https://www.epi.org/blog/inflation-sources-consequences-and-appropriate-policy-remedies/

Several very good primers were recently written on how to think about inflation in the coming months. But as the reaction to monthly price inflation numbers that ever tick above a 2% annualized rate continues to be disproportionately angst-ridden, another one may be useful.

Assessing this week's data and the ongoing debate about inflation and economic "overheating" requires an understanding of at least four key points:

- The source of inflationary pressure is crucial to assessing how policy should respond. Inflation coming from the labor market because workers are empowered enough to secure wage increases that run far ahead of the economy's long-run capacity to deliver them (that is, productivity growth) is the only source of inflation that should ever spur a contractionary macroeconomic policy response (either smaller budget deficits or higher interest rates). This type of inflation is what worries about "overheating" center on.

- Other sources of inflationary pressure are far more likely to be transitory and hence should not spur a contractionary policy response.

- Inflation in the prices of commodities is often volatile and driven largely by global markets. Such price increases are likely to hinge on idiosyncratic drivers like weather changes, oil field discoveries, or rapid growth in large economies outside the United States. This kind of inflation should not spur a contractionary response. These price increases are not driven by economic "overheating"; engineering an economic "cooling" by reducing budget deficits or raising interest rates will not stop them—but it will cause a lot of collateral damage in slowing growth within the United States.

- Inflation driven by very large relative price changes is also highly likely to be transitory and should not be met with a contractionary macroeconomic policy response.

- Arguing that inflation stemming from many sources should not be met with a contractionary policy response does not mean that this type of inflation is good, or even just benign. Such inflation often does reduce typical workers' living standards. But to be effective, anti-inflation policy must address such types of inflation with tailored measures, not across-the-board macroeconomic austerity.

- Spillovers of inflation that begin outside the labor market but spark inflation driven by wage-price spirals are highly unlikely given the extremely weak bargaining position and leverage of typical U.S. workers in recent decades. This degraded bargaining position also suggests that unemployment rates might reach far lower levels than they did in past decades before spurring wage growth sufficient to drive excess price inflation.

Policymakers need to keep an eye on wage-driven inflation

As recoveries proceed, the unemployment rate falls, and labor markets move into a "high-pressure" state, typical workers' leverage to achieve faster wage growth increases. Over the long run, the highest average sustainable pace of wage growth workers can achieve is the sum of the inflation target set by the Federal Reserve (currently 2%) and the economy's rate of potential productivity growth, where productivity is simply the inflation-adjusted value of the income generated in an average hour of work in the economy. Potential productivity growth is the rate of growth that would prevail in tight labor markets with low rates of unemployment. For the United States, this rate is likely roughly 1.5%. Nominal wages can thus rise by 3.5% a year (2% price inflation target plus 1.5% potential productivity growth) without putting pressure on price inflation to move above 2%.

To see why nominal wages should be allowed to grow as rapidly as the sum of productivity growth and the Fed's inflation target, imagine that both nominal wages and productivity rose 2% in a year. In this scenario, hourly wages climb 2%, but the amount produced in each hour of work—the definition of productivity—also rises 2%. If labor costs rise 2% and output rises 2%, then costs per unit of output (i.e., prices) would not rise at all—inflation would be 0%. But the current inflation target of the Fed is not zero, it is 2%. This target means that nominal wage growth can be 2% higher than trend productivity growth before labor costs (determined by both wages and productivity) threaten to push inflation over the Fed's target.

Theoretically, if macroeconomic policy is too expansionary (fiscal support is high and the Fed keeps interest rates low), then pressure in labor markets could push wage growth above this 3.5% long-run target for a sustained period of time. But this 3.5% target is a long-run average target—discrete periods in which wages grow faster than 3.5% are not necessarily inflationary. Wage growth could, for example, run above this long-run target for a spell after a recession that saw it stay below it for a long time. A long-run target means that below-target wage growth is averaged with equal periods of above-target growth. Eventually, macroeconomic policymakers could find themselves having to cool off a high-pressure labor market if wage growth puts heavy, consistent upward pressure on prices for a sustained period of time.

