Understanding the Cost Disease of Services

As my internal clock is not on internet time, I'm only now getting up a post in reaction to the death of William Baumol, who has been a consistent reference on this blog over the years. My topic page on the productivity slowdown is in many ways an extended riff on his work.

I can share no personal stories about the man, as I never met him. What I can do is spend some time digging through what I consider the key paper of his most famous idea, the "cost disease of services". I'd like to think that as an academic, he'd appreciate this as much as an anecdote.

Before we get started, Baumol was one of the handful of towering figures of economics who recently passed, along with Ken Arrow and Allan Meltzer. In response, I would like to suggest that someone move Robert Solow to a secure underground bunker, and encase him in bubble wrap, just in case.

Back to Baumol. The central paper is "Macroeconomics of Unbalanced Growth: The Anatomy of Urban Crisis", published in 1967 in the American Economic Review. For me, this contains a handful of insights that allow you to understand much of the story of economic growth in the fifty years since it was published.

To start, Baumol divides economic activity up in the following way:

The basic source of differentiation resides in the role played by labor in the activity. In some cases labor is primarily an instrument - an incidental requisite for the attainment of the final product, while in other fields of endeavor, for all practical purposes the labor is itself the end product.

For the first case, labor as an instrument, you can read "manufactured goods". He uses the example of an air conditioner. Just by looking at the A/C unit, or using it, there is no way for you to assess how much labor went into producing it. The labor is just incidental from your perspective as a consumer of the product.

Contrast that with the following:

On the other hand there are a number of servics in which the labor is an end in itself, in which quality is judged directly in terms of amount of labor. Teaching is a clear-cut example … An even more extreme example is one I have offered in another context: live performance. A half hour horn qunitet calls for for the expenditure of 2 1/2 man hours in its performance, and any attempt to increase productivity here is likely to be viewed with concern by critics and audience alike.

Here, labor is the very essence of the product. If you go see the horn quintet, then you are buying the 1/2 of each of those players time. Likewise, for a class you are in many ways buying the teachers time. At a (nice) restaurant, you are often purchasing the time and attention of a waiter.

The first big conclusion, which is really an assumption of Baumol's, is that labor productivity growth in the first kind of production (goods) is relatively fast, while labor productivity growth in the second kind (services) is relatively slow. This is just due to the nature of the work involved. For most services, you cannot do "more with less". No one wants to see the 1/2 hour horn quintet played in only 12 minutes.

So where does the cost disease come in? The next crucial assumption Baumol makes is that labor costs (wages) in the two kinds of activities move together. To be clear, he doesn't assume (or need to assume) that wages are identical in the two sectors, only that a wage increase in one sector puts upward pressure on wages in the other sector. This would be the case if labor was somewhat mobile between the two activities. Another way of saying this is that workers could work in either sector. (They may not be equally productive in both sectors, as in Alwyn Young's recent paper, which raises the possibility that Baumol is wrong about relative productivity growth. Maybe go read this post and his paper after you finish this one.).

And we're done. Productivity growth in the goods sector raises the wage in that sector, but also raises the output of that sector. So the ratio of wage to output - a measure of the cost of a unit of output - stays constant over time. Higher wages in the goods sector put pressure on wages in the service sector, so wages rise over time there. But (taking the exteme position) productivity is not growing in services, and so output is not growing. The ratio of wages to output in services - a measure of costs - is thus rising over time. This is the "cost disease of services".

The crucial elements are, again, the assumption that labor productivity growth is relatively slow in services, and the assumption that labor is mobile between sectors. Given this, the cost of services will rise over time.

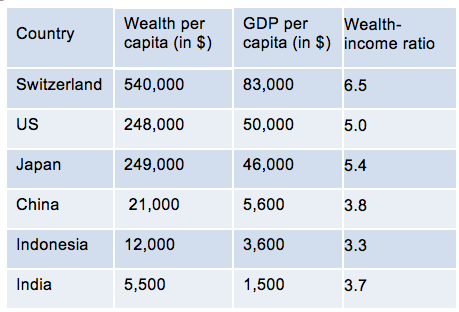

For my money, the biggest insight Baumol had was to to notice the differential in how labor matters to production in goods and services. The subsequent logic is, by itself, not a major breakthrough. The Balassa/Samuelson effect - developed by those authors in articles published in 1964 - is the same idea. They distinguish between tradable and non-tradable goods, rather than goods and services per se, and they are thinking about a cross-sectional comparisons of countries, rather than one country over time, but the outcome is identical. Countries that are very productive in tradable goods will tend to have high aggregate price levels (an empirical regularity known as the "Penn Effect"), as that productivity drives up costs in their non-tradable sectors.

Here it is worth noting that labels matter. If you call this "cost disease", it sounds like a problem. If you call this "the Penn Effect", it means that rich countries have higher prices, and is just an empirical oddity. "Cost disease" sounds bad, but is a lot like dying in your 90's from old age. It's awful that you are dying, but let's not overlook that you made it into your 90's. Baumol's cost disease is a result of incredible affluence.

The precise symptoms of the cost disease depend on further assumptions. Baumol traced out the possibilities in the rest of the paper. We have that the costs (and thus prices) of the service sector are rising relative to the goods sector.

We may inquire what would happen if despite the change in their relative costs and prices the magnitude of the relative outputs of the two sectors were maintained … if the demand for the product in question (services - DV) were sufficiently price inelastic or income elastic.

