The Biden administration spent a couple of weeks lowering expectations in advance of last week's Employment Situation Report from the Bureau of Labor Statistics, warning that after a year of mostly good news on job creation, we would likely see a loss of jobs in January due to Omicron. In these reports, an entire month is represented by a "reference week," and the survey asks respondents very literally if they worked that week. A "no, I didn't" can be the result of layoffs or the inability of a previously non-employed person to find a job. But not going to work due to a snowstorm, a bad hurricane, or a strike also count as not working, so temporary, non-macroeconomic events like a May 2016 strike at Verizon or the 2012 superstorm Sandy sometimes have a large impact on jobs numbers. Even among those who were not gravely ill, Omicron seems to have made a large number of people too sick to come to work for at least a few days in January. Airlines canceled many flights due to shortages of available crews. Some restaurants in my neighborhood had to close or temporarily switch to takeout-only. We saw disrupted deliveries to grocery stores around the country. It seemed like a lot of people missed work at least temporarily, and the January report was expected to reflect this. But then the actual numbers came in:

So what happened? One natural interpretation of these numbers is that the fears of an Omicron impact on the economy were wrong. But this is incorrect. What actually happened is that Omicron had a large negative influence on the economy in January, but the January jobs report included good news about prior months. These revisions not only added to our estimate of how robust the recovery was across 2021, but they also gave us a somewhat different impression of its shape. Altogether, they tell a tale of an economy in which both the virus itself and virus-related fears remain a, if not the, major constraint on growth. January jobs reports are oddToday's post relies largely on the work of two other excellent Substackers. Joey Politano and Matt Klein have both done fantastic analyses of this report, and I'd encourage anyone who's consistently interested in labor market data to subscribe to their 'stacks. I'm going to offer a somewhat less technical and somewhat more opinionated account of what happened, but all credit to the two of them for digging into the report to explain what really happened. It's helpful to know a little about how the monthly jobs report comes together. On the most basic level, it's a combination of two surveys:

