Trade and distribution

One of the remarkable implications of the theory of comparative advantage is that sharp distributional consequences are generically the flip side of the gains from trade. This point was first formalized in the famous Stolper-Samuelson (1944) theorem, which demonstrated that one of the factors of production would be left worse off in absolute terms as a consequence of opening up to trade. In a country where skilled labor is relatively abundant (compared to trade partners) and which has comparative advantage in skill-intensive goods, the loser would be unskilled labor. It is not simply that the gains from trade are distributed unevenly between skilled and unskilled labor; what is striking is that the losers suffer an absolute loss in real incomes.

The Stolper-Samuelson theorem is built on very specific assumptions: there are only two goods, two factors of production, and there is full mobility of factors between the two sectors of production. One might think that the stark distributional consequences it generates is a result of these specialized assumptions. In fact, the result is remarkably robust and generalizes very broadly. Consider a world with any number of factors of production and any number of goods. Factors could be mobile, immobile, or anything in between. Suppose production takes place under neoclassical assumptions: that is, producers maximize profits and minimize costs using conventional production functions. Then, as long as a country does not fully specialize – i.e., as long as it continues to produce very close substitutes for importables – opening up to trade must leave at least one factor of production worse off in absolute terms.[1] The result that openness to trade creates losers is not a special case; it is the implication of a very large variety of trade models.

Nevertheless, until recently it was not uncommon to dismiss this as a theoretical result with little empirical support. Early research by trade economists looked for effects across the skill divide, and the effects there were not that large. Trade seemed to account for perhaps 10-20 percent of the rise in the skill premium. In retrospect, it appears that this work missed the scale of the distributional effects because they mostly focused on the wrong margins. More recent work has focused on differences in labor markets across different communities and has uncovered much larger effects. Workers are apparently not very mobile spatially and communities that compete with imported goods can be hurt very badly by rising import competition.

Hakobyan and McLaren (2016) find that NAFTA produced modest effects for most U.S. workers, but an important minority suffered substantial income losses. Regions that were most affected by tariff reductions experienced significantly slower wage growth than regions that had no tariff protection against Mexico in the first place. The effect was greatest for blue-collar workers: a high-school dropout in heavily NAFTA-impacted locales had 8 percentage points slower wage growth over 1990-2000 compared to a similar worker not affected by NAFTA trade. The industry effect was even larger: wage growth in the most protected industries that lost their protection fell 17 percentage points relative to industries that were unprotected initially.[2] These are very large effects, especially when one bears in mind that the net gains from trade generated by NAFTA apparently have been quite small, less than 0.5 percent at best (Romalis 2007, Caliendo and Parro, 2015).

In a well-known paper Autor, Dorn, and Hanson (2013) have documented the labor-market disruption caused by the "China trade shock," which was not only large but also very persistent. These authors' unit of analysis is the commuting zone. Their baseline result is that a commuting zone in the 75th percentile of exposure to Chinese import growth had a differential fall of 4.5 percent in the number of manufacturing employees and a 0.8 percentage point larger decline in mean log weekly earnings, compared to a commuting zone at the 25th percentile. They also find a significant impact on overall employment and labor force participation rates, indicating that this is an additional margin of adjustment to trade shocks. As the authors stress, this implies that the wage reductions are under-estimated, both because of increase in non-participation and the fact that the unemployed are more likely to have lower ability and earnings. Moreover, these local labor-market effects appear to have been highly persistent. The wage, labor-force participation, and unemployment consequences had not dissipated after a full decade of the China trade shock (Autor et al. 2016).

Trade, fairness, and appropriate remedies

How should such distributional effects be remedied? In a market economy, labor markets are buffeted constantly by shocks of different types. Jobs can be lost or displaced because of demand shocks, technology shocks, management decisions, and a host of other reasons. Trade is only one source of labor market disruption, and normally far from the most important one. Most economists would probably agree that there should be some kind of compensatory mechanism (unemployment and training benefits) when the shocks hit those at the bottom end of the labor market. They would also agree, however, that the safety net should not discriminate by the type of shock. If we are going to help those who are adversely affected by labor market disruptions, we should treat those who are hit by import competition differently from those who are displaced — against their will — for other reasons.

