https://economicfront.wordpress.com/2020/05/18/victory-ohios-plan-to-deny-workers-their-unemployment-insurance-is-shelved/

-- via my feedly newsfeed

As economic projections worsen, so do the likely state budget shortfalls from COVID-19's economic fallout. We now project shortfalls of $765 billion over three years, based on the new projections from the Congressional Budget Office (CBO) of yesterday and Goldman Sachs of last week. The new shortfall figure, significantly higher than our estimate based on economic projections of three weeks ago, makes it even more urgent that the President and Congress enact more fiscal relief and maintain it as long as economic conditions warrant.

CBO now projects that unemployment will peak at 15.8 percent in the third quarter of this year (July-September), fall to a still-high 11.5 percent by the last quarter, and remain at an elevated 8.6 percent at the end of 2021. Goldman's new projection estimates that unemployment will peak at an astonishing 25 percent this quarter and still remain at 8.2 percent at the end of 2021. These CBO and Goldman estimates, considerably more pessimistic than their estimates of early April, account for the aid that Washington has already enacted for businesses, individuals, and state and local governments. Goldman's projections also assume that policymakers will provide additional fiscal relief.

Our projection of $765 billion in shortfalls over state fiscal years 2020-22 — much deeper than in the Great Recession of about a decade ago (see chart) — is based on both the historical relationship between unemployment and state revenues and on the average between the latest CBO and Goldman projections. It covers state budget shortfalls only, not the additional shortfalls that local governments, territories, and tribes face.

Federal aid that policymakers provided in earlier COVID-19 packages isn't nearly enough. Only about $65 billion is readily available to narrow state budget shortfalls. Treasury Department guidance now says that states may use some of the aid in the CARES Act of March to cover payroll costs for public safety and public health workers, but it's unclear how much of state shortfalls that might cover; existing aid likely won't cover much more than $100 billion of state shortfalls, leaving nearly $665 billion unaddressed. States hold $75 billion in their rainy day funds, a historically high amount but far too little to meet the unprecedented challenge they face. And, even if states use all of it to cover their shortfalls, that still leaves them about $600 billion short.

States must balance their budgets every year, even in recessions. Without substantial federal help during this crisis, they very likely will deeply cut areas such as education and health care, lay off teachers and other workers in large numbers, and cancel contracts with many businesses. (States and localities furloughed or laid off nearly a million workers in April alone.) That would worsen the recession, delay the recovery, and further harm families and communities. State and local cuts in health care also could shortchange coronavirus response efforts. The large shortfalls could lead states and localities to raise taxes and fees as well.

The coronavirus relief bill that the House passed on May 15, the Heroes Act, includes substantial state and local fiscal relief, both by providing flexible grant aid and by strengthening and extending the temporary increase in the federal share of Medicaid costs in the Families First Act of March — a particularly effective and efficient form of aid that alleviates state budget pressures and protects health coverage. States will need aid of this magnitude to avoid extensive layoffs of teachers, health care workers, and first responders, which would further weaken an already weak economy.

While the coronavirus pandemic has shut down much of the U.S. economy, with over 33 million workers applying for unemployment insurance since March 15, millions of workers are still on the job providing essential services. Nearly every state governor has issued executive orders that outline industries deemed "essential" during the pandemic, which typically include health care, food service, and public transportation, among others. However, despite being categorized as essential, many workers in these industries are not receiving the most basic health and safety measures to combat the spread of the coronavirus. Essential workers are dying as a result. While the Trump administration has failed to provide essential workers basic protections, working people are taking action. Some are walking off the job in protest over unsafe conditions and demanding personal protective equipment (PPE), and unions are fighting to ensure workers are receiving adequate workplace protections.

The coronavirus pandemic has revealed much about the nature of work in the U.S. As state executive orders defined "essential services," attention was focused on the workers performing those services and the conditions under which they work. Using executive orders from California and Maryland as models, we identify below 12 "essential" industries that employ more than 55 million workers, and we detail the demographics, median wages, and union coverage rates for these workers. In doing this, we build on the excellent work by the Center for Economic and Policy Research in their report A Basic Demographic Profile of Workers in Frontline Industries. Key differences are that we use a different data set—the Current Population Survey (CPS) instead of the American Community Survey (ACS), so we could get union breakdowns—and we expand the definition of essential to include occupations found in California and Maryland's executive orders.

