Markets post-Brexit

U.S. stock prices fell more than 5% in the two-day aftermath of the British vote to leave the European Union. But equities have since regained those losses and are back near all-time highs.

S&P 500 stock price index, Jan 4 to July 1. Source: FRED.

By contrast, the yield on 10-year U.S. Treasury bonds fell about 25 basis points post Brexit and stayed there. That puts long-term interest rates down about 75 basis points for the year and near their all-time low.

Yield on 10-year U.S. Treasury bond, Jan 4 to June 30. Source: FRED.

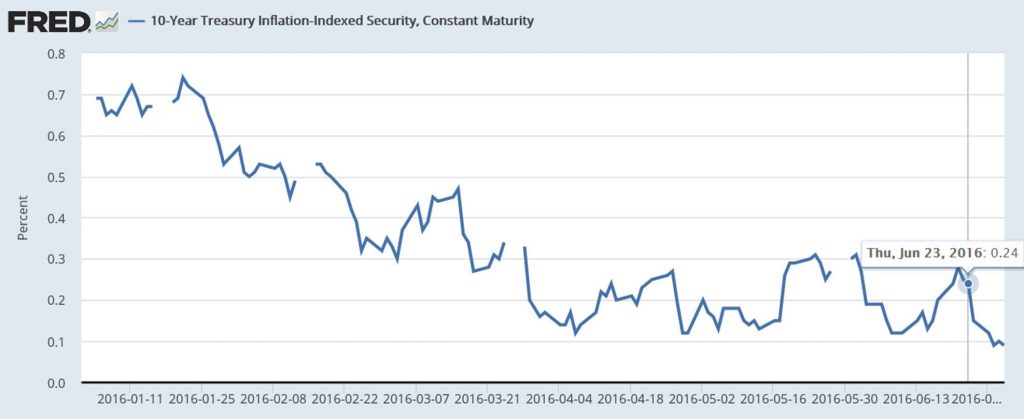

The inflation-compensated 10-year yield fell about 15 basis points post Brexit and 60 bp for the year. That leaves the other 10-bp decline in nominals post Brexit to be accounted for by lower expectations of inflation.

Yield on 10-year Treasury Inflation Protected securities, Jan 4 to June 30. Source: FRED.

All this is consistent with the view that Brexit initially sparked fears of substantial effects on economic growth. These fears may have since subsided. But the expectation remains that central banks around the world will be keeping real rates low for an even longer period than anticipated prior to the British vote.

Here's a plot of the 10-year expected inflation rate that is implied by the difference between the previous two graphs. Currently it's down to 1.4%. If you described this series as "well-anchored," what you might mean is that it's anchored well below the Fed's long-run 2% target. And it seems to have drifted even lower as a result of events in Britain last week.

Breakeven inflation rate on 10-year Treasuries, Jan 4 to June 30. Source: FRED.

In other words, markets think the Fed will try a little harder, but be a little less successful, to achieve its long-run objectives.

Harpers Ferry, WV

No comments:

Post a Comment