National GOP leaders on Wednesday released a 9-page document that they called a tax "framework" (available here on the Washington Post site) describing in vague terms how they intend to cut taxes for the nation's wealthiest people while doing very little that serves the government needs. Overall, the GOP framework would amount to about $2.2 TRILLION in less revenue to support federal programs (like protecting the environment from corporate pollutants, supporting higher education loans for students, funding basic university research) (assuming $5.8 trillion loss to lowering rates and shift to territorial system and maybe $3.6 trillion recouped by eliminating as yet unspecified deductions). See GOP proposes deep tax cuts, provides few details on how to pay for them, Washington Post (Sept. 27, 2017).

- They promise 3 rates (12%, 25% and 35%, without stating what the applicable income brackets for those rates should be). That lowering of rates is primarily beneficial to the wealthiest, since the people who just barely get by on their wages (especially with the new corporate regime of calling people in for short shifts, as needed, rather than paying them a regular full-time job) are hit hardest by the payroll taxes that won't be lowered at all under this plan. That is, ordinary wage-earners in the middle and lower classes are generally already taxed on a consumption basis--they spend what they earn and have little left for saving for the future. They pay relative low income taxes but pay significant payroll taxes through withholding on their wages (with no deferral). This is another excursion into the current GOP's 'alternative fact' universe, where huge tax cuts mainly benefiting the wealthy are sold as a 'simplifying' reform that will benefit ordinary people.

- Although the lowest rate is higher than the poorest wage-earning taxpayers pay now, the planners claim that this is still a tax cut because of the "doubling" of the standard deduction for those taxpayers that do not itemize. However, the personal exemptions are eliminated, so that the combination of the standard deduction and the higher rate is likely to be at best a minimal cut for small families and an actual tax increase for larger families. See, e.g., this article.

- They promise to eliminate the "alternative minimum tax", a tax provision that was enacted as a safety provision to ensure that wealthy taxpayers who can afford tax planning and generally can most easily benefit from the various loopholes and tax subsidies written into the code would pay some modicum of taxes rather than get off scott-free from any tax burden. The "framework" (page 5) claims that "it no longer serves its intended purpose and creates significant complexity." It is admittedly somewhat complex, but not unduly so with modern tax preparation software which makes that complexity a minimal problem. I have been required to pay the AMT, and it hasn't made my life or tax return filing more complex. In fact, the people who owe the AMT should be paying more tax than they would pay without the AMT, and that means it is in fact serving its intended purpose of ensuring that taxpayers cannot aggregate too many of the various haphazard subsidies in the Code to permit them to essentially escape a reasonable tax burden on their economic income. Elimination of the AMT is a tax break for the well-to-do: Trump, for example, has had to pay the AMT (real estate developers are one of the much-favored groups in terms of various tax expenditures in the Code that benefit them).

- They plan to eliminate the estate tax--a tax that ONLY applies a low 35% rate to individuals who leave estates worth more than 5.5 million dollars or couples that leave estates more than 11 million dollars, and even then is often the only tax that the assets in those estates have ever been subject to, since these wealthy Americans are the ones most able to take advantages of various trusts and other loopholes and borrowing to ensure that they live as tax-free as possible off their assets during their lifetimes and pass them almost wholly intact to their heirs with stepped up basis to start the game all over again. This is a tax break for the very wealthy and their silver-spooned heirs--especially lucrative for the multibillionaires who own (and live off of) most of the financial assets.