As shown in Table 1, a majority of essential workers by these definitions are employed in health care (30%), food and agriculture (20%), and the industrial, commercial, residential facilities and services industry (12%).

Table 2 shows the demographics of essential workers by industry, including gender, education level, and race and ethnicity.

Table 3 shows the median wages for nonessential and essential workers by gender, education, and race and ethnicity. Half of the essential industries have a median hourly wage that is less than the nonessential workforce's median hourly wage. Essential workers in the food and agriculture industry have the lowest median hourly wage, at $13.12, while essential workers in the financial industry have the highest, at $29.55.

Table 4 shows the union coverage rates of essential and nonessential workers by industry. One in eight (12%) essential workers are covered by a union contract, with the biggest share working in emergency services (51%). Strikingly, some of the most high-risk industries have the lowest unionization rates, such as health care (10%) and food and agriculture (8%).

Prior to the coronavirus pandemic, essential workers provided critical services that often went unnoticed. Now, more than two months into the pandemic, many essential workers are still risking their lives without basic health and safety protections, paid leave, or premium pay. Before the coronavirus pandemic, unions played a critical role in ensuring workers receive fair pay and working conditions. The following are examples of how unions help working people.

The Trump administration's failure to provide essential workers basic protections during the coronavirus pandemic sheds light on the importance of unions. The following are examples of how unions are fighting for protections for essential workers.

The coronavirus pandemic has revealed the lack of power far too many U.S. workers experience in the workplace. There are roughly 55 million workers in industries deemed "essential" at this time. Many of these workers are required to work without protective equipment. They have no effective right to refuse dangerous assignments and are not even being granted premium pay, despite working in difficult and dangerous conditions. Policymakers must address the needs of working people in relief and recovery legislation, and that should include ensuring workers have a meaningful right to a union.

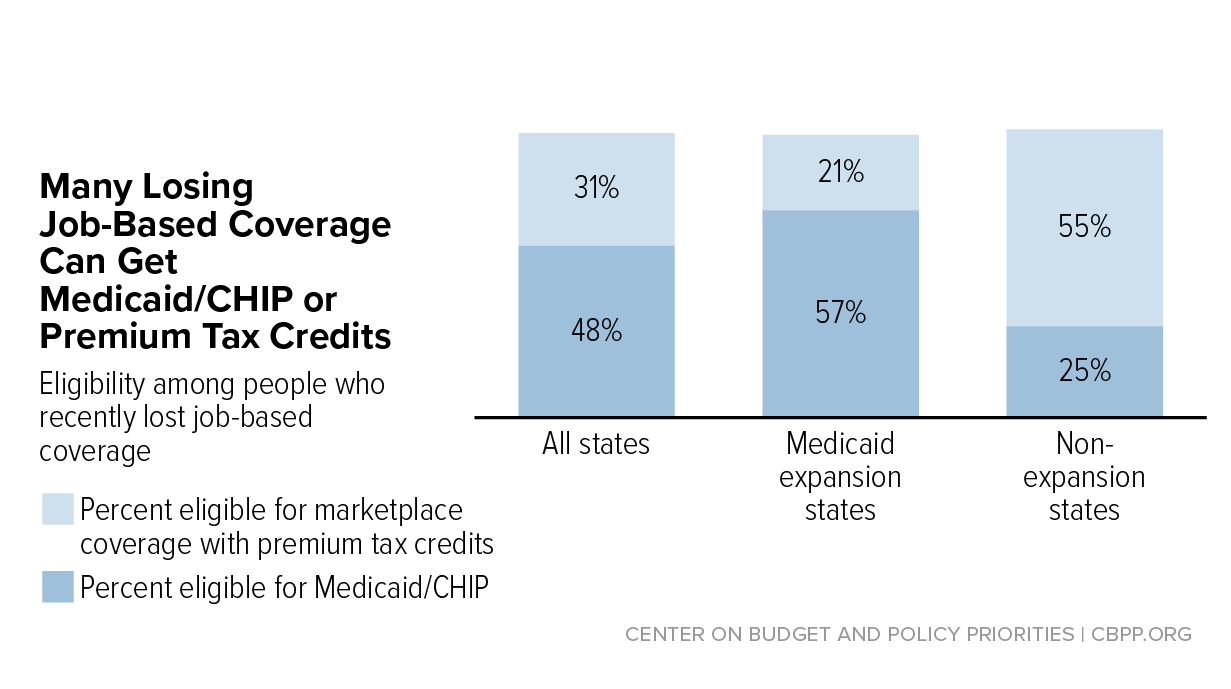

Congress should take steps to help as many people as possible access marketplace plans at this critical time.

