https://www.cbpp.org/health/commentary-trump-administration-rules-on-health-waivers-weaken-pre-existing-condition

-- via my feedly newsfeed

The nation's payrolls added 250,000 jobs last month, the unemployment rate held steady at a 49-year low, the closely watched labor force participation rate increased, and year-over-year wage growth broke 3 percent for the first time since 2009. Given that inflation has been running a bit short of 2.5 percent, this means workers are finally seeing real gains in the buying power of their paychecks.

Wages were up 3.1 percent for all private sector workers and 3.2 percent for middle-wage workers, suggesting that the tight labor market is generating broad gains, not just helping those at the top of the earnings scale.

One slight caveat re wage growth is that in the previous October (2017), hourly pay in this series fell four cents in nominal terms, a rare event. Thus, the base off to which this October's wage gain is compared was unusually low. However, the moving-average figures below, which smooth out such monthly noise, show clear acceleration in the pace of wage gains. Also, averaging over the past three months shows hourly wages growing at a very strong 3.6 percent annual rate compared to the prior three months. This represents a clear acceleration over the prior two "quarters," when annualized growth was 2.6 and 3 percent, respectively.

In other words, the U.S. job market is tighter than it has been in decades and this dynamic is revealing at least two important insights. The first, which we knew, is that slack matters: the absence of full employment saps worker bargaining power and constrains wage growth. When we move toward full capacity in the job market, workers get back some of the clout they lacked, and employers must share more of the gains with them.

Second, and this most economists did not know, is that there was and still probably is more room-to-run in the labor market than conventional wisdom believed and thus more room for non-inflationary gains. The distributional implications of this critical insight cannot be overstated: full employment provides the biggest gains to the least advantaged, too many of whom have long been left behind in previous economic expansions.

Our monthly smoother, which averages over 3, 6, and 12-month windows to get a better look at the underlying trend of job growth, shows that trend job gains are north of 200,000, more than enough to push our already low unemployment rate down even further. Is this trend persists, and even if it fades some, it will likely take the jobless rate down to below 3.5 percent in coming months.

As noted, the tighter job market has delivered faster wage growth. The smooth trend in the next two figures show a slow staircase of wage gains, from around 2 percent in 2013, to 2.5 percent around 2016, to closing in on around 3 percent now. Contrast this staircase with the "elevator down" shortly after the recession. This pattern of sharp wage-growth losses and slow wage-growth gains is precisely why it is so important for policy makers to preserve and build on the gains generated by the close-to-full-capacity job market.

This admonition is especially the case when we consider how "anchored" price growth has been. The next figure shows that as the unemployment rate has fallen well below the Fed's estimate of the "natural rate"—the lowest rate they believe to be consistent with stable inflation—price growth remained at the Fed's 2 percent target. This anchored inflation dynamic has held even as wage growth has picked up.

Based on these relationships, I and others have suggested the Fed consider pausing in their interest-rate hiking campaign. This is a unique moment for a truly data-driven Fed to build on these critically important labor market gains that are finally—nine years into the expansion—deliver some potentially lasting gains to middle- and low-wage workers.

Finally, a political note. In applauding this strong report a few days ahead of a uniquely important midterm, it is impossible (for me, at least) to discuss the current job market apart from its political implications. First, one reason for the very tight labor market is the tax cut and spending bills that were added to the deficit, which at 4 percent of GDP, is far higher than it should be at this stage of the recovery. This deficit spending is boosting the growth rate by perhaps a percentage point, which I (along with most other economists) believe will start to fade later next year.

In other words, the policy agenda of piling onto the budget deficit when the economy is already closing in on full employment has, to its credit, revealed more labor capacity than most economists and the Fed believed was available. But it is also robbing the U.S. Treasury of much needed revenue at a time when we're going to need more, not less, revenues to meet the fiscal challenges we face.

Moreover, Trump is clearly building on trends he inherited. His constant refrain that the job market was terrible before he got here is the fakest of fake news. And then there's the reckless trade policy, the hateful rhetoric with its murderous consequences, the chaotic dysfunction at the highest levels, and the never-ending stream of lies.