- They plan to give corporations an exceeding low statutory rate of 20%, even though the primary beneficiaries will be the owners and managers who already have enjoyed a hugely disproportionate share of corporate gains (compared to their workers) that has resulted in the cascading inequality of distribution of resources in this country, in part because the wealthy typically own most of the countries' financial assets and get a very low preferential capital gains rate on their income compared to the higher rate on wages paid by ordinary, non-wealthy wage-earners. It is claimed that low corporate tax rates are necessary to allow corporations to be competitive, based on the statement that our statutory rate (the rate provided in section 11 of the Income Tax Code) reaches a maximum of 35% for the biggest companies. But the majority of corporations--even highly profitable ones-- pay no income tax at all. And those that do pay a corporate income tax pay an average effective tax rate (actual tax as a percentage of actual economic income) around 24% , at best, and that is not substantially higher than the corporate tax rates in other developed countries. Further, most of those other developed countries do not depend solely on the income tax--they generally have some kind of value-added tax (a VAT) in addition to income taxes and often have various other taxes (such as a financial transaction tax). Making claims about competitiveness based solely on the corporate income tax is, in other words, foolishly incommensurate and really says nothing whatsoever about ability to compete.

- Further, they plan to allow corporations to expense all investments, at least for the next 5 years, even though the economic reality is that expensing is an upfront subsidy since wear and tear is most significant at the back end of an investment, not the front end. Expensing (see page 7 of the framework) will cost huge amounts of tax revenues. It is just a way to reduce corporate taxable income (not economic income) even further, making the 20% rate on a lower amount of income produce even less tax revenues from corporations, which already pay a ridiculously low amount and are enjoying record high profits.

- The framework calls for changing to a territorial system (at a time when most U.S. multinationals have already used various gimmicks to 'offshore' their main profit-making IP) and lower taxes on U.S. multinationals. The result will likely be significantly lower corporate tax payments from U.S. multinationals. Further, unless the reorganization provisions and ability of U.S. multinationals to move active businesses overseas on a tax free basis is curtailed, these rules will likely encourage other companies to offshore even more of their active business assets. It will favor multinationals over domestic corporations, pushing even more companies to move businesses overseas.

- And they intend to preserve the R&D credit (see page 8 of the framework) -which was eliminated in the 1986 tax reform and then reinstated on a piecemeal basis over multiple years due to pressures from corporate lobbyists. There is no evidence that the R&D credit, rather than the more legitimate business deduction or capitalization for research expenses, produces more research. And Congress has done nothing--in spite of years of pushing for making the R&D credit permanent--to establish that it provides any actual economic growth benefit. It just provides an upfront dollar for dollar reduction in taxes compared to the deduction's lesser benefit. And there is no evidence that the credit has resulted in more money being put into research. Research intensive businesses with good leadership invest in research whether or not they get a special tax benefit because otherwise their busienss will die. (Of course, businesses with no attention to anything other than the bottom line may make bad decisions: one reason the pharmacology industry has been lagging is that they have tried to merely buy others' research rather than doing it themselves, and like the infamous purchaser of Epipen, they have simply gorged themselves on exploitative prices because of their monopoly on a particular drug.)

- They plan to have income from "pass-through" entities like partnerships taxed at very low rates to the individuals, who already enjoy exceedingly low rates on their gains from corporate stocks and other financial assets (the preferential capital gain rates) and will receive even more cash out of their corporate stock ownership with the even lower proposed statutory rate on corporate stock. This plan for pass-throughs, by the way, will continue to lavish tax benefits on an already super-coddled wealthy class--those who run real estate development businesses through partnership structures (the Trump empire, for one), those who run hedge funds (some of the wealthiest individuals in the country) and those who run master limited partnerships (fossil fuel tycoons).

- They say they will "simplify" taxes--which should mean eliminating most or all of those absurd provisions that have grown over the years to clutter the tax statute with special subsidies (that, again, mostly benefit the wealthy). But there is no indication that the GOP has any intent to eliminate any of the special giveaways. With real simplification that made economic sense, the framework would call for things such as

- eliminating the preferential capital gain rate (that benefits the wealthy who own the vast majority of the capital assets)

- eliminating the section 1031 "like kind exchange" rules (that allow wealthy real estate developers to trade properties for significant gains but defer tax on those gains indefinitely, often til death when the step up in basis allows their heirs to inherit and start the game all over again)

