|

Monday, May 31, 2021

Fwd: 🎉 Dean Baker just shared "The Booming Economy and Debt and Deficit Fears" for patrons only

Friday, May 28, 2021

Realizing a Green New Deal: Lessons from World War II [feedly]

https://economicfront.wordpress.com/2021/05/27/realizing-a-green-new-deal-lessons-from-world-war-ii/

Many activists in the United States support a Green New Deal transformation of the economy in order to tackle the escalating global climate crisis and the country's worsening economic and social problems. At present, the Green New Deal remains a big tent idea, with advocates continuing to debate what it should include and even its ultimate aims.[1] Although perhaps understandable given this lack of agreement, far too little attention has been paid to the process of transformation. That is concerning, because it will be far from easy.

One productive way for us to sharpen our thinking about the transformation is to study the World War II-era mobilization process. Then, the U.S. government, facing remarkably similar challenges to the ones we are likely to confront, successfully converted the U.S. economy from civilian to military production in a period of only three years.

It is easy to provide examples of some of the challenges that await us. All Green New Deal proposals call for a sharp decrease in fossil fuel production, which will dramatically raise fossil fuel prices. The higher cost of fossil fuels will significantly raise the cost of business for many industries, especially air travel, tourism, and the aerospace and automobile industries, triggering significant declines in demand and reductions in their output and employment. We will need to develop a mechanism that allows us to humanely and efficiently repurpose the newly created surplus facilities and provide alternative employment for released workers.

New industries, especially those involved in the production of renewable energy will have to be rapidly developed. We will need to create agencies capable of deciding the speed of their expansion as well as who will own the new facilities, how they will be financed, and how best to ensure that the materials they require will be produced in sufficient quantities and made available at the appropriate time. We will also have to develop mechanisms for deciding where the new industries will be located and how to develop the necessary social infrastructure to house and care for the required workforce.

We will also need to ensure the rapid and smooth expansion of facilities capable of producing mass transit vehicles and a revitalized national rail system. We will need to organize the retrofitting of existing buildings, both office and residential, as well as the training of workers and the production of required equipment and materials. The development of a new universal health care system will also require the planning and construction of new clinics and the development of new technologies and health practices. In sum, a system-wide transformation involves a lot of moving parts that have to be managed and coordinated.

While it would be a mistake to imagine that the U.S. wartime experience can provide a readymade blueprint for the economic conversion we seek, there is much we can learn, both positive and negative, from it. In what follows, I first highlight some of the key lessons and then conclude with a brief discussion of the relevance of the World War II experience to our current efforts to transform the U.S. economy.

1. A rapid, system-wide conversion of the U.S. economy is possible

The primary driver of the wartime conversion was the enormous increase in military spending over the years 1940-1943. Military spending grew by an incredible 269.3 percent in 1941, 259.7 percent in 1942, and 99.5 percent in 1943. As a consequence, military spending as a share of GDP rose from 1.6 percent in 1940 to 32.2 percent in 1943. That last year, federal spending hit a record high of 46.6 percent of GDP and remained at over 41 percent of GDP in each of the following two years.[2]

The results were equally impressive: the combined output of the war-related manufacturing, mining, and construction industries doubled between 1939 and 1944.[3] In 1943 and 1944 alone, the United States was responsible for approximately 40 percent of all the munitions produced during World War II.

This record has led many to call what was accomplished a "production miracle." However, a more complete assessment of the period tells a different story. For example, there is little difference between the years 1921-24 and 1941-1944 in either the growth of industrial production or the growth in real gross nonfarm product.[4]

Paul A. C. Koistinen casts further doubt on production miracle claims, pointing out that:

When placed in the proper context, the American production record does not appear exceptional, unless the characterization applies to all other belligerents. Gauged by the percentage distribution of the world's manufacturing production for the period 1926-1929, the United Sates in the peak year 1944 was producing munitions at almost exactly the level it should have been. Great Britain is modestly high, Canada low, Germany high, Japan very high, and the Soviet Union spectacularly high.[5]

The explanation for these two significantly different views of the period is that the transformation involved far more than the increase in military spending. There was also the curtailment or outright suppression of the production of many industries, the rationing of limited supplies of many goods, and the development and production of entirely new goods and services. For example, civilian automobile production was stopped, tires and food were rationed, and synthetic rubber was created and produced in significant amounts. Between 1940 and 1944, the total production of non-war goods and services actually fell by some 9 percent, from $180 billion to $164 billion (in 1950 dollars).

