https://www.cbpp.org/research/poverty-and-inequality/poverty-line-proposal-would-cut-medicaid-medicare-and-premium-tax

More than 250,000 seniors and people with disabilities would lose their eligibility for, or receive less help from, Medicare's Part D Low-Income Subsidy Program, meaning that they would pay higher premiums for drug coverage and more out of pocket for their prescription drugs. Meanwhile, more than 150,000 seniors and people with disabilities would lose help paying for Medicare premiums, meaning that they would have to pay premiums of over $1,500 per year to maintain Medicare physician coverage.

More than 300,000 children would lose comprehensive coverage through Medicaid and the Children's Health Insurance Program (CHIP), as would some pregnant women. In addition, more than 250,000 adults who gained Medicaid coverage from the Affordable Care Act's (ACA) expansion would lose it.

More than 150,000 consumers who buy coverage through the ACA marketplaces would lose eligibility for or qualify for reduced cost-sharing assistance, increasing their deductibles by hundreds or even thousands of dollars. And tens of thousands would lose eligibility for premium tax credits altogether, driving their premiums up, in many cases by thousands of dollars. In addition, millions of consumers who buy coverage in the marketplace would still get premium tax credits, but their credits would be smaller. They, too, would thus have to pay higher premiums; these increases would start small but would grow over time.

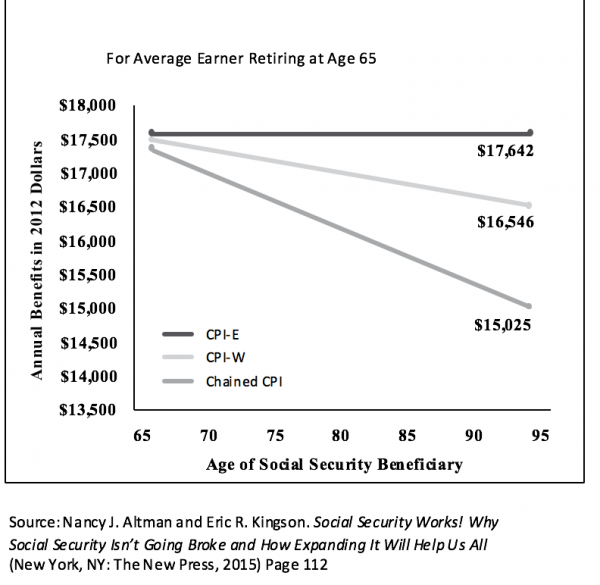

EITHER CHANGE WOULD LIKELY MAKE THE POVERTY LINE LESS ACCURATE OVERALL WHILE ALSO INCREASING THE NUMBER OF PEOPLE WITHOUT HEALTH INSURANCE AND EXPERIENCING OTHER FORMS OF HARDSHIP.The Administration, through an Office of Management and Budget notice, has requested public comment on changing the measure used to adjust the poverty line each year for inflation using an alternative index, such as the chained Consumer Price Index (CPI) or the Personal Consumption Expenditures Price Index (PCEPI). Both measures rise more slowly than the current measure, the CPI for All Urban Consumers (CPI-U).[3] As a result, either alternative measure would result in a lower poverty line, and the gap between the poverty line under the current versus either of the proposed methodologies would widen each year. The Administration claims that it seeks to make the poverty line more accurate, but, as explained below, either change would likely make the poverty line less accurate overall while also increasing the number of people without health insurance and experiencing other forms of hardship.

This analysis focuses on the impact of updating the poverty line using the chained CPI; using the PCEPI would have a somewhat larger effect, meaning that even more people would lose eligibility for health coverage programs, and the cuts to these programs would be even larger.[4]

FIGURE 1

Proposed Change Would Have Wide-Ranging Impacts on Health Programs

Over time, the change to the poverty line would cut a wide range of health programs. (See Figure 1.) By the tenth year, the annual cut across federal health coverage programs would total in the billions of dollars, Congressional Budget Office (CBO) estimates indicate.[5] That's because millions of people would either lose eligibility for these programs or receive less help. Based on the current income distribution of program enrollees relative to the poverty line, we estimate that updating the poverty line using the chained CPI would, after ten years, have the effects described below. These estimates are subject to significant uncertainty, but, taken as a whole, they provide a snapshot of the wide-ranging impact the Administration's proposal would have across health programs.[6] (For a detailed explanation of the methodology behind our estimates, see the Appendix.)