The view that policy makers should not be concerned by the nature of the underlying shock is predicated on an implicit judgement that all market shocks are alike and therefore require identical responses, if any. But this judgement is not consistent with basic moral intuitions. To make the point as starkly as possible, consider the following thought experiment. Suppose Harry and John run two firms that compete with each other. How do you feel about the following scenarios?

- Harry works really hard, saves and invests a lot, comes up with new innovations, and outcompetes John, resulting in John and his employees losing their jobs.

- Harry gets a competitive edge over John by finding a cheaper supplier in Germany.

- Harry drives John out of business by outsourcing to a supplier in Myanmar, which employs workers in 12-hour a day shifts and under extremely hazardous conditions.

- Harry brings workers from Myanmar to the U.S. under temporary contracts, and puts them to work under conditions that violate domestic labor, environmental, and safety laws.

These scenarios are isomorphic from a purely economic standpoint insofar as each creates losers as well as gainers in the process of expanding the overall size of the economic pie for the national economy. That is, Harry's gains are larger than John's losses. They differ only in the manner in which these gains and losses are generated.

When I present these scenarios to my students, they react very differently to them, and I imagine most other audiences would too. Scenario 1 generally elicits the least opposition; what is happening seems to be the normal operation of a competitive market economy. Scenario 2 typically raises few concerns either – at least for an audience that is well educated and understands the benefits of international trade. But support drops sharply when I present scenarios 3 and 4. It appears there is something problematic with the exchanges described in the latter two scenarios. Some self-reflection may suggest that what is different is that these scenarios entail a form of market competition that would be considered unacceptable if it took place at home, and therefore has been legally ruled out in the domestic jurisdiction.

Some may remain unconvinced that the distributional burden created by scenario 3 is any different than that in scenarios 1 or 2. To economists, in particular, it may seem that the source of comparative advantage does not matter, even if it is abuse of labor rights. But then such economists should also be in favor of scenario 4 (which would of course break the law) – and I have met few who are willing to go that far. But then why should scenario 3 be OK if scenario 4 is not?