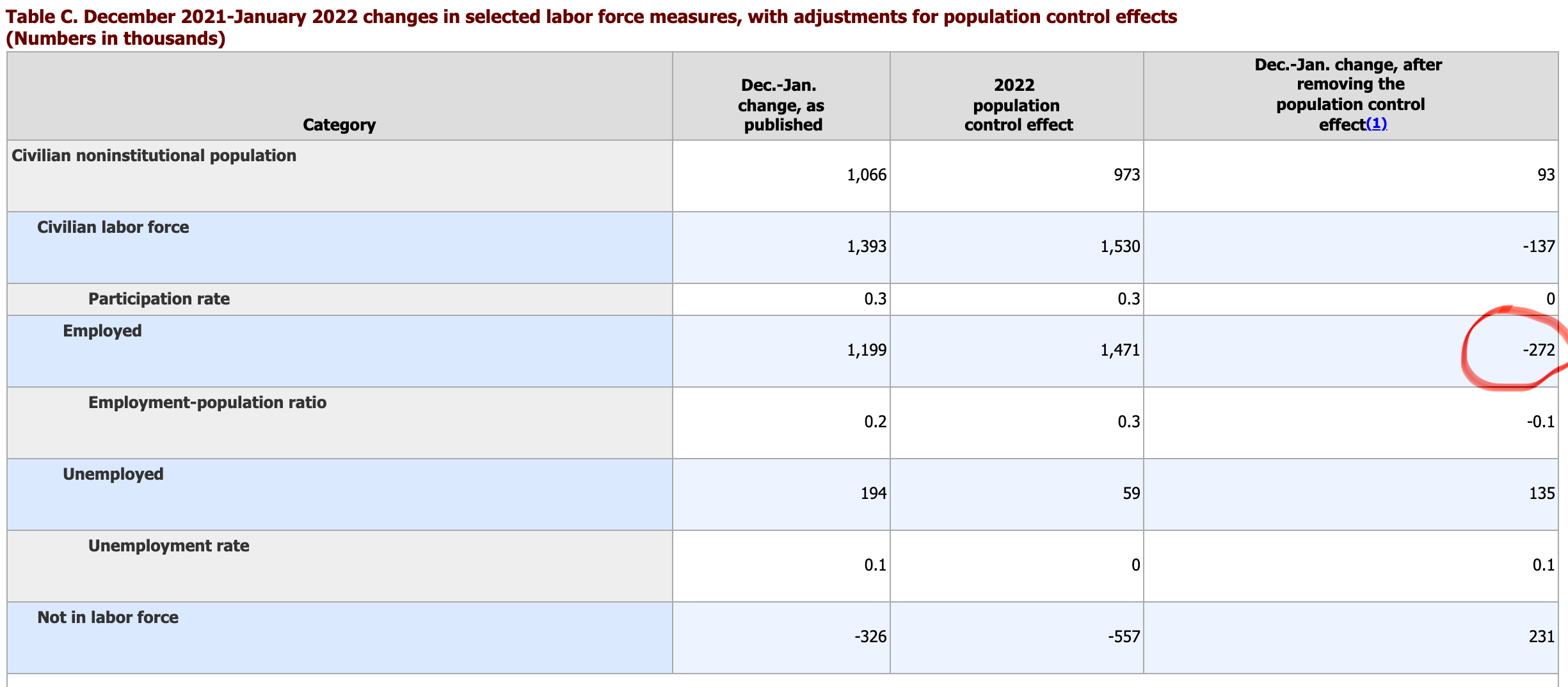

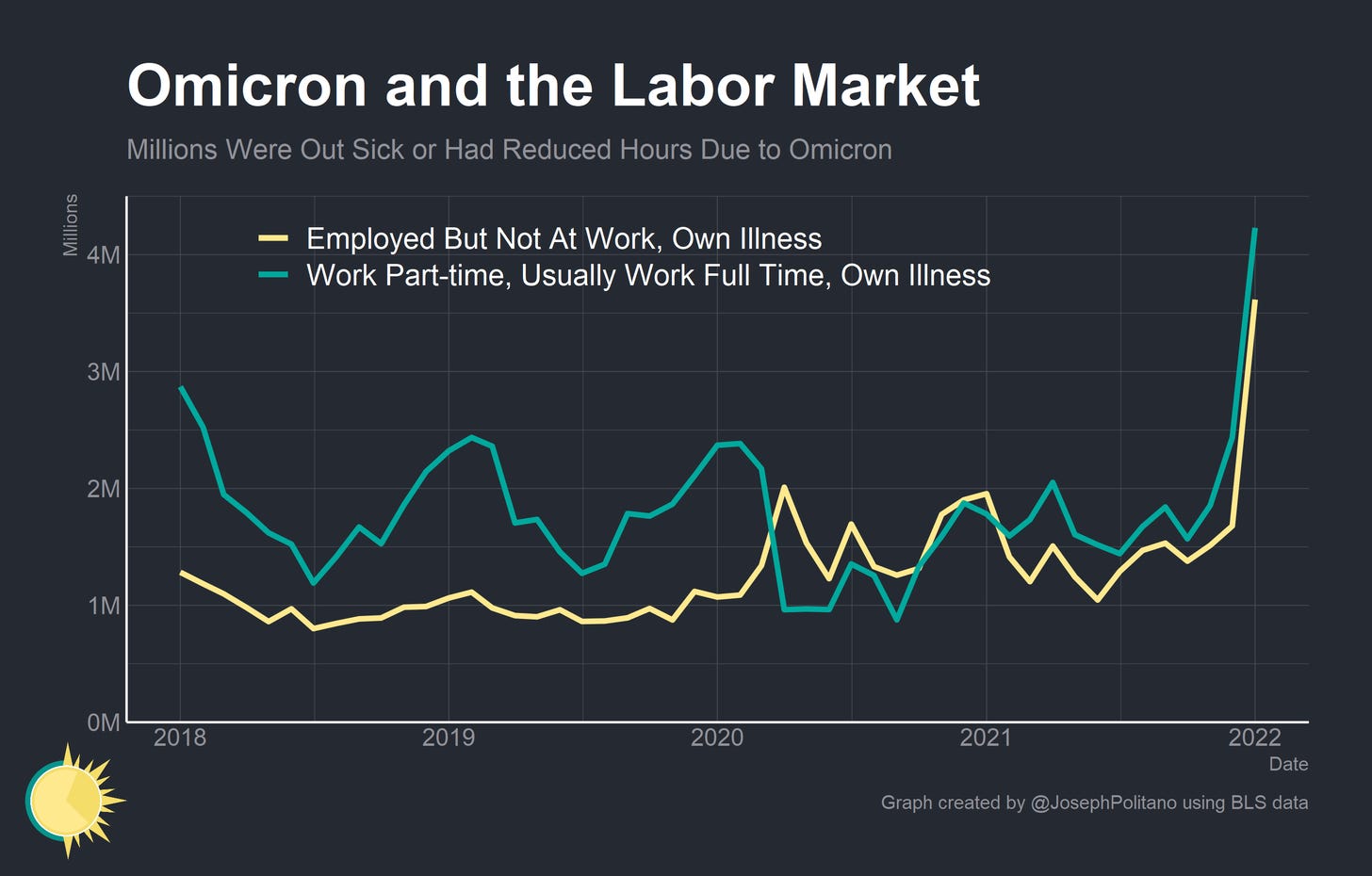

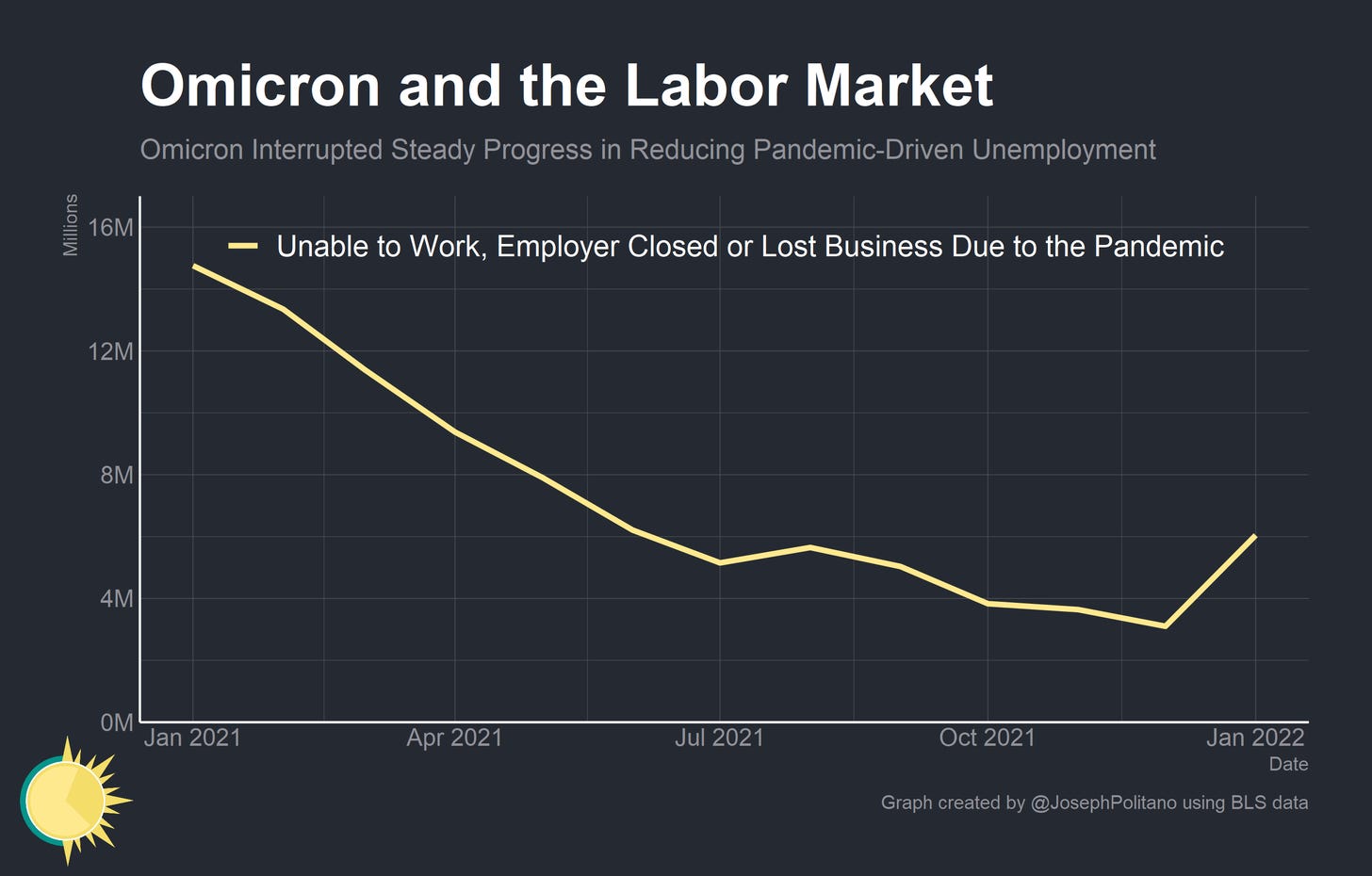

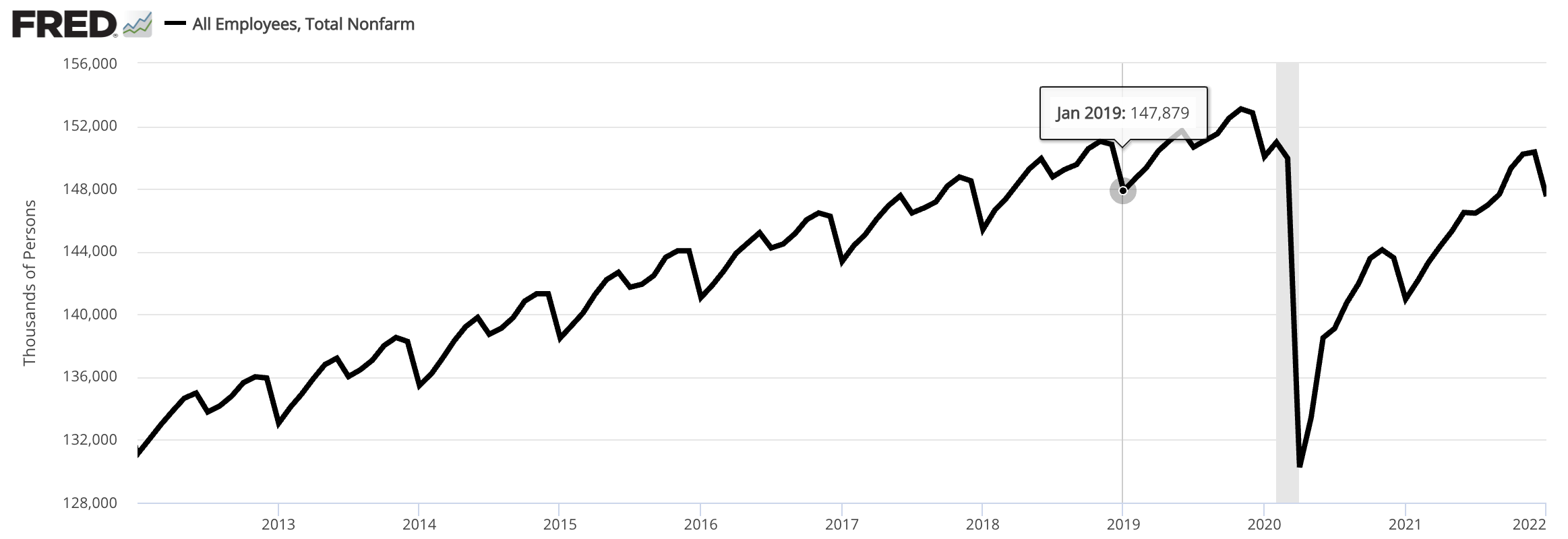

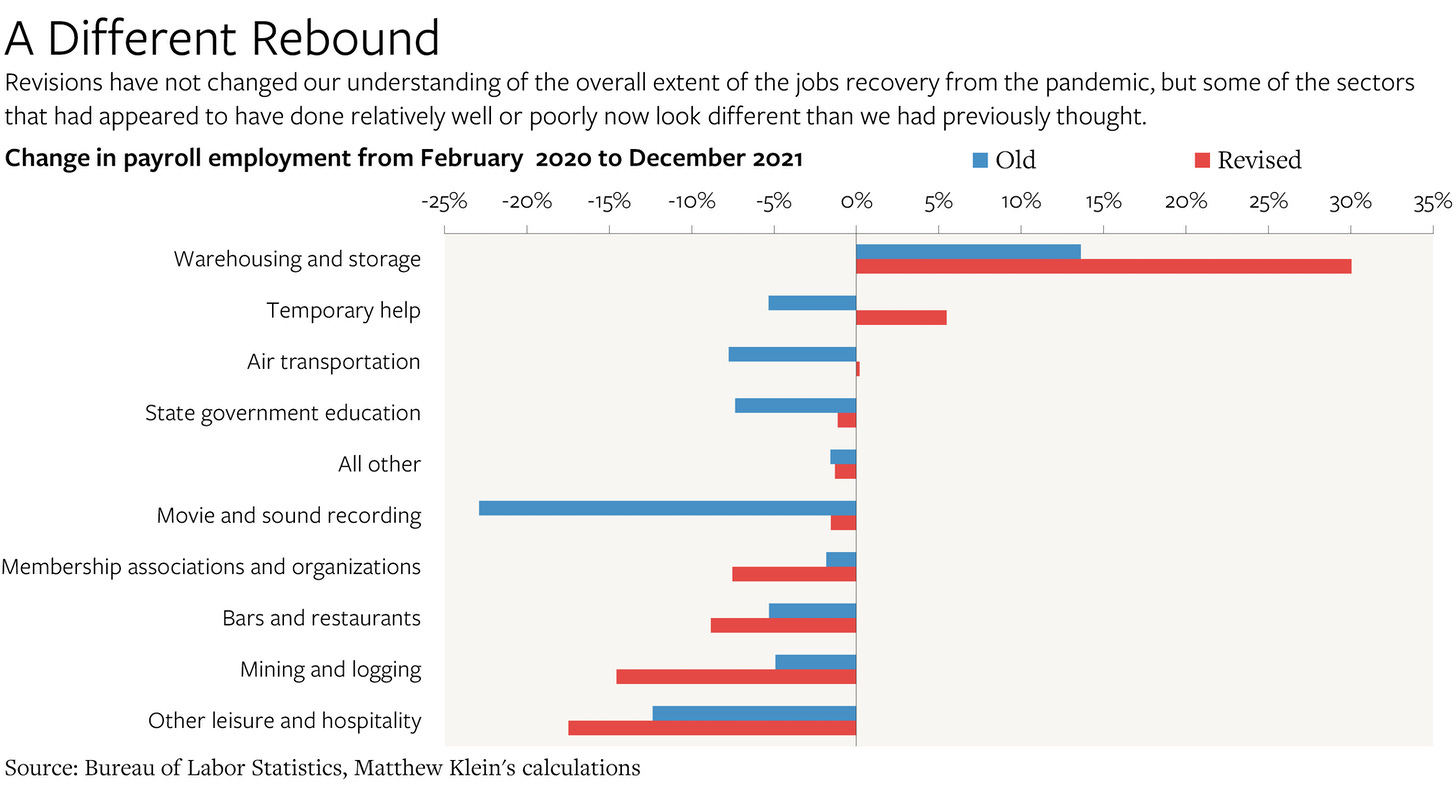

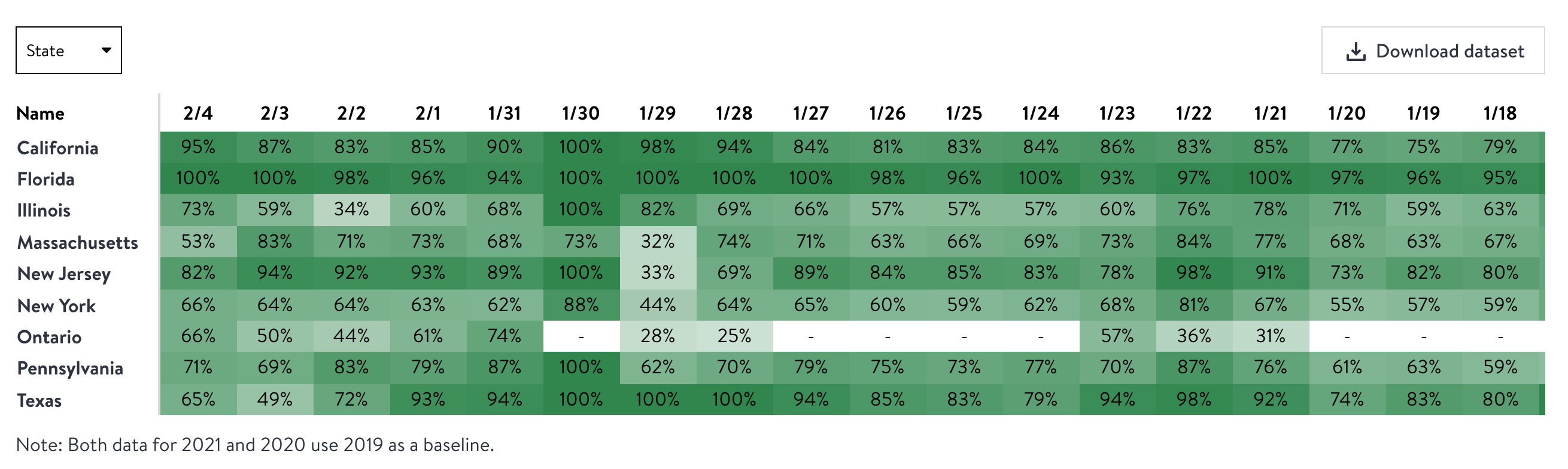

The establishment survey is generally considered more accurate and is the canonical source of information for the questions that it answers, but to understand the labor market, we also need information that doesn't show up in the establishment survey. Calculating the unemployment rate or more a sophisticated measure like the employment-population ratio, for example, requires knowing how many non-employed people say they're looking for work. Talking to employers doesn't tell you that, so we also need the household survey. But surveys rely on statistical samples of the population. To go from survey data to a point estimate about the level of employment, you need to make some background assumptions about the population you are surveying. Each month's report is revised the next month and then revised a second time as those assumptions are updated. There is also a seasonal adjustment that is applied to each report to try to extract the macroeconomic signal from the underlying noise. On top of this, January happens to be the month when the BLS does an annual update of some of its models. As part of this process, they use administrative data from the Unemployment Insurance system to check to see whether their survey-based estimates from a few months ago were accurate. They also use updated census data to change their estimate of how many people there are or what age they are. With updated data, they're able to generate new and better estimates. The January jobs gains came entirely from these changes. Population revisions create tons of jobs in JanuaryNear the end of the report, the BLS explains that with