In other words, the tremendous gains in U.S. military production were achieved, and in a relatively short period of time, not because of some impossible-to-repeat production miracle, but because a government directed-mobilization succeeded in fully employing the country's resources while shifting their use from civilian to military purposes.

2. State capacities and action matter

The economy's successful transformation demonstrates the critical importance of state planning, public financing and ownership, and state direction of economic activity. Mobilization officials faced two major tasks. The first was to quickly expand the economy's capacity to produce the weapons and supplies required by the military. The second was to manage the scarcities of critical materials and components caused by the rapid pace of the mobilization.

The first task was made significantly more difficult by a lack of corporate support. Most corporations were reluctant to undertake the massive expansion in plant and equipment required to achieve the desired boost in military production. In fact, private investment actually fell in value over the years 1941-43. It was the federal government, using a variety of new policy initiatives, that provided the solution.

One of the most important initiatives was the creation of the Defense Production Corporation (DPC). In May 1940, Congress passed a series of amendments which allowed the still operating depression-era Reconstruction Finance Corporation (RFC) to create new subsidiaries "with such powers as it may deem necessary to aid the Government of the United States in its national defense program." The DPC was one of those new subsidiaries.

Since the RFC had independent borrowing authority, the DPC was able to directly finance the expansion of facilities deemed critical to the military buildup without needing Congressional approval. The DPC kept ownership of the new facilities it financed, but planned the construction with and then leased the new facilities for a minimal fee to predetermined contractors who would operate them. The DPC eventually financed and owned some one-third of all the plant and equipment built during the war.

By its termination at the end of June 1945, the DPC:

owned approximately 96 per cent of the capacity of the synthetic-rubber industry, 90 per cent of magnesium metal, 71 per cent of aircraft and aircraft engines, and 58 per cent of the aluminum metal industry. It also had sizeable investments in iron and steel, aviation gasoline, ordnance, machinery and machine tool, transportation, radio, and other more miscellaneous facilities.[6]

The DPC supported facilities expansion in other ways too. Responding to concerns of shortages in machine tools and the industry's reluctance to boost capacity to produce them, the DPC began a machine tools pool program. The DPC gave machine tool producers a 30 percent advance to begin production. If the producers found a private buyer, they returned the advance. If they found no buyer, the DPC would pay them full price and put the machine tool in storage for later sale. This program proved remarkably successful in boosting machine tool production and, with machine tools readily available, speeding up weapons production.[7]

The second task, the timely delivery of scarce materials to military and essential civilian producers, was accomplished thanks to the efforts of the War Production Board (WPB), the country's primary wartime mobilization agency. In late 1942, after considerable experimentation, it launched its Controlled Materials Plan (CMP). The plan required key claimants, such as the Army, the Navy, and the Maritime Commission, to provide detailed descriptions of their projected programs and the quantities of essential controlled metals required to realize them, with a monthly production schedule for the upcoming year. The WPB industry divisions responsible for these metals would then estimate their projected supply and decide the amount of each metal to be allocated to each claimant following WPB policy directives. The claimants would then adjust their programs accordingly and assign their metal shares to their prime contractors who were then responsible for assigning supplies to their subcontractors.

When, over time, a shortage of components replaced the shortage of metals as the most serious bottleneck to military production, the WPB introduced another program. The newly established Production Executive Committee created a list of 34 critical components. One of its subcommittees, working in concert with the CMP process, would then arrange for essential manufacturers to receive all their required scarce materials and components.

3. Flexibility is important

Flexibility in both planning structures and mobilization policies was critical to the success of the conversion. President Roosevelt began the mobilization process in May 1940, with an executive order reactivating the World War 1-era National Defense Advisory Commission (NDAC). In December 1940, he replaced the NDAC with the Office of Production Management (OPM). Then, in August 1941, he created the Supply Priorities and Allocation Board (SPAB) and placed it over the OPM with the charge of developing a long-term mobilization strategy and overseeing OPM's work. And finally, again using an executive order, he established the War Production Board (WPB) in January 1942, replacing both the OPM and the SPAB.