The impacts of the proposal would also continue to grow after the tenth year: impacts on program eligibility thresholds would roughly double between the tenth and twentieth year the policy was in effect (and continue growing after that).

Impact on Seniors and People With Disabilities Covered Through Medicare

While eligibility for Medicare does not depend on income, lower-income Medicare enrollees qualify for help paying premiums, deductibles, and other cost sharing through Medicaid or the Medicare Low-Income Subsidy (LIS) program. In many cases, eligibility for that assistance is based on the federal poverty line.

Medicare enrollees can qualify for extra help through Medicaid in one of two ways:

They can qualify for full Medicaid benefits, including help with Medicare cost sharing and long-term care services and supports (which Medicare does not cover), generally either because they have incomes below certain thresholds (or high medical need relative to their incomes) or because they qualify for the Supplemental Security Income program.

They can qualify just for Medicaid programs that help with Medicare cost sharing, generally based on whether they have income below 100 or 135 percent of the poverty line.

Medicare enrollees who qualify for extra help through Medicaid also qualify for the LIS program, which helps pay premiums and cost sharing for Medicare prescription drug coverage (Medicare Part D). In addition, Medicare enrollees not enrolled in Medicaid can qualify for either full or partial LIS benefits based on whether they have income below 135 or 150 percent of the poverty line.

After ten years of updating the poverty line using the chained CPI:

More than 250,000 low-income seniors and people with disabilities would lose eligibility for, or get less help from, the LIS Program, substantially increasing their prescription drug costs.Most of these people would no longer be eligible for the full LIS benefit. Based on 2019 program parameters, they would have to pay premiums of about $100 per year, instead of no premiums, to maintain prescription drug coverage through Medicare Part D; would have a standard deductible of $85, instead of no deductible, for their Part D coverage; and would pay 15 percent of the cost of drugs (instead of small copayments) once they meet the deductible (and until they hit the catastrophic limit, $5,100 in out-of-pocket spending).[7]Others would lose eligibility for the partial LIS benefit. Based on 2019 program parameters, that means they would have to pay premiums averaging about $400 instead of about $300 per year to maintain prescription drug coverage through Medicare Part D; would have a standard deductible of $415, instead of $85, for prescription drug coverage; and would pay 25 percent or more, instead of 15 percent, of the cost of their drugs once they meet the deductible and until they reach the catastrophic limit.[8]

More than 150,000 low-income seniors and people with disabilities would lose eligibility for a Medicaid program that covers their Medicare Part B premium. That means they would have to pay premiums out of pocket to maintain Medicare coverage for physician and other outpatient care. The 2019 Part B premium is $1,626 per year ($135.50 per month).

Many other low-income seniors and people with disabilities would lose eligibility for a Medicaid program that helps them afford their Medicare deductibles and other cost sharing.[9] Since Medicaid would no longer cover their Medicare hospital or physician cost sharing, they could face a hospital deductible of $1,364, a physician services deductible of $185, and additional co-insurance and copays (based on 2019 program parameters), compared to generally no cost sharing currently.

Impact on Children and Adults Covered Through Medicaid and CHIP

Most child and adult enrollees qualify for Medicaid and CHIP based on their incomes, and the income cut-offs for these programs are generally based on the federal poverty line. After ten years of updating the poverty line using the chained CPI:

More than 300,000 children would lose Medicaid or CHIP coverage, and some pregnant women would lose Medicaid or CHIP coverage, as well. In the median state, the policy change would be equivalent to lowering the eligibility threshold for children from 255 to 250 percent of the poverty line, calculated using the current methodology, and for pregnant women from 205 to 201 percent of the poverty line.[10]

More than 250,000 adults who gained coverage from states' expansion of Medicaid through the ACA would lose it, because the policy change would effectively lower the income threshold for coverage from 138 percent to about 135 percent of the poverty line. Some very low-income parents covered through Medicaid in non-expansion states also would lose coverage.