new Census data, they now think there are more people in the country but fewer old people than they previously believed. This increases the size of the labor force by a lot, raising the employment-population ratio. They also specifically say, "Data users are cautioned that these annual population adjustments can affect the comparability of household data series over time." But when we talk about job growth, we are specifically talking about comparisons over time. If you scroll down further to Table C, they show how the altered population estimates change the reported month-of-month change. And it says that if you apply the new population estimate to December 2021, you would have seen a loss of jobs between December 2021 and January 2022. The growth of jobs is purely a reflection of the changed population estimate. That doesn't mean the jobs aren't real. But they are jobs we had all along. Using consistent household survey data, employment fell in January. And not only did it fall, but it fell for precisely the reason the Biden administration was worried it would fall: lots of people missed work because they were sick. The economy is a complicated chain of dependencies. Robust labor demand is good for workers, but constraining labor supply is bad, so while some people missed work because they were sick, other people who weren't necessarily sick missed work due to temporary closures induced by other people being sick. Population estimates don't impact the establishment survey, which did show strong job growth, particularly in the revisions to the November and December numbers. But what normally happens during a period of fast job growth (and certainly what happened consistently in 2021) is that the establishment survey misses a bunch of jobs early on that show up in the household survey. They're then discovered in revisions. We also need to note