All three agencies, the NDAC, OPM, and WPB, relied heavily on divisions overseeing industrial sections to carry out their responsibilities. The NDAC had 7 divisions: Industrial Production, Industrial Materials, Labor, Price Stabilization, Farm Products, Transportation, and Consumer Protection. The first two were the most important.

The Industrial Production Division had 8 sections, the most important being aircraft; ammunition and lite ordnance; and tanks, trucks, and tractors. The Industrial Materials Division had three subdivisions, each with its own sections: the mining and minerals products subdivision had sections for iron and steel, copper, aluminum, and tin; the agricultural and forest products subdivision had sections for textiles, leather, paper, rubber, and the like; and the chemical and allied products division had sections for petroleum, nitrogen, etc.

Each division, subdivision, and section had an appointed head, and each section head had an industry advisory committee to assist them. The divisions, subdivisions, and sections were responsible, as appropriate, for assessing the industrial capacities of their respective industries to meet present and projected military needs, facilitating military procurement activity, and assisting with plant expansion plans and the priority distribution and allocation of scarce goods.

When Roosevelt felt that an existing mobilization agency was not up to the task of furthering the war effort, he replaced it. Accordingly, each new mobilization agency had a more centralized decision-making structure, broader responsibilities, and greater authority over private business decisions than its predecessor.

Thus, the OPM, reflecting a different stage in the mobilization, was more narrowly focused on production and had only four divisions: Production Division, Purchases Division, Priorities Division, and Labor Division. Later, in recognition of the spillover effects of military production on civilian production, the Civilian Supply Division was added and given responsibility for all industries producing 50 percent or less for the defense program.

The WPB had six divisions: Production Division, Materials Division, Division of Industry Operations, Purchases Division, Civilian Supply Division, and Labor Division. The newly created Division of Industry Operations included all nonmunitions-producing industries and had responsibility for promoting the conversion of industries to military production and for maximizing the flow of materials, equipment, and workers to essential producers.

4. Conversion means conflict

Powerful corporations and the military opposed policies that threatened their interests even when those policies benefitted the war effort. Corporations producing goods of direct importance to the military often refused to undertake needed investments. Corporations producing for the civilian market routinely ignored agency requests that they curtail or convert their production to economize on the nonmilitary use of scarce materials.

By late 1940, this corporate resistance had begun to cause shortages, especially of strategic materials. Aluminum was one of those materials and Alcoa, the only major producer of the metal, aggressively resisted expanding its production capacity even though a lack of aluminum was causing delays in military aircraft production. A similar situation existed with steel, with steel executives arguing that there was no need for capacity expansion while critical activities such as ship building and railroad car manufacturing ground to a halt because of a lack of supply.[8]

This growing shortage problem, and its threat to the military buildup, could have been minimized if large producers of consumer durables had been willing to either reduce their production or convert to military production. But almost all of them rebuffed NDAC entreaties. They were enjoying substantial profits for the first time in years and were unwilling to abandon their civilian markets.

The industry that drew the most criticism because of its heavy resource use was the automobile industry. In 1939, the automobile industry "absorbed 18 percent of total national steel output, 80 percent of rubber, 34 percent of lead, nearly 10-14 percent of copper, tin, and aluminum, and 90 percent of gasoline. Throughout 1940 and 1941, automobile production went up, taking proportionately even more materials and products indispensable for defense preparation."[9]

In some cases, this corporate opposition to policies that threatened their profits lasted deep into the war years, with some firms objecting not only to undertaking their own expansion but to any government financed expansion as well, out of fear of post-war overproduction and/or loss of market share. This stance is captured in the following exchange between Senator E. H. Moore of Oklahoma and Interior Secretary and Petroleum Administrator for War Harold L. Ickes at a February 1943 Congressional hearing over the construction of a federally financed petroleum pipeline from Texas to the East Coast:

Secretary Ickes. I would like to say one thing, however. I think there are certain gentlemen in the oil industry who are thinking of the competitive position after the war.

The Chairman. That is what we are afraid of, Mr. Secretary.

Secretary Ickes. That's all right. I am not doing that kind of thinking.

The Chairman. I know you are not.

Secretary Ickes. I am thinking of how best to win this war with the least possible amount of casualties and in the quickest time.

Senator Moore. Regardless, Mr. Secretary, of what the effect would be after the war? Are you not concerned with that?

Secretary Ickes. Absolutely.