Most of these enrollees would likely qualify for subsidized coverage through the ACA marketplaces. But not all would. Parents in non-expansion states would fall into the "coverage gap:" their incomes would be too high for Medicaid and too low to qualify for marketplace tax credits. And people whose employers offer them coverage usually can't qualify for premium tax credits through the marketplaces, even if the employee premium for their coverage is higher than they can realistically afford. This can be a particular barrier to coverage for children, because, due to the so-called "family glitch," the entire family is ineligible for premium tax credits if a parent is offered self-only coverage with an employee premium below 9.86 percent of income, even if the premium for family coverage is significantly higher.

Moreover, for near-poor adults losing Medicaid coverage, marketplace plans would generally come with higher premiums and cost sharing, leading to lower take-up of coverage and barriers to obtaining needed care.[11] Notably, the uninsured rate for adults with incomes just above the poverty line is about 34 percent in non-expansion states, where they have access to marketplace coverage, compared to 17 percent in expansion states, where they instead have access to Medicaid.[12] And for children losing Medicaid or CHIP, marketplace plans may offer less comprehensive coverage.[13] Overall, a significant number of those losing Medicaid or CHIP coverage as a result of the poverty line change would likely become uninsured, while many others would likely experience greater difficulty affording coverage or getting needed care.

In addition to people losing comprehensive coverage through Medicaid, many thousands of people, mostly women, would lose Medicaid coverage for family planning services. Twenty-five states provide Medicaid coverage for family planning services to people not otherwise eligible for Medicaid. In 22 of these states, eligibility is based on income relative to the poverty line, so the proposed change would cause people to lose coverage for these services, which are essential for women's health and family well-being.[14] (Many of these are states that have not taken up the ACA Medicaid expansion, and so even very low-income adults are not eligible for comprehensive Medicaid coverage.)

Impact on ACA Marketplace Consumers

Because premium tax credit eligibility and the credit amounts are calculated based on consumers' income relative to the poverty line, about 6 million marketplace consumers would see reductions in their premium tax credits and consequently have to pay higher premiums. These cuts would start small, but would grow over time.

Notably, almost all of these consumers also will see higher premiums due to another recent Administration action. Similar to the proposed poverty line change, the Administration's 2020 rule setting standards for the ACA marketplaces made a seemingly technical change to the formula for calculating premium tax credits, impacting tax credits and therefore premiums for millions of people.[15] After ten years, a family of four making $80,000 would pay over $300 more in annual premiums as a combined result of this change and the proposed change to the poverty line.

In addition, growing numbers of people would lose eligibly for premium tax credits or cost-sharing assistance altogether. After ten years of updating the poverty line using the chained CPI:

Tens of thousands of consumers no longer would qualify for premium tax credits at all, since the policy change would effectively lower the income cut-off for the tax credits from 400 percent to 392 percent of the poverty line. Older people and families would see particularly large premium increases, since they would lose tax credits worth thousands of dollars.

More than 200,000 consumers would face reductions in the cost-sharing assistance they receive, meaning that their deductibles, co-insurance, copays, and total limits on out-of-pocket costs would increase. That includes:

More than 50,000 people who would see their deductibles increase from about $250 to about $850, based on 2019 cost-sharing levels.[16]

More than 50,000 people who would see their deductibles increase from about $850 to about $3,200.

Tens of thousands of people who would see their deductibles increase from about $3,200 to about $4,400.

Administration's Arguments for Change Are Flawed

The Administration's argument for the potential policy change is that the chained CPI is a more accurate measure of inflation. But it is not clear whether the chained CPI is a more accurate measure for low-income households. For example, low-income households spend more of their income on housing, for which costs have been increasing faster than the overall CPI in recent years. Two recent studies suggest that, at least in recent years, inflation for low-income households has been higher than for the population as a whole.[17]

Meanwhile, evidence indicates that the poverty line is already below what is needed to raise a family. Considerable research over the years — including a major report by the National Academy of Sciences[18] — has identified various ways in which the poverty line appears to be inadequate. For example, the poverty line doesn't fully include certain costs that many low-income families face, like child care. In accordance with the guidance of the National Academy of Sciences panel, federal analysts worked carefully with researchers over a number of years to develop the Supplemental Poverty Measure (SPM), which more fully measures the cost of current basic living expenses. With this more careful accounting, the SPM's poverty line is higher than the official poverty line for most types of households, and its poverty rate is slightly higher than the official poverty rate.

