Harpers Ferry, WV

Thursday, January 17, 2019

Manchin Martinsburg to meet with furloughed workers

Harpers Ferry, WV

Wednesday, January 16, 2019

Will China’s Economy Hit a Great Wall? [feedly]

https://www.nytimes.com/2019/01/15/opinion/will-chinas-economy-hit-a-great-wall.html

-- via my feedly newsfeed

Links (1/15/19) [feedly]

https://economistsview.typepad.com/economistsview/2019/01/links-11519.html

- Will China's Economy Hit a Great Wall? - Paul Krugman

- Disruption, Concentration, and the New Economy - Raghuram Rajan

- The Flynn Effect (Rising IQ Scores Over Time) Reverses - Tim Taylor

- Bad Precedent - Cecchetti & Schoenholtz

- 1789, the return of the debt - Thomas Piketty

- Front-Door Criterion Follow-Up - Marc F. Bellemare

- How Much Value Was Destroyed by the Lehman Bankruptcy? - Liberty Street

- In Conversation with Atif Mian - Equitable Growth

- Why deficits are sustainable and inflation has a life of its own - Roger Farmer

- Does Ultra-Low Unemployment Spur Rapid Wage Growth? - FRBSF

- What U.S. Government Shutdown Means for Economic Data - Washington Post

- Border walls - VoxEU

- The future of work - Economic Principals

- Machine Learning & Econometrics - Dave Giles

- Should we worry about temporarily raising government debt? - mainly macro

-- via my feedly newsfeed

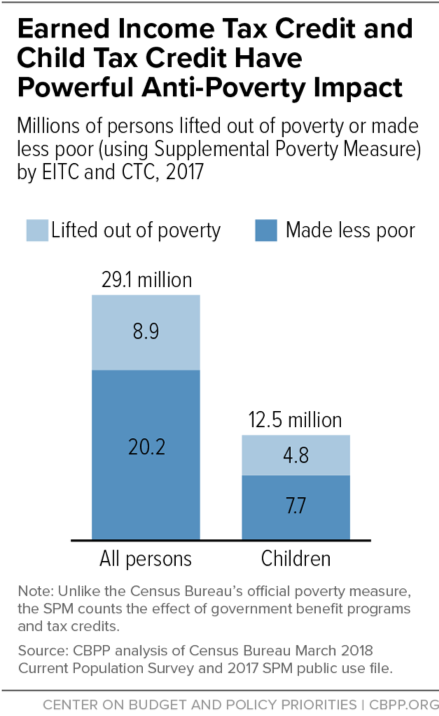

Working-Family Tax Credits Lifted 8.9 Million People out of Poverty in 2017 [feedly]

https://www.cbpp.org/blog/working-family-tax-credits-lifted-89-million-people-out-of-poverty-in-2017

-- via my feedly newsfeed

Au pair lawsuit reveals collusion and large-scale wage theft from migrant women through State Department’s J-1 visa program

Tuesday, January 15, 2019

Time to Make a Deal on the Federal Minimum Wage [feedly]

https://workingclassstudies.wordpress.com/2019/01/14/time-to-make-a-deal-on-the-federal-minimum-wage/

The federal minimum wage has been stuck at $7.25 per hour since 2009. Until last year, when the unemployment rate dropped almost to the level of full employment, wages were stagnant, exacerbating inequality. In 2018, average hourly earnings went up 3.15% and closed the year with a 3.9% jump. Even with those recent adjustments, workers still need a federal minimum increase.

The Raise the Wage Act offers the prospect for change. The bill was introduced in May 2017 by Rep. Bobby Scott (D-VA), the ranking Democrat on the House Committee on Education and the Workforce, but it died in committee in 2018 with 170 co-sponsors, Democrats all. It proposed a dollar-a-year increase over seven years, eventually reaching $15.00 – more than twice the current minimum. It would also phase out lower pay for tip-credit workers who are currently frozen at $2.13 per hour as well as disabled worker exceptions.