Senator Moore. Are you not concerned with the economic situation with regard to existing conditions after the war?

Secretary Ickes. Terribly. But there won't be any economic situation to worry about if we don't win the war.

Senator Moore. We are going to win the war.

Secretary Ickes. We haven't won it yet.

Senator Moore. Can't we also, while we are winning the war, look beyond the war to see what the situation will be with reference to –

Secretary Ickes (interposing). That is what the automobile industry tried to do, Senator. It wouldn't convert because it was more interested in what would happen after the war. That is what the steel industry did, Senator, when it said we didn't need any more steel capacity, and we are paying the price now. If decisions are left with me, it is only fair to say that I will not take into account any post-war factor—but it can be taken out of my hands if those considerations are paid attention to.[10]

Military procurement agencies, determined to maintain their independence, also greatly hindered government efforts to ensure a timely flow of resources to essential producers by actively opposing any meaningful oversight or regulation of their activities. Most importantly, the procurement agencies refused to adjust their demand for goods and services to the productive capacity of the economy. Demanding more than the economy could produce meant that shortages, dislocations, and stockpiling were unavoidable. The Joint Chiefs of Staff actually ignored several WPB requests to form a joint planning committee.

David Kennedy provides a good sense of what was at stake:

As money began to pour into the treasury, contracts began to flood out of the military purchasing bureaus—over $100 billion worth in the first six months of 1942, a stupefying sum that exceeded the value of the entire nation's output in 1941 . . . Military orders became hunting licenses, unleashing a jostling frenzy of competition for materials and labor in the jungle of the marketplace. Contractors ran riot in a cutthroat scramble for scarce resources.[11]

It took until late 1942 for the WPB to win what became known as the "feasibility dispute," after which the military's procurement agencies grudgingly took the economy's ability to produce into account when making their procurement demands.

5. Class matters

Leading corporations and their executives took advantage of every opportunity to shape the wartime mobilization process and strengthen their post-war political and economic power. Many of the appointed section heads responsible for implementing mobilization policies were so-called "dollar-a-year men" who remained employed by the very firms they were supposed to oversee. And most of these section heads relied on trade association officials as well as industry advisory committees to help them with their work. In some cases, trade association officials themselves served as section heads of the industries they were hired to represent. These appointments gave leading corporations an important voice in decisions involving the speed and location of new investments, the timing and process of industry conversions, procurement contract terms and procedures, the use of small businesses as subcontractors, the designation of goods as scare and thus subject to regulation, the role of unions in shopfloor production decisions, and labor allocation policies.

NDAC officials initially welcomed the participation of dollar-a-year men on the grounds that business executives knew best how to organize and maximize production. However, they soon often found these executives speaking out against agency policies in defense of corporate interests. In response, the OPM created a Legal Division and empowered it to write and implement regulations designed to limit their number and power, but to little avail. As the agency's responsibilities grew, so did the number of dollar-a-year men working for it.

Little changed under the WPB. In fact, between January and December 1942, their number grew from 310 to a wartime high of 805, driven in large part by the explosion in the number of industry advisory committees.[12] The WPB's continued dependence on these nominally paid business executives was a constant source of concern in Congress.

Corporate leaders also never lost sight of what was to them the bigger picture, the post-war balance of class power. Thus, from the very beginning of the wartime mobilization, they actively worked to win popular identification of democracy with corporate freedom of action and totalitarianism with government planning and direction of economic activity.

As J.W. Mason illustrates:

Already by 1941, government enterprise was, according to a Chamber of Commerce publication, "the ghost that stalks at every business conference." J. Howard Pew of Sun Oil declared that if the United States abandoned private ownership and "supinely reli[es] on government control and operation, then Hitlerism wins even though Hitler himself be defeated." Even the largest recipients of military contracts regarded the wartime state with hostility. GM chairman Alfred Sloan—referring to the danger of government enterprises operating after war—wondered if it is "not as essential to win the peace, in an economic sense, as it is to win the war, in a military sense," while GE's Philip Reed vowed to "oppose any project or program that will weaken" free enterprise.[13]

Throughout the war, business leaders and associations "flooded the public sphere with descriptions of the mobilization effort in which for-profit companies figured as the heroic engineers of a production 'miracle'." For example, Boeing spent nearly a million dollars a year on print advertising in 1943-45, almost as much as it set aside for research and development.