There are three important points to note about wage-driven inflation and the use of contractionary macroeconomic policy to combat it:

- It has been literally unheard of in the United States since at least the 1970s. This is not an accident—the institutional structure of the U.S. economy has changed so much since then that engineering a wage-price spiral is actually quite difficult. The long-story-short version of the change in these institutional structures is that policymakers have dismantled nearly every bulwark to bargaining power and leverage that typical workers had in labor markets when negotiating (even implicitly) with employers. Given this extremely disadvantageous bargaining position, it takes very low unemployment for a very long time to give much spur to wage growth.

- Although no one much likes inflation, inflation that stems from rapid wage growth is by definition not damaging to living standards on net. In high-pressure labor markets, when wages are rising smartly, workers may get frustrated that nominal wage raises are not buying as much as they hoped when they demanded them, because of the rapid price growth that followed. But if it is wage increases that lead to price growth, then these increases will not reduce living standards. Over a very wide range of unemployment rates, lower rates are consistent with nominal wages rising faster for every percentage point decline in unemployment than prices, meaning that workers win from labor market tightening.

- Although the problem of inflation control has not been pressing for a long time, policymakers should think hard about policy levers to use to spread the sacrifice of inflation control more equitably if such control becomes necessary in the future. Currently, the plan if wage-driven price inflation appears is to make macroeconomic policy more contractionary (mostly through higher interest rates), which would reduce the demand for labor and relieve inflationary pressure from the labor market. In the United States, such a demand slowdown has traditionally meant that some small minority of workers lose their jobs entirely while most of the workforce remains employed (albeit with less leverage to achieve wage gains). Other countries have instituted policies (particularly work-sharing) that spread the lower labor demand over many more workers, by reducing hours for a very large pool of workers to absorb the lower levels of labor demand rather than entirely laying off a much smaller pool of workers. There is a lot to like about a strategy that spreads the pain of accommodating reduced labor demand more broadly. The United States should try hard to find policy levers to implement this strategy—by, for example, providing more incentive and support for the take-up of short-time compensation programs in the unemployment insurance system.

Macroeconomic austerity is not the right tool for dealing with supply shocks and relative price changes

Inflation sometimes increases even without any upward pressure at all from the labor market. One example was the first five years of recovery following the Great Recession of 2008–2009. Between mid-2009 and mid-2014, unit labor costs grew by 0% while prices rose at a 0.8% annualized rate. In this instance, all of the (admittedly mild) upward pressure on prices came from widening profit margins. These profit margins could rise precisely because the labor market was so damaged by the Great Recession that wage growth slowed to a crawl. If the Fed had responded to this price pressure by raising interest rates to slow demand growth, wage growth would have fallen even more.

The best-known set of price pressures that do not come from the labor market—and hence should be mostly ignored by macroeconomic policymakers—are the prices of food and energy, both of which are hugely influenced by global markets, not just U.S. markets (let alone the U.S. labor market). They are also influenced by idiosyncratic drivers like weather and the discovery of new oil fields. Efforts to tamp down price spikes in these sectors with measures to cool off the U.S. labor market would be extraordinarily ineffective while inflicting much collateral damage on U.S. workers. (Recognition of the difference between types of inflation is behind the concept of "core" inflation—inflation that strips out the prices of food and energy.)

Often the practice of stripping out food and energy prices when discussing the proper stance of macroeconomic policy is criticized on the grounds that it constitutes cherry-picking of data. "Removing the sectors with high inflation of course makes inflation seem lower" is a common refrain from critics of core measures of inflation. However, focusing on core inflation for making decisions about the proper stance of macroeconomic policy is absolutely the right thing to do. Furthermore, food and energy price inflation are not routinely higher than core inflation, they are just more volatile. Indeed, for long periods of time core inflation has been substantially higher than inflation that includes foods and energy prices. During those periods, complaints about stripping out food and energy prices rarely emerge.