The Fight for $15 campaign, largely engineered and financed by the Service Employees International Union, has been a key force in defining $15.00 an hour as the goal. Their work has helped set eight states on the path to establishing minimum wages of between $12 and $15 per hour in coming years, including Arizona, California, Colorado, Maine, Massachusetts, Minnesota, New York, and Washington. Thirteen cities, including New York City, Seattle, and San Jose, are already at $15 or higher. While Fight for $15 has created momentum for the new Democratic House majority, today's leaders should not forget the lessons learned from decades of living wage fights.

On January 18, 1997, ACORN and Local 100, United Labor Unions (then affiliated with the SEIU), presented voters in Houston, Texas with what seemed a radical proposal at the time: a city ordinance to raise the minimum wage to the level of $6.50 per hour for all workers. Only months before, the federal minimum had finally risen from $4.25 per hour to $4.75. In a patronizing campaign against us, service industry and general business employers insisted that they understood our demand, but we were going about it the wrong way, and our proposal would cost jobs. While we won in lower-income and working-class districts, we lost the election 2 votes to 1. In River Oaks, the district where former President George H. Bush lived and voted, we garnered just one vote.

Soon after, ACORN put a similar proposal before Denver voters, asking them to approve a minimum wage of $6.25. An expensive, blunt force campaign in the final two weeks by the hotel and restaurant association and fast food operators swamped us. Again, we lost two to one loss even as we swept black and brown, lower income, and working precincts throughout the city.

We learned a key lesson from those losses: do the research. In Arizona, Michigan, Florida, and Ohio, we used polling to find out the rate that would gain support from at least 60% of voters. When we did that, even strident corporate campaigns didn't block our way. Where we couldn't do polling, we pegged the increase more modestly as a premium above the federal minimum, usually one dollar, which won in New Orleans, Missouri, and elsewhere. Once we learned to propose acceptable target rates, we won many more votes, and no living wage statewide proposition has lost at the ballot box in more than a dozen years. Between 1996 and 2008, we won more than 125 "living wage" campaigns around the country, delivering billions of dollars' worth of raises to millions of workers. Where we won increases indexed to cost-of-living, like Florida, lower-waged workers continue to benefit.

State and local minimum wage and living wage campaigns have continued in full force and fury. Approximately twenty states and twenty-three localities now have higher base hourly wage rates than the federal standard, and some 5.2 million workers began this year with a wage increase. Individual bumps in annual pay from $90 to $1300 add up to about $5.4 billion of increased income for workers. This is good news. But workers in twenty-nine states – about 2.2 million people — are still stuck at $7.25 per hour – or less!

It's time to make a deal.

Reportedly, Democrats believe they now have enough votes to pass something like the Raise Wages Act and demand that the Senate either support, negotiate, or reject raising workers' wages. We need to force politicians to finally deliver, whatever the intraparty polarization and squabbles.

We also need to remember the lessons from the past. In Houston, Denver, and initially New Orleans, we lost support when we proposed raising the minimum 37% over the existing federal standard. To get to $15 on a fast track would be a jump of more than 100%, doubling the minimum wage. Pew Research found only 52% support for that big an increase.

It's just not likely to happen all at once.

Even raising the minimum $1 per year is steep and unprecedented. The last ten-year freeze of the federal minimum, between 1997 and 2007, the raise was seventy cents annually for three years l. A dollar per year for seven years will be hard to win.

But low wage workers need a deal, and at this point, just about any raise would do. Fifty more cents an hour for a full-time, 2080 hours a year worker is over $1000. Sure, a dollar would be even better, but any raise would be a godsend. This would be even better if we could finally win some form of automatic indexing for future increases and at least lift the cap on tipped workers' wages. Both of those adjustments would be worth paying some real money to achieve at the negotiating table.

Does making a deal hurt the states and cities that are already over the federal minimum wage? No, indeed. As President John F. Kennedy argued, raising the minimum wage "lifts all boats," because workers making $10 or $12 an hour would fight to keep their hourly wages a few dollars higher than the minimum wage. If employers want to keep those workers, they will have to pay more.

