https://www.epi.org/blog/all-pain-and-no-gain-unemployment-benefit-cuts-will-lower-incomes-and-consumer-spending/

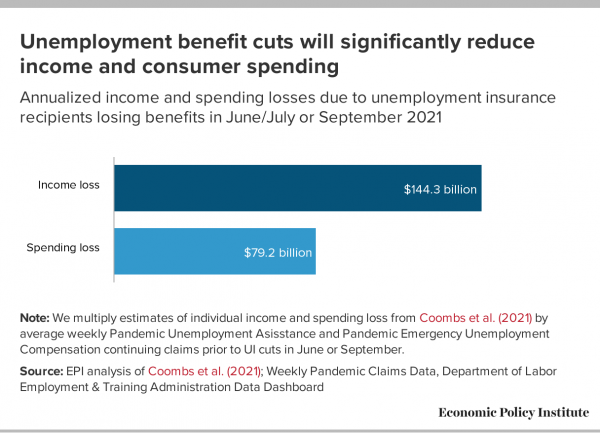

Congress and the Biden-Harris White House have let expanded unemployment benefits expire in the middle of the ongoing COVID-19 pandemic, even while employment is still well below pre-pandemic levels. As a result, annual incomes across the U.S. will fall by $144.3 billion and annualized consumer spending will drop by $79.2 billion, according to the best available evidence on the effects of recent unemployment benefit cuts.

In March 2020, as the economic impact of the pandemic spread quickly, Congress critically expanded unemployment insurance (UI) benefits by providing $600 (and later, $300) monthly supplements, extending benefit periods, and making previously excluded workers—such as independent contractors and those with low incomes—eligible for UI.

However, about half of states prematurely terminated these programs between June and late July 2021, and then, by letting the federal law expire in September, Congress and the White House cut off pandemic UI entirely. In total, more than 10 million workers lost all of their unemployment benefits because of either the state-level program terminations or the September program expiration.

Claims that the pandemic unemployment benefits have slowed economy-wide job growth—which fueled the state-level terminations—are false. Instead, any potential gain to job growth driven by lower benefits chasing people into the labor market seems to have been offset by two counterweights: first, a consumer demand effect, in which there is a drag on growth stemming from reduced household spending when UI benefits are lost; and second, a "congestion" effect, in which job gains among former UI recipients crowd out other job seekers.

In fact, new research from a team of economists shows that the early, state-level UI terminations significantly reduced total incomes and consumer spending. The study found the benefit losses following these early terminations led to only the smallest boost in job-finding: Earnings from work rose by only $14 per UI recipient per week in states that cut off benefits, but weekly UI income fell by $278, for an average weekly net income loss of $264 per recipient. Because of lower total incomes, UI recipients spent $145 less weekly. On an annualized basis, the average person losing UI saw their annual income drop by $13,728, leading to an annual spending reduction of $7,450.

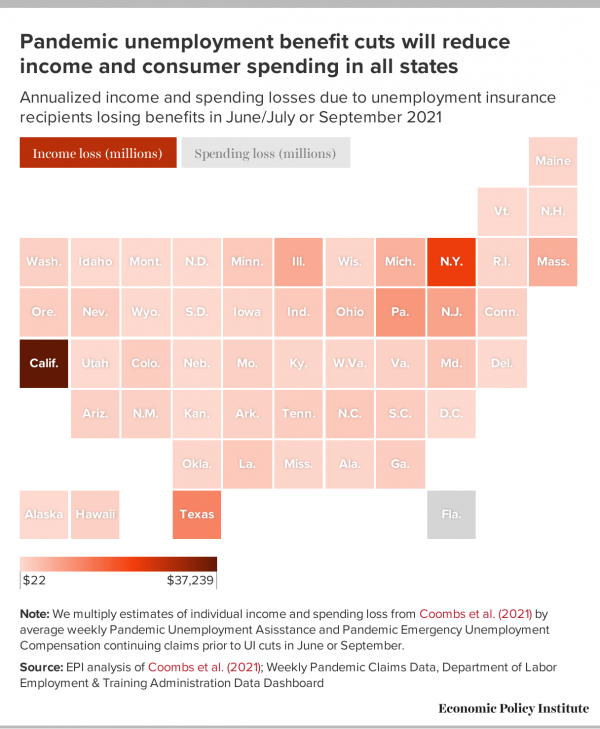

Figure A extrapolates the annualized findings to both the June/July and the September UI cuts, which eliminated unemployment benefits for over 10 million workers nationally. Total annualized incomes of those previously receiving pandemic UI benefits will fall by $144.3 billion as a result of these cuts. And, as a result of falling incomes, annualized consumer spending will fall by $79.2 billion. Figure B shows the income and consumer spending losses in each state.

Unemployment benefit expansions provided a critical lifeline to workers and their families during the pandemic. The extended benefits were a significant reason why the number of people in poverty actually fell in 2020 despite record-level job losses. Removing those income supports will increase poverty and will disportionately harm people of color, as Census data for late June indicated that Asian, Black, and Hispanic workers were much more likely to be receiving unemployment benefits than white workers. People of color are also more likely to live in states that normally have more restrictive unemployment benefits in the absence of the pandemic UI extensions.

Overall, the resulting income and consumer spending losses of the most recent unemployment benefit cuts will be devastating to families struggling during the COVID-19 pandemic. Congress should immediately restore the pandemic unemployment benefits and begin work on long-run reform of the UI system.

Methodology

We calculate national and state-level estimates for reduced income and consumer spending due to pandemic UI expiration by extrapolating from the estimates in Coombs et al. 2021, who find that for the average affected UI recipient, the state-led UI terminations around June 2021 reduced weekly UI payments by $278, and raised weekly earnings by $14, for a net weekly income loss of $264. They also find that for the average affected UI recipient, the June 2021 UI terminations reduced weekly spending by $145. We annualize these amounts by multiplying by 52 weeks.1

We then multiply the income and spending reductions by state-specific estimates of the number of Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) recipients losing benefits in the month before pandemic UI benefits are ended in each state. Conceptually this is similar to the estimates provided in Andrew Stettner's earlier analyses of benefit cuts. As a result, there are two groups of states: (A) states that ended UI programs early, between June and late July, and (B) the remaining states, which saw their programs expire on Labor Day.

We categorize those states that maintained PUA and PEUC but ended the $300 supplement early into group (B). We use average PUA and PEUC continuing claims for the weeks ending May 22 and May 29 for group (A). For group (B), we use average values from the weeks ending August 14 and August 21. We completely omit Florida from the analysis because the state has failed to report PUA and PEUC continuing claims data. For Georgia, we use only PUA continuing claims because the state failed to report PEUC continuing claims. Table 1 lists the resulting income and consumption losses for each state.

Note

1. Kyle Coombs et al., "Early Withdrawal of Pandemic Unemployment Insurance: Effects on Earnings, Employment and Consumption," Working Paper, August 2021, https://files.michaelstepner.com/pandemicUIexpiration-paper.pdf.

-- via my feedly newsfeed

No comments:

Post a Comment