The National Association of Manufactures (NAM) was one of the most active promoters of the idea that it was business, not government, that was winning the war against state totalitarianism. It did so by funding a steady stream of films, books, tours, and speeches. Mark R. Wilson describes one of its initiatives:

One of the NAM's major public-relations projects for 1942, which built upon its efforts in radio and print media, was its "Production for Victory" tour, designed to show that "industry is making the utmost contributions toward victory." Starting the first week in May, the NAM paid for twenty newspaper reporters to take a twenty-four-day, fifteen-state trip during which they visited sixty-four major defense plants run by fifty-eight private companies. For most of May, newspapers across the country ran daily articles related to the tour, written by the papers' own reporters or by one of the wire services. The articles' headlines included "Army Gets Rubber Thanks to Akron," "General Motors Plants Turning Out Huge Volume of War Goods," "Baldwin Ups Tank Output," and "American Industry Overcomes a Start of 7 Years by Axis."[14]

The companies and reporters rarely mentioned that almost all of these new plants were actually financed, built, and owned by the government, or that it was thanks to government planning efforts that these companies received needed materials on a timely basis and had well-trained and highly motivated workers. Perhaps not surprisingly, government and union efforts to challenge the corporate story were never as well funded, sustained, or shaped by as clear a class perspective.[15] As a consequence, they were far less effective.

6. Final thoughts

Although the World War II-era economic transformation cannot and should not serve as a model for a Green New Deal transformation of the U.S. economy, it does provide lessons that deserve to be taken seriously. Among the most important is that a rapid system-wide transformation, such as required for a Green New Deal, is possible to achieve, and in a timely manner. It will take the development of new state capacities and flexible policies. And we should be prepared, from the beginning, that our own efforts to create a more socially just and environmentally sustainable economy will be met by sophisticated opposition from powerful corporations and their allies.

The conversion history also points to some of our biggest challenges. Germany's military victories in Europe as well as Japan's direct attack on the United States encouraged popular support for state action to convert the economy from civilian to military production. In sharp contrast, widespread support for state action to combat climate change or restrict corporate freedom of action does not yet exist. Even now, there are many who deny the reality of climate change. There is also widespread doubt about the ability of government to solve problems. This means we have big work ahead to create the political conditions supportive of decisive action to transform our economy.

Perhaps equally daunting, we have no simple equivalent to the military during World War II to drive a Green New Deal transformation. The war-time mobilization was designed to meet the needs of the military. Thus, the mobilization agencies generally treated military procurement demands as marching orders. In contrast, a Green New Deal transformation will involve changes to many parts of our economy, and our interest in a grassroots democratic restructuring process means there needs to be popular involvement in shaping the transformation of each part, as well as the connections between them. Thus, we face the difficult task of creating the organizational relationships and networks required to bring together leading community representatives, and produce, through conversation and negotiation, a broad roadmap of the process of transformation we collectively seek.

And finally, we must confront a corporate sector that is far more powerful and popular now than it was during the period of the war. And thanks to the current freedom corporations enjoy to shift production and finance globally, they have a variety of ways to blunt or undermine state efforts to direct their activities.

In sum, achieving a Green New Deal transformation will be far from easy. It will require developing a broad-based effort to educate people about how capitalism is driving our interrelated ecological and economic crises, building a political movement for system-wide change anchored by a new ecological understanding and vision, and creating the state and community-based representative institutions needed to initiate and direct the desired Green New Deal transformation.

It is that last task that makes a careful consideration of the World War II-era conversion so valuable. By studying how that rapid economy-wide transformation was organized and managed, we are able to gain important insights into, and the ability to prepare for, some of the challenges and choices that await us on the road to the new economy we so badly need.

Notes

[1] These include debates over the speed of change, the role of public ownership, and the use of nuclear power for energy generation. There are also environmentalists who oppose the notion of sustained but sustainable growth explicitly embraced by many Green New Deal supporters and argue instead for a policy of degrowth, or a "Green New Deal without growth."

[2] Christopher J. Tassava, "The American Economy during World War II," EH.Net Encyclopedia, edited by Robert Whaples, February 10, 2008.

[3] Harold G. Vatter, The U.S. Economy in World War II (New York: Columbia University Press, 1985), 23.

[4] Vatter, The U.S. Economy in World War II, 22.