Of all of the divisions in the United States now, the wage gap might be easiest to attack. Even Republicans feel the pressure as the 2020 election comes into view. We need to make it hard for them to defend keeping the minimum wage at $7.25 an hour. They will argue that $15 an hour is catastrophic, and we must be prepared to fight back. Republicans may not like bargaining over a hike in the minimum wage, but other than the stone-cold ideologues, some of whom are in the White House, they will be ready to do so.

It's time to demand an increase in the federal minimum wage but also to talk realistically about the terms of an agreement. Lower wage workers must have a raise, and they need it now. We can't wait for a new President or a new Congress.

Wade Rathke

-- via my feedly newsfeed

Opportunity Zones: Can a tax break for rich people really help poor people? [feedly]

https://www.washingtonpost.com/outlook/2019/01/14/opportunity-zones-can-tax-break-rich-people-really-help-poor-people/

There's no evidence that simply giving rich people more after-tax income helps those with fewer means. If this new idea works, it's because it incentivizes those with capital gains to reinvest their returns in places starved for capital investment.

Let me explain, and then talk about what could go right and wrong with this new tax policy.

When an investor sells an asset, she pays a tax, typically at a rate of about 24 percent, on the asset's appreciation, i.e., its capital gain. But if she taps this new incentive, she can diminish her liability by putting the gain in a fund dedicated to investing in disadvantaged areas certified as Opportunity Zones (OZs). The longer she leaves the investment in place, the bigger the tax break on both the original capital gain and on the returns from the investment itself (see here for details).

OZs don't assume that just because they get a tax cut, wealthy people will make investments that will somehow lead to higher incomes for others. The tax break is conditioned on investing in economically left-behind places where patient, equity capital is a scarce commodity. To push back on sheltering risk, investors can't just park their deferred gains in OZs. They must be used to build new homes or businesses, finance new or expanding companies in the zones, or substantially rehabilitate preexisting structures and/or businesses.

As an early contributor to this idea, I was motivated by two realities. One, the United States is fraught with capital scarcity in most places amid race/gender unbalanced capital accumulation in just a few places. The vast majority (over 75 percent) of venture capital goes to white male founders in Massachusetts, New York and California. Two, it is increasingly well understood that the facile economic solution to being stuck in a depressed area — move to a better place! — isn't working. Diminished geo-mobility has left too many families in places with too little opportunity. If policy is going to help them, it needs to bring jobs and investments their way.

It is inconceivable that a few white guys in three states are the only people and places where untapped potential exists. Instead, I'm sure the status quo underinvests in the future of ailing regions and less-advantaged demographics. Hence the bipartisan backing the Opportunity Zones idea garnered in both chambers of Congress before it was wrapped into the tax overhaul package.

ADVERTISING

It's too soon in the life of OZs to evaluate actual investments, but we can examine some critical, early developments, including the zone certification process, market reactions and some early, proposed investment targets. Such monitoring is essential if we want OZs to realize their potential to help left-behind places and people, vs. them turning into another wasteful, ineffective, place-based tax break.

A good place to start is the outcome of the certification process, wherein governors designated over 8,700 OZs across all 50 states, the District, and U.S. territories (almost all of Puerto Rico received designation to aid disaster recovery) to receive tax-favored investments. Eligibility criteria include places with above-average poverty rates and below-average incomes.

According to the Economic Innovation Group, a D.C. policy organization closely associated with OZs (I co-chair EIG's research advisory board), the average zone has a 29 percent poverty rate — nearly twice the national rate — and a median family income of $42,400, nearly 40 percent lower than the national median of $67,900. EIG finds that more OZ adults lack a high school diploma than have earned a bachelor's degree. Likewise, on jobs, housing and life-expectancy measures (almost four years shorter among zone residents), OZs paint a picture of economic distress and disinvestment.

In Louisville, for example, the 19 certified OZs have a poverty rate of 43 percent compared with 14 percent for its metro area. Median income is $22,000 in the zone compared with $52,000 in the metro area; over half of zone residents are African American compared with 14 percent metro-wide residents.