This blog post is cross-posted in the American Constitution Society's Expert Forum Blog.

As unemployment approaches levels last seen during the Great Depression, and requests for mortgage forbearance increase every week, the Consumer Financial Protection Bureau (CFPB) has proceeded doggedly ahead in undermining consumer protection. The CFPB has suspended enforcement of most of the rules requiring mortgage servicers to help homeowners who have fallen behind in their payments; eased disclosure requirements for remittance transfer providers; and reduced collection and reporting of critical fair lending data. Apparently unsatisfied with rolling back regulatory requirements in the middle of a pandemic-driven economic crisis, the CFPB is also paying hundreds of thousands of dollars to a small "taskforce" of conservative academics and industry lawyers whose charter is to reconsider every aspect of consumer protection.

Although Congress specifically mandated that the CFPB's advisory committees follow federal sunshine laws, the CFPB has allowed the taskforce to meet without notice behind closed doors. The first public glimpse of its plans was a sweeping request for information issued in late March. While the rest of the country was struggling to address the spiraling economic threats posed by COVID-19, the taskforce asked questions about weakening fair lending laws and deregulating consumer finance markets.

Following the CFPB's expected repeal of consumer protections on payday loans and encouragement to banks to make their own high-priced, short-term loans, the taskforce asked about "impediments" to expanding such lending. It questioned whether consumer benefits like privacy and accuracy in credit reporting are worth the cost to industry and suggests that enforcement penalties discourage competition. In the midst of the pandemic, the CFPB taskforce is giving the public a mere two months to comment on fundamental questions like "the optimal mix of regulation, enforcement, supervision, and consumer financial education," how best to measure whether or not consumer protection is effective, and which markets should and should not be regulated.

The taskforce explicitly centers "informed choice" and "competition" as the preferred means of providing consumer protection, with enforcement only as a backstop. Left unchallenged, this framework threatens a dangerous future. Lenders, not consumers, choose debt collectors and loan servicers, and decades of competition in those markets has not reduced the volume of consumer complaints about harassing and abusive behavior. Even in markets where consumers can, in theory, choose the product and provider, abusive lenders often make that choice for them. The vast majority of homeowners don't comparison shop for a mortgage, the largest portion of many family budgets, and in the last great economic crisis, millions of homeowners lost their homes because of loans they couldn't afford with terms they couldn't understand.

Informed choice is a fantasy in most modern consumer credit markets, with pricing driven by obscure algorithms and marketers focused on exploiting consumer weaknesses. Competition in many consumer financial markets may benefit corporations and investors but not the ordinary people who foot the bill and lose their homes.

The taskforce cites the National Commission on Consumer Finance as its inspiration. But unlike the five-member, ideologically homogeneous taskforce, accountable only to the director of the CFPB, the National Commission on Consumer Finance was specifically authorized and funded by Congress; its work was bipartisan; a majority of its 12 members, supported by dozens of staff and student researchers, were members of Congress accountable to the public; its work spanned four years and drew on multiple public hearings with hours of testimony from leading consumer advocates as well as individual consumers and lenders. Whereas the National Commission concerned itself with "market excesses," the taskforce asks only about "informed choice." Whereas the National Commission recognized that consumers can be burdened with excessive debt, the taskforce's only reference to burden is that of the cost of compliance with consumer protections.

We have only until June 1 to submit comments on this information request. This may be our only chance to weigh in before the taskforce issues its report. If we think—as Congress did in 2010 when it created the CFPB, mandated consumer protections, and set the parameters for measuring the effectiveness of consumer protections—that consumer protection requires more than informed choice and competition; that enforcement and supervision and regulation are critical pieces of ensuring effective consumer protection; and that education alone is not and never can be enough, then we must comment.

In the wake of the 2007-2008 foreclosure crisis and the Great Recession, Congress recognized the central role that vigilant, focused consumer protection plays in ensuring economic stability. It created the CFPB so that never again would haphazard consumer protection derail economic prosperity. That focus and those consumer protections are threatened now.