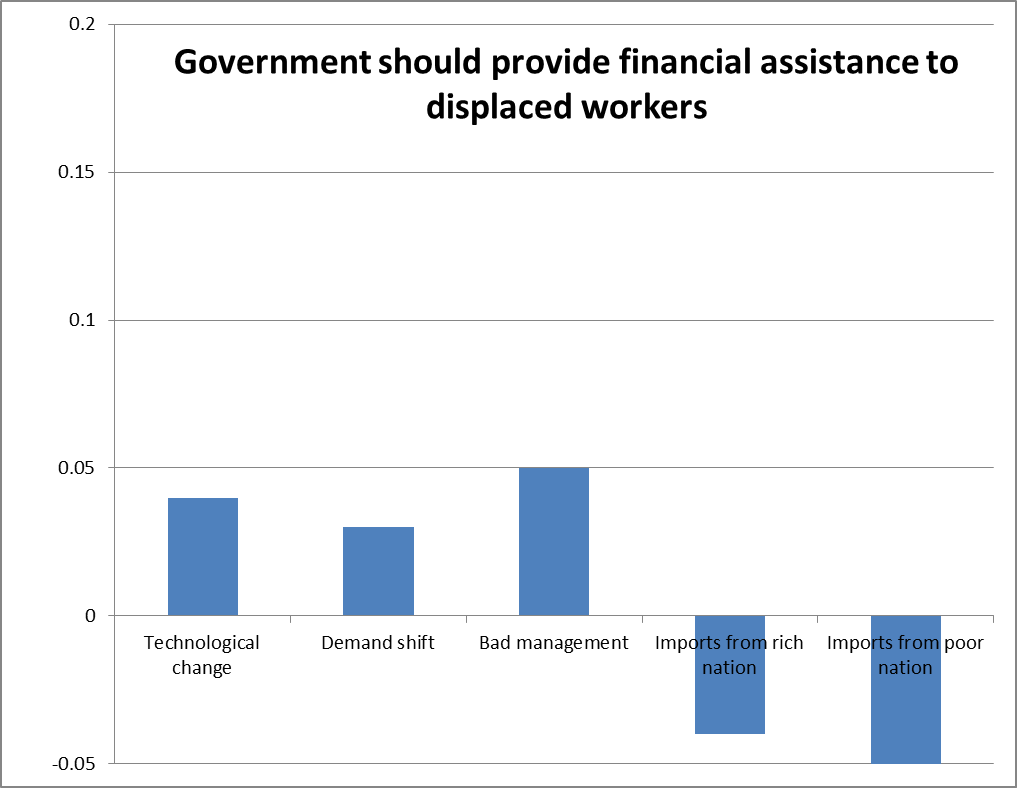

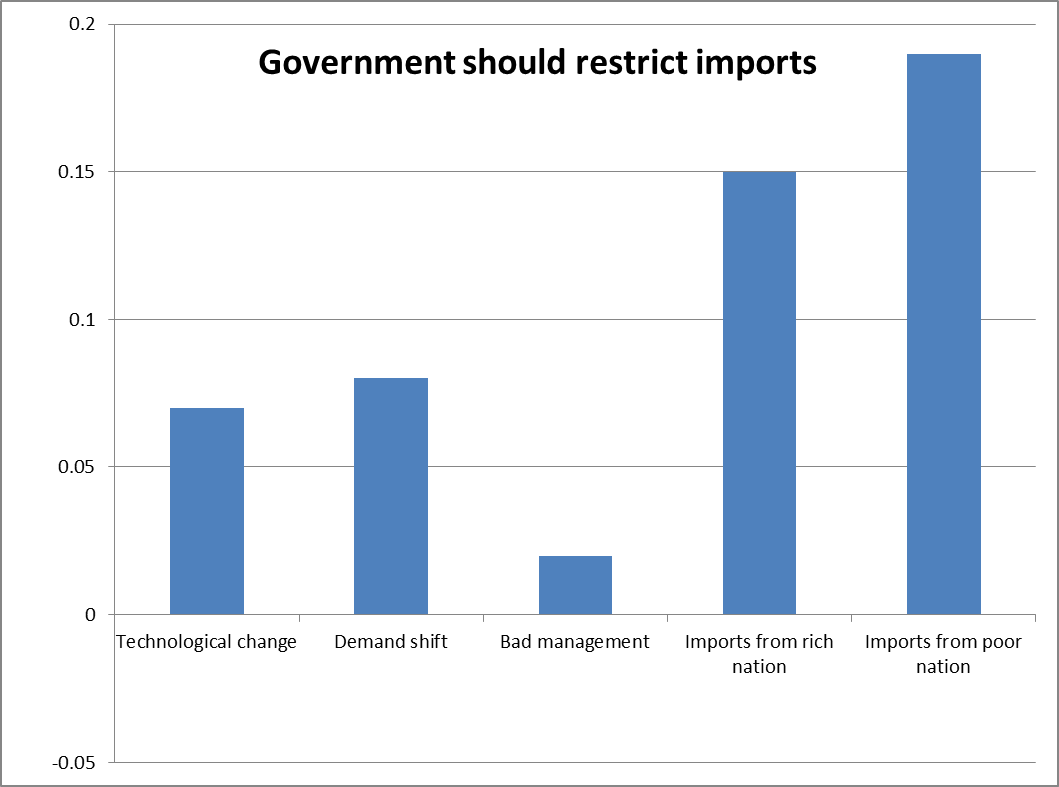

In recent work, Rafael di Tella and I carried out a survey in which we presented respondents with a news story about a possible factory closure that would leave hundreds of workers at risk of unemployment. Our "treatments" consisted of different explanations for why the factory might close. These included: a technological shock (automation), a demand shock (changing consumer preferences), management failures, and two trade shocks, outsourcing to a developed country (France) and outsourcing to a developing country (Cambodia). A control scenario where no specific shock is mentioned was also included. Then we asked two questions on how the government should respond: (a) whether the government should provide financial assistance to displaced workers, and (b) whether the government should restrict imports.