Changes in relative prices lead to only transitory inflation increases

A recent example of inflation clearly not coming from an overheating labor market can be seen in the May 2021 data from the Consumer Price Index (CPI), which rose by 0.6% in a single month. A big part of the measured acceleration in year-on-year inflation was the simple arithmetic quirk of comparing prices in May 2021 to prices in May 2020, the month that saw vast swathes of the U.S. economy virtually shut down because of COVID-19. Aside from this (very large) quirk, the biggest contribution to the overall rise in inflation came from extraordinarily rapid inflation in the price of used cars, which by definition were built by labor in the past. Clearly, any price increase in this sector in May could not have been driven by labor market conditions in May. Responding to the spike in used car prices by raising interest rates would have made no sense.

Another example can be seen in the years before the COVID-19 shock. During the economic recovery and expansion following the Great Recession, the cost of housing consistently grew more rapidly than overall inflation. Housing does depend, at least in some small part, on the current cost of production, which depends partly on labor market conditions. However, the cost of housing also depends on many factors besides labor market-driven cost pressures. In the United States, for example, the aggregate price inflation in housing is driven by a subset of cities in which demand for housing has outstripped the building of new units. Supply growth, in turn, has largely been kept too low by a range of restrictions and zoning regulations that are unrelated to labor market conditions.

A rise in the relative price of housing will, of course, put some upward pressure on average inflation at first. Over time, as housing costs take up more of households' incomes, spending will be reduced on other items; prices in these sectors should hence face some downward pressure, preserving the average rate of inflation around the Fed's target. But responding to any upward pressure on overall inflation stemming from a big change in relative prices (say, the rising cost of housing) by instituting a more contractionary macroeconomic policy stance would make little sense.

The same logic holds for large price changes caused by market concentration and monopolization. Monopolies usually charge higher prices than firms in more-competitive markets. These monopoly prices put pressure on household budgets and harm economic efficiency, but they do not cause overall inflation, largely because the higher relative prices driven by monopolization reduce the resources that households have to spend in non-monopolized sectors, and this reduced demand depresses price growth in those sectors. The proper policy tool to reduce the harm done by monopolies charging excess relative prices is competition policy, not contractionary macroeconomic policy.

Even painful inflation does not always call for intervention by the Fed

The arguments above that inflation driven by influences outside the labor market should not be met by a macroeconomic policy response might make people think we're arguing that such inflation is benign, or even good. That is not our argument.

A spike in food prices driven by events abroad, for example, reduces U.S. households' purchasing power and makes them poorer. Policymakers should see whether anything can be done to alleviate this—say by addressing potential bottlenecks in food production. Policymakers should certainly use fiscal policy to transfer resources—increasing food stamp benefits, for example—to reduce the damage the food price shock inflicts on the most vulnerable. But an across-the-board effort to weaken economy-wide demand growth in the U.S. would not effectively target a food price spike driven by global influences—and it would cause collateral damage by slowing job and wage growth in all other sectors in the economy.

Moreover, large changes in relative prices, such as the cost of housing, are often a response to genuine scarcity, not the result of an overheating economy. The best policy response would be measures that reduce that scarcity—by building more public housing and changing regulations to spur more private-sector building, for example. In the specific case of housing, raising interest rates in response to a housing cost inflation would actually lead to a perverse outcome. Housing construction is capital intensive and tends to be financed with debt. Raising the cost of this debt by raising interest rates would likely lead to less construction, making the demand–supply imbalance in the sector even worse and leading to faster housing inflation.