another specific piece of January weirdness. Normally a lot of companies add extra staff in the lead-up to Christmas, then lay them off in January. The unadjusted data shows a catastrophic recession every January, but the seasonal adjustment algorithm makes it go away. Every 12 months there's a sharp downward jag in employment, and every January is the worst employment month of the year. Seasonal adjustment takes a January that was better than the average January and calls it job growth. Now to be clear, seasonal adjustment isn't some kind of scam or trick. We want to know how the labor market is doing. And what happens in a strong labor market is you see a below-average number of January layoffs. The official data is telling us what we wanted to know — demand for workers remained robust in January 2022. But in terms of "labor market data vs. your lying eyes," both surveys are saying the same thing, which is that the economy hit January 2022 with a lot of momentum but there really was an Omicron disruption. Beyond that, though, the revisions also show us that the pandemic weighed harder than we knew on the labor market all year. Restaurants are in worse shape than we knewThe pandemic pretty clearly boosted employment in warehouse and logistics work while hurting employment in hotels, bars, and restaurants. I think if you spent all of last year ignoring labor market data, that's what you would have guessed — leisure and hospitality are still pretty depressed, while transportation and warehousing are booming. That is broadly what the data showed, with a fair amount of nuance. But as Klein's chart here shows, revisions basically eliminated a lot of that nuance; there really was a huge structural shift in demand for workers out of leisure and hospitality and into warehouses. In particular, a collapse in film production and air transportation now seem to