The results (shown in Figure 1) support three broad conclusions. First, respondents' willingness to provide financial compensation to workers is dependent on whether the shock is trade related or not. Non-trade shocks increase willingness to provide financial support; trade shocks decrease it (in both cases relative to the control scenario). Second, trade shocks greatly increase preferences for import protection, relative to non-trade shocks. Third, there is a further difference between trade that involves a developed country and trade that involves a developing country. The preference for import protection is greatest in the case of outsourcing to a developing country.

Clearly our respondents draw sharp differences across the scenarios and how the government ought to respond. While financial compensation – safety nets – is viewed as appropriate for domestic market shocks, it is viewed unfavorably for trade shocks. And they viewed trade with developing countries as more problematic than trade with developed countries, exhibiting a preference for much greater import protection in the first case.

One way to interpret these results is through the lens of distributive fairness. International trade is viewed differently from domestic competition because certain kinds of international competition can undermine domestic norms with regards to what's an acceptable redistribution. (Note that a similar thing happens when competition from tax havens undermines the domestic tax regime, or when imports from jurisdictions with poor safety enforcement undermine domestic consumer safety rules.) This is the argument that corresponds to scenario 3 in the thought experiment above. In this case, compensation is generically inadequate because what is at stake is the surreptitious modification of the rules of the game – the undermining of domestic social bargains through the back door. Trade is not merely a market relationship, but an instrument for reconfiguring domestic institutions to the detriment of certain groups. One could argue that such instances require targeting directly the trade flows that have the alleged effect.

In summary, we need to distinguish between two different arguments for why trade may be problematic from a distributional – and hence social and political – perspective. When international trade operates just like any domestic form of market competition, it makes little sense to set it apart and decouple it from other approaches for dealing with inequality in labor markets at large (unemployment compensation, progressive tax systems, active labor market policies, employment-friendly macro policies, etc.). But when trade entails practices that violate laws or norms embodied in our domestic institutional arrangements, and thereby undercuts domestic social bargains, it is legitimate to restrict the import flows that have the alleged effect.

In the specific context of trade with developing nations, what should be of particular concern for labor advocates is not low wages or labor costs per se, to the extent that those reflect labor productivity or alternative employment opportunities. Trade is unfair when competitive advantage is gained through the violation of worker rights in the exporting country. The proposed policy is a remedy against this kind of trade, to prevent social dumping.

A remedy against social dumping

A policy that targets social dumping must distinguish between true social dumping and regular market competition. Therefore it needs a domestic investigatory process of fact finding. To see how such a process can be devised we can take our cue from the prevailing trade remedy regime under the WTO. Two types of trade remedies are especially relevant: ant-dumping and safeguards.

The WTO allows countries to impose anti-dumping duties when imported goods are being sold below cost. In addition to determining dumping, domestic authorities must show a "material injury," or threat thereof, to a domestic industry. And under the Agreement on Safeguards, countries are allowed a (temporary) increase in trade restrictions under a narrow set of conditions. Triggering the safeguards clause requires determination that increased imports "cause or threaten to cause serious injury to the domestic industry," that causality from imports be firmly established, and that injury be not attributed to imports if there are multiple causes for it. Safeguards cannot be applied to developing-country exporters unless their share of imports of the product concerned is above a threshold. And affected exporters must be compensated by providing "equivalent concessions."

A broader interpretation of safeguards would acknowledge that countries may legitimately wish to restrict trade for reasons going beyond competitive threats to the profitability of their industries.[3] As I have discussed, distributional conflicts with domestic norms or social arrangements are one such reason. We could imagine recasting the current agreement into an Agreement on Social Safeguards, permitting the application of safeguard measures under a broader range of circumstances. This would require replacing the "serious injury" test with another hurdle: the need to demonstrate broad domestic support, among all concerned parties, for the proposed safeguard measure.

To see how that might work in practice, consider what the current WTO agreement says:

"A Member may apply a safeguard measure only following an investigation by the competent authorities of that Member pursuant to procedures previously established and made public in consonance with Article X of the GATT 1994. This investigation shall include reasonable public notice to all interested parties and public hearings or other appropriate means in which importers, exporters and other interested parties could present evidence and their views, including the opportunity to respond to the presentations of other parties and to submit their views, inter alia, as to whether or not the application of a safeguard measure would be in the public interest. The competent authorities shall publish a report setting forth their findings and reasoned conclusions reached on all pertinent issues of fact and law."