- eliminating the various preferences for fossil fuels that have been in the code in one form or another for years, giving oilmen their wealth while subsidizing the most polluting kind of fuel extraction and use (all the while with their lobbyists arguing against significant long-term subsidies for more environmentally friendly wind and solar)

- phasing out the mortgage interest deduction--at least for mortgages at more than the average national housing price-- so that multimillionaires cannot get the benefit of the interest deduction on $1.1 million of mortgages, again, a provision that primarily benefits the wealthy in the top 20% of the income distribution, and

- eliminating the provision in the charitable contribution provisions that allows wealthy shareholders to donate certain assets for a full fair market value deduction rather than a basis deduction--thus significantly reducing the overall income tax they owe.

But of course--although most academic research suggests that a mortgage interest deduction serves no legitimate purpose, the GOP 'six' indicate they will retain it, because it "help[s] accomplish important goals that strengthen civil society as opposed to dependence on government: home ownership". Fact is, countries without a mortgage interest deduction have just as high rates of home ownership, and the economic effect of the deduction (especially in its current form) is to favor purchase of ever larger homes by those taxpayers in the upper income distributions.

As with so much else from the man currently holding the office of President, what is said (paraphrasing) --that the wealthy will not get a tax cut and the poor and middle class will get big tax cuts --can't be trusted. Like so much else, Trump says he is "very good at it", but then he thinks he is good at everything and is inevitably shown to be fairly ignorant of the issues that matter. The framework, like everything else the GOP has proposed this year --including repeal of the Affordable Care Act; defunding of Medicaid; withdrawal of scientific information about climate change from the EPA website, reduction in the size of existing national monuments meant to protect the land for all of us --is designed to benefit the GOP establishment's wealthiest donors who continue to call the shots on tax and economic policies.

And of course the claim that this 'framework' can result in "the simplicity of a 'postcard' tax filing for the vast majority of Americans" is absurd. The complexities of accounting for various income sources and the heightened complexities that most low-income Americans face in claiming the Earned Income Tax Credit will remain, even if rates are reduced and the standard deduction replaces the standard deduction and personal exemptions. The claim (page 4 of the framework) that "typical families in the existing 10% bracket are expected to be better off under the framework due to the larger standard deduction, larger child tax credit and [unspecified] additional tax relief that will be included during the committee process" seems clearly wrong for many if not most of those taxpayers in that lower bracket.

And their posturing that this "reform" is to benefit "small businesses" is equally absurd. The main beneficiaries of the pass-through rate will be the huge joint ventures, master limited partnerships, real estate partnerships (like the Trump companies), and hedge funds whose owners will enjoy a reduction in their tax rate on that income from 39.6% to 25%. Most actual small business owners are already paying tax around the 25% rate.

The proposal will not end incentives to ship job and capital overseas (see page 3 of the framework on goals)--those gimmicks with transfer pricing of intangibles will continue, as any lowering of the corporate tax rate here to 20%, which is below the international average of 22.5% (according to the report--it may well be too low a figure), will push other countries to lower their rates as well. It is a corporate lobbyist's ideal playground--playing one country against the other to push the "race to the bottom" faster and faster and continue the quasi-sovereign hegemony of multinational companies around the world. If we want to end the corporate inversions and the transfer pricing gimmicks, we know various ways we could do that, including changing transfer pricing mechanisms in ways that various academics have recommended. Congress hasn't really wanted to, since their wealthy corporatist donors wouldn't like it.

What reveals the hypocrisy of the GOP is their sudden switch from deficit hawks during the Obama administration, which made it harder to get a decent stimulus package through Congress and to promote funding for desperately needed infrastructure projects, even when interest rates were incredibly low, to a willingness to incur significant deficits in order to debt- fund even more tax cuts for the wealthy on top of the Bush-era tax cuts that led to a switch from federal surplus to federal deficits and more debt. As Ed Kleinbard so aptly states, "The Republican tax "plan" is a deficit-busting mess, and it would slash the President's taxes", Vox.com (Sept. 28, 2017).