have not happened,¹ and the warehouse surge was just enormous. This doesn't radically alter our understanding of the overall state of the labor market, but it means that the pandemic was weighing more heavily on the economy than the non-revised data showed. So what's up with restaurants? Well, for eight states (and Ontario), OpenTable can give us information on restaurant bookings now compared to two years ago. And it showed January restaurant demand staying very strong in Florida and kind of strong in Texas and California, but really hurting in New York, Illinois, Pennsylvania, and Massachusetts. This seems like a mix of blue/red effects and warm/cold effects. We've had unusually harsh weather this January in D.C., and I have seen people braving the outdoor dining scene in freezing temperatures. Common sense is that if we had California's weather, all those outdoor dining structures would've been packed. But a lot of Covid-cautious people stayed home rather than shiver or brave Omicron indoors. And I think this is going to be a tough policy nut to crack. The restaurants aren't closed in blue America — the cautious people are avoiding them either altogether or during waves. And eating out in restaurants, even though it's something that I personally enjoy a lot, is an extremely discretionary activity. It's not like skipping doctor's appointments or taking your kid out of school. If you don't want to go out to dinner except when the weather is good, you can live that way basically indefinitely. That being said, as I wrote in my piece on normalcy, I do think Democratic policymakers should consider the interplay between school quarantine rules and other behavior. Saying a kid needs to quarantine for at least 10 days if he gets Covid-19 rather than applying the normal "don't come to school if you feel sick" rule significantly raises the stakes around