As written, the clause allows all relevant groups, and exporters and importers in particular, to make their views known, but it does not actually compel them to do so. Consequently, it creates a bias in the domestic investigative process towards the interests of import-competing groups, who are the petitioners for import relief and its obvious beneficiaries. This is also a key problem with hearings in anti-dumping proceedings, where testimony from other groups besides the import-competing industry is not allowed.

A key reform, then, would be to require the investigative process in each country to: (i) gather public testimony and views from all relevant parties, including consumer and public-interest groups, importers of the product(s) concerned, and exporters to the affected country, and (ii) determine whether there exists broad support among these groups for the application of the safeguard measure in question. Protectionism pure and simple would not have much chance of success if groups whose incomes would be adversely affected by trade restrictions — importers and exporters – were necessarily part of the deliberative process and the investigative body had to determine whether these groups also support the safeguard measure. At the same time, when deeply and widely held social norms are at stake, these groups are unlikely to oppose safeguards in a public manner, as this would endanger their standing among the public at large. Imagine, for example, that forced labor was used in producing goods for export in country X, or that labor rights were widely and violently repressed. Exporters to country X and downstream users of X's products would find it difficult to publicly defend free trade with this country.

In less clear-cut cases, the main advantage of the proposed procedure is that it would force a public debate on the legitimacy of trade and when it may be appropriate to restrict it. It ensures that all sides would be heard. This is something which rarely happens. This procedure could also be complemented with a strengthened monitoring and surveillance role for the WTO, to ensure that domestic procedures are in compliance with the expanded safeguard clause. The specific oversight criteria might include transparency, accountability, inclusiveness, and evidence-based deliberation. An automatic sunset clause could ensure that trade restrictions do not become entrenched long after their perceived need has disappeared.

WTO panels would still have jurisdiction, but on procedural rather than substantive grounds. They would examine the degree to which requirements of democratic deliberation were fulfilled. Were the views of all relevant parties, including consumer and public-interest groups, importers and exporters, civil society organizations, sufficiently represented? Was all relevant evidence, scientific and economic, brought to bear on the final determination? Was there broad enough domestic support in favor of the opt-out or safeguard in question? The panels may rule against a country because the internal deliberations excluded an interested party or relevant scientific evidence. But they would not be able to rule on the substantive claim—whether in fact the safeguard measure serves the public interest at home by furthering a domestic social purpose. This echoes the procedural emphasis in the existing Agreement on Safeguards, although it greatly increases the scope of its application.

The proposed procedure would force a deeper and more representative public debate on the legitimacy of trade rules and on the conditions under which it may be appropriate to suspend them. The most reliable guarantee against abuse of opt-outs is informed deliberation at the national level. The requirements that groups whose incomes would be adversely affected by the opt-out—importers and exporters—participate in the deliberations and that the domestic process balance the competing interests in a transparent manner would minimize the risk of protectionist measures benefiting a small segment of industry at large cost to society. A safety valve that allows principled objections to free trade prevail makes it easier to repress protectionist steam.

Even though domestic interests would presumably dominate the deliberations, the consequences for foreign countries need not be entirely overlooked. When social safeguards pose serious threat to poor countries, for example, non-governmental organizations and other groups may mobilize against the proposed opt-out, and those considerations may well outweigh ultimately the costs of domestic dislocations. A labor union may win protection when its members are forced to compete against workers abroad who toil in blatantly exploitative conditions. They are much less likely to carry the day against countervailing domestic interests when foreign working conditions reflect poor productivity rather than repression of rights. As the legal scholar Robert Howse notes, enhancing confidence in the ability of domestic deliberations to distinguish between legitimate domestic regulations and protectionist "cheating" should allay concern that domestic measures are purely protectionist. "Requiring that regulations be defensible in a rational, deliberative public process of justification may well enhance such confidence, while at the very same time serving, not frustrating, democracy" (Howse 2000, p. 2357). The proposed safeguard would be the embodiment of the principle that countries have the right to uphold national standards when trade undermines broadly popular domestic practices, by withholding market access or suspending WTO obligations if necessary.