[5] Paul A.C Koistinen, Arsenal of World War II, The Political Economy of American Warfare 1940-1945. (Lawrence, Kansas: University of Kansas Press, 2004), 498.

[6] Gerald T. White, "Financing Industrial Expansion for War: The Origin of the Defense Plant Corporation Leases," The Journal of Economic History, Vol. 9, No. 2 (November, 1949), 158.

[7] Andrew Bossie and J.W. Mason, "The Public Role in Economic Transformation: Lessons from World War II," The Roosevelt Institute, March 2020, 9-10.

[8] Maury Klein, A Call to Arms, Mobilizing America for World War II (New York: Bloomsbury Press, 2013), 165.

[9] Koistinen, Arsenal of World War II, 130.

[10] As quoted in Vatter, The U.S. Economy in World War II, 24-25.

[11] As quoted in Klein, A Call to Arms, 376.

[12] Koistinen, Arsenal of World War II, 199.

[13] J.W. Mason, "The Economy During Wartime," Dissent Magazine, Fall 2017.

[14] Mark R. Wilson, Destructive Creation, American Business and the Winning of World War II (Philadelphia: University of Pennsylvania Press, 2016), 102.

[15] Union suggestions for improving the overall efficiency of the mobilization effort as well as their offers to join with management in company production circles were routinely rejected. See Martin Hart-Landsberg, "The Green New Deal and the State, Lessons from World War II," Against the Current, No. 207 (July/August 2020); Paul A. C. Koistinen, "Mobilizing the World War II Economy: Labor and the Industrial-Military Alliance," Pacific Historical Review, Vol. 42, No. 4 (November 1973); and Nelson Lichtenstein, Labor's War at Home, The CIO in World War II (New York: Cambridge University Press, 1982).

-- via my feedly newsfeed

Mike Roberts: China: demographic crisis? [feedly]

https://thenextrecession.wordpress.com/2021/05/23/china-demographic-crisis/

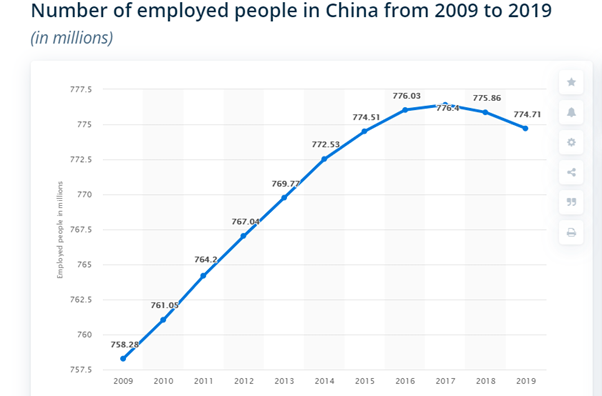

Much has been made recently of the slowdown in population growth in China. China's population grew at its slowest rate in decades in the ten years to 2020, according to the latest census data, which also showed that births declined sharply last year. The nation's once-in-a-decade census, which was completed in December, showed its population increased to 1.41bn in 2020 compared with 1.4bn a year earlier. The population grew just 5.4% from 1.34bn in 2010 — the lowest rate of increase between censuses since the People's Republic of China began collecting data in 1953. Those over-65s now make up 13.5% of the population, compared with 8.9% in 2010 when the last census was completed.

This has led many China observers and Western economists to argue that China's phenomenal growth rate that has taken over 850m Chinese out of poverty (as officially defined) is now over. The argument is that living standards have only risen for the average Chinese because China brought its huge workforce from the land and into the factories in the cities to produce goods for exports at low prices. Now with an ageing population and falling working-age population, China's economy will flag. Given falling working population, along with an intensifying campaign by the US and its Western allies to isolate China economically and technically, China's growth story is over.