the virus beyond its actual health impact on children. One point of view is that inducing fully vaccinated families to be more cautious in their behavior is a benefit of these quarantine rules because caution per se is a good idea. But from an economic point of view, it's counterproductive, and it would be helpful to nudge people into dining out if they can. Good short-term newsMy bottom line on all of this is that a correct understanding of the January jobs report should make you more optimistic about the short-term. There really was a significant Omicron effect on the economy in January, but we can expect that to taper in February. That will be a nice supply-side boost to the economy. And since restaurants in the northeast appear to be a seriously depressed sector, reduced pandemic concerns in February and then better weather come springtime should generate a further economic tailwind. But beyond the big, obvious questions about inflation, the Fed, the stock market, energy prices, etc., I wonder to an extent how robust American society will prove to be against future waves of the virus. The availability of vaccines and boosters and the accumulated antibodies from prior infections all mean that the virus is becoming less deadly over time. But vaccine protection does wane, the virus seems to keep evolving, and I don't think we'll be able to say this is "over" any time soon. So I think the Biden administration needs to ponder, not just as a matter of policy but as a matter of rhetoric and signaling, what outcome they are looking for. Unvaccinated people getting vaccinated is clearly good. People getting boosters as needed is clearly good. But if boosted people refrain from travel and indoor dining during Covid-19 waves, is that good? It strikes me as a large economic burden for a minimal public health gain, and among a population that is much more