However, some high-profile zones were poorly chosen, raising the risk of subsidizing places that are already on a stable footing. Exhibit A is the zone chosen for one of Amazon's second headquarters in Queens. Not only will this area already receive over $1 billion in tax credits and subsidies from the deal local governments struck with Amazon, it also is considerably more prosperous than the typical zone. Its choice was a function of a glitch in the law that allows governors to nominate up to 5 percent of better-off places next to low-income ones. EIG found that governors used this discretion sparingly; it was tapped by less than 3 percent of OZs. Other, independent research found less than 4 percent of chosen tracts showing signs of gentrification before nomination. Still, even while these are small percentages, such leakage undermines the intent of the program and wastes valuable tax revenue. It is also possible that such places could absorb disproportionate shares of OZ investments.

That said, given that most zones appear to be well chosen, what kind of investments might follow?

To answer this question, I looked at a few of OZ investment prospectuses starting to come out, and I urge fellow skeptics to do the same. There's evidence that governors worked with mayors to designate zones, and many mayors are now leading the charge to steward investment into their communities. One such case is Oklahoma City, which chose the 23rd Street Corridor, long a commercial and cultural hub at the core of the city's African American community. In 2014, the city government designated the area as "blighted," but development plans have foundered for lack of patient capital. Residential housing, retail (including a much-needed grocer), and health facilities are all featured options in their OZ prospectus. Similar ideas are in motion for Park DuValle neighborhood in Louisville, and the Civil Rights District in Birmingham, Ala. In Boulder, Colo., stakeholders are coming together to figure out how their local OZ can be used to address the city's lack of affordable housing, a problem that has long kept low-income families from living close to work.

Yes, such investments invoke gentrification risk. It is not for nothing that James Baldwin relabeled the 1960s urban renewal as "Negro removal." But unlike the federal projects of that era, OZs and their investment funds have zero power to override local rules. As columnist Jan Burton said about the Boulder initiation, "We control our zoning and land use decisions, and we retain the long-standing 1 percent per year growth limit on housing units. We control our own future."

I'm keeping my powder dry on this one. If OZs turn out to largely subsidize gentrification, if their funds just go to places where investments would have flowed even without the tax break, or if their benefits fail to reach struggling families and workers in the zones, they will be a failure (my Center on Budget and Policy Priorities colleagues raise these and other concerns about OZs). Moreover, when it comes to anti-poverty policy, readers of this column know my preference for direct hits vs. bank shots. The most direct ways to help those left behind is to guarantee them jobs, incomes, housing and health care. The direct way to improve infrastructure in poor neighborhoods is for public projects to build it.

But the fact is that most OZ communities have faced disinvestment and depopulation for so long, they have both the need and capacity to absorb new investment, development and people without displacing local residents. And our politics is such that we're living in a second-best world. At the same time, the inequality of our era means there are trillions of dollars in idle capital sitting on the sidelines over here, and communities suffering from decades of disinvestment over there. As Bruce Katz, a longtime regional development expert told me, "For a lot of these places, Opportunity Zones represent the last and best chance to drive a new economic vision."

Thus, I suggest we give OZs a chance, while scrutinizing their progress. That will require the Treasury to dictate strong reporting requirements that will accommodate thorough evaluation. As I've stressed, my support for the idea is conditional on such data and what they show (my biggest concern is that the Treasury fails to collect the tracking data needed to evaluate relevant outcomes). I'm enthusiastic, not naive, and the last thing we need in this country is a new way for investors to shelter capital gains. But we have a pressing need to channel lasting, opportunity-creating investments to people in left-behind places, and OZs might just meet that need.

-- via my feedly newsfeed

West Virginia GDP -- a Streamlit Version

A survey of West Virginia GDP by industrial sectors for 2022, with commentary This is content on the main page.

-

John Case has sent you a link to a blog: Blog: Eastern Panhandle Independent Community (EPIC) Radio Post: Are You Crazy? Reall...

-

---- Mylan's EpiPen profit was 60% higher than what the CEO told Congress // L.A. Times - Business Lawmakers were skeptical last...

-

via Bloomberg -- excerpted from "Balance of Power" email from David Westin. Welcome to Balance of Power, bringing you the late...