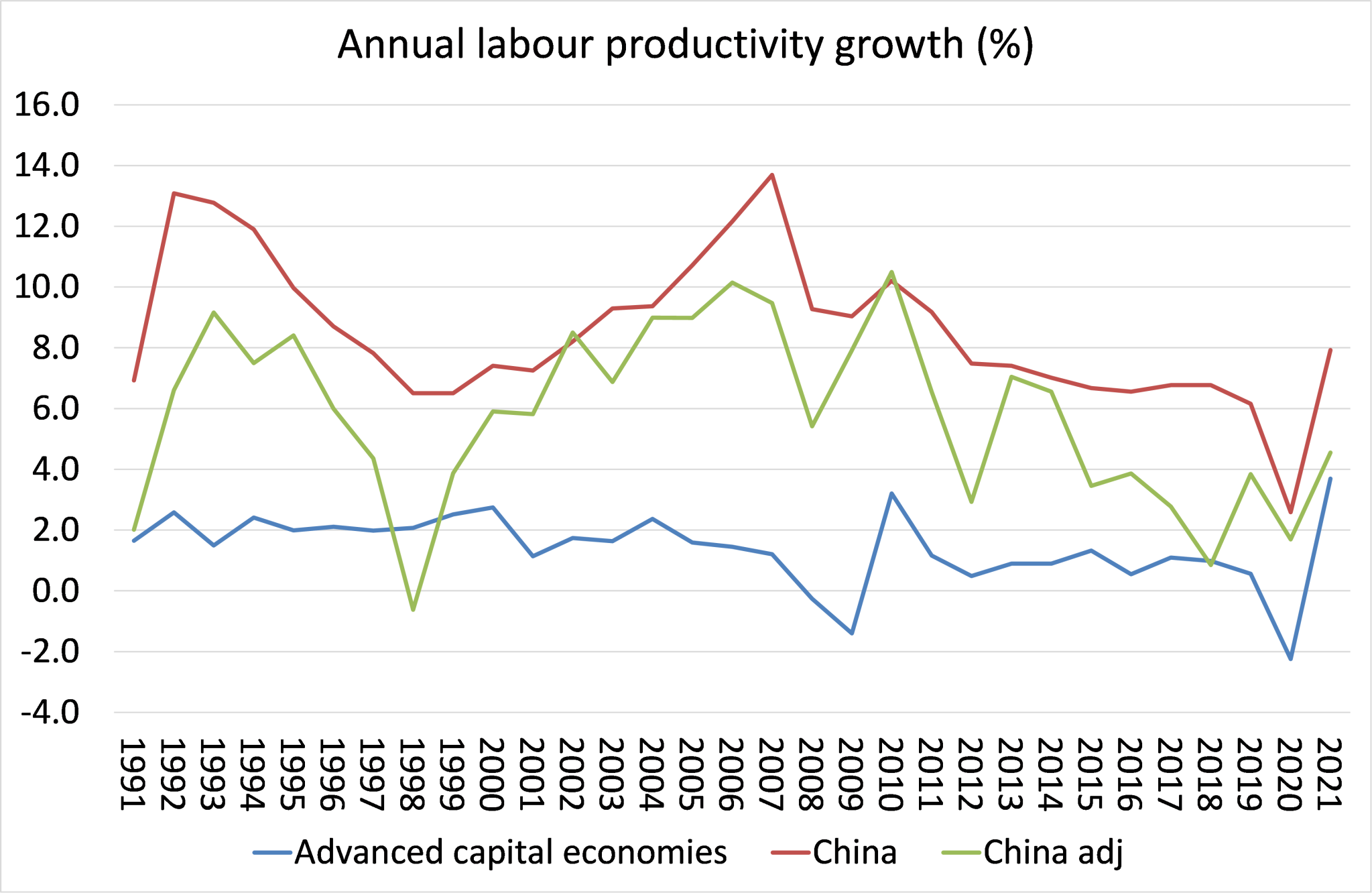

But is that true? Real GDP growth depends on two factors: more employment and more productivity per worker. If it is true that China's workforce is not going to rise but even fall over the next decades, that means sustaining economic growth depends on raising the rate of productivity growth.

In a previous post, I have argued against the sceptics who reckon that China cannot achieve growth rates of say 5-6% a year over the remainder of this decade, or more than twice the rates forecast for the major capitalist economies (the US Congressional Budget Office forecasts just 1.8% a year for the US).

For a start, while China's labour productivity growth rate has declined in the last decade, it was still averaging over 6% a year before the pandemic struck. That compares with just 0.9% a year in the advanced capitalist economies. Even if you accept the revisions made by The Conference Board to China's productivity record (which I don't: – see the post above), China still achieved an over 4% a year productivity growth in the last decade, some four times faster than in the advanced capitalist economies.

So even if the labour force does not grow in this decade (or even decline by say 0.5% a year), real GDP growth in China is still going to be at a minimum of 3.5% a year, and much more likely to be 5-6% a year, close to the Chinese government's forecast in its latest five-year plan.

