http://triplecrisis.com/wto-and-food-security-biting-the-hand-that-feeds-the-poor/

Since 2013, controversy has swirled around India's National Food Security Act (NFSA), the most ambitious food security initiative in the world, with its plans to buy food grains from small-scale farmers to distribute to some 840 million poor Indians, two-thirds of the country's people. The controversy came at the World Trade Organization (WTO), where the U.S. government accused India of unfairly subsidizing its farmers by paying a support price above market prices.

At the WTO biannual ministerial conference in Bali, India stood firm, questioning the subsidy calculation as an artifact of old WTO rulemaking and asserting that, in any case, such programs that are used for legitimate food security purposes should be exempt from such restrictions. The conflict nearly torpedoed the WTO's modest negotiated agreements in Bali, but a "Peace Clause" granted India and other developing countries with such programs a grace period while negotiators tried to reach a permanent solution. (See my coverage of the controversy here.)

That grace period is up now, as trade ministers from across the globe board planes for the December 10 opening of the WTO's 11th Ministerial Conference in Buenos Aires, Argentina. With no progress on the matter at the 2015 conference in Nairobi, Kenya, India and other developing countries have called for a simple exemption of such programs from WTO restrictions. U.S. negotiators, themselves under fire for "dumping" agricultural surpluses on global markets at prices below the costs of production, are demanding more restrictive measures and further concessions from developing countries.

I covered the Bali conflict, pointing out the unabashed hypocrisy of the U.S. government, which subsidizes wealthier farmers at higher rates for less compelling reasons, calling out a far poorer country for subsidizing its much poorer farmers for the purpose of feeding a large and hungry population.

As the controversy dragged on toward the Nairobi WTO meeting in late 2015, I traveled to India to see the reality of the National Food Security Act. What I found were moderate subsidies, which helped stabilize rural markets while putting urgently needed food rations into hands of poor women so they could feed their families. What I saw, in fact, was a far more ambitious version of the U.S. farm programs enacted as part of the New Deal for much the same reasons.

Feeding the hungry

I traveled to Shivpuri in the state of Madhya Pradesh, an area of the country in which 26 starvation deaths in 2001 and 2002 had shocked the nation and pushed the country's Supreme Court into intervening to insist that the government do more to ensure poor citizens' right to food.

According to the 2011 Madhya Pradesh Development Report, the state had the highest infant mortality rate in India—42 percent of children under five were stunted and 36 percent were underweight, with 18 percent qualified as severely underweight, or "wasted." As one of India's most populous states, with 75 million people, the human costs of food insecurity, even in just this one state, boggled the mind. In 2003, an estimated 160,000 children died before their fifth birthday, a child death rate of 89 per 1,000 live births.

The NFSA increased the basic food ration from 20 to 35 kilos/month (44 to 77 pounds/month) of cereals for a family, and expanded eligibility so the majority of rural Indians could qualify. Beyond the basic grains—rice and wheat—the NFSA entitled recipients to distributions of sugar, salt, and kerosene for cooking. All were given out by the Public Distribution System (PDS) through a network of thousands of village-level ration shops.

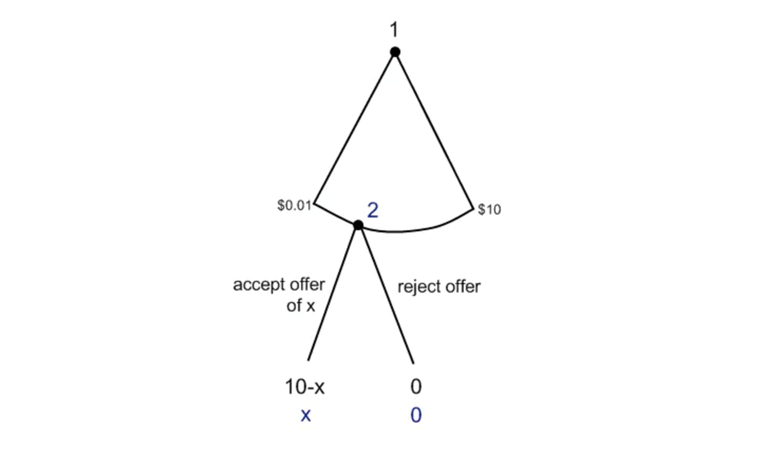

Recipients pay very low, subsidized prices; a kilo of rice that might cost 20 rupees in the market cost just 1 rupee in the ration shop—about 1 penny per pound instead of 10. A ration card was issued to qualified female heads of household, with the card stamped and registered to show compliance, a system soon to be replaced with more corruption-proof, fingerprint-based biometric systems for identifying beneficiaries and documenting distributions.

In the villages of Upsil, Benskedi, and Bineka, I met villagers who generally applauded the expansion of the program but demanded better service from the ration shops as well as the inclusion of lentils and cooking oil, key local sources of protein and fat. Children seemed poor but not desperately malnourished, though one can't know from such a visit.

As it turned out, I visited these villages at one of the less needy times of year, just after food crops had been harvested. Three months earlier, I would have seen the hungry season, that paradoxical period when the fields are green with early growth but last year's stores have long run out. In regions as poor as Shivpuri, they have a different name for that season.

"We call it the season of death," said Sachin Jain of Vikas Sanvad, a member organization of the Right to Food Network in the state capital of Bhopal. Nineteen people in the region died in 2011 from malnutrition. Six died just two months before my visit.

But Sachin confirmed that things were improving with the NFSA. Thanks to the full range of court-ordered anti-hunger measures—school lunches, Integrated Child Development Services for women and young children, and the National Rural Employment Guarantee Program, in addition to NFSA—rural welfare had improved considerably. Government spending on programs for children under six years old increased twentyfold over the previous decade. The child death rate had been cut almost in half in 10 years. In Madhya Pradesh, the percentage of underweight children had dropped from 60 percent in 2006 to 43 percent in 2016.

Food better to distribute than cash

There is significant variation in how well the NFSA is being implemented across India's vast territory, but Madhya Pradesh has emerged as a leader. That was thanks in no small part to government officials like Dr. Manohar Agnani, State Commissioner for Food and Civil Supplies, the agency in charge of the Public Distribution System.

Dr. Agnani told me that Madhya Pradesh, with its high poverty levels and strong program inclusion, expects to enroll 75 percent of the state population, not just 67 percent, more than 60 million people. For reference, that is more beneficiaries than the U.S. has in its entire SNAP (food stamp) program.

He said food distributions for India were far preferable to cash benefits, which are favored by the U.S. government because they are seen as less "market-distorting." Agnani was dismissive of the new fascination with cash. "We have discrimination based on gender and caste," he said. Many male heads of household, he told me, would use cash distributions for things other than food, and for themselves rather than their families. Men would more readily control the income. "I don't believe in efficiency at the cost of effectiveness and gender equity," he went on.

Agnani, who has since moved on to a job with the national Health Ministry, said that Madhya Pradesh has proven that the NFSA can be implemented efficiently and effectively to reach the millions of Indians going hungry. But what about its procurement at subsidized prices? That was the question on the table at the WTO.

Originally published by Food Tank.

-- via my feedly newsfeed

Our current political moment

Our current political moment