What reveals the GOP hypocrisy even more is their presentation of this framework without any appropriate CBO or Joint Committee on Taxation analysis. And statements by Senator Bob Corker (Tenn) in connection with scoring tax reform that they don't trust the CBO, implying that the GOP should go to a private (pro-GOP) source for "dynamic scoring" so that it will show the results they want--is truly worrisome. See The sudden and regrettable demise of the CBO, USNews.com (Sept. 21, 2017). It disparages the nonpartisan professionals in the Budget Office while showing that the GOP is willing to do practically anything to further the lie that their budget, with huge tax cuts proposals for the wealthy, will miraculously result in widespread economic growth that will float even poor folks' boats.

We already know that tax cuts do not have the miraculous growth effect that they claim. Kansas actually engaged in an "experiment" to prove that tax cuts would stimulate growth. Even the state's GOP legislature recognized the utter failure of the claim, as the state's economy sank under the burden of the tax cuts. Kansas actually voted to end the experiment and raise taxes!

And of course we have experimented this way nationally with various Republican administrations. Reagan cut taxes drastically in his first year in office, caused huge deficits and then increased taxes every year of his term afterwards. The cuts ended up most especially benefiting the wealthy, because the tax increases took the form of higher payroll taxes and other means of hitting lower-income folks that didn't bother the wealthy. George H.W. Bush promised not to raise taxes, but recognized that he could not keep that promise and run the government appropriately. If we are going to spend billions on continuing to buy arms and military planes we don't need (a silly idea, but one that seems ingrained in the GOP mentality), then we have to have more money to fund things we really do need, such as a fair medical care system for the most vulnerable (Medicare) and funding for basic research that corporations don't want to pay for (NSF and NIH, among others). George W. Bush cut taxes on the wealthy and corporations, fulfilling corporate lobbyists wish lists that had been circulating for 20 years, including creating a 'tax holiday' for corporations to repatriate untaxed profits that they had offshored at a very low rate. All that was promised to drive economic growth, but of course it didn't. As with the similar idea in this year's "reform" talk, the 2004 tax holiday provided a way for corporations that had engaged in various gimmicks to move their profits overseas to low tax jurisdictions (even while the money is often in U.S. banks) to bring it back to the US at low or no taxes and then use it to do stock buybacks that benefited their wealthy shareholders with big boosts of income taxed at preferential capital gains rates. Most of those corporations did not use those funds in any way to create job--in fact, some of the biggest so-called repatriators laid off employees at the same time. The tax holiday merely gave even more of a tax subsidy to unpatriotic corporations that were willing to scam the system by pretending to sell their invaluable IP to offshore subsidiaries, and then even higher payments to the CEOs for raking in more cash. In other words, the tax holiday was a great exercise in supporting the creation of an even greater inequality gap. Historical trends are fairly clear on this. The U.S. economy has thrived more under Democratic presidents who have increased taxes and has turned to deficits more under Republican presidents who have cut taxes.

What we should do at a minimum is increase the amount that corporations pay into the federal government, so that a higher percentage of our GDP is paid in corporate taxes, as in other developed countries. And we should add a financial transactions tax, at least, to the mix while eliminating the preferential capital gains rate and the like-kind exchange provision.