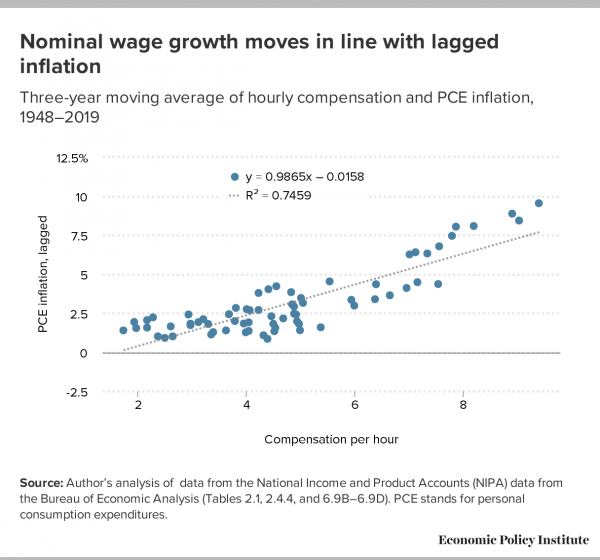

Nothing about arguing against a macroeconomic policy response to some sources of inflation denies that inflation can harm living standards. Instead, it just argues that macroeconomic policy will not actually address some sources of inflation and using macroeconomic austerity to tamp down such sources of inflation would carry far too high a collateral cost. It is worth noting, however, that a common view that inflation leads mechanically to one-for-one reductions in workers purchasing power is often wrong. Nominal wage growth generally responds relatively quickly to higher inflation. Figure A shows the three-year moving average of hourly earnings and lagged inflation in the price index for personal consumption expenditures (PCE). The correlation between the two is nearly exactly 1, meaning that on average wages adjust relatively quickly to changes in inflation.

This quick adjustment of wage growth to price inflation is not true for low-wage workers. Figure B shows the correlation coefficient between the three-year moving average of PCE inflation and the nominal wage growth for the 10th, 20th, 50th, and 90th percentiles of the U.S. wage distribution. It has long been noted that wages at the low end of the distribution are highly influenced by explicitly political decisions—mostly the value of the federal minimum wage. Given this, the failure of these wages to fully adjust quickly to lagged inflation is hardly a shock. It may be surprising to see that median wages do almost fully adjust to lagged price inflation.

Finally, it is worth noting that this too-simple analysis does not mean that inflation always mechanically reduces wage growth for the 10th and 20th percentiles. For example, the (lagged) price inflation itself may have been caused in turn by past wage growth. But, this analysis may help remind us that it is rare for prices to move by themselves and so inferring that living standards fall one-for-one with increases in inflation would be incorrect. Wage growth, after all, is the outcome of (explicit and implicit) bargaining between workers and employers, and both parties are well aware of what has happened to price inflation in the recent past as they strike their bargains.

Inflation—even when it is not coming from the labor market—is not all pain

The public largely fears inflation. Much of this fear is rational: All else equal, inflation reduces the purchasing power of current income. But, when inflation unexpectedly rises or falls, there are other distributional consequences as well, and not all of them are bad. For example, unexpected inflation tends to transfer wealth from lenders to debtors.

Consider the example of residential mortgages. The interest rates on such mortgages are set by banks with expected inflation in mind. When inflation is running high and is expected to continue to do so, interest rates are higher; when inflation is low and expected to remain so, interest rates are lower. The sharp reduction in inflation between the late 1970s and today is by far the single biggest reason why mortgage interest rates for U.S. households fell so much in that period. If a household took on a mortgage payment with a 4% interest rate when inflation was 2%, then the effective real (inflation-adjusted) interest rate was 2% (4% nominal interest rate minus 2% inflation). But if inflation unexpectedly bumped up to 3%, the real interest rate would fall to just 1%. The borrower would be paying back a stream of mortgage interest to the bank that is worth less in purchasing power than either side expected when the contract was signed. The increase in inflation makes the mortgage less burdensome to the household and less profitable to the bank.