Current safeguard procedures require most-favored nation (MFN) treatment of exports, permit only temporary measures, and demand compensation from the country applying the safeguard. These need to be rethought in the context of the broader arrangement I am proposing. MFN treatment will often not make sense. If the safeguard is a reaction to labor abuses in a particular country, it is appropriate to direct the measure solely against imports from that country. Similarly, an ongoing abuse will require ongoing use of the safeguard. Instead of imposing temporary relief, it would be better to require periodic review or a sunset clause that could be revoked in case the problem continues. This way trade restrictions or regulations that hamper other countries' interests are less likely to become ossified.

The issue of compensation is trickier. When a country adopts a safeguard measure, the logic goes, it revokes a "trade concession" it had previously granted to other countries in an internationally binding agreement. Those other countries are entitled to receive equivalent concessions or to revoke some of their own concessions in return. In a dynamic world with near constant change, the nature of the concessions that a country grants to others cannot be predicted perfectly. This uncertainty turns international trade agreements into "incomplete contracts." When unforeseen developments change the value or cost of trade flows—because of new technologies (genetic engineering), say, or new values (on the environment), or new understandings (on desirable development strategy)—who controls rights over those flows? The requirement of compensation places those rights squarely with the international trade regime; the exporter can continue to demand market access on the original terms. But we might just as legitimately argue that the value of the original concessions depend on the circumstances under which they were provided. Under this interpretation, an exporter could not claim a benefit that did not exist, nor the importer be forced to suffer a loss that was not originally contemplated, when the agreement was signed. This would bring control rights closer to nation states and sharply limit the amount of compensation that exporters could expect.

Authoritarian regimes likely will become easier targets for safeguard action by democratic nations when their exports cause problems in those nations. Even though some of their labor practices, for example, will be easy to justify, others may not be. Minimum wages significantly lower than in rich countries can be rationalized in the domestic debate by pointing to lower labor productivity and living standards. Lax child labor regulations are often justified by the argument that it is not feasible or desirable to withdraw young workers from the labor force in a country with widespread poverty. In other cases, arguments like these carry less weight. Basic labor rights such as non-discrimination, freedom of association, collective bargaining, and prohibition of forced labor do not cost anything. Compliance with these rights does not harm, and indeed possibly benefits, economic development. Gross violations constitute exploitation of labor, and will open the door for safeguards in importing countries on the ground that they generate unfair distributional costs.

Broadening safeguard action in this manner would not be without its risks. The possibility that the new procedures are abused for protectionist ends and open the door to unilateral action on a broad front, despite the high threshold envisaged here, has to be taken into account. But as we have already seen with the rise of Trump, doing nothing is not riskless either. Absent creative thinking and novel institutional designs, the tensions created by globalization will reinforce the protectionist backlash. That would be far worse than the safeguard regime I have just described. Moreover, qualms about the protectionist slippery slope have to be tempered by considering the abuse that occurs under the existing rules, without great detriment to the system. If mechanisms with explicit protectionist intent, such as anti-dumping, have not destroyed the multilateral trade regime thus far, it is not clear why well-designed exit clauses would have consequences that are worse.

I address two remaining questions briefly. First, would such a scheme affect developing countries and their development prospects adversely? I would argue not, since the aim of the proposal is to delegitimize unwarranted protectionism (against developing countries in general) by enabling trade restrictions in those, relatively narrow range of circumstances where they are warranted on social grounds. My hypothesis is that generalized protectionism is rendered more likely in the absence of such a clause against social dumping. Moreover, the social safeguards described here could be paired with a "development box" that provides developing countries their own, enhanced policy space with respect to the use of industrial policies (Rodrik 2011). Such an exchange of policy space between the advanced and developing nations would benefit both partners, without necessarily harming prospects for global trade.

Second, why not address labor rights by incorporating labor clauses directly into international trade agreements, instead of providing domestic safeguards?[4] This has been the preferred route for two decades now, but with very meager results (Rodrik 2018b). Experience with aid conditionality shows that trying to get countries to change their policies in return for continued material benefits (financial assistance or continued market access) does not have a very good track record. Regardless of what happens in trade agreements, there needs to be a domestic mechanism to address the problems discussed in this essay.