By focusing on just one of many questions about the current poverty measure (how it is updated for inflation), and proposing a change that would lower the poverty line, the Administration's proposal would likely make the poverty line less accurate overall in measuring what families need to get by.[19] Consistent with this, the data show that households just above the poverty line have high rates of material hardship: for example, high uninsured rates and difficulty affording health care, as well as high rates of food insecurity.[20]

Importantly, no statute or regulation requires the Administration to revisit the current methodology for updating the poverty line. Rather, the Administration is making an entirely discretionary choice to consider a change that would weaken health coverage programs and increase uninsured rates and other hardship — part of a broader policy agenda of undermining health coverage programs.[21]

Appendix: Methodology Behind Estimates

Our estimates reflect the impact of updating the Census poverty thresholds using the chained CPI rather than the CPI-U for ten years, starting with the 2018 thresholds (which will be finalized in 2019), based on CBO's economic projections.[22] We adjust for changes in program enrollment, again using CBO projections. However, all of our estimates are based on the current income distribution of program enrollees relative to the poverty line, without taking into account how the income distribution may shift over the coming decade. In some cases, this limitation likely leads us to modestly overstate the impact of eligibility changes, but it should not change the qualitative conclusions.

Medicare enrollees. Our general approach is to use 2017 American Community Survey (ACS) data to estimate the share of Medicare enrollees with incomes between the current eligibility thresholds for various assistance programs and the lower thresholds that would result from updating the thresholds with the chained CPI for ten years. We apply these percentages to administrative tallies of the number of people enrolled in the relevant program and scale those estimates by CBO's projection of Part D LIS enrollment growth through 2029.

Specifically, to estimate the number of people losing eligibility for the Qualifying Individual (QI) program (which pays Medicare Part B premiums), we estimate the share of Medicare enrollees with incomes between 120 and 135 percent of the poverty line who fall into the income range that would lose eligibility. We apply that percentage to 2013 QI enrollment (the most recent available data) and scale based on projected LIS enrollment growth.

People losing eligibility for the QI program would also lose eligibility for the full LIS benefit. To estimate the number of additional people losing full LIS eligibility, we first estimate the number of people receiving full LIS benefits who are not enrolled in Medicaid. Based on CMS data on the number of dual eligible beneficiaries versus the number of LIS full benefit enrollees, more than 1 million people fell into this group in 2018. We estimate the share of Medicare enrollees with incomes below 135 percent of the poverty line who fall into the income range that would lose eligibility for the full LIS benefit, and apply that percentage to the number of full LIS beneficiaries not enrolled in Medicaid, and scale based on projected LIS enrollment growth.

Finally, to estimate the number of people losing eligibility for the partial LIS benefit, we estimate the share of Medicare enrollees with incomes between 135 and 150 percent of the poverty line who fall into the income range that would lose eligibility. We apply that percentage to 2018 partial LIS enrollment and scale based on projected LIS enrollment growth.

Medicaid and CHIP enrollees. To estimate the share of Medicaid expansion and child Medicaid and CHIP enrollees who would lose coverage, we use 2017 ACS data to determine the share of Medicaid adult expansion enrollees and Medicaid and CHIP enrollees with income between the current eligibility threshold for those programs and the lower eligibility threshold if the poverty line were to rise by chained CPI growth rather than CPI-U growth for ten years. For children, we account for state-level differences in Medicaid/CHIP eligibility thresholds. We then apply these percentages to CBO projections of Medicaid expansion enrollment and Medicaid and CHIP child enrollment in 2029.

Marketplace enrollees. To estimate the number of people losing eligibility for cost-sharing assistance or premium tax credits (or receiving reduced cost-sharing assistance), we use 2019 Centers for Medicare & Medicaid Services (CMS) plan selections data, scaled (adjusted downward) based on CBO's projections for the number of subsidized marketplace enrollees in 2029.