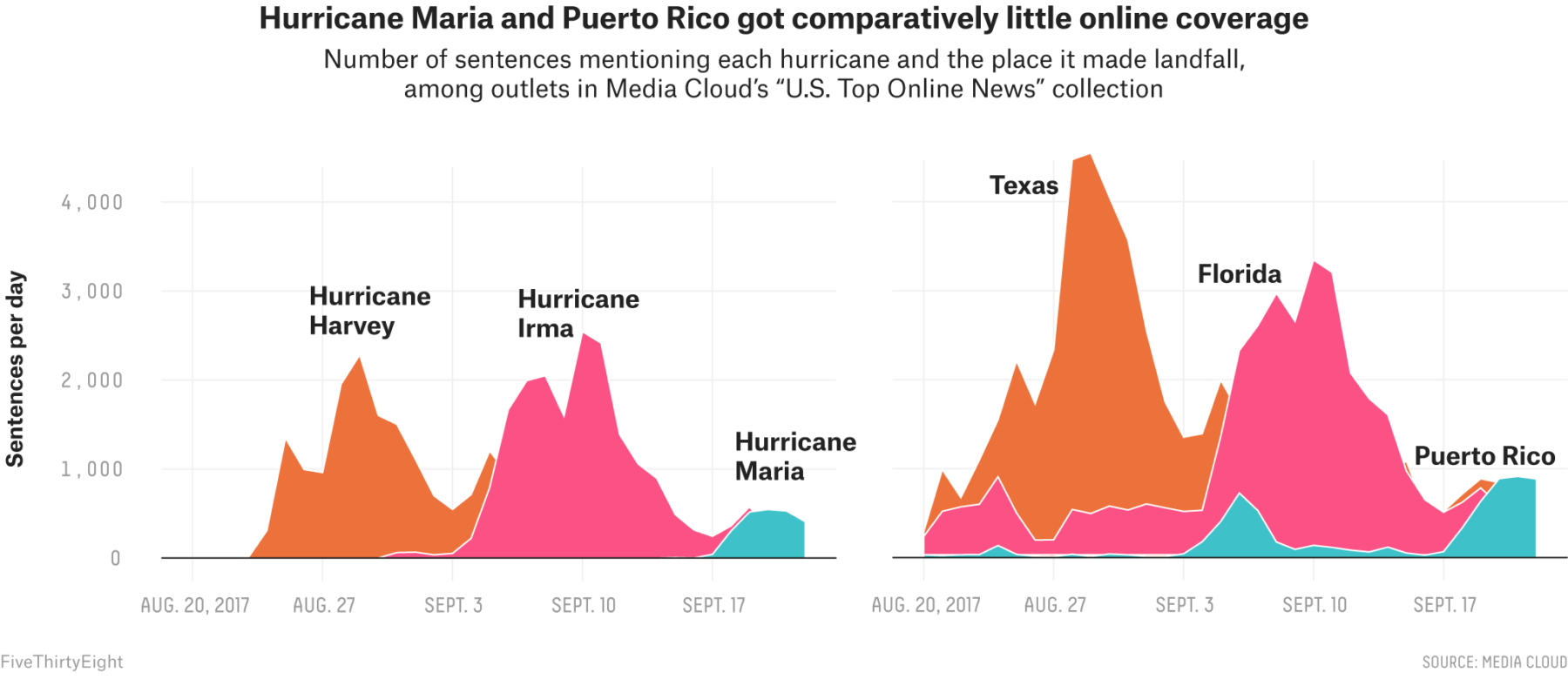

Funding the government so that it can deal with the hundreds of billions in financial aid needed in Texas (Hurricane Harvey) and Florida (Hurricane Irma) and Puerto Rico (Hurricanes Irma and Maria) while at the same time starting to handle some of the deteriorating federal roads, railways, bridges and other infrastructure throughout the country would be the best way to ensure that we could continue the economic growth begun under the Obama administration. That funding would require REAL tax reform: eliminating the preferential capital gains rate, eliminating the many loopholes by which highly profitable corporations manage to pay almost no federal income tax, and creating a significantly higher graduated rate structure for taxing estates (while eliminating the step up in basis).

(Of course, we should also recognize that spending the hundreds of billions annually on defense does much less to defend America and make it great than spending a higher proportion of that money on education, infrastructure, and other ways to increase opportunities for all. Let's get rid of the militaristic jingoism that keeps the U.S. armament industry rolling in cash and start funding scientific and health research through NSF and NIH. That is the way we created a thriving middle class after the second World War and the way to support continuing innovations that will make a difference in our lives and economy into the future.)

-- via my feedly newsfeed