[1] The proof of this result is sketched in Rodrik (2018a). Let the unit cost of production for the importable sector that is being liberalized be expressed as , with denoting the return to the ith factor of production used in that sector. Since payments made to the factors must exhaust the cost of production, changes in unit costs are a weighted average of changes in payments to each of the factors, where the weights (in perfect competition) are the cost shares of each factor. In other words, , where a "hat" denotes proportional changes, is the cost share of factor i, and . Consider what happens with trade liberalization. The effect of trade liberalization is to raise the domestic price of exportables relative to importables. Let the importable described above be the numeraire, with price fixed at unity. We are interested in what happens to the returns of factors used in the importable. Since this good is the numeraire, we have the equilibrium condition , stating equality between price and unit cost (the zero-profit condition). As long as the good continues to be produced, this condition holds both before and after the liberalization. Therefore . Hence there must be at least one factor of production, call it the kth factor, such that . (The inequality will be strict when goods differ in their factor intensities.) Meanwhile exportable prices have increased (), thanks to the liberalization. Hence, and the return to the kth factor declines in terms of both the importable and exportables, producing an unambiguous fall in real returns, regardless of the budget shares of the two goods.

Notes

[2] Given the nature of identification, these results refer to relative wage changes. But since real wages of blue collar workers have generally stagnated, they are telling also about the magnitude of real income impacts.

[3] I have written about the social safeguards clause in Rodrik (1997 and 2011), on which the following paragraphs are based. Legal aspects are discussed in Shaffer (2019).

[4] See Tucker (2018) for a recent such proposal. Tucker advocates an international agreement that explicitly targets higher unionization rates, allowing countries discretion on how to get there. These targets would be paired by international arbitration that can be initiated by labor groups.

References

Autor, David, David Dorn, and Gordon Hanson, "The China Syndrome: Local Labor Market Effects of Import Competition in the United States," American Economic Review, 103(6), 2013, 2121–2168.

Autor, David, David Dorn, and Gordon H. Hanson, "The China Shock: Learning from Labor Market Adjustment to Large Changes in Trade," Annual Review of Economics, 8, 2016, 205–240.

Caliendo, Lorenzo, and Fernando Parro, "Estimates of the Trade and Welfare Effects of NAFTA," Review of Economic Studies, 82, 2015, 1–44.

di Tella, Rafael, and Dani Rodrik, "Labor Market Shocks and the Demand for Trade Protection: Evidence from Online Surveys," 2019, forthcoming.

Hakobyan, Shushanik, and John McLaren, "Looking for Local Labor Market Effects of NAFTA," Review of Economics and Statistics, 98(4), October 2016, 728–741.

Howse, Robert, "Democracy, Science, and Free Trade: Risk Regulation on Trial at the World Trade Organization," Michigan Law Review, Vol. 98, No. 7, June 2000.

Rodrik, Dani, Has Globalization Gone Too Far? Institute for International Economics, Washington, DC, 1997.

Rodrik, Dani, The Globalization Paradox: Democracy and the Future of the World Economy, W.W. Norton, New York, 2011.

Rodrik, Dani, "Populism and the Economics of Globalization," Journal of International Business Policy, vol. 1, 2018(a).

Rodrik, Dani, "Can Trade Agreements Be a Friend to Labor?" Project Syndicate, September 14, 2018 https://www.project-syndicate.org/commentary/trade-agreement-labor-provisions-small-practical-effect-by-dani-rodrik-2018-09.

Romalis, John, "NAFTA'S and CUSFTA'S Impact on International Trade," Review of Economics and Statistics, 89(3), August 2007, 416–435.

Shaffer, Gregory, "Reconceiving Trade Agreements to Address Social Inclusion," Illinois Law Review, 2019, forthcoming.

Stolper, Wolfgang, and Paul A. Samuelson, "Protection and Real Wages," Review of Economic Studies, 9, 1941, 58-73.

Tucker, Todd N. "Seven Strategies to Rebuild Worker Power for the 21st Century Global Economy: A Comparative and Historical Framework for Policy Action," Roosevelt Institute, September 2018.