Specifically, we use the data CMS releases on the number of marketplace plan selections by people in different income groups (e.g., 100-150 percent of the poverty line, 150-200 percent of the poverty line) to estimate the number of people with income between the current eligibility thresholds for various forms of assistance and the lower eligibly thresholds that would result from the proposed change after ten years.[23] For example, since the change would lower the income cut-off for cost-sharing assistance from 250 to 245 percent of the current poverty line, we estimate that the number of people in the income range losing eligibility would be one-twentieth of the total number of people with incomes between 200 and 300 percent of the poverty line.[24] We also adjust these estimates for the share of consumers in each income group purchasing silver plans, since only those purchasing silver plans are eligible for cost-sharing assistance.

To estimate the number of consumers who would see immediate reductions in premium tax credits, we use CMS data on 2018 effectuated enrollment. Starting with the 8.9 million consumers receiving premium tax credits, we subtract the share of consumers who already have zero net premium (and therefore might not be affected by a cut to their premium tax credits) and the share with incomes between 300 and 400 percent of the poverty line (since tax credits would not change for people in this income range).[25]

TOPICS:

Health, Poverty and Inequality

End Notes

[1] Office of Management and Budget, Request for Comment on the Consumer Inflation Measures Produced by the Federal Statistical Agencies, May 7, 2019, https://www.federalregister.gov/documents/2019/05/07/2019-09106/request-for-comment-on-the-consumer-inflation-measures-produced-by-federal-statistical-agencies.

[2] The proposal would also affect many basic assistance programs beyond health-related ones; for a partial list, see Department of Health and Human Services, "What Programs Use the Poverty Guidelines?" https://www.hhs.gov/answers/hhs-administrative/what-programs-use-the-poverty-guidelines/index.html.

[3] The Office of Management and Budget notice requests comments on how the Census poverty thresholds are updated for inflation. The Department of Health and Human Services (HHS) calculates its poverty guidelines, which are the basis for program eligibility, based on the Census thresholds.

[4] After ten years, use of the chained CPI would reduce the poverty line by 2.0 percent, while use of the PCEPI would reduce the poverty line by 3.4 percent, according to CBO projections.

[5] In 2013, CBO produced estimates for two chained CPI proposals, one that would apply the chained CPI government-wide and an Obama Administration budget proposal that excluded the poverty guidelines and means-tested programs more generally from the change. Comparing the two estimates shows that government-wide use of the chained CPI would cut about $4 billion from means-tested health programs by the tenth year (and over $15 billion over ten years); most of these cuts are from the change to the poverty guidelines. See https://www.cbo.gov/system/files?file=2018-09/44231_ChainedCPI_0.pdfand https://www.cbo.gov/sites/default/files/cbofiles/attachments/Government-wide_chained_CPI_estimate-2014_effective.pdf.

[6] All figures are estimates of the number of people who would otherwise enroll in these programs who would lose eligibility (that is, they take into account that program take-up is less than 100 percent).

[7] For a more detailed description of LIS and Medicare Savings Program benefits, see https://www.ncoa.org/wp-content/uploads/part-d-lis-eligibility-and-benefits-chart.pdf and https://www.ncoa.org/wp-content/uploads/medicare-savings-programs-coverage-and-eligibility.pdf.

[8] These and other dollar figures for Medicare premiums and cost sharing correspond to 2019 program parameters. For a summary of the assistance available through the Medicare Low-Income Subsidy Program and the Medicaid Savings Programs, see the following resources from the National Council on Aging: https://www.ncoa.org/wp-content/uploads/part-d-lis-eligibility-and-benefits-chart.pdf and https://www.ncoa.org/wp-content/uploads/medicare-savings-programs-coverage-and-eligibility.pdf.

[9] The available data do not allow us to estimate the number of people falling into this group, but it would be at least tens of thousands and could be well over 100,000.

[10] This would occur unless states reset their eligibility thresholds to offset the federal change; it is unlikely that most states would do so.

[11] Jessica Schubel, "Partial Medicaid Expansions Fall Short of Full Medicaid Expansion With Respect to Coverage and Access to Care," Center on Budget and Policy Priorities, August 13, 2018, https://www.cbpp.org/research/health/partial-medicaid-expansions-fall-short-of-full-medicaid-expansion-with-respect-to.