This is the next essential insight, which is that demand for services is price inelastic and/or income elastic. What this means is that despite the rising costs, people continue to consume services, and may in fact increase their expenditure on services as they get more expensive. Baumol traces out the implications of the demand for services on the aggregate economy. In the following quote, the "progressive sector" is the goods sector, with rising productivity, and the "nonprogressive sector" is services, with slow productivity growth. Italics are Baumol's original.

If productivity per man hour rises cumulatively in one sector relative to its rate of growth elsewhere in the economy, while wages rise commensurately in all areas, then relative costs in the nonprogressive sectors must inevitably rise, and these costs will rise cumulatively and without limit. … Thus, the very progress of the technologically progressive sectors inevitably adds to the costs of the technologically unchanging sectors of the economy, unless somehow the labor markets in these areas can be sealed off and wages held absolutely constant, a most unlikely possibility. We see then that costs in many sectors of the economy will rise relentlessly, and will do so for reasons that are for all practical purposes beyond the control of those involved. … If their relative outputs are maintained, an ever increasing proportion of the labor force must be channeled into these activities and the rate of growth of the economy must be slowed correspondingly.

I tried to summarize this in my own words three or four times, but I don't think I did a better job than Baumol. Many posts on this blog have been about the realization of Baumol's prediction regarding slowing productivity growth as we transition into the non-progressive sectors. I'll just reiterate that the slowdown in aggregate growth implied by Baumol's cost disease is driven by the nature of demand, not a technological limit.

Often people interalize the cost disease part of Baumol's paper, without taking into consideration the second part regarding the effect of the demand for services. Scott Alexander has a recent post on cost disease from a few months ago that demonstrates this. Alexander's post is not unique, it just happened to be the last thing in my reading list on this topic, and so I'm using it to illustrate a point.

It's a (very) long post, but Alexander goes through education, health, and government services, effectively documenting the cost disease. He crystallizes this by asking the following kind of question. "Which would you prefer? Sending your child to a 2016 school? Or sending your child to a 1975 school, and getting a check for $5000 each year?"

He then does this with college; modern college, or your parent's college plus 72,000 dollars? And then with health care; modern health care, or your parent's health care (plus ACE inhibitors and some other now off-patent technologies) plus 8000 dollars each year?

Alexander's implicit answer to all these questions is that you would choose the the second option; the older level of service plus the cash. Much of the post is spent explaining that the service offered today is of no better quality than the service offered a generation ago. And while I'd quibble with that broad conclusion, that's not the point. Let's stipulate that the quality of healthcare and education have not changed in a generation, which is like taking Baumol's thought experiment as a precise statement about the world.

Here's the question that Baumol implicitly asked himself. What do people spend all that extra money on?

They could use it towards a new car or a major appliance, both manufactured goods. Perhaps this is what Alexander has in mind; he never says what he thinks happens to the extra money.

But they might spend that extra five or eight thousand dollars to finally take a well-deserved vacation, meaning it is spent on tourism and hospitality services. Or they may well decide to spend that money sending their kids to a better (and more expensive?) school, or putting them in a full time daycare rather than part-time. Or in sending one of their kids to college who might not otherwise have gone. Perhaps the savings are used to send someone back to get a Master's degree to get a promotion at work, or acquire a new certification that increases their wage.

And some of those savings might be spent on health services. Individuals may undertake procedures to permanently deal with chronic problems rather than only alleviating symptoms. Maybe the kids get full orthodontic treatment, rather than the partial work that only straightened one tooth. The savings Alexander proposes could be spent on seeing specialists to deal with persistent health issues, rather than relying on a GP.

From Baumol's second insight, the demand for these kinds of services is income elastic and price inelastic. Which means that a huge part of the money people get back from Alexander's thought experiment is plowed right back into education and healthcare. What does that do? It shifts the demand curve out for healthcare and education. And then what happens? The price goes up, and the actual amount of new health care or education acquired is not that large. Moreover, there is no appreciable decline - and there may be an increase - in the share of total GDP accounted for by healthcare and education.

This is the same outcome Baumol described, even though for him the origin of this was a productivity increase in the goods sector. But the origin of the productivity increase is unimportant, what matters is the structure of demand for services. So long as our demand for services is income elastic and price inelastic, the share of healthcare and education in GDP are going to rise as we get more productive, no matter where that productivity improvement comes from.

This is not a claim that healthcare or education are efficiently run, by the way. I can list, off the top of my head, a good five or six university administrators that I would get rid of tomorrow without any noticable effect. We could spend the next week swapping stories of ridiculous medical bills for $20 band-aids and the like. But their high costs are not entirely due to deliberate inefficiency, and lowering these costs would not lower their share of GDP.

I think Alexander's post is one example (of many) taking the "disease" part of "cost disease" too literally. Rising costs in education and healthcare do not always represent a pathology. In a lot of ways we are the victims of our own prosperity and preferences here. There is nothing about Baumol's analysis that implies living standards are lower or welfare is impaired by the cost disease. Remember that the cost disease is a consequence of productivity improvements in the first place.

While "cost disease" may not have been the best choice of names, Baumol has to be credited with anticipating the path of economic growth and structural change in developed countries over the late 20th century. He did this without resorting to any math beyond what I could use in an intermediate college course, and in language accessible to anyone. If you're interested in economic growth, it is well worth finding some time to sit down are read through his body of work

Harpers Ferry, WV