This same process works in reverse. If instead of unexpectedly rising from 2% to 3%, inflation unexpectedly falls from 2% to 1%, then the real interest rate on the mortgage would rise to 3%, leading to payments from the borrower to the bank that are higher in inflation-adjusted terms. An unexpected decline in inflation thus constitutes a transfer from debtors to lenders. An unexpected fall in inflation that increased the real burden of household debt was a contributing factor to the slowness of the recovery from the Great Recession. It is a key reason why it is so important that macroeconomic policymakers (mostly the Fed) ensure that their stated inflation target is symmetric: It is as important to keep price growth from falling below target for an extended period of time as it is to ensure that price growth does not rise above target for an extended period of time. One underappreciated aspect of the large, unexpected episode of inflation in the 1970s and early 1980s is that it provided a large transfer to debtors—mostly mortgage holders—over that decade. This windfall to mortgage holders likely played an outsized role in many peoples' estimation of the benefits of homeownership.

Finally, a common claim about inflation's malign effects is that it hurts people on "fixed incomes." The classic archetype conjured up to describe such people are low-income retirees. But a large majority of retiree income comes from Social Security payments, which are completely indexed to inflation, particularly for low-income and low-wealth retirees. Social Security provides 90% of income for the lowest-income quarter of retiree households and at least half of all income for more than half of all retiree households. Retirees with higher incomes and wealth usually hold investments in instruments (bonds and stocks) that generally see higher returns as inflation rises. Retirees who held all of their assets in cash would indeed see inflation eat away at their wealth, but very few households do hold much of their wealth in cash (for very good reason).

Can inflation that starts outside the labor market become labor market driven?

The episode of wage-price spirals that started in the 1970s has become the lodestar for people who implicitly argue that any uptick of inflation—even when the source is not labor market pressure—needs to be met with an overwhelming response from macroeconomic policymakers. A standard narrative of the 1970s inflation is that while it was sparked by oil-price shocks (global events—1973 Yom Kippur War and the 1979 Iranian Revolution led to the price of oil doubling and then doubling again throughout the 1970s), it then kicked off a wage-price spiral in the labor market, with higher prices leading workers to demand higher wages and higher wages pushing up the cost of production and so on.

In this telling, it was only the determination of Fed Chair Paul Volcker to crush inflation with sustained interest rate increases—whatever the cost in terms of higher unemployment and stunted wage growth—that broke the spiral. The lesson taken from this episode is often that even inflation that does not begin in the labor market can become labor market driven and that drastic measures are needed to tame it when it does.

This narrative is hugely incomplete, and the lessons drawn from it are clearly wrong. Moreover, the conclusions do not apply to the institutional structure of the U.S. economy today, for several reasons.

Spillovers into labor market–driven inflation are highly unlikely in today's economy

The narrative is incomplete because it fails to contextualize the U.S. economy as it ran into the first oil price shock. For nearly 30 years before the 1973 oil price shock, U.S. workers had seen annual wage increases that averaged over 2%, as wage growth tracked economy-wide productivity growth, which was rapid in historical terms. In 1965-69, the unemployment rate averaged under 4%, and it fell to as low as 3.2%. In short, U.S. workers were setting expectations of wage growth based on assumptions that productivity growth would exceed 2% and that their wages would rise in tandem with it.

Besides these deeply ingrained aspirations about wage growth, the institutional structure of the U.S. economy gave typical workers the leverage and bargaining power to reliably achieve them. The unemployment rate was kept below estimates of the "natural rate" (the lowest level unemployment was thought to be able to go without sparking inflation) by a cumulative 15 percentage points between 1949 and 1973. Unionization rates averaged over 30% in the private sector. The federal minimum wage rose steadily in near-lockstep with productivity growth between 1938 and 1968. Import competition from low-wage countries was minimal. Top marginal tax rates for much of the period were well above 50%, severely sapping the incentive for capital owners and corporate managers to bargain hard to claim every last bit of a firm's earnings for themselves.

In addition, the oil price spikes of 1973 and 1979 were not the only shocks the economy suffered; there was also a significant deceleration in productivity growth. This productivity slowdown is one of the least understood major economic trends of the past 50 years. Whatever its cause, it cut the fastest sustainable wage growth possible to deliver to workers in half. Because productivity data are so volatile, it took years to recognize this productivity slowdown, so workers continued to bargain as if the old 2% trend productivity growth were continuing.