likely to be persuadable by the Biden administration than the hard-core Covid-19 denialists. As Omicron wanes, it'll be easy for the administration to do some cheerleading. But while there's no guarantee there will be another severe wave, there's a very strong possibility that there will be, and they ought to make a plan for it. Do they want to take a Fauci-led approach that emphasizes the virtue of precaution or do they prefer an economy-focused approach that emphasizes building confidence and the virtues of normalcy? Right now, I think they'd be likely to default toward the former. But they ought to be taking advantage of the opportunity to build up national stockpiles of tests and Paxlovid and preparing a message of "it's good and appropriate to keep traveling and dining with friends and family and living life" because the cost to the economy of doing otherwise is quite real. 1 My best guess is that the rise of streaming services is changing who is employing people in film production just as the shift from business to leisure demand is changing where air transportation workers are. This is the kind of thing you need the administrative data to catch. |

Tuesday, February 8, 2022

Matthew Yglesias: Breakdown of the Jan Jobs Report

Subscribe to:

Post Comments (Atom)

West Virginia GDP -- a Streamlit Version

A survey of West Virginia GDP by industrial sectors for 2022, with commentary This is content on the main page.

-

John Case has sent you a link to a blog: Blog: Eastern Panhandle Independent Community (EPIC) Radio Post: Are You Crazy? Reall...

-

via Bloomberg -- excerpted from "Balance of Power" email from David Westin. Welcome to Balance of Power, bringing you the late...

-

---- Mylan's EpiPen profit was 60% higher than what the CEO told Congress // L.A. Times - Business Lawmakers were skeptical last...

No comments:

Post a Comment