[12] Center on Budget and Policy Priorities, "Frequently Asked Questions About Partial Medicaid Expansion," April 10, 2019, https://www.cbpp.org/research/health/frequently-asked-questions-about-partial-medicaid-expansion.

[13] Kelly Whitener and Tricia Brooks, "Marketplace Coverage Is Not an Adequate Substitute for CHIP," Georgetown Center for Children and Families, September 2017, https://ccf.georgetown.edu/wp-content/uploads/2017/09/Marketplace-v3.pdf.

[14] Guttmacher Institute, "Medicaid Family Planning Eligibility Expansions," May 1, 2019, https://www.guttmacher.org/state-policy/explore/medicaid-family-planning-eligibility-expansions.

[15] Aviva Aron-Dine and Matt Broaddus, "Change to Insurance Payment Formulas Would Raise Costs for Millions With Marketplace or Employer Plans," Center on Budget and Policy Priorities, updated April 26, 2019, https://www.cbpp.org/research/health/change-to-insurance-payment-formulas-would-raise-costs-for-millions-with-marketplace.

[16] Dollar figures for typical deductibles and out-of-pocket limits for consumers qualifying for different tiers of marketplace cost sharing assistance are from Kaiser Family Foundation, "Cost-Sharing for Plans Offered in the Federal Marketplace for 2019," December 5, 2018, https://www.kff.org/health-reform/fact-sheet/cost-sharing-for-plans-offered-in-the-federal-marketplace-for-2019/.

[17] See, for example, Greg Kaplan and Sam Schulhofer-Wohl, "Inflation at the Household Level," Journal of Monetary Economics, 2017, https://gregkaplan.uchicago.edu/sites/gregkaplan.uchicago.edu/files/uploads/kaplan_schulhoferwohl_jme_2017.pdf, and David Argente and Munseob Lee, "Cost of Living Inequality during the Great Recession," Kilts Center for Marketing at Chicago Booth — Nielsen Dataset Paper Series 1-032, March 1, 2017, https://ssrn.com/abstraSchct=2567357.

[18] Constance Citro and Robert Michael, eds., "Measuring Poverty: A New Approach," Committee on National Statistics, National Research Council, 1995, http://www.nap.edu/openbook.php?isbn=0309051282.

[19] For additional discussion, see Sharon Parrott, "Trump Administration Floating Changes to Poverty Measure That Would Reduce or Eliminate Assistance to Millions of Lower-Income Americans," Center on Budget and Policy Priorities, May 7, 2019, https://www.cbpp.org/press/statements/trump-administration-floating-changes-to-poverty-measure-that-would-reduce-or.

[20] About half of non-elderly adults just above the official poverty line showed one or more forms of financial insecurity, according to a December 2017 Urban Institute survey, similar to the share for the poor. Steven Brown and Breno Braga, "Financial Distress among American Families: Evidence from the Well-Being and Basic Needs Survey," Urban Institute, February 14, 2019, https://www.urban.org/research/publication/financial-distress-among-american-families-evidence-well-being-and-basic-needs-survey/view/full_report.

[21] For a list of other Administration actions undermining coverage, see https://www.cbpp.org/sabotage-watch-tracking-efforts-to-undermine-the-aca.

[22] In Medicaid, including the Medicaid Savings Programs and the Medicare Low-Income Subsidy Program, the programmatic impact would be felt in 2029. For marketplace premium tax credits and cost-sharing assistance, the programmatic impact would be felt in 2030.

[23] These data are available from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/2019_Open_Enrollment.html.

[24] Since CMS does not provide data on the number of people with incomes in the range just above 400 percent of the poverty line, we are not able to apply this same approach to estimate the number of people losing eligibility for premium tax credits. But based on the number of plan selections by people with incomes between 300 and 400 percent of the poverty line and the drop-off in the number of consumers at higher income levels across the income distribution, it would be in the tens of thousands.

[25] In the proposed Notice of Benefit and Payment Parameters for 2020, CMS reported that 17 percent of marketplace consumers have zero net premiums. We estimate the share with incomes between 300 and 400 percent of the poverty line based on the 2019 plan selections data.

-- via my feedly newsfeed