I like a full employment labor market as much—surely more—than anyone. But I guarantee you it's possible to achieve it without all the hate.

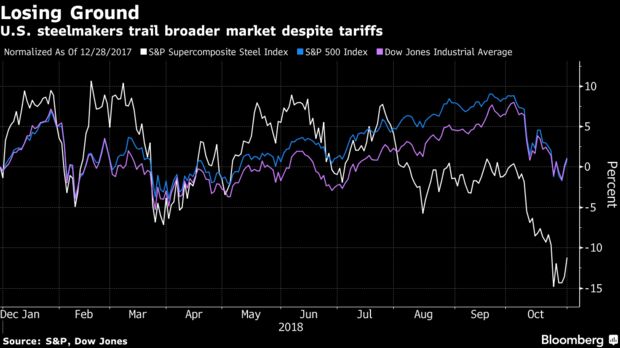

The largest U.S. aluminum and steel producers -- companies that were supposed to benefit from tariffs -- have all lost value this year.

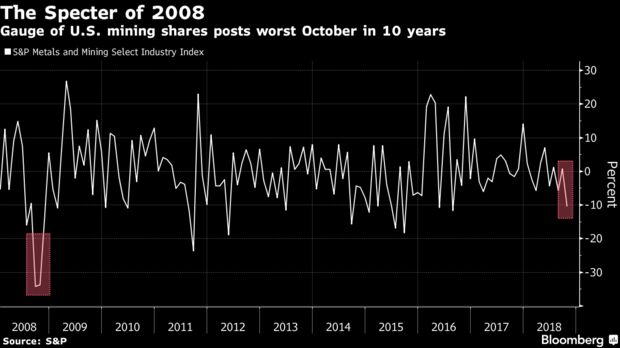

Shares of every major U.S. steel and aluminum producer are down for the year, while Century Aluminum Co. and Alcoa Corp., the country's two biggest aluminum makers, had the worst October since 2008. It was the biggest October drop since 2009 for U.S. Steel Corp., which reports quarterly earnings Thursday afternoon. The sell-off last month outpaced a broader market slump in the worst month for global equities in more than six years.

Companies in metals and mining have been hit especially hard amid concern that the rising trade frictions from the tariffs have helped crimp economic growth. That's eroded metal prices that initially surged when the U.S. announced the levies. The S&P Supercomposite Steel Index has slid 8 percent this year, and fell further behind stock-market gauges in October.

The S&P Metals and Mining Select Industry Index, which tracks 29 U.S. metal and mining companies including Alcoa, lost more than 10 percent last month on its biggest October sell-off since 2008. Chicago-based Century, TimkenSteel Corp. and AK Steel Holding Corp. were among the worst performers.

Caterpillar Inc., the top mining-equipment maker, posted its largest October drop in 10 years.

"The verdict the market has been rendering the past few weeks is this uneasiness and anxiety about the overarching macroeconomic picture, and there are increasing questions about the stress points emerging in the global economy," John Mothersole, an analyst for IHS in Washington, said in a telephone interview.

On Thursday, the S&P metals and mining gauge rose as much as 2.3 percent as U.S. equities rallied amid signs that the Trump administration will ease its trade war with China.

Richard Falk's lecture on 'World Order in the Age of Trump and Trumpism' at West Chester University, October 24, 2018.

The title requires a few words of explanation. By the 'Age of Trump,' I mean not only the current American president. The phrase is meant to encompass elected leaders like him around the world. I have a friend in India who refers to Narendra Modi as 'our Trump' and the newspapers have been full of commentary to the effect that the new leader of Brazil, Jair Bolsonaro, amounts to 'a Brazilian Donald Trump,' although some familiar with Bolsonaro's worldview insist that 'a Brazilian Joseph Goebbels' is more accurate. This extension of Trump to Trumpism is meant to make us aware that Trump is not just an American abnormality. He reflects a structural conditions that seem global in character, although with significant variations from nation to nation.