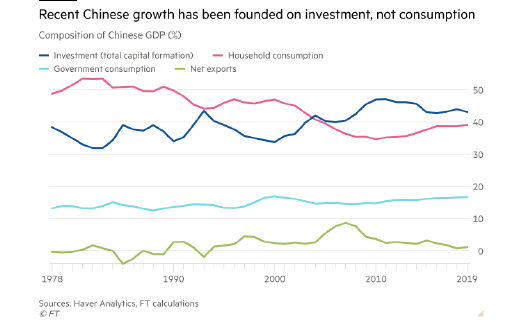

Ah, but you see, China cannot maintain previous productivity growth rates because its economy is badly imbalanced, so the latest argument of Western China 'experts' goes. What is this imbalance? Well, up to now China has grown fast partly because of its labour supply (which is no longer rising) and partly because of massive investment, led by the state sector, in industry, infrastructure and technology.

But now, continued expansion of investment can only be achieved by credit injections and rising debt. And that lays the basis for either poor productivity growth or a debt crisis, or both in the next decade. The answer, according to these experts, is that China should reduce its investment ratio (successful in boosting the economy) and switch to raising consumption and expanding service industries.

You might ask, how successful have capitalist economies been while their investment ratios have fallen back and consumption has dominated? Not at all. So this all smacks of the crude Keynesian view that it is consumption that drives investment and growth, not vice versa. And behind this is also the ideological aim to reduce China's state sector domination and push for a service sector dominated by capitalist enterprises (including foreign ones), particularly in banking and finance.

I have presented the arguments against this consumption model in a previous post on China, so I won't repeat them here. Suffice it to say that they don't hold water. Indeed, as Arthur Kroeber, head of research at Gavekal Dragonomics, has put it: "Is China fading? In a word, no. China's economy is in good shape, and policymakers are exploiting this strength to tackle structural issues such as financial leverage, internet regulation and their desire to make technology the main driver of investment." Kroeber echoes my view (as above) that: "On a two-year average basis, China is growing at about 5 per cent, while the US is well under 1 per cent. By the end of 2021 the US should be back around its pre-pandemic trend of 2.5 per cent annual growth. Over the next several years, China will probably keep growing at nearly twice the US rate."

So there is no reason for China to abandon its growth model based on state-led investment in technology to compensate for the decline its workforce.

It has been the reason for its high productivity growth compared to the West in the last few decades and will continue to be so, as long as the government does not buckle to the siren words of the Western experts. Those siren words have already led to the further opening-up of the financial sector to foreign companies and an increasing reliance of portfolio capital flows (namely financial investment) rather than productive investment. Since 2017, foreign investors have tripled their holdings of Chinese bonds and now own about 3.5 per cent of the market. Equity inflows have been comparable. That makes for an increased risk of a financial bust and damage to China's productivity performance.

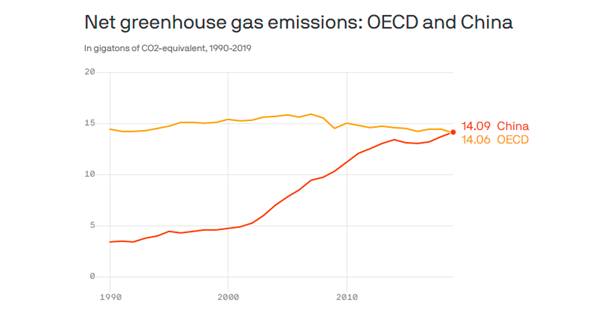

The move to investment in technology rather than heavy industry and infrastructure is key to China's sustainable growth rate and to reducing the rise in greenhouse gas emissions, where China is now the world leader.

According to a recent report by Goldman Sachs, China's digital economy is already large, accounting for almost 40% of GDP and fast growing, contributing more than 60% of GDP growth in recent years. "And there is ample room for China to further digitalize its traditional sectors". China's IT share of GDP climbed from 2.1% in 2011Q1 to 3.8% in 2021Q1. Although China still lags the US, Europe, Japan and South Korea in its IT share of GDP, the gap has been narrowing over time. No wonder, the US and other capitalist powers are intensifying their efforts to contain China's technological expansion.

-- via my feedly newsfeed