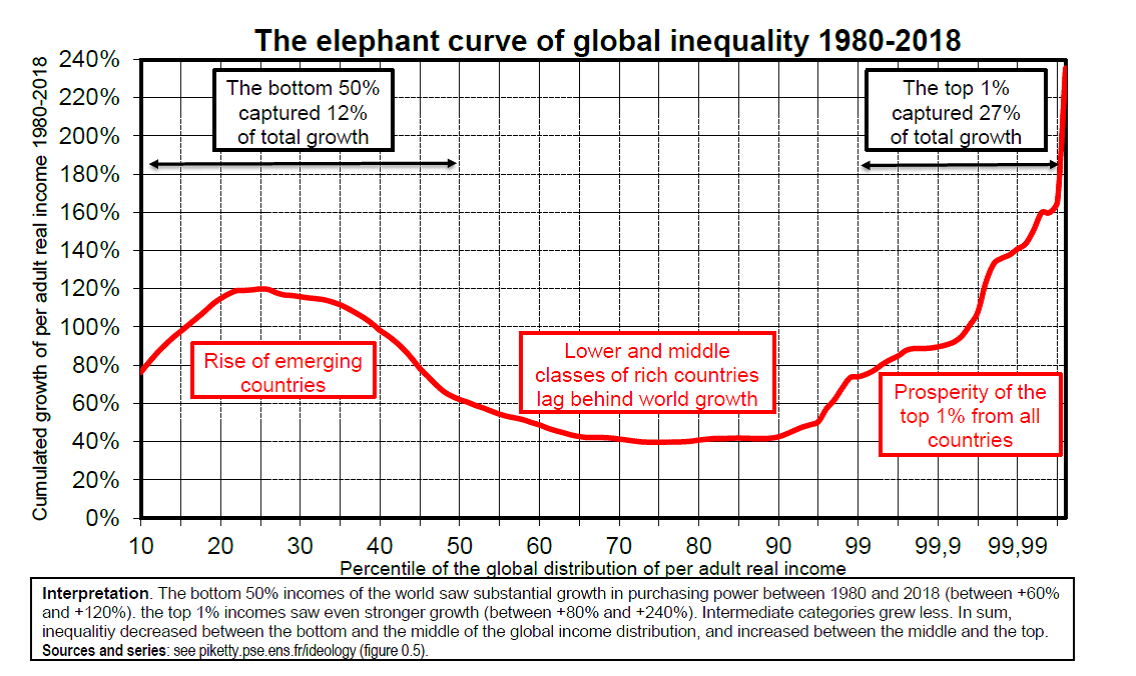

In the wake of the denial of global warming, now on the wane, at least superficially, are we at present witnessing the denial of the rise in inequality?

In the wake of the denial of global warming, now on the wane, at least superficially, are we at present witnessing the denial of the rise in inequality?