By referring to 'Trumpism' my intention to highlight several issues beyond this autocratic brand of 'democratic' leader: (1) To associate 'Trumpism' with a deliberate U.S. withdrawal from political and neoliberal globalization, without significantly challenging, perhaps even augmenting military globalism, enhancing capabilities to project destructive power anywhere on the planet, while weakening alliance commitments and multilateral trade frameworks; (2) Trumpism also refers to the populist base of support for a global array of strong leaders, and their accompanying right-wing social, economic, and cultural policies, with the threat of 'fascism' and fascist tendencies being increasingly feared and perceived, even in centrist discourse; (3) Trumpism also involves a shift of preferred worldview from globalist to nationalist centers of political gravity, with a loss of normative support for human rights, democracy, and multilateral diplomacy and cooperative forms of multilateral problem-solving and treaty making; and (4) in the American setting, this phenomenon of Trumpism is not tied solely to the person of Trump; it could survive Trump if one or more of several scenarios unfold—for instance, in the 2018 and 2020 national elections the Republican Congress is reelected, even if Trump should be defeated or compelled to resign—in effect, the Republican Party has been effectively taken over by the ideas, values, and approach of Trump, and vice versa; it is difficult to disentangle ideological cause and effect as between party and leader.

To read the full lecture, please click here...

Megyn Kelly is out at NBC after an uproar over her comments in defense of blackface Halloween costumes during an episode of her television show last week. NBC has canceled "Megyn Kelly Today" and Kelly will be negotiating an exit from her contract. Speculation that Kelly would get a full payout for her three-year, $69 million contract drew a bitter response from people on Twitter. "Congrats to Megyn Kelly for getting $69 million for thinking blackface is fine," one person tweeted.

Kelly's unfathomable severance package isn't the only thing separating her from regular working people. She actually may have a say in her noncompete clause. According to The Hollywood Reporter, her legal representation is "attempting to keep her noncompete clause as short as possible. Six months is the standard in the television news industry."

Nearly one in five U.S. workers are bound by noncompete agreements, which block them from working for a competitor for a set period of time if they leave their current job. That's nearly 30 million people who have essentially lost their full right to leave their jobs. And it's not just highly paid workers who are required to sign them—14.3 percent of workers without a four-year college degree and 13.5 percent of workers earning up to $40,000 a year have noncompetes.

Noncompetes are a big problem. If you are a typical worker and you are not in a union, one of the most important points of leverage you have to negotiate for a raise or fight back against abuse is the fact that you can quit and work somewhere else. A noncompete agreement weakens your power: you have to stay with your employer because you can't seek or accept a better-paying job with a competitor.

Most ordinary people don't have the capacity to hire a high-priced litigator to protect their interests when it comes to noncompete clauses. Many people don't even know that they signed a noncompete clause—or understand what it means.

There is no justifiable reason that a sandwich maker should be prohibited from working for a competing establishment for two years after leaving his job at a sandwich shop. But that is exactly what was happening with employees of Jimmy John's, until the New York attorney general's office took action. Reporters and factory managers—along with workers at doggy day care and grooming services, summer camps, and warehouses—have also had to sign noncompetes.

The proliferation of noncompetes is bad for America. Noncompetes contribute to stagnating wages and inequality. They represent just one more way the rules governing work in this country are rigged against working people from their first day on the job.

What can we do about this? The White House could call attention to the issue, as the Obama administration did in its waning months. State attorneys general can challenge them. And policymakers can work to restrict or ban them. EPI's First Day Fairness Agendacalls for banning noncompete clauses, with very limited carveouts (to cover genuine trade secrets). The First Day Fairness Agenda should be required reading for anyone who says they care about lifting wages and ending inequality.

Megyn Kelly will do just fine. But ordinary workers are at risk. The freedom to change jobs is crucial to workers' advancement. It's time for us to protect that freedom for those who don't have $69 million payouts.