Workers and capital owners tried to pass through the economic damage from the oil price shock to each other by escalating nominal wage demands and price increases, respectively. They both also assumed the shock's damage would quickly fade away, thanks to rapid productivity growth. What is so surprising about the episode from the vantage point of 50 years later is that workers had any ability at all to engage effectively in this distributional conflict. Today, a combination of an external shock and a productivity slowdown would simply result in a lower path of wage growth, not a wage-price spiral with workers able to quickly respond to price increases by demanding and getting higher wages. It is often said that this period was characterized by "labor militancy." This description is accurate enough as far as it goes: U.S. labor furiously resisted declines in living standards spurred by inflation (and lower productivity growth), and their resistance contributed to wage-price spirals. This period is not said to have been characterized by "capital militancy," in part because capital is effective in protecting its incomes in all periods.

The role of productivity growth as an anti-inflation buffer is often neglected

All else equal, every percentage point increase in productivity growth pushes down inflation by a percentage point. An important contributor to inflationary pressures was the unexpected decline in productivity growth by more than a percentage point in the early 1970s and its continued low level for decades. Such a productivity slowdown is highly unlikely to appear soon in today's U.S. economy. In fact, productivity growth might begin rising significantly as labor markets tighten. In the years before the COVID-19 recession, extremely weak productivity growth began firming up, as unemployment rates continued to fall and wage growth began mildly accelerating. It has long been theorized that rising labor costs provide a powerful spur for firms to invest in labor-saving capital equipment and processes (i.e., to look for measures to boost productivity). Evidence supporting this view is compelling (if not complete).

The key role of faster productivity growth in muffling inflationary pressures underscores how anti-austerity macroeconomic policy cannot be the only anti-inflationary strategy. If, for example, public investments can spur productivity growth, they can constitute a sensible medium-run anti-inflation policy. The evidence on public investment and productivity growth is compelling. Such investments are a large part of the Biden administration's American Jobs and American Families Plans. Calls to abandon these proposals in the name of avoiding economic overheating make no sense in any way (among other things, these plans are fully paid for with tax increases, which should allay most fears of causing overheating) but these proposals' potential for boosting anti-inflationary productivity growth are an under-appreciated reason why these are sound macroeconomic investments to make.

The degraded bargaining power of workers is key to clear-eyed anti-inflationary policy

The need to consider the institutional context of the economy when assessing inflation risks does not apply only to the question of whether inflation from outside the labor market can spark labor market–driven inflation. It also applies to the questions of how low unemployment can go before labor markets are truly "high-pressure" and able to deliver wage growth in excess of productivity growth and how rapidly price inflation will follow from labor market tightening.

In short, the prospect of near-term "overheating" is not just a question of how expansionary the current macroeconomic policy stance is. It is also a question of how robust the institutions that allow typical U.S. workers to bargain for higher wages on a level playing field with employers are. Low unemployment rates and expansionary macroeconomic policy help level this playing field a lot—but other institutions and policies will determine exactly what level of unemployment is consistent with what level of wage growth. Because institutions buttressing U.S. workers' bargaining power have been so degraded in recent decades, it is likely to take quite a low unemployment rate to spark wage growth that runs above the economy's ability to pay for any extended period.

Conclusion

The causes and consequences of inflation can be complex, and policies appropriate to combat some variants of inflation are not appropriate to combat others. It is quite clear that large upward jumps in inflation cause anxiety to typical U.S. households. Too often in the past policymakers reacted to this anxiety by turning to the one anti-inflationary tool they knew best: launching more-contractionary macroeconomic policy. This response is often poorly targeted and always carries large costs. We need a much smarter debate about inflation and what to do about it.

-- via my feedly newsfeed

No comments:

Post a Comment